The Mighty Deception – Focus on Politics and Economy

January 9, 2010

By Padmini Arhant

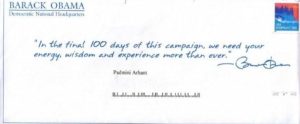

January 19, 2010 marks the first anniversary for the Presidency of Barack Obama. The columnist from the leading national news organization chided the right and the left political factions in the article, the excerpts listed below.

“In a world of ideological sniping, Obama can’t win.”

By Richard Cohen, Washington Post, January 5, 2010

“Last month, no American soldiers were killed in Iraq. Last month, the unemployment rate dipped a bit, the stock market ended the year up, the financial system did not crater, Detroit’s Big Three began to get a pulse – and yet a consensus started to form that Barack Obama, who is either responsible for or merely presided over all this good stuff, is a failure.

On the left, the president is being pummeled for health care legislation that does not include a public option and has not dispatched insurance executives to Guantanamo. On the right, he is being pummeled for socializing the economy, establishing death panels and allowing maniacal Nigerians to load their Calvins with boom-boom and fly into peaceful Detroit. It’s a cartoon.

Any way you measure the polls, Obama did not have a good year.

In foreign policy, Obama has sorely disappointed his fans on the left for escalating the war in Afghanistan and on the right for not escalating it enough…

He has not brought peace to the Middle East.

Obama could be a great president. He has already achieved much – possibly saving the country from financial ruin, salvaging the auto industry, getting some sort of health care reform. Possibly, possibly.

Yet, his numbers sink as his achievements rise. He is the Johnny Appleseed of cognitive dissonance, so utterly detached that when he wins it seems to be only for himself. Pollsters measure him but poets have described him.

William Butler Yeats got it down years ago: “The best lack all conviction, while the worst are full of passionate intensity.”

————————————————————————————————–

Perspective: By Padmini Arhant

The author’s hyperbolic characterization of the left position particularly with the dispatching of the insurance executives to Guantanamo and the article concluding with the quotation ‘the worst are full of passionate intensity,’ suggests the print media eternal love fest with any incumbent administration.

As such, democracy is under siege with the legislations merely passed and mostly stalled at the Corporations’ will, aided by their representatives’ inaction in the Senate and the House. It’s further exacerbated with the established print and mainstream media presenting the figures but not the facts thereby joining the elitists against the populists.

Therefore, it’s essential to place things in perspective for a fair analysis.

Iraq war without casualties in the past month is great news. However, the reason behind that is adopting the “left position” to scale down the troop level and make a firm commitment for troop withdrawal, a diametrically opposite decision by the administration on Afghanistan. Despite the reality, the pledge towards peace and non-violence is characterized as “ideological sniping” rather than pragmatic stance.

The dip in the unemployment rate and the rise in stock market are welcome. Nevertheless, the national unemployment and the states’ joblessness is still in double digit with the middle class dropping to the poorer category and the poor driven to being food stamps dependents.

Stock market performance is directly related to the real and projected industry earnings. Since, the health care reform unarguably in favor of the health care industry in the absence of robust competition such as the government insurance program, the health industry stocks skyrocketed at the confirmation of the public option eliminated from the debate.

In other areas, the defense stocks always thrive rain or shine with the U.S perpetual engagement in warfare. The exception to the genuine growth is the technology sector boosting the figures and again with the drastic employment cuts to survive global competition.

It’s indeed a relief that the financial sector did not crater with the infusion of trillion dollars that has surely benefited the Wall Street more than the main street still being defrauded with no aggressive financial regulations in sight including the oversight demanding accountability on the massive taxpayer bailouts.

Detroit’s big three began to get a pulse – yet the State of Michigan ranks the highest in unemployment rate with an average 15.8 percent described as the worst annual rate in “at least 40 years,” and disproportionately greater among the African American as well as other minority groups.

It’s true that the Obama presidency salvaged the financial and auto industry from ruin and currently involved in the health care reform. Although, the salvation of these sectors were carried out to protect jobs, stimulate the economy by unleashing the liquidity in the financial market while reining in on the foreclosures through affordable lending programs, the progress has been either too slow or in many instances absolutely non-existent due to the bailout beneficiaries’ usual business tactics.

Meanwhile, the financial institution such as Fannie Mae and Freddie Mac executives are back in action with the same modus operandi i.e. extravagant bonuses for extraordinary failures in the sub-prime mortgage debacle that initiated the free fall of the economy into the ditch.

In the health care reform as cited above, the proof of the pudding relies on the economic impact of the remaining uninsured millions other than the 30 millions predicted to be covered under the exclusively private proposal. Other issues, like raising taxes on health care plan opted by the work force in lieu of employment benefits are a matter that will weigh in on the cost factor determined by the supply and demand free market elements.

“Some things never changes,” regardless of the power in the White House or the Congress is evident in the past year evaluation.

The Wall Street traditions continue with the financial, health care, communications and energy industries dictating terms and conditions in defiance of the free market fundamentals.

Among them are:

Demanding bailouts and refusing to be subject to scrutiny,

Legislations drafted to promote obscene profits at the expense of exhausted taxpayers and exploited consumers eventually driving the economy to the cliff and,

Last but not the least the communications industry, Comcast resisting government intervention in the monopoly of the diverse media, such as the takeover of NBC and sister networks along with the national communications service and AT&T barring competition in the deal with Apple computers in the Smart Phone – iPhone subscription services and more.

With respect to green jobs creation, the notion is ideal and it would invigorate the battered economy, provided the energy giants do not railroad the budding entrepreneurs vital to expand the sector for community access and local job opportunities.

It’s clear that the ideological sniping from the left or the right is ineffective with the administrations in power succumbing to Wall Street pressure on all issues.

There is one thing to expect loyalty from the supporters through lavish praise and flattery that would simply qualify as cronyism in the backdrop of ‘business as usual’ environment. Another aspect where the actual situation in people’s life has not changed in terms of retaining jobs, homes and the health care proposal entirely entrusted under private care responsible for the status quo.

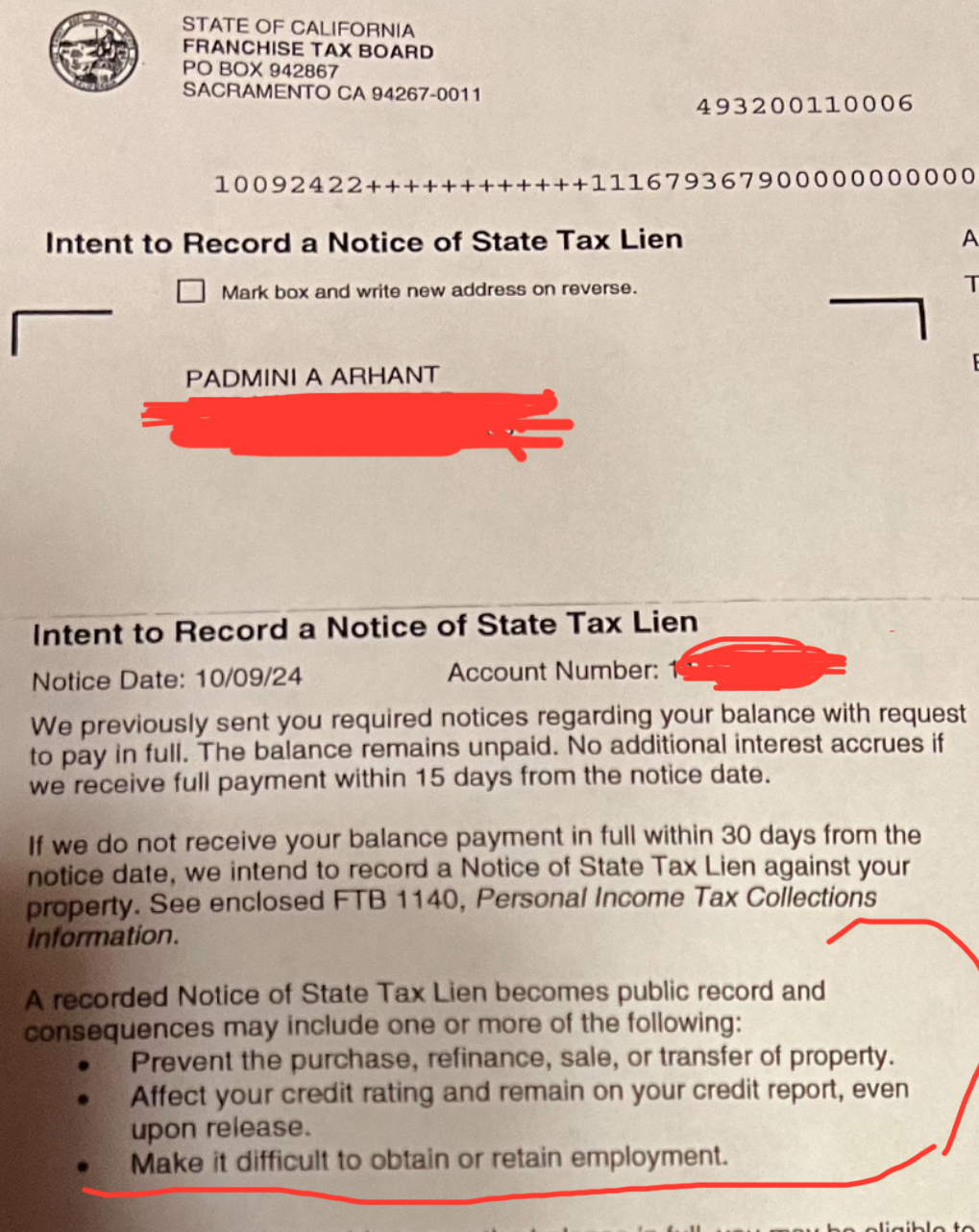

My silence is not necessarily my disappearance into the oblivion. Any suggestions and requests made thus far in both domestic and foreign policies have been slighted even though they are decisively in favor of the struggling populace at home and abroad. Perhaps, that might be the cause for the utter disregard of opinions and ideas offered upon several political figures’ insistence to participate in the legislative process.

For instance, my request towards transparency and accountability promised during the election campaign by the Obama candidacy has deviated to closed chamber discussion with lobbyists and party members notably in the health care legislation, financial regulations and climate bill negotiations.

I’ve been urging that the oversight committee (if it exists!) hold the financial sector accountable for the bailouts and demand they comply with their end of the bargain in facilitating the credit flow and lending practices crucial to energize the stagnant economy, is largely ignored.

Likewise, the stimulus packages passed under both Bush and Obama administrations viz. TARP money $700 billion in 2008 and $787 billion in 2009 respectively has substantial amounts in cash that has not been invested vigorously to protect or create jobs in the manufacturing sector and public projects i.e. infrastructure maintenance, green technology etc.

I’m still awaiting on the logical reasoning behind withholding the vast stimulus funds for purpose other than the economic recovery via housing market revival, job growth and tax credits to small businesses and medium corporations who are forced to minimize overheads through job cuts.

In addition, the Congress passed relief funds for meager $75 billion to deal with the housing market particularly to decelerate foreclosures, is reportedly served with an acute amount of approximately $2.3million and not billion. Further, it’s reported that the treasury secretary Timothy Geithner’s explanation was “the funds held in reserve to rescue financial institutions from the housing market downturns.”

I emphasized on the required urgent action during the Bush administration bailout activities in resurrecting the Glass-Steagall Act and the long overdue aggressive financial regulations to prevent the precipitous decline of the financial assets hurting the average citizens. Not surprisingly, it received no attention.

Now, it appears that the recently passed House bill on the financial reform has incorporated some of the rigorous policies instead of the comprehensive GS Act possibly anticipating the standard revolt from the Senate.

Not all is lost but there are serious grievances among the general public that are justified with the families facing economic difficulties and it’s appropriately revealed during the November 2009, gubernatorial and congressional elections.

Considering the facts, should one remain complicit to the prevalent camaraderie between Wall Street and Washington in spite of the culture corroding the systems and bankrupting small businesses and ordinary individuals in the society?

My specific role is to represent the people i.e. the humanity at the domestic and international fronts. The task is to work for the general mass and common good to restore democracy, peace and harmony, social justice and freedom, the basic right of all living beings.

Unfortunately, the guidance on foreign policy has been deliberately dismissed by selective entities with a cavalier approach to humanitarian crisis affecting millions of innocent lives. There will be in-depth discussion in this context to dispel the myths and misconceptions surrounding the international crises.

Washington functions on the dogma that “Those who try to please all, pleases none.” The irony in the legislators’ action is the public interest invariably marginalized over the personal and special interests in the appeasement trend.

Hope and Change is yet to be experienced and possible with a paradigm shift that recognizes alleviating people’s plight as the primary goal in public service.

Thank you.

Padmini Arhant

National Unemployment – A Reality Check

November 10, 2009

By Padmini Arhant

According to the latest reports, the current jobless rate is 10.2% with 16 million Americans competing for 3 million jobs. Apparently, this figure does not include the underemployed. The Corporate related unemployment is further expected to rise up to 10.8% by the end of next year. Another grim factor is the joblessness among the self-employed and the small business retrenchments reportedly escalate the figure to an alarming 17.5% resembling the severe depression era.

Growing unemployment is a major impediment as consumer spending is directly linked to the job market posing a downside for the entire economy. Despite, the economic growth at 3.5% along with the 9.5% annual productivity for the recent quarter, the American workforce is yet to benefit from the surge in these areas.

The most affected sectors appear to be construction, manufacturing and retail. Although, the recent stimulus signed by President Obama extends unemployment benefits for 14 weeks and 20 weeks to the worst hit states combined with the tax credits for the first time and other home buyers, the problems confronting the industries required to generate jobs is attention worthy.

Construction industry is obviously dependent upon the housing sector and the housing market revival methods are due for review with respect to foreclosures and lending practices by the finance sector.

In fact, the credit crunch is predominantly responsible for the sluggishness in the respective areas of the economy. Unless and until the bailed out finance industry honor the commitments made to the American public during the substantial bail outs, the industries tied to credit market particularly the housing, manufacturing and retail cannot emerge from the recession.

If the various bailouts approved thus far have the built-in transparency and accountability factor then the oversight committee ought to investigate the recipients on the investments of those taxpayer funds legislated for providing jobs and stimulating the economy. Regardless, the trillions of dollars accumulated to the national deficit from the banking sector and automobile industry bailouts deserve scrutiny in terms of actual allocation that is not conspicuous given the depressing jobless data.

On the other hand, the government must provide a legitimate reason for not moving forward with the committed investments held in the $787 billion stimulus package including the remainder from the Bush administration passed TARP funds. When the controversial economic stimulus took place at different times, the purpose was to revitalize the economy with the desperately needed job growth besides enabling the relevant productivity levels and overall economic performance.

Any delay in energizing the job market would adversely affect the broader economic prospects for all industries with the consumer base lagging in the necessary spending, the fulcrum of the economic cartwheel.

Manufacturing industry has been harshly hit with the corporate executive failure in the automobile industry precipitated by the finance sector’s liquidity freeze that triggered the economic meltdown in the shadow of the hedge funds and sub-prime debacle. It is imperative to jumpstart the manufacturing sector macro economically to achieve the targeted employment goals.

Evidently, the prevailing policies and the applied mechanisms are either inadequate or ineffective. Perhaps, the additional or aggressive measures could bolster the weak sectors in promoting the anticipated job growth, the real indicator of the economic pulse. Nevertheless, the consolidated interjection of the monetary reserves and management resources from the private and the public sector is paramount to resuscitate the ailing job market.

A disturbing aspect of the impressive 9.5% productivity report is the executive attitude towards the workforce. In spite of the workers’ significant contribution, i.e. limited labor force tripling the mass production, the management has categorically denied wage increases, additional hiring or other compensations in the form of bonuses etc. claiming that it would be detrimental to the organization ‘s profit oriented schemes.

It is elaborated as corporations aimed at increased earnings in the backdrop of weak dollar, declining exports, business decision to operate on lower inventories and other economic woes. As reasonable as they might be, somehow the conditions seem to apply only towards the labor force explicitly stated by the industry spokesperson that the workers should remain content with the fact that they have a job in the gloomy economy.

Meanwhile, the CEO’s salary package maneuvered from the Congress chided bonuses to lucrative shares and stock options with immediate encashment irrespective of the corporate results; the disingenuous modesty is adequately serving the highest in the hierarchy. Never mind the exploitation of the workforce, the human capital in this context.

In terms of the businesses with cash reserves operating on small inventories, the strategy is counterproductive, not to mention the catastrophic impact on the wholesale, small businesses and the retail industry. The wholesalers relying on the medium and large corporations’ inventory purchases forced to carry out massive layoffs potentially having a ripple effect on the economy with a possible inflation.

The swift passage of the ‘Cap and Trade’ bill boosting the green technology sector would be a phenomenal job growth subsequently alleviating the burden on the national deficit.

In light of the available facts, it would be appropriate to attribute the unemployment status to the myriad of activities or the lack thereof by both private and the public entities. It could be highlighted as the culmination of stringent corporate policies, limited private and public investments, reining credit flow, uncontained foreclosures and lack luster home sales in the housing market…causing the precarious unemployment situation.

Therefore, the government and the free market thorough evaluation of the status quo are essential to invigorate the frail job market.

A jobless economic recovery ultimately leads to a negative economic trend in the absence of robust stimulants explained above. Jobs represent the nerve of the economy with serious economic and political ramifications.

Contrary to the rhetoric echoed in the chambers of Congress and the media, the health care reform is equally important in the equation because it bankrupts the small businesses and individuals alike. Both groups are constantly struggling to make ends meet with the atrocious health care costs prohibiting investments in other necessities.

Economy and health care matter are intertwined and partisan politics has no place at the critical moment debilitating many American lives.

It is incumbent on the United States Senate to rise to the occasion and overwhelmingly approve the health care bill with the federal run health care program titled as the ‘public option’ in recognition of the American plight.

The simultaneous actions by Washington and free market are vital in curbing the rising unemployment statistics. Job assurance to every American translates into job security for the legislators and the executives. Since jobs create taxpayers and consumers,

Washington and Wall Street cannot thrive without progress in the main street.

Thank you.

Padmini Arhant

Capitalism alias Communism

September 6, 2009

By Padmini Arhant

Throw a treat to the man’s best friend and he/she will do any tricks for you.

Not quite true, contrarily some canines unlike the ‘few’ in their masters’ species resist being the “Pavlov’s dog.” Besides loyalty, the canines’ discriminative power is unparallel to the particular voices on the airwaves and cable news network ever willing to perform on the note – ‘show me the bait and leave the trashing to…’

Lately, with the relevant media on vacation, the field is wide open and vulnerable for dumping wastes of all kind. As usual, the specific network presenting ideas and style taken right out of their targets’ page yet choosing to remain oblivious to’ plagiarism,’ do not refrain from perennial attack politics.

Recently, there has been deafening noise and fear mongering about the nation becoming ‘Communist’ and claims that certain entities may be out to destroy the sanctity of the sacred ‘Capitalism.’ Further, the network featuring the long confused biracial harmony against the alleged Anti-Profit, Corporate bashing otherwise the ‘indomitable’ alien force is indicative of the desperate times seeking desperate means.

It’s a feast to the eyes when the image on the HD / 3D monitors transcends race but again demoralizing when it happens for the wrong reasons. As though the berating isn’t enough the religion is brought into the conversation as an ally. The emphasis on the United States of America, proclaimed as the exclusively “Judio-Christian” nation presumably conquered by the aliens determined to eliminate the demonstrably competent ‘Capitalism’ and threaten the viability of the robust free market system. Never mind the other religious representations and diversity in the society. They are mere taxpayers, consumers and statistics among the electorates.

It should be obvious by now that the United States is a planet within a planet with the multitude race, religion, non-religion and several other factors from all over the world. The bellicose barrage playing the religious card is nothing but gutter politics.

Whatever works to polarize the democratic secular system used to ignite the sparks regardless of the blazing fire possibly consuming the pyrotechnicians and the entire gamut?

In view of the over pouring incendiary remarks marred with ignorance, it’s essential to demystify the myth dominating the communication mass media, the single most propaganda machine overly misused in the modern age partisanship.

Understanding Communism:

Karl Heinrich Marx, The German political economist, sociologist… perhaps conceptualized a utopian environment against the extreme inequalities at that time. The political theorist’s influence over the exploited working class permeated the western and central Europe, and subsequently the other parts of the world.

Communism emerged from the societal decay with the wealth concentration in the particular segments, i.e. the agricultural landowners and merchants seeking entitlement to national wealth while depriving the remaining population from similar fortunes, and leaving them to compete with one another in the Darwinian ‘survival of the fittest’ world.

What began as the revolutionary movement towards the greater good for all developed into the previously condemned parochial system, as it operated with the power sanctioned to the selective groups in the nation governance that simultaneously set aside the enormous wealth for them in the name of the republic. Communism on the face of it initially portrayed as the well-oiled machine satisfying the wants of all, only to be degenerated in the systemic abuse of power.

Even though ‘Communism’ spread to benefit the ‘Community’ with the objective of creating a classless and stateless society, the end did not justify the means. The classic examples are the former Soviet Union and the present China, Cuba and North Korea.

Again, the interesting twist in the twenty first century is the nostalgia for the former Soviet era among the economically deprived many Russian citizens in the fast-paced ‘ONG’ (Oil and Natural Gas) enriched Russian economy.

In fact, the United States held responsible for the failure of the former Russian leader Mikhail Gorbachev’s ‘Glasnost’ (Government Accountability and Transparency) and ‘Perestroika’ (the political and economic reform). The reason attributed to the Western paranoia to the pervasive ‘Communism’ and the secrecy behind the iron curtains.

The irony in the response to Communism by the United States is the successful dismantling of the former Soviet Union along with the brutal deterrence in Vietnam, Laos and Cambodia, and isolating Cuba and North Korea, while fervently forging alliance with the vastly threatening Communist regime in the Far East – China.

Communism soon became the most dreaded form of authority in the latter half of the twentieth century because of the iron fist rule in the former Soviet Union and across the Soviet bloc, that caught on like the wild fire to the South Asian regions led by China and adapted by Latin America in their rejection of feudalism.

Furthermore, the equality theme dissipated with the ruling Communists’ power absorption and control of the major institutions on the land, specifically the mass media. As a result, the population promised to be free of social and economic barriers subject to severe oppression on all accounts like in the case of contemporary China, Cuba and North Korea.

Perspective on Capitalism:

The widespread ‘Communism’ in the mid twentieth century triggered the wealthy to converge and protect their capital in the ‘Capitalist’ economy more so than ever. Capitalists’ paradoxical dual platform was protectionism while floating free trade practices essentially enabling a monopoly on not only the national but also the global economy. Hence, the free market archaic labels on every consumer product sold in the global market.

In an uncanny resemblance to the ‘Communist’ system the free market has not met the expectations of the people in the society as they are entrenched in consumers and workers exploitation like their counterpart ‘Communism.’ The common tools for both systems are ‘Power’ and ‘Wealth’ for suppression of freedom and choice in the form of civil liberties evidenced in the on-going ‘health care’ battle.

How did the free market infiltrate the national economic and political scene?

The Capitalist agenda thrives in a democratic system with mega investments in the political campaigns. All levels of government i.e. local, state and federal elections are heavily funded by the lobbyists aka the ‘Special Interests’ representing every imaginable industry. Any effort to legislate the ‘public’ financing with a cap on electoral spending demolished prior to the declaration of such process to let the private industry proliferate in the nation governance usually beginning on the campaign trail.

Some poignant moments in recent memory –

The finance sector giants such as ‘Goldman Sachs’, AIG, Citi groups etc smoothly organizing the fire sale of the rivals and massive bailouts for themselves. The oil industry with Exxon Mobil, Chevron Texaco, ConocoPhillips and others possess the political proxies in the House and the Senate rallying for off shore drilling and blocking the ‘Cap and Trade’ energy bill.

Should the ‘health industrial complex’ trail behind in the muscle-flexing match?

Absolutely not. Therefore, the Health Care Industry actively promoting the anti-government slogans through their paid political representatives, so that they can continue the absurd profiteering strategy without the people represented public option in the contentious health care reform.

On a broader perspective, the national defense controlled and managed by the ‘military industrial complex’ behind every military operations ranging from the civil to international wars vehemently opposed to any ‘peaceful’ resolutions to justify the phenomenal defense budget crescendo regardless of the political factions in the White House.

The proof of the pudding is in the decision to proceed with the additional troops deployment in Afghanistan. Despite the colossal failure in the ‘so-called’ war against terror, the pursued military occupation misdirected as ‘nation building.’ Such adamant position is reflective of the Machiavellian policy and ‘hawkish’ representation at crucial levels of government, relevant departments in the administration and the defense hierarchy. Ignoring the human casualties on all sides and squandering the scarce national resources is the motto of the defense program conspicuous in the status quo.

The role of Kellogg Corporation and the internationally defamed ‘Halliburton’ in Iraq and Afghanistan herald the degradation of morality in the lowest order.

Again the private industry prioritizing extravagant profit over people’s lives is synonymous with the military and medical industrial complex, ‘apparently’ engaged in saving and safeguarding lives.

Likewise, in other areas of life sustenance the Nuclear industry in their effort to leave the footprints has the legion in Congress, respective Cabinets and the White House to stampede the renewable energy alternatives in the green technology vogue. In this context, the anti-environment coalition is ever stronger than witnessed before. It’s not uncommon for the opposition to rise against the incumbent power’s any and every policy. However, the vitriolic politics defying common sense and logic in the ‘global warming’ issue is the height of idiosyncrasies that is reprehensible.

How does Capitalism perform in the global economy?

Globalization is nothing but the marginalization of the domestic and foreign workers alike. The two most important wings of the business sector, the workers who are also the consumers are the convenient scapegoats for the free market operators. In order to cope with the vigorous global competition, the corporate downsizing with massive layoffs or outsourcing at a relatively cheaper rate with a disregard for standard labor laws on foreign soil is the preferred path to ‘Nirvana,’ (the eternal bliss), in the capitalist jargon it is the cornucopia of profits.

As for the environmental hazards are concerned, the deadly gas leakage in the devastating Union Carbide disaster in Bhopal, India – killing several thousand residents and abandoning millions suffering from life threatening diseases as well as the oil spilling on the domestic and international shores meticulously evaded or dealt against it through the top-notch legal expertise hired at a premium price.

Global economy is also heavenly for tax evasions with the Corporations reallocating off shore income towards their personal future.

The icing on the cake is the communications mass media – a blaring private and free market owned enterprise to undermine democracy. Issues of national interest and citizens welfare browbeaten to conjure the dazed viewers and readers. At the same time there is responsible journalism visible in the most editorials, columns, articles and television presentations other than the cyberspace to counteract the partisan tidal wave

Lately, the legitimate concerns in the form of opinions, ideas and commentaries on numerous national and international issues either discounted or dismissed as an unqualified intervention in the asserted ‘our highest government ’ matter, striking yet another chord with ‘Communism.’ in the first amendment right.

Aiming at profit is the fundamental cause for any commercial activity. Nevertheless, the methods and strategies to achieve those profits often found unscrupulous in the modern market economy. Wealth acquired at the cost of the citizens’ life and livelihood does not last long, and no sooner than later the proprietary disillusioned on the asset transformed into liability.

The analogy presented, as “One size do not fit all.” It does not apply to those corporations playing by the rules with an utter respect for the democratic political system…stay focused on the business management rather than ‘nation’ control. These Corporations occasionally victimized by the labor Union’s excessive demands viz. higher workers compensation under the guise of ‘labor protection.’ There are also individuals abusing consumer rights in business dealings with contempt for the other party’s status.

The excessive greed for ‘Power’, ‘Profit’ and ‘Popularity’ in the aggressive world economy and political system has eroded the human qualities for care, compassion and courage to uphold justice and fairness in the society.

Concisely, Capitalism is the new era Communism dictating terms and conditions to the market forces and intrusively implementing national policies through political agents on the prolonged or permanent Corporate payroll at the dawn and during the representative’s political career.

The common denomination under both systems is – the powerful oppress the powerless and the victims are none other than the general population in both Capitalism and Communism.

Democracy is meaningful with the government of the people, by the people and for the people.

Thank you.

Padmini Arhant

.

Finance Sector and Economic Impact

August 31, 2009

By Padmini Arhant

When the Bush administration officially recognized the economic recession in late December 2007, the malignant cancer in the financial sector was widespread – originating from gross mismanagement, underhand dealings, some in breach of lenient SEC regulations… a scenario analogous to the health abuse by overindulging individuals submitting to a potentially terminal illness.

Upon diagnosis, the prognosis called for a radical treatment to prolong life. Hence, the former administration executed a series of financial bailouts commencing with Bear Stearns, AIG, including major and minor banks bailout to a tune of $700 billion TARP (Toxic Assets Relief Program) fund.

Incidentally, the former Treasury Secretary Henry Paulson bound by vested interest and commitment to his alma mater Goldman Sachs let the comparable investment group Lehman Brothers submerge into insolvency.

Is cherry picking a coincidence or key Treasury representative fulfilling obligations to the dominant force Goldman Sachs in the finance industry?

Please refresh your thoughts after reviewing the blogpost ‘Bailout Debacle’ March 22, 2009 listed under Economy and Business category at www.padminiarhant.com

In this context, the cited article revealing facts behind the bailout is attention worthy.

According to http://www.wsws.org/articles/2008/sep2008/paul-s23.shtml – Thank you.

Published by the International Committee of the Fourth International (ICFI)

Who is Henry Paulson?

By Tom Eley, 23 September 2008

“Henry Paulson rose through the ranks of Goldman Sachs, becoming a partner in 1982, co-head of investment banking in 1990, chief operating officer in 1994. In 1998, he forced out his co-chairman Jon Corzine “in what amounted to a coup,” according to New York Times economics correspondent Floyd Norris, and took over the post of CEO.

Goldman Sachs is perhaps the single best-connected Wall Street firm. Its executives routinely go in and out of top government posts. Corzine went on to become US senator from New Jersey and is now the state’s governor. Corzine’s predecessor, Stephen Friedman, served in the Bush administration as assistant to the president for economic policy and as chairman of the National Economic Council (NEC). Friedman’s predecessor as Goldman Sachs CEO, Robert Rubin, served as chairman of the NEC and later treasury secretary under Bill Clinton.

Since taking office, Paulson has overseen the destruction of three of Goldman Sachs’ rivals.

In March, Paulson helped arrange the fire sale of Bear Stearns to JPMorgan Chase. Then, a little more than a week ago, he allowed Lehman Brothers to collapse, while simultaneously organizing the absorption of Merrill Lynch by Bank of America.

This left only Goldman Sachs and Morgan Stanley as major investment banks, both of which were converted on Sunday into bank holding companies, a move that effectively ended the existence of the investment bank as a distinct economic form.

These bailouts have been designed to prevent a chain reaction collapse of the world economy, but more importantly, they aimed to insulate and even reward the wealthy shareholders, like Paulson, primarily responsible for the financial collapse.

Paulson bears a considerable amount of personal responsibility for the crisis.

Paulson then handsomely benefited from the speculative boom. This wealth was based on financial manipulation and did nothing to create real value in the economy. On the contrary, the extraordinary enrichment of individuals like Paulson was the corollary to the dismantling of the real economy, the bankrupting of the government, and the impoverishment of masses the world over.

Paulson was compensated to the tune of $30 million in 2004 and took home $37 million in 2005. In his career at Goldman Sachs he built up a personal net worth of over $700 million, according to estimates. “

————————————————————————————————–

True Perspective: By Padmini Arhant

The entire economic meltdown ceremoniously attributed to the financial sector’s wayward unruly conduct in the absence of limited or no regulation. Typically, it’s a free market voluntarily surrendering to a free fall after skyrocketing profits in the pockets of privileged few in the society.

Who did the private enterprise otherwise the market system’s oligarchs approach for salvation?

It was none other than the taxpayers of the economy represented by the government.

It’s poignant to underscore the convenience for private sectors to seek the taxpayer i.e. government’s assistance when they are drowning and fleetingly dismiss the same government as an incompetent, redundant agency during the buoyancy like in the health care battle.

The day is not far when the health care and insurance industry configured to the obscene profit driven settings mimic their counterpart finance industry imploring the taxpayers/consumers bailout.

When the wealth management industry succumbs to their own greed ladened follies, can the health care and insurance industry sustain the malpractice at the economy’s expense?

If there is any respect for the laws of nature or ethical consideration, the key economic components such as the finance, health industry and others would realize that universally every substance has a limited potential to thrive and exceed performance level at any given time. The mankind periodically experienced catastrophic blows in the form of severe economic recession to ‘Great Depression’ due to the prevailing markets inertia.

Still, the lesson is never learned by the delusional segment forging permanency on this planet; choose to remain confined to the improbable cause in wealth amassment.

Now directing focus on the finance sector, the ‘artful dodger’, a nickname of the Charles Dickens’ melancholy character ‘Oliver Twist’ when turned down for more porridge, despite the courteous magic word ‘please,’ was never discouraged to maneuver the situation in personal favor.

Unlike the character ‘Oliver Twist’ a victim of severe socio-economic disparity…parallel to the modern twenty first century reality, the finance sector is well armed with tactics adherence to the rule of law in appearance but decisively biting the hands that feeds them, i.e. the consumers and taxpayers.

What are the latest strategies by the finance industry to clean up the mess on their balance sheets?

The current trend in the finance sector is adapting to the new age attraction i.e. presentation and mass appeal even if it is lacking in substance. If anything achieved from the domino effects by the financial sector, it is the mastery of unsavory techniques to impress shareholders at the consumers’ peril.

During the bailouts, both the prior and the incumbent administrations were unequivocally guaranteed instant revival of the lending activity, a predominant factor in the liquidity crisis exacerbating the economy until date.

It’s been nearly twelve to eighteen months since the infamous massive bailouts with no relief to the average citizen, retailers or the small businesses, crucial for the economic recovery. The economy deprived of the consumer spending flow because of the financial institutions’ stringent policy to hoard the taxpayers’ funds received in the form of bailouts at zero percent or nominal interest rate. Instead the taxpayer bailout is unabashedly used for extravagant bonuses to the architects of the financial calamity.

Although, the Obama administration recently capped the finance charges and interest rates on credit card borrowings to ease the extraordinary burden on average citizens, the industry leapfrogged Congress with discretionary interest rates not limited to atrocious 29.9% APR and threatening to increase further on default payments.

Another proactive measure by the banks in an effort to window dressing the balance sheet was minimizing risk exposure related to credit card and consumer lending. The industry defiantly targets the vulnerable groups like students, homeowners and the lower to median income consumers with abrupt cancellation of accounts in good standing.

The irony is noteworthy. It’s considered perfectly normal if the finance industry absconded their responsibility to the American taxpayers/creditors not barring any accountability to the oversight committee regarding the bailout investments. However, the then taxpayers/creditors as consumers/borrowers now subject to scrutiny and unprecedented means by the same financial institutions holding the mantle to lending and borrowing.

While the myriad of finance industry borrowed taxpayer funds at zero or negligible interest rate, the sector in return either withholding financing in most cases or lending at an exorbitant rate to the consumers who are also the creditors.

In the housing market, the situation synchronizes with the other lending areas such as credit card, personal loans etc. The reason for the agonizing slump in the real estate across the nation squarely falls back on the commercial banks reluctant to unleash the cash flow to qualified first homebuyers and responsible mortgagees/homeowners unable to purchase or refinance their homes. The stranglehold on consumer borrowing precipitates the foreclosures notwithstanding the vertical decline in home sales and values.

Again, the White House initiatives to restrain foreclosures and assist primary residence owners through TARP fund allocation need evaluation as the financial institutions are focused on ‘business as usual’ and not measuring up to the rigorous standard that exists for average consumers while the bailed out financial industry borrowers exempt from it.

The status quo is inadequate and compromises the high value homes in the government pursuit to rescue the conforming loans, i.e. Fannie Mae and Freddie Mac toxic assets. Fannie Mae and Freddie Mac, is a private company backed by government funds.

Not surprisingly, the illicit practice permeated to the commercial real estate affecting the prospects in that segment.

Home equity, the major and sometimes the only asset for overwhelming majority being inaccessible along with the spiraling health care and insurance costs for families, the overall economic impact is enormous forcing many to bankruptcy accelerated by the escalating unemployment rate.

Did the bailout beneficiaries show any evidence to qualify for funding?

Supposedly not, then why should they be allowed to run the economy into muck and handsomely rewarded with taxpayer bailout for the colossal failure in financial history?

Where are the taxpayer funds invested and why are they not held accountable thus far?

Is the financial market granted constitutional immunity?

And if not,

What is holding the legislators from intervening on behalf of the electorate to probe the public affairs maintained as private matter by the industry?

Meanwhile, the investment group, Goldman Sachs implicated for alleged insider information to high value investors through trade specialists deserve proper investigation and due process. The SEC regulations must apply to all without exception in absolute transparency.

With the holiday season approaching, the consumer spending is vital to expedite the stagnant economic growth. As stated above, the positive development in housing and job market intertwined with the investment pace, only possible through private sector faithful participation in lending and reactivating the economy.

Unless and until the finance sector across the board, the commercial, investment and insurance industries get their act together and relinquish the ‘subprime’ syndrome, the sagging economy will continue and eventually consume the source, the financial groups.

The financial sector is obligatory to the taxpayers as creditors and borrowers particularly with respect to the disproportionate bailouts.

Finally, with no further procrastination on the financial markets audit, it’s imperative for the Congress appointed oversight to obtain legitimate explanation on investments and lending abstinence. Any dissatisfactory response and non-cooperation by the industry must be pursued with mandatory judicial protocol.

Thank you.

Padmini Arhant

Economic Bailouts On An Unprecedented Scale

July 23, 2009

By Padmini Arhant

Presentation of Economic Bailouts on an Unprecedented Scale

From: Stimulus Package Details

Source: http://www.stimuluspackagedetails.com/bailout.html

Mortgage Stimulus Packages

No industry has been helped more by the various economic stimulus packages than the real estate industry.

Add it all up, and $500 billion was committed in 2008 by the Bush Administration, and

The Obama Administration chipped in another $275 billion in early 2009, not to mention the $1 trillion that was designated for buying up toxic assets (which are comprised primarily of sub-prime loans given to suspect borrowers, collateralized by overvalued real estate).

Economic Bailouts On An Unprecedented Scale

Starting in 2008, and extending into 2009, the U.S. Federal Government became involved in a myriad of companies and industries, handing out bailouts at an alarming rate, blurring the lines between capitalism and socialism, free enterprise and government intervention.

Below, in alphabetical order, are the major recipients of economic bailouts.

Automakers

$25 billion in low-interest loans to General Motors, Ford, and Chrysler

$22 billion in low-interest loans to General Motors, Chrysler

$30 billion to help General Motors steer through bankruptcy

Total: $77 billion

AIG – Insurance Company

$60 billion loan – September 2008

$40 billion purchase of preferred shares – September 2008

$25 billion in purchase of toxic assets – October 2008

$25 billion loan (credit limit raised to $85 billion total) – October 2008

$30 billion loan – 2009

Total: 180 billion

Bear Stearns – Investment Bank And Brokerage Firm

$29 billion in guarantees – 2008

Fannie Mae/Freddie Mac – Mortgage Companies

$300 billion – 2008

$200 billion – 2009

Total: $500 billion

G-20 World Leaders Stimulus

$1 Trillion Stimulus Package – G-20 World Leaders Stimulus – April 2009

The leaders of the 20 most powerful countries in the world (representing 85% of global economic production) convened in London and agreed to $1 trillion in economic stimulus funds, as well as tighter global financial regulations.

June 2009 update: According to the Obama Administration, only about 5% of the $787 billion stimulus package passed in February 2009, has been distributed.”

————————————————————————————————–

Bush Stimulus Package

July 23, 2009

By Padmini Arhant

Presentation of Bush Stimulus Package details

From: Stimuls Package details – Thanks

Source: http://www.stimuluspackagedetails.com/bush.html

Bush Stimulus Packages

In 2008, the Bush Administration handed out a slew of economic stimulus packages.

Under President George Bush’s administration, the Federal government gave

$29 billion to bail out Bear Stearns,

$178 billion to American taxpayers in the form of economic stimulus checks,

$300 billion to bail out American homeowners,

$200 billion to bail out Fannie Mae and Freddie Mac,

$150 billion to bailout AIG, and

$700 billion to bail out banks (TARP).

Total Bush Administration Bailout – $1.557 trillion dollars i.e. $1 trillion and $557 billion dollars.

Timelines Of The Bush Economic Stimulus Packages

Following is a timeline of the economic stimulus packages, in chronological order.

March 2008 – $29 Billion Stimulus Package – Wall Street Bailout

The Federal Reserve stepped in to prevent the collapse of Bear Stearns (one of the world’s largest investment banks and brokerage firms) by guaranteeing $29 billion worth of potential losses in its battered portfolio. This provided enough economic stimulus for JP Morgan Chase to take over the beleaguered firm.

May 2008 – $178 Billion Stimulus Package – Average American Bailout

The U.S. Treasury provided an economic stimulus package to American taxpayers in the form of $600 economic stimulus checks for individuals and $1,200 economic stimulus payments for couples.

That cost the government $100 billion, and they threw in another $68 billion in tax breaks for businesses, $8 billion to increase unemployment benefits from 26 weeks to 39 weeks, and a $4 billion economic stimulus package to be doled out to states and local municipalities to buy and rehab foreclosed properties.

July 2008 – $300 Billion Stimulus Package – Homeowners Bailout

The Bush Administration committed $300 billion for 30-year fixed rate mortgages for at-risk borrowers, as well as tax credits for first-time homebuyers, who could be eligible to receive up to a $7,500 tax credit.

September 2008 – $200 Billion Stimulus Package – Fannie Mae and Freddie Mac Bailout

Fannie Mae and Freddie Mac (privately owned mortgage companies that are backed by the federal government) were about to fail, due to declining house prices and rising foreclosures.

The Bush Administration stepped in with a $200 billion economic stimulus package and placed Fannie Mae and Freddie Mac and their $5 trillion in home loans in “temporary conservatorship,” to be supervised by the Federal Housing Finance AgeSeptember 2008 – $50 Billion Stimulus Package To Guarantee Money Market Funds

When the economic crisis reached a crescendo, Americans began to pull their money out of money market funds – historically considered to be the safest investment. To stop the bloodshed, the U.S. Treasury agreed to guarantee up to $50 billion, for up to a year.

September 2008 – $25 Billion Stimulus Package – Automakers Bailout

In an attempt to stave off bankruptcies for the “Big 3 automakers,” the Bush Administration gave General Motors, Ford, and Chrysler $25 billion in low-interest loans.

September – November 2008 – $150 Billion Stimulus Package – AIG Bailout

With the world’s largest insurance company in dire straits and 74 million clients at risk, the American government chipped in and gave AIG (American Insurance Group) $150 billion in a stimulus package that included: loans, purchase of toxic assets, and purchase of preferred shares.

October 2008 – $700 Billion Stimulus Package – Banks Bailout

The Bush Administration, under the umbrella of the U.S. Treasury, committed $700 billion in economic stimulus money under TARP (Troubled Asset Relief Program). By many accounts, if this economic stimulus money hadn’t been injected, credit between banks would have frozen overnight, and not only the American economy, but also the global economy, would have seized up.

———————————————————————————————

Is The Economic Stimulus Package Working?

“Is the economic stimulus package working” seems to be the question on most people’s minds.

But which economic stimulus package are you talking about?

Bear Sterns was taken over by JP Morgan Chase, so maybe that $29 billion economic stimulus plan worked.

We all got our economic stimulus checks in 2008, but we didn’t necessarily put them back into the economy, so that $178 billion might not have been well-spent.

The $300 billion mortgage stimulus, “Hope For Homeowners,” awarded in July 2008 didn’t work very well either, because few people took an interest in the program. While proponents of this particular economic stimulus package estimated that 400,000 homeowners could be helped over a three-year period, in the first month, only 111 had applied.

The $200 billion economic stimulus handout to Fannie Mae and Freddie Mac, the mortgage giants, stabilized them enough to prevent collapse.

The $50 billion economic stimulus to stabilize money market funds might have averted a disaster.

The $150 billion doled out to AIG, the insurance giant, prevented their closure, but must not have completely solved the problem since AIG came back for $30 billion more less than six months later, even as they were awarding $165 million in bonuses to their top executives.

The $25 billion given to the Big 3 automakers, Chrysler, Ford, and GM, allowed them to live to see another day, but they remain on the brink of disaster.

The $700 billion bank bailout, given in extreme haste in October 2008, might have kept the banks functioning, but no one really knows where that money went or what was done with it, so it’s hard to judge whether TARP is working.

$700 Billion Bush Stimulus

The $700 billion Troubled Asset Relief Program, (TARP), given out by the George Bush Administration in October 2008. No one can seem to track down any details on this. The money was given to banks with the goal that they would lend it to people. They didn’t seem to do that, but no accountability was written into the hastily concocted plan, which seems to have been concocted in a matter of days, in a “cocktail napkin” format.

And that was just the economic stimulus packages of 2008.

Bush Stimulus Package

July 23, 2009

By Padmini Arhant

Presentation of Chronological Stimulus Package Details:

From: Stimulus Package Details

Source: http://www.stimuluspackagedetails.com/bush.html – Thanks.

Bush Stimulus Packages

In 2008, the Bush Administration handed out a slew of economic stimulus packages.

Under President George Bush’s administration, the Federal government gave

$29 billion to bail out Bear Stearns,

$178 billion to American taxpayers in the form of economic stimulus checks,

$300 billion to bail out American homeowners,

$200 billion to bail out Fannie Mae and Freddie Mac,

$150 billion to bailout AIG, and

$700 billion to bail out banks (TARP).

Total Bush Administration Bailout – $1.557 trillion dollars i.e. $1 trillion and $557 billion dollars.

Timelines Of The Bush Economic Stimulus Packages

Following is a timeline of the economic stimulus packages, in chronological order.

March 2008 – $29 Billion Stimulus Package – Wall Street Bailout

The Federal Reserve stepped in to prevent the collapse of Bear Stearns (one of the world’s largest investment banks and brokerage firms) by guaranteeing $29 billion worth of potential losses in its battered portfolio. This provided enough economic stimulus for JP Morgan Chase to take over the beleaguered firm.

May 2008 – $178 Billion Stimulus Package – Average American Bailout

The U.S. Treasury provided an economic stimulus package to American taxpayers in the form of $600 economic stimulus checks for individuals and $1,200 economic stimulus payments for couples. That cost the government $100 billion, and they threw in another $68 billion in tax breaks for businesses, $8 billion to increase unemployment benefits from 26 weeks to 39 weeks, and a $4 billion economic stimulus package to be doled out to states and local municipalities to buy and rehab foreclosed properties.

July 2008 – $300 Billion Stimulus Package – Homeowners Bailout

The Bush Administration committed $300 billion for 30-year fixed rate mortgages for at-risk borrowers, as well as tax credits for first-time homebuyers, who could be eligible to receive up to a $7,500 tax credit.

September 2008 – $200 Billion Stimulus Package – Fannie Mae and Freddie Mac Bailout

Fannie Mae and Freddie Mac (privately owned mortgage companies that are backed by the federal government) were about to fail, due to declining house prices and rising foreclosures. The Bush Administration stepped in with a $200 billion economic stimulus package and placed Fannie Mae and Freddie Mac and their $5 trillion in home loans in “temporary conservatorship,” to be supervised by the Federal Housing Finance Agency.

September 2008 – $50 Billion Stimulus Package To Guarantee Money Market Funds

When the economic crisis reached a crescendo, Americans began to pull their money out of money market funds – historically considered to be the safest investment. To stop the bloodshed, the U.S. Treasury agreed to guarantee up to $50 billion, for up to a year.

September 2008 – $25 Billion Stimulus Package – Automakers Bailout

In an attempt to stave off bankruptcies for the “Big 3 automakers,” the Bush Administration gave General Motors, Ford, and Chrysler $25 billion in low-interest loans.

September – November 2008 – $150 Billion Stimulus Package – AIG Bailout

With the world’s largest insurance company in dire straits and 74 million clients at risk, the American government chipped in and gave AIG (American Insurance Group) $150 billion in a stimulus package that included: loans, purchase of toxic assets, and purchase of preferred shares.

October 2008 – $700 Billion Stimulus Package – Banks Bailout

The Bush Administration, under the umbrella of the U.S. Treasury, committed $700 billion in economic stimulus money under TARP (Troubled Asset Relief Program). By many accounts, if this economic stimulus money hadn’t been injected, credit between banks would have frozen overnight, and not only the American economy, but also the global economy, would have seized up.

————————————————————————————————–

Is The Economic Stimulus Package Working?

“Is the economic stimulus package working” seems to be the question on most people’s minds.

But which economic stimulus package are you talking about?

Bear Sterns was taken over by JP Morgan Chase, so maybe that $29 billion economic stimulus plan worked.

We all got our economic stimulus checks in 2008, but we didn’t necessarily put them back into the economy, so that $178 billion might not have been well-spent.

The $300 billion mortgage stimulus, “Hope For Homeowners,” awarded in July 2008 didn’t work very well either, because few people took an interest in the program. While proponents of this particular economic stimulus package estimated that 400,000 homeowners could be helped over a three-year period, in the first month, only 111 had applied.

The $200 billion economic stimulus handout to Fannie Mae and Freddie Mac, the mortgage giants, stabilized them enough to prevent collapse.

The $50 billion economic stimulus to stabilize money market funds might have averted a disaster.

The $150 billion doled out to AIG, the insurance giant, prevented their closure, but must not have completely solved the problem since AIG came back for $30 billion more less than six months later, even as they were awarding $165 million in bonuses to their top executives.

The $25 billion given to the Big 3 automakers, Chrysler, Ford, and GM, allowed them to live to see another day, but they remain on the brink of disaster.

The $700 billion bank bailout, given in extreme haste in October 2008, might have kept the banks functioning, but no one really knows where that money went or what was done with it, so it’s hard to judge whether TARP is working.

And that was just the economic stimulus packages of 2008.

National Unemployment and the Economic Status

July 23, 2009

By Padmini Arhant

The ravenous economy has absorbed about $3.7 trillion dollars via bailouts and stimulus plans, (please refer to individual stimulus package topics for breakdown) yet the nation’s jobless rate rising like a tidal wave rather than settling along the shores. Several arguments mounting regarding the precarious job situation across the nation with some fifteen states like California, Michigan, Indiana, Ohio and others experiencing double digit in job losses accumulated over a period of time.

Not surprisingly, criticisms with an ominous prediction such as a possible return of the ‘Great Depression’ from various political and economic factions pouring against the current administration’s level of action and apparent inaction in averting the precipitous decline of the job market.

The irony being, President Obama’s opponents and fierce critics expressing deep concerns over the present generation’s children and grandchildren burdened with the burgeoning multi-trillion dollars national deficit from the ‘supposedly’ bizarre and revolutionary health care reform.

Unfortunately, the pervasive selective memory among the cynics forbids anyone from reminding the junkyard legacy by the previous administration. Nevertheless, it’s important to revisit the situation in order to find a pragmatic and an effective cure for the epidemic unlike a band-aid treatment tactic by the prior administration.

As detailed earlier on many occasions, the wild adventures in the past eight years eroded the fundamentals of the capitalist system. Immediately following the 9/11 attacks, the widespread panic about the United States economic and national security surely had an impact on the American investments ranging from housing to stock market including the exodus of some expatriates selling homes combined with the withdrawal of their investments.

The Bush-Cheney administration laid out the extravagant scheme to trump the situation with yet another war by invading Iraq when the mission in Afghanistan had barely begun. Conservative ideology dictates that wars promote prosperity. Actually, the notion might not be far-fetched because wars are highly beneficial to the nexus group gambling with others’ life and nation’s wealth.

When the administration inheriting a surplus economy engaged in a dubious agenda at the most improper and inconvenient time, the market conditions in 2002 and onwards became more volatile due to enormous speculations surrounding the United States affordability to wage another war.

The Bush-Cheney administration sailed through the storm with false assurances and blatant lies that Iraq war would be self-funded through oil revenues expected to be reaped exclusively by the United States in return for the establishment of democracy.

One must also not forget the administrations’ prophesy on the premature valentine’s day celebration by the cheering Iraqis handing out rose bouquets to the U.S. occupying forces at the expense of their blood and national treasury.

The excessive borrowing commenced at the dawn of the Iraq war with the fiscal conservatives now objecting to their constituents’ health care benefits, then turning a blind eye and signing a blank check to an unarguably a corrupt administration.

Funding two simultaneous wars converted the national surplus to national deficit adversely affecting the Treasury Notes and subsequently the U.S. currency in the international market. In the backdrop of the weakening Bond market, the stock market performance accelerated with investors’ confidence in the growth of different sectors specifically the oil and defense stocks due to the on-going wars, technology sector and the financial sector with hyperbolic balance sheets.

Above all, during that time the Federal Reserve and the Treasury’s overly cautious inflationary measure by reducing the interest rates beyond market conditions and unleashing the free market from necessary regulations in an utter conflict of interest essentially provided a fertile ground for the financial sector to exploit the unique opportunity in the lending activity.

In addition, the conglomerate like AIG and major investment banks extending towards the commercial bank’s activities risking long-term investments for short-term gains induced further competition for the traditional banking sector adopting strategies detrimental to the key components of the economy viz. the housing market, retail and commercial lending.

The financial sector’s unethical and unscrupulous practices in every aspect of lending targeting the nerve of the economic system i.e. the consumer, exacerbated the economic recession.

From the notorious sub-prime mortgages in the housing market now appropriately defined as ‘toxic assets’ bundled into the mortgage backed securities exchanged through international trading, to teaser rates offered on credit card later escalating to atrocious interest rates exceeding market affordability…are primarily responsible for the chronic ailments of the current real estate and the liquidity crisis.

Unequivocally the present woes of the economy are attributable to the overwhelming greed by the financial sector and the defiance for any rule of law until date. As clarified by President Obama during the press conference on date, the financial regulatory reforms are in order.

Since some prominent economists have been recently pushing for more stimulus over and above the total $3.7 trillion dollars, it’s necessary to obtain the facts and details on earlier investments to evaluate the methods applied as a result of the negative economic growth and dismal unemployment rate.

Please refer to stimulus package details followed by careful analysis in the subsequent segments.

Meanwhile, it’s imperative and incumbent on all bailout recipients and the previous administration officials regardless of hierarchy to come forward, testify under oath to Congress as the representatives of the American electorate, and explain exactly where and how the trillions of dollars have been invested.

Is it a coincidence that Goldman Sachs after being assisted by the former Treasury Secretary Henry Paulson in gobbling Bear Stearns and Lehman Brothers, emerges with a bumper profit rewarding its every employee with a despicable amount $700,000 bonus the past week ? – Absolutely not.

It’s about time the criminals of the financial world are brought to justice in order to avoid a twenty first century revolution in the world’s modern democracy.

Congress must act in the interest of the people and abide by the constitutional rule of law with an honest and thorough investigation of the massive bailouts carried out at the expense of the hard working American taxpayers.

Thank you.

Padmini Arhant

Save the Nations’ Newspapers – OP-ED

April 9, 2009

Like everything else in this economy, the newspaper industry is on the brink of demise. The reasons according to the publishers are the competition from various sources ranging from the Information Superhighway to electronic gizmos producing data with the touch of a button.

The survival of the newspaper industry is paramount in a democracy. It is appropriate to pledge unequivocal support to print press as someone having grown up knowing the world events and current affairs through newspapers. Personally, the newspaper was a window to the outside world and enabled a better understanding of issues unfolding at home and elsewhere. The newspapers offer knowledge, awareness and critical thinking on different topics.

One might argue why subscribe to a newspaper when the same information is accessible on-line free of charge? Although, it is a valid argument, it still does not match the convenience of a newspaper in hand while traveling or commuting to work on public transport and reading in a relaxed manner at home without Google search and browsing Yahoo/AOL articles. Further, the conventional source relieves common stress caused by prolonged use of computers. It is a healthy diversion in a manner books remain popular over audio and video versions.

Some national as well as local newspapers’ editorials, columns and articles are praiseworthy on many issues concerning life. The investigative and independent journalists deserve special recognition for their contribution to humanity due to risks involved in the exposure of subjects that may or may not be challenged in legal terms and otherwise. Similarly, there are reporters providing vital information from war zones and remote corners of the world by endangering their lives. These veteran newsmakers cannot be isolated in this context.

However, it is essential to bring certain issues to the publishers’ attention that could rescue the dying industry. The lack of objectivity in few columns and news articles is one of them. In an era of idolization of political figures, some journalists traveling with public entities tend to edge over the professional ethics and present conflicting content of the same article from other mass media such as television particularly cable news network, international channels and the potent internet. Unfortunately, the authors of such articles fail to recognize the fact that any information from them is verifiable through other sources for authenticity and to an extent affect their credibility if proven false. When they represent a reputable news organization, the conspicuous flaw reveals the devil in the detail magnified on comparison with live images on-line and television. The general public prefer facts not fiction in a newspaper article related to public figures , government affairs and corporate activities.

Another factor behind the decline of the newspaper industry is the ideology driven concept not barring political affiliations and the pandering to the authorities in government and business rather than a neutral position in the presentation of facts to confirm fair and balanced reporting. The educated and technologically savvy mass justifiably turned off by the extreme views and polarization in the newspaper industry. If the internet sources blamed as the major threat to the print press, perhaps it is time for newspaper publishers to exercise the freedom of press and responsible journalism like their on-line competitors and dedicate service to people more than any others in a democracy.

Whenever the press and television newsmedia regardless of the status as mainstream or not assumes the role of personal talking points to the authorities in power, democracy is in jeopardy forcing majority population to seek alternative sources for reliable information. It defeats the purpose of free press in a democracy that prioritizes politics over people, when the primary focus should be accuracy, transparency and accountabilty in public matter.

As stated earlier in numerous blogposts on this website www.padminiarhant.com industries and government ultimately depend on the main street, as they are the consumers and voters with real power in a functioning democracy.

On that note, a sincere request to all citizens across the nation to salvage the local and favorite newspaper through subscription since the survival of newspaper industry means restoration of voice in a democracy.

Thank you.

Padmini Arhant

Bailout Débācle

March 22, 2009

By Padmini Arhant

The past two weeks dominated with AIG and oligarchs debating over the controversial $165 million and now increased to $218 million bonuses to executives instrumental in driving the insurance giant to the brink of collapse along with the financial markets of the world.

As usual, Washington vs. Wall Street dispute contributed to media frenzy and aptly reflected in the roller coaster performance of the stock market. The interesting factor in the blame game is those pointing fingers at others fail to acknowledge that remaining fingers are pointing towards them as they are equal partners in this charade.

By now, well-educated American taxpayers upon the quest to secure their future convinced that both Wall Street and Washington have serious credibility issues in wealth management and nation governance.

The back and forth allegations in the political crossfire reveals the true sense of Washington politics and Wall Street free market systemic corporate management failure. Again, the beneficiaries in this deal are the legislators responsible for the bailout approval and the corporations rewarded with taxpayer’s funds for unprecedented incompetence in modern economic times.

They are the beneficiaries because the legislators secured their emoluments by rushing the operating budget $410 billion omnibus bill ladened with pork projects to the tune of $8 billion to curb ‘government shut down’ rather than passing the required operating budget and isolating the earmarks spending for individual scrutiny through separate legislation.

The Corporate executives in due diligence spared no opportunities to collect remuneration, bonuses retrospectively and in the foreseeable future to maintain their status among the top 10% wealthiest hierarchy.

Let’s not forget in the Darwinian "Survival of the fittest contest" the weak, fragile and frail average taxpayer doesn’t stand a chance against the ferocious Corporate executives (compared to sharks) and Capitol Hill crusaders.

Events unfolding in the entire scenario deserves attention from every citizen involuntarily pledged to carry the burden of national debt currently projected at $9.3 trillion i.e. $1 trillion budget deficits every year for a decade, 2010-2019.

It is worth examining the role of legislators, corporations and lobbyists in securing taxpayer bailouts more prevalent in the past year 2008 and continuation of it in 2009. Prior to the diagnostic procedure, it is essential to shed light on the alliances forged by the key cabinet members and Wall Street merchants.

According to http://www.wsws.org/articles/2008/sep2008/paul-s23.shtml – Thank you.

Published by the International Committee of the Fourth International (ICFI)

Who is Henry Paulson?

By Tom Eley, 23 September 2008

Henry Paulson rose through the ranks of Goldman Sachs, becoming a partner in 1982, co-head of investment banking in 1990, chief operating officer in 1994. In 1998, he forced out his co-chairman Jon Corzine “in what amounted to a coup,” according to New York Times economics correspondent Floyd Norris, and took over the post of CEO.

Goldman Sachs is perhaps the single best-connected Wall Street firm. Its executives routinely go in and out of top government posts. Corzine went on to become US senator from New Jersey and is now the state’s governor. Corzine’s predecessor, Stephen Friedman, served in the Bush administration as assistant to the president for economic policy and as chairman of the National Economic Council (NEC). Friedman’s predecessor as Goldman Sachs CEO, Robert Rubin, served as chairman of the NEC and later treasury secretary under Bill Clinton.

Agence France Press, in a 2006 article on Paulson’s appointment, “Has Goldman Sachs Taken Over the Bush Administration?” noted that, in addition to Paulson, “[t]he president’s chief of staff, Josh Bolten, and the chairman of the Commodity Futures Trading Commission, Jeffery Reuben, are Goldman alumni.”

Prior to being selected as treasury secretary, Paulson was a major individual campaign contributor to Republican candidates, giving over $336,000 of his own money between 1998 and 2006.

Since taking office, Paulson has overseen the destruction of three of Goldman Sachs’ rivals. In March,

Paulson helped arrange the fire sale of Bear Stearns to JPMorgan Chase. Then, a little more than a week ago, he allowed Lehman Brothers to collapse, while simultaneously organizing the absorption of Merrill Lynch by Bank of America. This left only Goldman Sachs and Morgan Stanley as major investment banks, both of which were converted on Sunday into bank holding companies, a move that effectively ended the existence of the investment bank as a distinct economic form.

In the months leading up to his proposed $700 billion bailout of the financial industry, Paulson had already used his office to dole out hundreds of billions of dollars. After his July 2008 proposal for $70 billion to resolve the insolvency of Fannie Mae and Freddie Mac failed, Paulson organized the government takeover of the two mortgage-lending giants for an immediate $200 billion price tag, while making the government potentially liable for hundreds of billions more in bad debt. He then organized a federal purchase of an 80 percent stake in the giant insurer American International Group (AIG) at a cost of $85 billion.

These bailouts have been designed to prevent a chain reaction collapse of the world economy, but more importantly, they aimed to insulate and even reward the wealthy shareholders, like Paulson, primarily responsible for the financial collapse.

Paulson bears a considerable amount of personal responsibility for the crisis.

Paulson, according to a celebratory 2006 Business Week article entitled “Mr. Risk Goes to Washington,” was “one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in their pursuit of profits.” Under Paulson’s watch, that meant “taking on more debt: $100 billion in long-term debt in 2005, compared with about $20 billion in 1999. It means placing big bets on all sorts of exotic derivatives and other securities.”

According to the International Herald Tribune, Paulson “was one of the first Wall Street leaders to recognize how drastically investment banks could enhance their profitability by betting with their own capital instead of acting as mere intermediaries.” Paulson “stubbornly assert[ed] Goldman’s right to invest in, advise on and finance deals, regardless of potential conflicts.”

Paulson then handsomely benefited from the speculative boom. This wealth was based on financial manipulation and did nothing to create real value in the economy. On the contrary, the extraordinary enrichment of individuals like Paulson was the corollary to the dismantling of the real economy, the bankrupting of the government, and the impoverishment of masses the world over.

Paulson was compensated to the tune of $30 million in 2004 and took home $37 million in 2005. In his career at Goldman Sachs he built up a personal net worth of over $700 million, according to estimates.

—————————————————————————————————————–

Washington and Wall Street Analysis:

By Padmini Arhant

The beginning of the chain link usually found on the campaign trail, when corporations fund election campaigns through donation loopholes despite contribution limits by electoral commission and reign in on the successful candidate for the entire term.