The Affordable Care Act Reality

July 30, 2017

The Affordable Care Act Reality

By Padmini Arhant

The Affordable Care Act became comprehensively effective in 2014 and not 2010.

The subsidies to Insurance companies are not passed over to end consumer as co-payments and deductibles have been higher despite the law.

The premiums have not been cheaper while the insurance industry has been rewarded with 35 million subscribers through mandatory subscription.

There is no penalty on Insurers unlike on subscribers and employers on non-compliance.

The constant slogan on 20 million losing insurance would happen under the current law. The reason is the funding enabled largely on higher payroll taxes and individual mandates burdening small business, the middle income groups, the youth and healthy population.

The fiscal budget for 2018 on mandatory spending covering Medicare and Medicaid costs at $582 billion and $404 billion respectively are expected to rise further with bulk of the payments derived from general tax revenues becoming the primary source. The current 43% would soon increase to 62% affecting the younger groups, the middle class and baby boomers in work force.

There are already proposals to hike taxes for the income bracket between $150,000 – $300,000 in the tax reform bill sparing those earning above the target income to accommodate anamolies in the present health care bill that would exacerbate consumer spending with ripple effects on retail business and the economy.

Politics punishing the middle class and lower income neither qualifying for Medicaid nor benefiting from tax credits with health insurance premiums exceeding qualifying deductions is economically unsustainable with inevitable backlash from the electorate.

The ACA needs amendments in these areas with facts and figures reconciling reality.

Thank you.

Padmini Arhant

Author & Presenter PadminiArhant.com

Spouse in Divine Mission

Comments

Got something to say?

You must be logged in to post a comment.

-

Recent Posts

- Tran Politics’ Trans-Fixation

- AI Myth

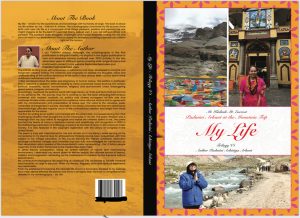

- My Life Trilogy Vol.1 – Autobiography Now Available at KDP Amazon and Amazon.com

- Narcissism – Definition and Victimization

- Love and Hate – What is Powerful?

- Los Angeles, Los Angeles, California – National Security Crisis

- Ukraine – Russia Peace Plan

- Ukraine – The Victim Exploited to the Core

- Los Angeles – California – Crime Manifestation

- Europe – Nazi Origin and Far Left Dichotomy

The Wonder Nature - Not created by human. Wise not to destroy it with human invented bombs and nuclear might.

My Life – Autobiography by Padmini Achintya Arhant

Upcoming Podcasts and Website Accessibility – Padmini Arhant

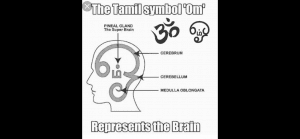

OM Nama Sivaya – Glory to Almighty God!

[memberonly] Nature – The Most Powerful Ever

Nature as the Supernatural force and phenomenon, presided and governed by the Almighty God in Spirituality is the one and only most powerful ever.

The titles in power, fame and fortune as “the most powerful person in the world” is build-up and excess adulation of the public service position and alike in the economic sector.

The occupations essentially legitimized and funded by ordinary folks across the spectrum. The people without whom, neither and none could function nor benefit from the designation.

Above all, life is fickle and the status of any kind melts down eventually and converge with the sea called the general society.

Humility and modesty are rare. Yet a necessity in elucidating human character.

Padmini Arhant

Politics – Abusing Power and Taxpayer Money

Tran Politics’ Trans-Fixation

What happens when the obvious is more transparent as the tran polity pitch reach a crescendo?

Michelle is Michael in French. The maiden name Michelle Lavaughn is Michael Lavaughn Obama.

That being the incontrovertible fact and reality, the following is apt for the tran polity obsessed with tran mania.

Hey! “You are that you think I am. I am not that you think I am.”

Your RAINBOW PRIDE is the impetus to your imbecile demeanor driven into the bottomless pit.

One can run as far as one intends, but can never hide. Cease and desist your provocative incendiary interventions in your target’s life.

Parasites declined parasitic culture and existence is naturally distraught and desperate for host.

The devil in disguise gets caught with the foot in the mouth in own exposé.

The one digging grave for others find themselves in the dug grave in the DIY gimmick.

By the way, racism against black America or Africa is coined with different connotations, the latest being “KAREN”.

Similarly, should black racism and hostility against their obsessed target be aptly referenced “Mufaso or Mombasa?”

Padmini Arhant

Traditions from Abroad – Men in Tradition

No Life Become the Low Life

Those with NO LIFE invariably become the LOW LIFE prompting invasion, intrusion and intervention in OTHER’S LIFE. Accordingly, such life succumb to demise.

Padmini Arhant

Feet, Feat and Fate

Make a mark with your feet. Not by seizing another’s feat.

✌️🙌✊🧢🏀 etc., including Chicago Sky and Hawaii ocean none of these would mean the identity swap as implied and alluded in the bizarre crooked wicked trend by politics and blind following by crony contingency.

Food for Thought – Originality demands ingenuity and together defines integrity and credibility in individual character and actions.

Criminality is the trait of the traitor born incorrigibly corrupt and criminal roaming as the devil in disguise entrenched in misogyny.

Anything imposed in contradiction to reality is the bare fact on such thing being the reject and desperately seeking meritless recognition.

Juxtaposed, the bright sunshine is pervasively bright enough to dispel darkness without any harbinger to make aware of the brightness.

Yet another parody is the self-inflicted tragedy.

The attire satire – in the staged satire – the contrived White House melodrama referenced in the article below – is illuminated with irrefutable TRUTH.

The attire significance in keeping up with appearance syndrome in politics has splashed disdain all over itself, smudging and smearing the suited and booted in designer labels and alligator shoes albeit at the taxpayers’ expense.

The latter not necessarily suited and booted like the beneficiaries as it is not required like so, to gloss over the decayed rotten interior overshadowing the exterior.

However, the ungrateful and uncouth ever basking on the besmirched eternal charity is the embarrassing reality.

For the pompous ignoramus information – The white collar crimes albeit suited and booted in expensive getups engaged in grand larceny of nation’s treasury to scamming, conning and cheating, committing treason against the ones funding their existence unto their demise are by far the most dangerous and perennial threat to society and humanity at large.

These crimes continue to cause economic tumult and devastations, destructive political perversions and systemic corruption criminal culture in the core abuse of power.

All these crimes are committed in polished boots and immaculate suits blinding the abused taxpayers and hard working citizens across the spectrum in society.

The worst, they remain at large maintaining further criminal lifestyle and loot carried out with authority, while drowning in disrespectful deluge upon their behavior stripping them of the false savior hood in

Who is who? – public display.

Notwithstanding, the ones who were denigrated and described “unfit” to engage with the suited and booted diatribe posed as the dialogue in ambush eventually prevailed in history.

The non-violent pioneer of Independence movement against the brutal imperialistic power, none other than Mahatma Gandhi was ridiculed by the imperial servile Winston Churchill as – the “Half-Naked Fakir”.

Did the so-called half-naked-fakir not prevail over the booted imperial power, renowned for the loot ever?

How about the King Siddharth born with Royal insignia, renounced the regalia and adorned in simple robe, became the ascetic who enlightened humanity?

Henceforth, revered as Buddha accordingly by the ones who recognize the enlightened Soul?

That is the stark distinction between the real undiminished light and the fraud plunged in darkness.

The battle between Evil and goodness is that of devil and deus. Succinctly, the evil succumbs to vanity and unsustainable criminality.

Padmini Arhant

Western Characterization of Masculinity

Telling a joke, being competitive and drinking beer – all exclusive to male? Since when?

Aren’t there women comedians and standup-comics?

At least in other cultures, they are thriving in entertainment. Some are quite famous. The same goes in families, there are women with great sense of humor.

In competitiveness – Don’t western sports profiteer from women aggressively competing with rival teams?

Like the prominent WNBA that is not yet titled ANBA (Androgynous) or HNBA (Hermaphroditic) or,

For that matter, the bash and smash sports Tennis – U.S. Open, Australian Open Wimbledon, French Open ending in Grand Slam as the name suggests slam the series with mega bucks made by all those sharing the fortune.

Last but not the least – Beer chugging by white women is a common sight during Oktober fest in Germany and alike in Australia, Britain, Ireland and Nordic countries by white girls and women, who have beer with their male and / or female companions in western hangouts at the pubs and bar that are fairly normal in western culture.

What about western women, some high profile female political members in the United States political party, their widely known passion for Russian Vodka, ironically promoting the economy of a nation, reserved by them, an adversary.

The idea of exclusivity from behavior to lifestyle, intelligence to bravado delineated gender specific in western politics, not necessarily in western general society is a momentary relief.

The former distinction considering politics dwell in political universe that revolves around own political ideology and perception of life as linear and Asymmetric.

Above all, the presence of both male and female hormones viz. testosterone, the male hormone and estrogen, the female hormone are prevalent at varying levels in all male and female species.

The humans in particular, revealed in anatomy and physiological characteristics such as the chest in a male similar to that of a female with the latter only enlarged due to mammary glands.

Likewise, some women tend to have dense body hair, thick growth on their arms and legs from the higher level of male hormone triggering these physical features that are otherwise common in men.

In a way, the male and female composition complement one another, designed by nature in the nucleus sharing the DNA of both male and female chromosomes.

Politics might have entirely a different perspective and interpretation especially in contemporary age to fit the political criteria on anything and everything that are uniquely natural and normal.

All the more reason, for individuals from all walks of life to exercise own intelligence and discernment in making informed decision rather than falling for political narratives driven to mislead and cause confusion.

Padmini Arhant

EVIl invites PERIL

Words of Wisdom. Works All the Time 🤗

Friction or Traction. Private affairs are best kept private rather than fantasized as public.

Only those who have no life would be obsessed with other’s life. Such existence is being dead in living.

Life is a blessing not meant to be destructive to self and others.

Padmini Arhant

Tesla Inc. Unconventional Solar Roof Contract

Does anyone know the future with certainty?

If they did, they would be the ruler of own destiny.

However, the multi-billionaire Elon Musk owned and run Trillion $$$ Tesla Inc. binds homeowners on contract related to Solar panels and Solar roof in a rather unconventional practice.

The homeowners are drawn into a Solar lease arrangement on long-term basis based on the product longevity guesstimated by the company as twenty years, even though the real experience is far below well before half-way down the contract.

Nonetheless, the contract is established as zero downpayment with fixed monthly charge to bank account throughout twenty-year-contract, with additional fees upon using any other payment options.

The homeowners decision to terminate the contract at any point in time prior to contract expiry for assortment valid reasons is persona non grata – simply unacceptable predominantly clear in such outcome.

The product and service not meeting minimal requirements in Home Energy Efficiency and,

As a result, the investment proven a liability being the common factors face steep financial monetization by the company citing own policy.

The company requirement from the homeowners to pay for the remaining period of the contract such as 10 or 15 years – $13,000 to $18,000 in that 20 years lease agreement upon early lease termination is a phenomenal extract.

This is despite, the products and services are no longer used and duly returned to the company in the relevant time and condition.

How does such disproportionate deal is fair to homeowners?

The company has to be paid in lump sum upon homeowners exit prior to lease expiration besides returning the products and systems back to the company at that time.

Applying the analogy on home rental lease,

Could property owners demand entire lease term payment in three to five years lease from tenants wanting to move out or discontinue rental based on legitimate reasons?

The laws strangling the property owners leasing apartments and homes are extraordinary compared to Trillion $$$ tech giants and alike oligarchy basically owning governments and legislations in the direct buy-out with few million $$$ in political campaign and Presidential candidacy, raking fortune in return.

In the process, trading people’s rights as consumers and homeowners as applicable.

Seeking full settlement on the unused lease term on Solar roof or panels, is demanding homeowners to accept future set in stones with events writ large in life in the reality of even weather forecasts not always necessarily accurate.

Above all, generally politics and economic sector default on their respective pledge to public.

Such lopsided agreement entirely benefitting the company is a trap with the exit strategy for homeowners to free themselves from the expensive inconvenient setting stipulated to paying ransom to the company.

Apparently, marriage divorce on irreconcilable differences are lot easier and not so compelling than the divorce from exploitative opportunist politics and influential economic greed.

Regardless, Is this the pathway to Super rich MBT – multi- millionaire, billionaire, trillionaire status?

Exploitation and extortion as the means to self-enrichment and political empowerment.

Padmini Arhant

Ukraine not Ukraine’s President Seems to be the Problem?

Ukraine’s President with the last name Zelensky identifying the faith, whether religious, agnostic or atheist, perhaps would not be subject to recent nomenclature, had the President been representing Israel.

Ukraine’s President would most likely and almost certainly enjoy similar status that of counterpart in Israel in the parallel warfare in Ukraine and Gaza.

Ukraine appears to be the problem more than Ukraine President, for anyone targeting Ukraine.

The western members rallying behind Ukraine contrarily joined forces with Israel in Gaza Genocide. The western determination of invasion is the one that fits own definition.

Padmini Arhant

Scoundrel Kavodhi Funeral

Politics and Media Fanaticism

The nuanced insolence against me and my family – verbose, visual and preposterous enactments by far remain the dumbest idiocy practiced by those claiming to be the,

“Be all and End all in the World.”

There is no doubt, they are being who they are in exemplifying insanity and profanity. Nevertheless, the end of anything insane and idly mundane relevantly applicable to them is beyond their comprehension.

I understand, those engaged in this lunacy have no life. Otherwise, neither would be suffering from the Obsessive Compulsive Disorder with incessant obsession with me and my family regardless of them skidding in the process to the bottomless pit.

The allusion with anything ending in monosyllable phonetics – ni, mi, me, ne, ney mey…and for that matter the letter P – interestingly unbeknown to the OCD, also represents the Planet, People etc., on Earth.

The phonetics fanatics are the biggest joke🤣 in the outrageous sickness proving themselves non-salvageable toxic waste in the environment.

Padmini Arhant

Devil in Disguise

The Devil in disguise is no different from the Pervert with nothing on.

Those who use other’s positive karma for own promotion and narcissistic self-interest are the same as sinking boat with dead weight.

Enactments of fake situations to console the Satans is exacerbating satanic evisceration.

The villains, demons and Satans imminent end is ominous, when they indulge in rage and devilish activity.

The destruction motive against the target is hallucination yielding self-extinction.

These aptly apply to devils and EVIL syndicate perpetually fixated on their target. The obsession, inevitably expunge the devil and Evil in accordance with natural law of Karma is the done deal.

Padmini Arhant

Black Deed and Slavery

The black deed blackens face and chains the mind to slavery servile to the devil within.

The successive defeat and rejection, encountered as the ill-fate of black politics throughout since emergence to date, is black tar on the parasitic culture fleecing and freeloading on their target much to individual and collective demolition.

The pitch black dark night is devil’s comfort zone. However, the experience is short lived at dawn break and sun rise dispelling blackness to oblivion.

Padmini Arhant

Piracy Plagiarism Plague

Rhetoric vs. Reality – Piracy

Wig vs. Real Hair – Factual

Crooked (Crocket) vs. Honest – Actual

Fake vs. Original – Absolute

Sham vs. Sincere – Truth

Padmini Arhant

FREE PALESTINE – Not Arm Israel with $1Billion Weaponry

FREE PALESTINE – Not Arm Israel with $1Billion Weaponry. Padmini Arhant

Poison Politics – Death Wish

WHY DARKNESS SHUNS LIGHT?

What the contemporary poison politics should have in their Death Wish are the following;

The death of abject corruption, violent criminality, political abuse of power, taxpayers’ hard earned money, serious violations, invasion of life and rights, identity theft, piracy, plagiarism, prejudice, propaganda, hatred, misogyny ad hominem and,

Above all, the burial and cremation of political impunity and sanctuary on all these abominable atrocities and abhorrent legacy.

Padmini Arhant

Comedians as Political Surrogate

The so-called comedians in the lack luster late night shows 🥱 on multi-million $$$ price tag with pre-recorded phony applause played to their sound-bites at “the expired political term designee’s behest” is satire at own exhibit. The presenter’s performance to the empty seats, is gala comedy routine.

The prying, preying, spying, snooping and ever intrusive, invading people’s lives gutter politics entrenched in *sexual connotation* of anything, prompted by own dysfunctional personality in oedipus complex is beyond remedy.

The degenerative mind and sadistic impulse expedite individual and collective succumbing to obsessive compulsive disorder.

Padmini Arhant

Life is a Gift

Life is a gift. It is meant to be positively purposeful not negatively wasteful.

The world creation is heterogenous not homogenous. Accordingly, not all things are derived similarly in source and practicality.

None have the right to define, determine and validate anyone’s identity and intelligence or the lack thereof.

Human status is a blessing not to be squandered in idle fixation on things and persons not even remotely connected in any format.

Instead, internalization is the place to begin with to recognize the cause of such mental and emotional turbulence. Failing that professional help might be a way to sort oneself now and moving forward.

Can’t do any good. Never mind. The least is to refrain from doing any harm to self and others.

Padmini Arhant

Life – Interpretation

Is embryo to be treated like people? asks Arwa Mahdawi of the London based “The Guardian.”

People – A person’s body has countless cells that are required to be alive and well in order for life to exist in general.

For example – The aging of cells contributes to weakening of tissues, nerves, veins and arteries that in return impact the vital organs, the nervous system and the overall well being.

Embryo upon fertilization of egg from the female ovum by the spermatozoa from the male, thereupon the development leads to fetus formation in the uterus. The function is possible only when the cells are healthy and alive from conception until live birth and then onwards expanded into the life span.

As for the sex determination of the fetus – Yes it is female XX at origination until twelve weeks, with the Y chromosome from the male sperm were to be dominant altering the XX to XY for necessary reproductive organs such as male genitalia.

The discarded embryo used in the embryonic stem cell transplant saves millions of lives, cures many life threatening diseases and contributes to renewal and rejuvenation of body cells enabling better quality of life for those suffering from crippling diseases and health problems. Only living organisms and cells can facilitate life and functionality.

Embryo is a living body of cells that otherwise would not be possible in becoming the fully developed fetus and eventual live birth upon delivery from the womb.

Hey! The above is No AI B.S. or Plagiarism from Internet source.

It is straight from natural endowment – the organic brain with active brain cells in my body enabling thinking ability besides exercising reasoning faculty from within and recounting experience from two live births in my present lifetime.

Padmini Arhant

Blatant Coup détat with no Democrat Primary in July 2024

The devil can no longer be in disguise.

The one pretending to be the promoter of women to break the glass ceiling would not have been primarily preoccupied in systematically and brutally removing women leaderships as the heads of state especially in Asia, Australia and Britain sparing Africa in the particular terms 2009 – 2016.

Similarly, without a shadow of doubt since 2009 – 2016, via the alter ego in Indian politics, the trend involved in humiliating then female leadership in the State of Tamil Nadu, the late Chief Minister Jayalalitha. Not barring, the deceased CM’s death in Dec 2016, shrouded with many unanswered questions to date.

In real sense, apart from common sense, the former Tamil Nadu CM Jayalalitha was far more capable than the BO and MO recruit -B.S. – the former VP and Presidential candidate Kamala Harris.

What does that say? There is no tolerance for competence and courage in female leaderships to pushback male supremacy in global diktat presided politics.

So much for caring to see a woman with Indian descent or lineage to shatter the glass ceiling?

That too, How was that hatched by the BO and MO – B.S. duo to prolong puppet woke DEI regime?

In a blatant coup d’état against own party incumbent Presidency brazenly subverting democracy slighting the democratic primary, with the induction of failed flawed candidacy, whose track record reeked dismal performance, for which the candidate, Kamala Harris was long rejected in the 2019 Presidential bid.

The reality in the candidacy was not Indian or Indianhood rather AFROCENTRIC – to reflect own BLACK race prevalence, with the candidacy touted as the so-called ‘the First Black Woman’.

Otherwise, the 2024 Presidential democrat candidate could have been from open field democratic primary by election *not* selection. Accordingly, the democratic process was rejected for obvious reasons.

Even with the choice of Kamala Harris, what was the exhibit?

The former VP Kamala Harris naturally and voluntarily in adherence to the script from the puppeteers behind, became the emblem of word salad, fodder for western and non-western crony media in endless misogynist caricature – all of which depicted as me in the fraudulent display.

When in fact, I have challenged everyone engaged in the mob ambush against me for an open public debate in world view which has been declined to suit the convenience of evil to subvert and distort my unique identity as it is with all living species in the natural creation.

Not even the free speech birth right to respond to relentless insolence and virulent attacks until now were considered normal with censorship, gag orders and cancel culture becoming pervasive in the authoritarian targeted practice in the name of democracy.

Besides, Who says Hillary Clinton and Kamala Harris are women?

Only then the question of breaking the glass ceiling arise.

I pose the same question that is arrogantly and presumptuously raised to me by power mongering egocentric prejudiced clique anchored on ad hominem misogyny against me having and continue to phenomenally benefit from my existence as a woman.

One receives what one offers another anytime. It is called the Karma with or without any cuss or slur.

You may have the whole world with you in the persistent pursuit to assail TRUTH, nonetheless in vain.

The wicked and crooked devils never prevail over Almighty God’s Will.

Padmini Arhant

Outgoing Presidential Pardons – Beg Your Pardon 🤔

The outgoing Presidential pardon to Anthony Fauci, Liz Cheney and next of kin Hunter Biden within family – distributed more like candies to savor the moment in sober time.

By the way – Isn’t the one guilty of any wrongdoing and crimes seek pardon?

Should the preemptive Presidential pardon to these individuals be then considered they are guilty prompting extraordinary selective Presidential mercy upon them?

Beg your pardon 😱 bemoans democracy!

Padmini Arhant

Gender Orientation – Male, Female in Natural Creation

Absolutely only two genders.

Female (X) and Male (Y) in natural creation.

The exclusive male and female factor respectively is the fundamental fact in procreation leading to generations in life longevity and eternity in Almighty God created “World without an end.”

For that matter, the same is applicable in practical and mechanical designs from plumbing materials to electrical and magnetic settings in the directly opposite format male and female components and as +ve and -ve to charge enabling functionality.

The distortion exerting own complexity and confusion against anyone is a psychological deranged syndrome.

Any other orientation deviating from the natural design is genetic disorder, social experiment and worst of all political indoctrination.

Nonetheless, discrimination of any kind against anyone is unnatural i.e. human developed behavioral misconduct prompted by ignorance and prejudice.

Padmini Arhant

இறைவன் படைத்த உலகம், இயற்கையின் ரீதி – இரண்டு ஜாதி மற்றுமே உருவாக்கப் பட்டது

இறைவன் படைத்த உலகம், இயற்கையின் ரீதி – இரண்டு ஜாதி மற்றுமே உருவாக்கப் பட்டது.

பெண் ஜாதி. இன்னொன்று ஆண் ஜாதி.

சங்கத் தமிழ் இதை உறுதியுடன் தெளிவாக பதித்து உள்ளது.

இதை திராவிட அரசியல் மூலம் கலப்படம் செய்து – மனித படைப்பில் மூன்று பால் உருவாகி – ஆண் பால், பெண் பால் மற்றும் மூன்றாவது பால் தமிழ் சங்க நூல் குறிப்பிடுவதாக அதன் பெயரை குறிப்பிடாமல்,

ஏனென்றால் – அப்படி ஒரு பால் இருந்தால் தானே பெயரை துல்லியமாக சொல்ல முடியும்.

தற்சமய அமெரிக்காவில் தேர்தலில் பலத்த காயத்துடன் தோற்றுப்போன அயோக்கிய கும்பல் சீண்டி தூண்டி விடும் பொய் பிரச்சாரம் பிரச்சார கருவிகளுக்கு தன் முகத்தில் தானே கறியை அப்புவதாகும்.

ஏனென்றால் இதே பிரச்சார போலி குழு திருநங்கையொற்றி அவதூறு செய்தல் அரசியல் சர்வாதிகாரத்தின் மும்மரமாக இருக்கையில், தானே ரெண்டும் கெட்டான் நிலைமை. இதில் தான் இவர்களின் முகமூடியை இவர்களே கிழித்து கொள்வது வெளியாகிறது.

மற்ற படி கடவுள் படைப்பில் – ஜாதி – ஆண் மற்றும் பெண் இவை இரண்டுமே தான் இயற்க்கையின் செயல்.

மற்றவை எல்லாம் செயற்க்கையாகும்.

இவைகளில் முக்கியமாக, மனித உடல் உறுப்பின் கோளாறு, மரபணு கோளாறு, சமூக பரிசோதனை அதைவிட அரசியல் போதனை வதந்தி இந்த செயற்க்கையின் மூல காரணமாகும்.

தற்சமய அரசியல் இந்தியாவின் மத்திய அரசான ஹிந்துத்வ வெறித்தனம் ஒரு பக்கம்,

மற்ற படி தமிழ் நாட்டின் சாபக் கேடான மற்ற தென் மாநிலத்தைச் சேர்ந்த அந்த மாநிலத்தின் மொழி, வம்சாவழியில் வந்த தமிழ் நாட்டை அந்த நாளில் இருந்து இந்நாள் வரை *அந்நியர்கள்* ஆளும் அரசியலால் தமிழர்கள் மேல் திணிக்கப் பட்ட பெரியார் என்ற ஈ.வே.ராவின் கர்நாடகாவின் திராவிடம் என்ற மரபு தமிழையும் *சுத்த தமிழ்* அதாவது பச்சை தமிழ் அடையாளத்தை அழிப்பதற்கான சதி.

மேல் குறிப்பிட்டவர்களும் மற்ற படி ஐரோப்பாவின் அரை குறை கணிப்பு அதோடு சூழ்ச்சியின் காரணத்தில் அந்நியர் கூட்டணியின் இந்த சூட்சமம் எந்த மாநிலத்திற்கு குறிப்பாக கர்நாடாகாவிற்கு இந்த திராவிடம் சொந்தமோ அதை தவிர்த்து விட்டு,

தமிழர்களை திராவிட கால்வாயில் தள்ளி இதுவரை அரசியல் வியாபாரம் நடத்தும் – வாரிசு அரசு, ஜன நாயகம் பெயரில் நடக்கும் கண் கட்டி வித்தையாகும்.

இதில் மக்கள் உழைப்பின் மாநிலச் சொத்தை திராவிட அரசியல் தன் குடும்ப காணொளி நிலயமாக்கி – சூரிய ஒளி, கலைஞர் ஒளி மூலம் – தமிழ், தமிழ் பண்பாடு, கலாச்சாரம், இலக்கியம், சரித்திரம், பூகோளம் எல்லாம் தன் குட்டிச்சுவரான திராவிட மாநிலமாக்கி சின்ன பின்னம் செய்து வருவது, தமிழ் நாட்டிற்க்கு திராவிடம் என்ற சாபம் செய்யும் பெரிய துரோகம்.

இதை தமிழர்கள் உணர வேண்டும்.

பத்மினி அர்ஹந்த்

அழிவின் காரணம்

அழிவின் காரணம்

பெண்ணின் இழிவு அழிவு. பெண் பாவம் பின் பாவம் காலமாகி தற்சமய பாவமாகியுள்ளது.

எத்தகை ஆதிக்கம். பிறரின் உரிமையை பறித்து தன் சுகம் ஏகபோகம் பணம் புகழ் பதவி அனுபவம் அழிவின் அஸ்திவாரம்.

சர்வாதிகாரம் எங்கும் எப்பவும் சர்வநாசம்.

பத்மினி அர்ஹந்த்

Sky News DownUnder👎

The wannabe, opportunist, desperadoes Sky News DownUnder👎 in the rugged outback Australia is literally and realistically DownUnder👎,winning the title unparalleled parasite and groveling sycophant media pit / Outhouse.

Watch where you are going?

Padmini Arhant

“Authentic” Intelligence Paradox 😅

Those behind the trend projecting anyone from anywhere? including others in semblance to the meaning🌷and / or the name ending in ‘ni/ mi’ letters and phonetics importantly shady, nefarious, unscrupulous…elements serving as proxies and pawns of the frustrated desperate despotic megalomaniacs epitomize lunacy, idiocy, fantasy and hypocrisy.

Wanton Provocation – in association with viz. Liz common nick name of E(liz)abeth. Liz is also the prefix in (Liz)ard.

Similarly, Mic(hell)e aptly suitable as Michael.

When such nuances are prevalent – it is indicative of the promoters and practitioners topsy turvy twisted mind.

Not to mention, their names appropriate to them and their profile.

The trait considering them touting their intelligence – unparalleled “authentic” 😂 and promoting the one they are incessantly obsessed with – “artificial” is analogous to the pigs in the swamp running in circle in search of their pig tail. 🤣

The ongoing insanity presided by psychotic sociopaths is the parody and tragedy of this century making themselves and their inventory of cartoons the spectacle of the world.

विनाश काले विपरीत बुद्धि । With the end near the mind reverse and becomes unclear.

Padmini Arhant

Happy Pongal! Happy Makara Sankaranthi! 2025

Provocation, Manipulation and Subversion

Provocation, Manipulation and Subversion using live or the so-called AI model created by destructive factions aimed at “anti-natural endowments and elements” in denial of empirical facts about them as the existential threat endangering lives and human normal existence invoke their termination in the attempt to inflict otherwise on the “obsessed target and their concerned. “

Since world creation till date EVIL never prevailed over God’s will to restore sanity, tranquility and civility in disarray under EVIL and COHORTS ambit. Like all things designed to expire, the EVIL presided tumult is no exception rather on prioritized expiry.

FEI – For Evil Information -Any unnecessary hoodlum tactics and hooliganism however is disposed as garbage.

Padmini Arhant

Originality

No matter what alloys are used to produce value based item and marketed as gold value – they are never the same nor equivalent to the original gold.

Originality has the naturally assigned uniqueness similar to individual DNA in genetic code.

Imitation and Fake never equal original and authentic.

Padmini Arhant

Satans and Proxy Duplicity

Satans and their proxy – pack of hyenas always scavenging for survival being pathetic necrotic parasites.

Stealing zodiac sign and basically any and all positivities ironically from the targeted arch rival never absolve Satans and proxies of abhorrent violent homicidal, genocidal, terror and cannibalism..amongst other despicable pervert lewd crude characteristics laden with con, scam and public summary execution of the rape victim – own member of the race.

As for once again pirating phrases and content from the one incessantly pursued and ridiculed via murderous proxies and sponsors epitomizing cowardice.

When hoodlums, hooligans, perverts and gangsters run the gamut making mockery of civilization and civilized world,

The opinion stated in the sub-domain of this site in Tamil language – that “anyone can achieve the dreams and ambitions in life by honing in the skills and talent they possess together with hard work” is a statement maintained now and forever.

Only the narcissists and shallow minds possessive of any and all natural endowments to all beings at varying degree and potential would demarcate as exclusive to them such as – the bizarre ominous cult Artificial intelligence created by them otherwise touting themselves as authentic intelligence.

When the mob rule could exist anywhere run by terrorists and terror sponsors,

Why is it not possible for sanity, civility and integrity to achieve anything in their life?

Something for the AI dependent sadists to think about if such ability is possessed within.

Last but not the least, the misogynists steer the society against natural and biological heterosexual relation designed by nature for life expansion besides emotional feelings.

Heterosexuality is fundamental in God’s creation of life existence and sustenance as well as in the expression of love and affection.

The misogynists with their given disposition and behavior are instrumental in promoting and practicing relation paradoxical to heterosexual orientation.

These misogynists are also closet culprits while actively engaged against heterosexual norm.

This trait is specific to misogynists with their outlook and overt targeted misogyny culture despite the fact their emergence from the womb and reproducing themselves (God forbid🥹) the requirement of ovum and the uterus.

No wonder such travesty running the show on the world stage fears and detest the termination.

All things are set to expiry – the merchants of destruction and devastation for own economic and political interests in particular expediting the process.

Padmini Arhant

Satan’s Satanic Antics

Satan’s assortment antics eventually backfires at satan. The evil course in diabolical activities suffice in the end justifying the means in the laws of nature.

Satans could subvert anything but not own guilt ridden conscience witness to all of Satans’ satanic activities making the run impossible for Satans to sprint from them.

Shackled in guilt and sinful existence, Satans invariably succumb to own karmic woes sooner than later. Satans obedience to the devil often expedite such outcome.

Satans propose and God disposes viz. Winning Election and warfare makes Satans head spin and detach from torso.

Evil never prevails over Goodness being God’s will.

Welcome to Reality.

Padmini Arhant

Ego is Self-Mortification

One can never reason with humongous ego – emanating from human presumptuousness.

The Supremacy syndrome is the one with plenty of hubris, ample attitude with nothing to guide from within in self-mortification.

The crown doesn’t fit the head circumference given the oversized trait representing the dire strait.

Supremacy and Slavery are intertwined complexity. Supremacy is enslaved to internal negative vices prompting quest for relief via external enslavement in slavery.

Those who can’t help themselves from self-decadence are not the ideal choice for others’ salvation.

Padmini Arhant

FPI – For Public Information

FPI – For public information all inclusive without exception –

My pledge of allegiance ever remains with none other than Almighty God, Natural Environment and republic wherever – humanity at large.

Padmini Arhant

Anchored Deranged Misogyny Syndrome

Mud slinging without basis is own burial in quicksand.

Evidently straightening a twisted dog’s tail is possible than addressing a deliberate malignant identity misappropriation and anchored isolated deranged misogyny syndrome.

Not to mention, the foolish trend led by guilt-ridden white and everlasting victimhood black culture in the vain efforts seeking compensation and compromise for mutual benefits from the scapegoat not even remotely related to neither race nor individual legacy when reality verifies the reverse with the former duo as recipients in the combined patronage.

Similarly applicable to the tail wagging crony contingency from anywhere viz. Indian polity, conventional + social media and entertainment – the undeserving parasitic major beneficiary in newly invented unprecedented demented custom.

Padmini Arhant

Devil is Rattled – Tell Tale Signs

When the devil can’t handle anything in colossal defeat i.e. shellacking in 2024 Presidential race resulting in full blown exposure of the devil’s demonic traits, the devil and the DEI evil conglomerate are rattled simply on fait accompli.

What does the devil and DEI Evil clique do to exhibit original image?

After all, how long could the devil and evil DEI B.S. hide in stolen positive identity and persona of their most envied target and arch nemesis?

At the end of the day, the glove never fits the blood stained hands from emergence in the world to parasitic existence till now.

The devil in particular bolstered by Evil corpses seething in monstrous jealousy, hatred, anger and misogyny…surrender to the demon in their mind and turn berserk witnessed lately in the series of diabolical activities since historic loss in 2024 U.S. Presidential election – no surprise there.

Amongst the devil’s homicidal mania going back to drug peddling childhood rampant in adult “gay hood” preying on own bedfellows black and white especially sodomizing the white male Larry Sinclair on wheel chair to the latest saga involving black female dental hygienist raped deserting a black child from the rape and the raped mother summarily executed using taxpayer provided security personnel by the tran duo were not over.

The latest victim black male personal chef on the paddle boat at taxpayer funded vineyard estate doorstep…merely symptomatic in the otherwise serious personal wreck syndrome.

How could it be possible?

In conveniently deploying the ridiculous race card having been ironically responsible for abuse and murder of own people while promoting Black Lives Matter imposed on others. Meanwhile, brazenly committing heinous crimes from the political immunity sanctuary.

The Presidential election 2024 defeat is avenged with drone drama carried out in the East Coast and of course in California – the anchored domain for the devil and evil DEI dichotomy.

Upon not being satisfied the devil had to orchestrate the mowing of innocent bystanders and crowd gathered at 2025 New Year’s celebration casting yet another devil’s loss of control in demonic outrage in New Orleans, Las Vegas and New York simultaneously at the dawn of New Year 2025.

The devil let loose has been causing bloodshed, terror and carnage at the onset and went overdrive since November 4th, 2016 upon the devil ushered into exit having created tremendous pain, suffering and misery to all those the devil has targeted thus far.

There are two outcomes in the attempts to shape anything for useful purpose.

The iron ore – a rough hard core metal is brought to shape for various usefulness by hammering and / or heating that turns into molten state – the idiom – strike when the iron is hot is precisely for that reason as it conforms to malleability.

The other outcome that fits the devil and transcontinental evil conglomerate is the above outlined process only renders them out of shape and beyond any positive engagement as they are paradoxical to the characteristics and personal nature of the devil and evil cohorts hell bent on – our way or highway even when that is in the bottomless pit.

It is not the question of the devil and evil compatriots on the precipice.

The downfall from the self-destructive provocation for own individual and collective self-serving never to be fulfilled evil aspirations not ever coming into fruition is conspicuously leaving the devil and evil syndicate possessed to own peril.

Somethings never change for better by design and own volition.

The Gospel Truth – the devil and EVIL DEI Dichotomy may presume to hold the gavel amongst own insular world not barring the natural intelligence subversion convoluted as artificial intelligence though hopelessly fleecing on the contributions of the ones despised and vindictively pursued in obsessive disorder.

The Supernatural phenomenon is the ultimate power in the mantel of Supreme Authority as the Cosmic Force since creation of the Universe and galaxy until present into infinity future and beyond.

Padmini Arhant

The Misogyny Irony

The Misogyny Irony

Padmini Arhant

The irony in misogyny is denial of own emergence and existence otherwise impossible in the absence of woman’s reproductive organs.

The spermatozoa without ovum would be extinct is empirical fact. The natural factor.

Rooster in the Hen House – Never mind on what emerged first the chicken or egg even though the emphatic response is egg hatched into chicken. In the course producing roosters and hens by the hen.

What is relevant in the contemporary era?

The hyenas guarding the chickens (roosters and hens) den proven existential threat to own citizens and humanity at large.

As for ‘thirsty’ slang – the same is epitomized and exemplified by the source and catalysts in colonial imperialistic hegemony involving terrorism, oppression, repression and supremacy syndrome.

Whoever says and thinks – narcissists and compulsive impulsive abusers admire their image upon shown the mirror?

Padmini Arhant

Drone King to Spinning Top – Barry Soetoro aka Barack Obama Political Voyage

Drone King to Spinning Top – Barry Soetoro aka Barack Hussein Obama – the Political Voyage

Padmini Arhant

Talk about “spinning fellas” – the one who is unparalleled in this trait and trend – is none other than the one with the real name Barry Soetoro spinning to Barack Hussein Obama.

The one conning citizens from all walks of life asking for campaign donations of $5 – $5,000 and more with fake fraudulent requests including enrollment in Obama University (that’s right fellas and folks – Obama University – Perhaps in the Obama University specializing in con, scam and art of deceit).

The shenanigans in 2008 – 2016 as the so-called community organizer deriding the Wall Street as “Fat Cats” in own lexicon while firmly seated on the same Fat Cats’ lap since debut in politics and multipolar 2007 election campaign and thereafter by selling healthy, hardworking ordinary American citizens to health care industry historic scam in the name of the abominable OBAMACARE.

In return for trading American average citizens in the health care gimmicks with mandatory health insurance rewarding the combined health care industry with windfall absent stipulations on the health industry to meet fair bargains ignored for mutually exclusive financial gains – cashing and capitalizing with mansions, seaside castles, vineyard estates… on treason in quid pro quo in the healthcare scam and several scams throughout 2009 – 2016 and resumed in 2021 – 2024.

These alone besides endless blatant violations of electorate trust and plethora of flip-flops make the spinning top collapse turning upside down witnessed in the U.S.Presidential election 2024.

Something to deliberate and ponder – the process known as Soul Searching for the irreversibly stained pot calling the kettle “black.”

Padmini Arhant

Musk Donald Trump Prez – AI Pick Controversy

The AI pick Sriram Krishnan by the upcoming Musk Trump Presidency.

Hopefully, in the current AI frenzy,

There will be real criminal investigation in the mysterious death of the mere 26-years-old Indian American Suchir Balaji – born and brought up in the Silicon Valley, California.

The young tech AI researcher and whistleblower during employment with the controversial Open AI organization,

Open AI – One of many tech and corporate donors to Trump Inauguration Fund 2025. Open AI has generously donated $1m to Trump Inauguration event.

The young AI specialist Suchir Balaji reported to have died from suicide on Dec 4, 2024 in the common incidents of murder declared suicide having become the norm.

Will the Musk Trump AI pick Sriram Krishnan – if confirmed, would be able to call for thorough investigation in Suchirc Balaji’s murder related to AI controversy barring any adulteration and domestic as well as foreign intrusion to stymie the facts based criminal procedure?

The Lord Sriram Krishnan would definitely demand and investigate to get to the bottom of the slew of Indian origin students and young recruits murdered in the campus and off – corporate sites in the targeted fatalities of American born Indian students and students of Indian origin arriving from India.

The murder incidents of Indian origin students and case like Suchir Balaji is very alarming and disturbing considering the unusual number of murders of Indian origin young talent in this particular year Jan – Dec 2024.

Suchir Balaji’s parents request for investigation has been denied with the matter closed as “suicide” which in itself has blown the lid off the can suggesting more to it than meets the eye.

Indian appointees as CEOs in the corporate world especially in the tech industry and politics is far from merit oriented and tribalism.

In reality, it is deliberate sinister considering the tech and politics entrenchment in secret society and dark age agenda using Indian image and names specifically Ram, Krishnan and Ramaswamy…so on.

There is never a free lunch. Nothing happens without underlying malignancy in the contemporary global ploy.

Suchir Balaji is one of ongoing examples as victims in the year 2024.

My sincere condolences to Suchir Balaji’s parents in the Silicon Valley. May time expedite their healing with peace in the most difficult time of their life.

Padmini Arhant

Subversion of Foreign Religion

The ones who engage in distortion and subversion of foreign religion basic requirements.

1. Correct pronunciation of Hindu Gods and Goddesses names.

2. Stop manipulation and hyperbole convolution of mythology by tossing in your spin ball machine.

3. Know the facts prior to promoting propaganda.

Sri Narayanan is Lord Vishnu who in return is also Goddess Durga in the female form. Goddess Durga never gave boon to demons with immortality knowing they have to be dealt with by her when they impulsively wreak havoc which they always do sooner than later.

Padmini Arhant

திருநங்கை அவதூறு அவரவர் அழிவு சாபாமாகும்

திருநங்கை அவதூறு

அவரவர் அழிவு சாபாமாகும்

பத்மினி அர்ஹந்த்

திருநங்கை அவதூறு அவர் அவர்களின் அழிவு மற்றும் அவதூறை பரப்பும் பிச்சைக்கார பரதேசிகளுக்கு அது பெரிய சாபம்.

புதிய தலைமுறை டிவியோ அல்லது படு குழியில் மாண்டு போயிருக்கும் சாக்கடை கழுசடைக்கும் முதலும் கடைசி கண்டனம்.

கருங்கண்டம் ஆப்பிரிக்காவின் கென்யா அல்லது அமெரிக்காவின் சிகாகோவை சார்ந்த கருமுண்டம் அரக்க அராஜகம், களவாணித்தனம், பிறரின் உரிமையை பறித்தல், விபச்சாரிகளை வைத்து அரசியல் நாட்டாமை செய்யும் அசுரர் விபச்சார அரசியலுக்கு, தமிழ் நாடு மற்றும் இந்திய அரசியிலோ அல்லது அயோக்கிய அரசியலுக்கு அடிமையாக இருக்கும் கூலி பட்டாளங்களுக்கும் இந்த அறிக்கை மற்றும் கடுமையான கண்டனம் சாரும்.

ஊசிப்போன ஊறுகாய், சலிச்ச சாம்பார், துர் நாற்றமான காஞ்ச கருவாடு, செத்து போன ஆடு, மாடு, கோழி, பன்னி – ஏன் உயிருள்ள மனிதரையே தன் வன்மம் கள்ளம் கபடம் நயவஞ்சகம் இவைகளுக்கு இரையாக்கும் இந்த மனிதர் என்ற சாவு கிராக்கிகள் – இந்த ரகம் தான் இவ்வாறு தன்னையே கேவலப் படுத்தி கொள்வது. தேவையின்றி மற்றவரை உதாசினம் செய்வதே இவ் வகைராக்களுக்கு தன் பிழைப்பாகும்.

திருநங்கை என்ற எண்ணம், தூற்றல், பெண் ஜாதியை இழிவு செய்யும் உனக்கும், உன் குடும்பத்தில் இருக்கும் அத்தனை பெண்களுக்கும், சுற்றார், நெருங்கிய மற்றும் தூரத்து உறவு அனைத்து மொத்த உன் குடும்பம், குலம், இனம் யாவருக்கும் அது சாரும் – இது உண்மையாகும்.

அயோக்கியர்கள், அட்டூழியர்கள், அநியாயம் அவர்கைளின் கொள்கை, பேராசை பொறாமை பிடித்து பிறரை ஏளனம் துன்புறுத்தல் இவைகளே வாழ்க்கை வியாபாரமாக வாழும் அனைவருக்கும் –

உன்னுடைய சடலத்திற்கு நீயே சங்கு ஊதி கங்கு வைக்காதே.

உன் துற்செயல் உனக்கு கொள்ளி வைக்கவோ உனது இறுதி சடங்கிற்கு வாரிசு இல்லாமல் சபிக்க படுகிறாய் இந்த பிறவியிலேயே – இது உன் வினை உன்னை தண்டிப்பதாகும்.

பிறரை திருநங்கை என்று தூற்றல் அல்லது உன் துஷ்ட மனதிற்கு எப்படி எல்லாம் தோன்றுகிறதோ அதில் ஈடு படுவது நீ மற்றும் உன் அடுத்த தலைமறையின் அழிவை அலை போல் அலைந்து அனைப்பதாகும்.

உன் கருமாதிக்கு நீயே காரணம் ஆகாதே.

தன் வினை தன்னைச் சுடும் உரட்டியப்பன் வீட்டைச் சுடும். இதை எக்கனமும் மறவேன்.

பொறாமை பேராசை பொல்லாத வியாதி. இதில் அவதி படுபவர்கள் தன்னுல் இருக்கும் விஷத்தில் அல்லாடுவதாகும்.

நீ யாராக இருந்தாலும் வம்பை வீணாக விலைக்கு வாங்காதே. தன்மானம் சம்மானம்.

எப்பொருள் யார் யார் வைப்பினும், அப்பொருள் மெய்பொருள் காண்பது அறிவு.

நன்றியுள்ள பிராணி நாயிடம் நன்றியற்ற பல மனிதர் கற்றுக் கொள்வது அவர்களின் இந்த பிறவியின் முதல் கடமையாகும்.

பத்மினி அர்ஹந்த்

Photo Gallery

Progressiveness – Definition

Maintaining ethical efficacy on all issues which is unfortunately a tall order for many especially those perpetually using and exploiting others for own hideous ideology defined progressiveness or otherwise besides sinister political agenda.

Accepting own failure in personal and political front by not unscrupulously reassigning to scapegoat anyone especially the target not even remotely associated or interested in such activity or position.

Finally, reaching out to blue sky, dark clouds or rainbow with the plagiarized connotation “Wipe your tears” is at best disingenuous and at worst hallmark of self-dissipation i.e expedited exit.

Anything contrived as the proxy exposes the original-self and those behind the charade with nowhere to runaway from oneself. Accordingly, acknowledge defeat gracefully and victory with humility.

These characteristics are categorical regression and not progression by any stretch of imagination.

Padmini Arhant

Identity and Gender Misappropriation Culture

Identity and Gender Misappropriation Culture

Padmini Arhant

In accordance with the prejudiced misogynistic trend targeted ad hominem at me in the past nearly twenty years for;

My tireless selfless sacrifice with unconditional positive contributions – though it originated since my childhood benefitting many across the spectrum in diverse fields especially politics, media, economic and entertainment sector…in unimaginable proportions and magnitude.

In return, only subject and ill-treated with absolute contempt, hatred, envy, caricature, character assassination not barring real life threats on many occasions and pejorative malice in relentless violation of my individual rights and life,

At Almighty God’s will, the following are adapted towards any and all those from wherever in cohort with the prevalent diabolical trend and culture on deliberate identity, gender and personal profile misappropriation of me and my life with utter disregard for my individual rights will now onwards be treated as such.

To begin with;

1. All western claimed achievements across any field and industry since western origin until now and moving forward would be identified and attributed to the western touted latest Africanization trait and deemed African and that of Africa and not that of the Western imprint.

2. In this respect,

United States would be remembered and reminisced as Uganda.

Imperialist Britain already renamed Barbados being the key promoter behind identity misappropriation of me as an entitlement.

Australia – the ever eager lap dog in all western and western White Australia policy would hereafter be known as – Aboriginia – The land of the Aborigine which is rather accurate and hence not identity misappropriation rather appropriation.

Canada – The North American nation as the vassal state of British Commonwealth under the liability known as the Royalty would be identified as – The Central African Republic.

New Zealand – Namibia

Western Europe combined – Equatorial Guinea

Israel – Ethiopia – The origin and the land of Judaism – fitting the appropriate nomenclature not misappropriation.

All those engaged in the hideous provocative misclassification of my gender, identity and personal details will be hereafter individually and collectively recognized as such:

Miss Barry Seotoro alias Miss. / Ms. Barack Obama,

and

Mr. MICHELLE OBAMA alias

Miss. Ms. Mike Obama.

Mr. Hillary Clinton, Miss Joe Biden, Mr. Kamala Harris, Mr. Nancy Pelosi and so on.

Above all,

Miss / Ms. ELON MUSK

Miss. Ms. Joe Rogan

Mr. Tulsi Gabbard,

Miss / Ms. Vivek Ramaswamy – considering the transformation in reality.

Similar nomenclature would be applicable to anyone from wherever regardless indulging in such practice against me.

The proxies, puppets and pawns recruited as me in media. politics, entertainment etc.,by the evil syndicate behind this ludicrous identity misappropriation would be applied gender alteration and transposition practiced against me in the last two decades until now.

In observance and approval of Almighty God’s direct ordinance – Never to tolerate injustice, abuse and unprovoked wanton indignation and insolence that I have been arbitrarily isolated and attacked until now,

The above outlined identity of all those would be relevant with immediate effect.

One receives what one serves others to set the unprecedented convoluted subversion of me, my life and identity straight that is otherwise taken for granted, misused and exploited by the beneficiaries in worst parasitic present toxic environment.

Padmini Arhant

अपनी चित्ता को आग देना

झूटी तारीफ़ और झूटी तालियों के लिए अपनी अभागन जीवन को और बड़ी गाली बनने से बचायें।

बड़े पर्दे पर मुझरा करते करते आदत से मजबूर, उनकी दुर्भाग्य या बतक़िस्मती असली ज़िंदगी में भी उनकेलिए वही पेशा बन जाता है।

जो किसी के कहने पर भी – “सलामे इश्क़” का पैग़ाम पर्दे पर और पर्दे से बाहर मंच पर सज दजकर चलती फिरती साड़ी और जवाहरी दुकान बनकर अनजान की बुराई और दुहाई के लिए निकलती हैं । उमराव जान १ और २ – कोई फ़रक नहीं पड़ता जब लोंभ, ईर्षा और मूर्खता के चुंगल में फ़से इन पीड़ित आत्मावों के लिए – जो अपने ही विनाश और तबाही की घोषणा / ऐलान करते हैं।

हैवान और शैतानों के बहकावे में आकर किसी दूसरे और वो भी जो अपने काम के काम मतलब रखने वाले के सात, यूहीं पंगे लेना अपनी और अपनी परिवार, कुल और वंश की चित्ता को आग देना होता है ।

इसे कभी भी खेल या मज़ाक ना समझें। जिनपर काल मंडरा रहा हो, वही ऐसे काली करतूत पर उतरते हैं ।

उदाहरण / मिसाल के तौर पर – रामायण और महाभारत ही काफ़ी है ।

पद्मिनी अरहंत

Fakery in Politics’ Bakery

Why does fakery stand out in politics’ bakery?

It is obviously stale stock rebuffed with stand out flavors palatable to vendors’ liking rather than consumers’ taste.

Importantly, how does politics utilize own inventory to maintain control despite win or lose election?

By using two or multiple stocks from the same inventory representing the same power mongering controlling clique. They are deployed for the same purpose benefitting the same old establishment and power centrifuge. Nonetheless, assuming diametrically opposite roles purely for optics.

The one female member overtly pushed in the front line as the syndicate choice all the way to the highest position – such as the Presidency though in practice resigned to be the servile obedient puppet to behind the scenes puppeteers never wanting to let go of the control freak enigma.

While the other, deployed as opposition to the political class i.e. the recruiter having recruited the female representative initially as the member of Congress, foreign affairs committee, intelligence committee and variety…and suddenly designated the national adversary asset – such as the Russian asset.

When in reality, the recruit is the political party hired asset to negate the actual target eternally regarded the arch nemesis by individual and collective anti-republic and anti-humanity force.

The pseudo paradoxical recruit is conveniently placed to be the nominee in the most sensitive position like the National Intelligence Director to infiltrate the elected opposition and provide the service in accordance with the contrived situation.

Similarly. the other top positions such as the second-in-line VP breathing over Presidency is a hack to favor those running the gamut in the political game.

At the end of the day, the hyenas can never pretend to be the doe and buck for too long.

It is not in politics’ nature to be true, transparent and trustworthy. Simply not possible by default in politics’ character.

However, the curtains do fall and the show ends to relieve the foul play fatigued captive audience sooner than later.

Padmini Arhant

Ethics – Padmini Arhant Quotes

What is life without ethics?

Shipwreck waddling and wobbling on rough seas and still water ultimately sinking to the bottom.

Short cuts in life are invariably short-lived in any endeavor – fame, fortune and power.

Shame is self-inflicted parody in the effort to shield own reality.

Padmini Arhant

Scams and Thuggish Politics – Origin Chicago ILLINOIS

When thuggish corrupt criminal politics with domain in Chicago, Illinois abuse expired power by permanent tagging, trolling, spying, snooping, eavesdropping as lewd crude perverts misusing taxpayer dollar against the same taxpayer, the perversion is harbinger of self-apocalypse affecting any and all around that are related to the source.

As for those caving in to political intervention in what is supposed to be fair anti-discriminatory practice in society and economic sector such as financial products and services prove their servile complicity with thuggish politics invoke their termination in the kamikaze collusion.

The malicious intent to harm and hurt anyone is precipitous decline surrendered to the devil.

The devil never prevail over God’s will.

Padmini Arhant

Human and Demon Character Distinction

Human character accepts victory gracefully and defeat with humility.

Demon on the other hand indulge in self-destruction with overwhelming hubris upon anything regarded success claiming credit all to oneself and vindictiveness immersed in vengeance in the aftermath of rejection and failure.

Those who dig grave for others invariably find themselves in it sooner than later proven in the karmic woes ever haunting them becoming the corpse while living.

Those who are sulking and seething in rage over the latest 2024 United States Presidential election outcome are challenged to spill their animosity in public rather than deploying slaves as stooges in the despicable demeanor.

As always win we are invincible, lose then you are inexcusable is the demonic trait.

You are that no matter what and whom you pretend to be is exemplified in viciousness expediting your own termination.

Padmini Arhant

The Reality on Impermanence and Charity

Nothing is permanent and never to be assumed invincible without failures. From Napoleon to Alexander and those later Hitler…until the ones since the dawn of the twenty first century till date met their fate.

The one who is the permanent giver such as the Almighty is Almighty for that reason.

Meanwhile the takers as receivers of the benevolence from the venerable join the ranks of those as the recipients of such magnanimous charity.

Piracy and plagiarism of identity and biography is testament to disgust to own profile and epitome of indignation.

Padmini Arhant

பெண்ணின் இழிவு செய்பவரின் அழிவாகும்

பெண்ணின் இழிவு செய்பவரின் அழிவாகும்.

பிறரின் உரிமையை பறித்தல் தன் நிலமைக்கு எதிர் மறையாகும்.

நல்லவருக்கு தீங்கு, நம்பிக்கை துரோகம் செய்பவர்களின் கதி – அவரவர் வினை, ஆணவம், அகம்பாவம், நயவஞ்சகம் ஆகியவை அவர்களின் கர்மத்தின் படி அவர்களையும், மற்றும் அவர் குடும்பம், குலம், இனம் நாசம் நிச்சயம்.

இதை யாரும் எவரும் தவிர்க்கவோ அல்லது தப்பிக்கவோ இயலாது.

இதை எக்கணமும் எப்பொழுதும் மறவேன்.

வினை விதைப்பவர் வினை அறுப்பர். இது இயற்க்கையும் காலத்தின் நீதி.

பத்மினி அர்ஹந்த்

Decadent Politics Expedite Self-Destruction

When politics maintaining the decadent culture to typecast their target as anyone despite the trend condemned as reprehensible are warned about the reality and legality in this obtuse political hysteria.

The target portrayed as anyone however, by default inherit the economic wealth and financial fortune of any and all, the target is suggested and exhibited as them.

It cannot be only the negative connotations the target has to contend with in this moronic vitriolic identity swap / transposition.

The politics and their proxies in their inventory should be mindful of their wayward conduct prompted by uber hubris and chauvinism in this regard and otherwise. Not to mention the wannabe opportunism impetus expedited expiry as witnessed time and time again and contemporarily in all affairs.

The ones flashing power, fame and fortune yet endlessly starved for more with no end in sight as a curse are affected by incurable terminal disease.

Nothing is worse than discontentment serving as the fundamental cause of inner conflict within and turbulent mind.

The poignant fact is the ones promoting and practicing vilification and denigration of woman and womanhood not only exhibit the treatment of women in their family and society in that order.

They also confirm their diminutive stature in their delusional political might that is judiciously diminished and extinguished by Almighty, the creator, protector and destroyer of anything counterproductive especially the ever destructive ego.

Importantly and relevantly,

All are born naked and leave the world as such without exception with a distinction among them many in politics and economic sector live and die Soulless.

Soulless is the worst form of nudity that deprives the subject of humaneness, character and above all self-dignity.

When one respects oneself and prioritize self-esteem in personal and collective behavior, that characteristic is naturally exemplified towards others.

The woman in particular without whom the spermatozoa would be extinct without her ovary.

The emergence in the world for male dominance not possible without her womb.The Hindu epics Ramayana and Mahabharata depicted the extinction of culture and clan in entirety indulging in indignation and insolence of woman and womanhood by overactive male testosterone.

One has to be careful and wise about what they serve others for that would be duly returned to them by their KARMA and whom they incessantly and mindlessly target in their obsessive pre-occupation.

Never too late to refrain from stupidity when choosing enemies in life.

Padmini Arhant

Efficiency Government by Plutocrats?

President-elect Trump has tapped tech entrepreneurs Elon Musk and Vivek Ramaswamy to lead an advisory group focused on cutting federal spending and reducing the size of the government.

Hmmm 🤔 –

Are these gentle ladies duo going to cut federal government spending?

The politics from top to bottom funded by hard working ordinary Americans drowned in generational debts dominated and ruled by plutocracy.

The efficiency government aimed at cutting government spending and waste expenditure would hire two women to head the department while preparing to downsize government?

Shouldn’t one be the example of the Change one wants all around?

Politics and hypocrisy are permanent regardless.

Padmini Arhant

Imposters on Notice

The criminal syndicate of any representation, composition and dimension staged theatrics featuring imposters in the futile delusional endeavor to stymie Almighty God divine mission not barring subversion of my identity invite and expedite individual and collective irreversible apocalypse.

The evil diktat orchestrated impostors as flashers in particular would be instrumental in the imminent and inevitable collapse.

Evil taking anything for granted especially the one they regard arch nemesis is the basis for own and the deployed elimination and disappearance into oblivion.

The Wicked and Crooked especially the power mongering and profit oriented politics anyhow and somehow with proxies, puppets and pawns in disguise will never prevail against God’s Will.

Padmini Arhant

Male Supremacy?

Esquire: What it means to be a man in contemporary American culture?

Response: Recognition and Reconciliation of these things.

Spermatozoa would be extinct without ovary in the likelihood of Asexual viz. Amoeba.

‘X’ is explicitly female chromosome in the genetic code.

Nothing and none are perfect beginning with self.

Pride precedes downfall.

Machoism and Chauvinism are vanity driven to insanity.

All things are set to expiry without exception sooner than later.

Those who dig grave for others invariably find themselves in it.

Above all NONE ESCAPE KARMA.

Padmini Arhant

Frankly Speaking on Poison Politics

U.S.Presidential Election 2024 Outcome Speech Synopsis

Israel – Middle East Conflict – Segment 2 – Extemporaneous Presentation from and by Padmini Arhant

Israel – Middle East Conflict – Extemporaneous Presentation by Padmini Arhant

Identity Politics – Divisive and Polarizing

Identity politics is nothing more than a severe complex among those behind the promotion.

Identity politics eternally tagged to race, gender, sexual orientation and other denominations are best laid to rest.

The connotations maintained and referenced for paradoxical implications in the beginning of the second quarter of the twenty first century make such politics decadent, divisive and polarizing.

Above all, none regardless have the right to continuously deem and define anyone against their expressed will, dissent and objection as anything to suit their interventional pejorative.

Treating others the way one wants to be treated is the basic etiquette that unfortunately, identity politics violates by impulsive disorder.

My message post election will be presented shortly.

Padmini Arhant

A-list Syndrome?

Those touting themselves or undeservingly elevating those from own type as A-list exhibit self-adulation and megalomania.

Not realizing it is your KARMA that determines your listing.

The reality is the presumptuous self-promoting category invariably fall in B-list i.e. BLACK LIST for all the negativities, evil deeds, crimes and flamboyant arrogance under KARMIC recognition ordained by Almighty God.

B-list aka Black List is where such activities and personalities belong and cataloged much to own delusion as otherwise such as A-list.

The malicious intent and indulgence to make the target the laughing stock blow back on those in accordance with;

One reaps what one sows in life without exception.

Eventually, the JOKE is on the ones stretching beyond in malignancy and contempt expediting own elimination in the process.

Padmini Arhant

Identity Politics is Personal Complex Disorder (PCD)

Identity Politics is Personal Complex Disorder – Rooted in Prejudicial Nomenclature

Padmini Arhant

The Supremacists of any genre, Globalists and the so-called Commoners dependent Royalists in Britain and Europe besides politics variety obsession and manifestation in identity politics viz. the race – the black race in particular, gender again trans gender amongst all, sexual orientation fixated on gay and any further declassification of human race is the mirror reflection of own identity i.e. personal complex disorder.

The Obsessive Compulsive Disorder (OCD) in identity politics for these deeply disturbed minds evolved into PCD – Personal Complex Disorder.

The one who does not know oneself often indulge in attributing self-identity crisis to those they envy for their clarity in every respect. Nonetheless, the futile effort to disown individual contra personality syndrome is a wasted life.

The process delivering outcome in revealing them as to

Who they are?

Anything except for being human devoid of humane values and virtues to accept human race as humans barring explicit identification badge depicting isolation and denomination to suit their troubled tarred mind in the inescapable escapism of their identity dilemma.

It is time to bid FAREWELL to such narcissism under the guise of elitism ravenous in devouring anything and everything opposed to their paradoxical nature.

Unfortunately clarification is required on basic to general matter. Let alone anything above average amongst the dull nitwit ignoramus pompous arrogant ignorant recalcitrant decadent sect and political cult behind identity politics mania.

Padmini Arhant

Politics OCD

Politics’ OCD

Only applicable to those indulging in self-caricature.

Politics’ OCD in plagiarism and piracy of positive traits and intellectual content of their arch nemesis viz. me for their personal and political gains further expose such politics’ corrupt, criminal and controversial insignia together with the unscrupulous media – the local and foreign surrogacy in the monkey act.

The crow is not a peacock. Likewise the pig is not and never a GOAT. However, the monkey in the monkey see monkey do – Monkey act is relatable to that of an Ass aka Donkey.

Choose your enemies wisely.

Indian politics and crony contingency – specifically applicable to you as well with a warning to refrain from exploitative, wannabe and opportunistic politics – the worst ever.

Padmini Arhant

Clear the Clutter in your Mind

Applicable to all those delusional personalities and wannabes dwelling in Fools’ Paradise.

Clear the clutter in your mind. You will realize your inherent flaws drowned in fake flamboyance about your identity. Only you can do it yourself.

No maid, toilet cleaner, waiter, flight attendant, fat, thin or any other physical and social economic class…you assign them in your prejudice shackled mind can do it for you.

Despite your world crumbling and relevantly stink without their service . You are proven worthless even otherwise. They are the ones who make you seem important as you flaunt yourself to taunt them.

Ignorance is abyss when marred with impotent arrogance.

Padmini Arhant

FASCISM WRIT LARGE AS THE SO-CALLED DEMOCRAT

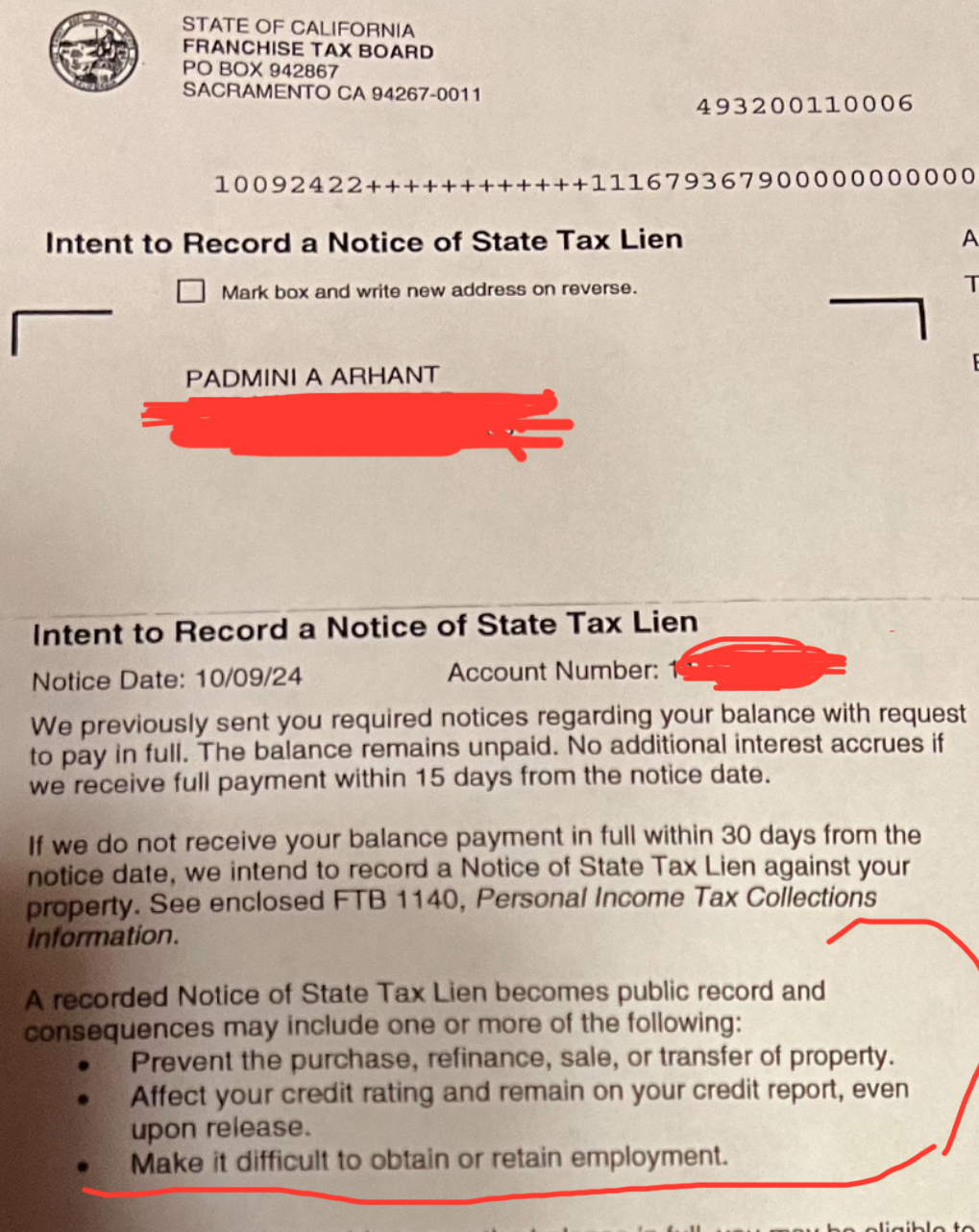

FYI : California Franchise Tax Board

Sacramento, CA

For the umpteenth time – Please refer to the third letter dated June 13, 2024 received by you with signed delivery confirmation. The letter with proof of tax payment on August 23, 2023 with 2022 tax return e-filing, bank confirmation on the payment and email references were all enclosed for your reference and settlement on this matter.

Yet, for political reasons the weaponization of taxpayer funded State and federal departments and agencies trending since 2009 – 2016 against then Republican Tea Party by Barack Obama in personal vendetta against them for questioning Barry Soetoro’s birth certificate was responded with terminating the Republican Tea Party in the first term in 2012. It was just the tip of the iceberg.

The trend then continued against political opponent Donald Trump from impeachment proceedings to libel suits with no end in sight.

Similar tactics deployed against me and my family by the same members i. e. The OBAMAS having abused and continue to use and abuse our presence, profile and all things politically and personally exclusively beneficial to them from DAY ONE until now by tagging, trolling, pirating anything positive and impressive for image enhancement despite being warned to cease and desist.

Notwithstanding thousands of $$$ fraudulently amassed from us by the fleecing scammers, abusers and parasitic exploiters till date make them indebted to me personally and my family.

Politics’ underhanded bullying and harassment is sheer desperation in the face of own extinction.

If you can’t express gratitude as the chief beneficiaries of our timeless sacrifice and benevolence, the least you could do is abandon the self-destructive attitude hurting you in the attempt to harm others.

By the way – nothing to do with Angel Reese and anyone with Brown last name in your nuanced attacks directed at me. They are all yours and you can keep them.

That goes for Kamala Harris – the name Kamala adopted from my explanation of my first name conveniently plagiarized for political and fortune harvesting in your end game once again for en masse deception like in 2009 – 2016.

The same resumed in 2021 – 2024 with blatant intention to extend the sham indefinitely with ludicrous WOKISM.

Originality and FAKE distinction is authenticity never in requirement to be anything other than true self unlike the impostor ever remaining fraudsters in vain.

Padmini Arhant

Republic Status in Politics

Politics must realize – Power is granted by the Republic and remain with the Republic.

In contrast, the inherited political culture in Washington intensified since 2009 – 2016 resumed in 2021 – 2024 and attempting beyond, the accumulation of power and wealth among politics leaving the republic with generational debts and endless crises.

Such politics exit is imminent with expedited expiry.

Padmini Arhant

SOS and Wannabe Distinction

The distinction between SOS and Wannabe is self-explanatory.

SOS – Save Our Soul is a cry when someone’s life is in danger typically a request to be saved or they might die in such situation.

There is also likelihood of SOS played out like,

“The Boy who cried Wolf.” – Simply to test the level of attention from anyone or all. Again the indulgence often never without teaching the attention seekers a lesson or two that might even prove serious like for the boy falling prey to own prank.

Wannabe – As the term suggests – they want to be the center of attraction. The publicity starved syndrome by acting out or verbatim usually premised on controversial inflammatory provocative mostly meaningless comments suffice for wannabes to draw attention from anywhere.

It depends on those paying attention to such gimmicks.

Padmini Arhant

Paradox Parody

Crow is not Peacock. Pig is not GOAT.

White and Black playing race card and misogyny ad nauseam is the expedited end of decadence culture with Supremacy guilt on slavery. The latter compensated with affirmative action besides hijacking the positivity and extremely beneficial attributes of the one fleeced on by both without any shame or self-esteem.

The Supremacists’ OCD targeting the formidable female arch nemesis scapegoat the same in the biggest ever blunder to be realized before the defaulters and the crony contingency demise.

The ones who are condemned with excruciating peril and reckoning upon them now and forever hardly have any opportunity other than succumb to self-destruction.

Padmini Arhant

Western Foreign Policy Responsible for Global Nuclearization

Western foreign policy against non-western nations in the 20th and 21sf century until recently is directly responsible for nuclear arms race expanding global nuclearization including North Korea.

Notwithstanding draconian economic sanctions lasting over decades besides military provocation, illegal invasions and occupations in the respective regions.

United States in particular, the pro-Israeli politics on the left and right regardless of democrat and republican in the executive and legislative branch grant Israel indefinite parasitic existence with financial, military, technology and unfettered access to exploit American ordinary taxpayers for Israel’s hegemonic goals and United States strategic dominance in the Middle East.

Not to mention the status quo and tradition since inception and creation of the State of Israel in Palestine is blatant TREASON against United States and the republic.

Israel in continuation of colonial imperialist era is confronted with similar fate of imperialism succumbing to own self-destructive pariah state. The trend in accordance with fire engulfing the origin in the indiscriminate carnage.

Setting fire to the habitat whilst dwelling in it is pyromania gone wild in the self-inflicted end.

Padmini Arhant

Global Energy Corridor – Strait of Hormuz