California Public Education Crisis

November 23, 2009

By Padmini Arhant

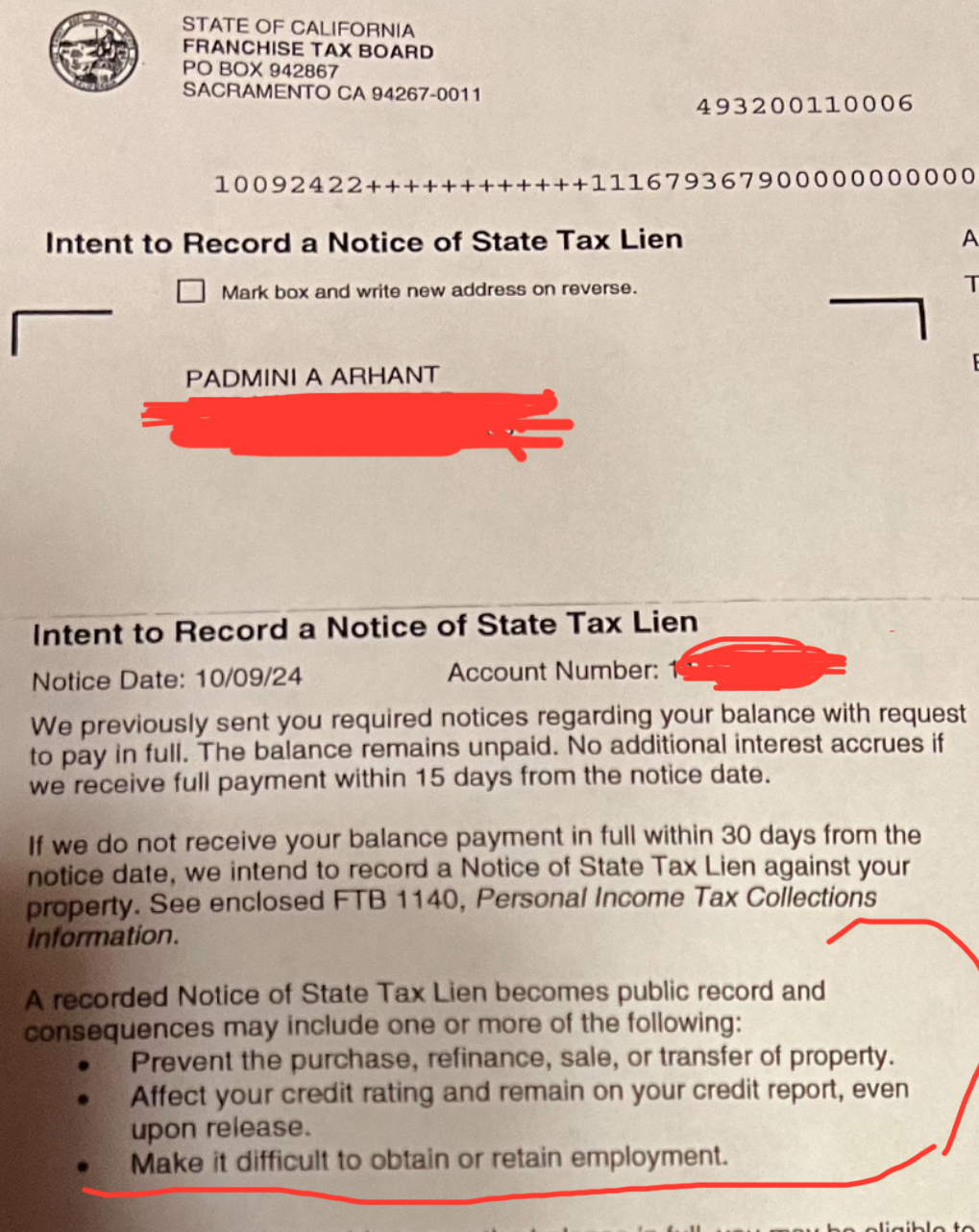

The world-renowned budget fiasco in California has led to its recognition as the ‘failed’ state in the nation. Through drastic budget cuts targeting the nerve of the economic system such as education, health care and other essential programs for children and elderly, the legislators and the Governor in Sacramento have successfully desecrated the Golden State into a bankrupt state.

As a result, the Californians are forced to bear the brunt of the ideology driven governance steadfast in prolonging the crisis rather than accepting pragmatic solutions offered to the elected officials least concerned or affected by their disastrous performance.

In the past week, the students in California were compelled to protest the atrocious 32 percent increase in undergraduate educational fees costing above $10,000 a year in the next fall, comparatively triple the cost a decade ago. Apparently, the UC Regents’ callous decision made after a 10 percent hike earlier this year.

Further, the authorities are wasting no time in salting the wound with employee furloughs, laying off non-tenured faculty leaving the students to attend virtual instructions, alternatively increased class size and slashing courses to the detriment of quality education.

Amid the health care reform characterized by the opposition as the ‘government take over’ of the private industry, the pitfalls from the privatization of public education cannot possibly be ignored.

The reasons provided for the appalling measures by the UC President Mark Yudof and campus leaders are the 20 percent decline in the state funding towards the UC budget. Whereas according to the UC faculty it’s been a phenomenal year of income for the UC System with revenue flowing in from various sources such as the federal stimulus funds, research grants, medical profits, proceeds via sale of parking, housing and medical services throughout California.

Another noteworthy issue being the massive recruitment of administrators at the expense of the teaching faculty and the students exacerbated the victims’ plight. In adherence to the corporate policy, the top hierarchy with earnings above $200,000 to $500,000 in the administration compensated with excessive salary packages and extravagant bonuses apart from discreetly sharing a small percentage of profits with senior administrators, athletic coaches and star faculty.

Yet in a new revelation, the UC seemingly lost $23 billion in the past two years due to investments in toxic assets and real estate mimicking the short-term gain strategy in the Wall Street. Subsequently, the most vulnerable members i.e. the students and faculty are mandatorily bailing out the institution from the financial mismanagement.

Firing non-tenure track faculty that teach over half of the university enrolment, substantial student fees, work overload with simultaneous salary reduction on workers, refusal to negotiate with unions are reported to be taking place.

The astonishing aspect is the privatization of the public education leading the UC President Yudof to lend $200 million to the state in an effort to earn profit from the interest, declaring such options ‘profitable’ compared to the institutional core academic activity. Again, UC is reportedly on a comfortable $20 billion budget with no requirement for draconian methods adopted against the struggling students and other members, the victims in the greed driven racket.

Source: The above-mentioned accounts partly cited from Bob Samuels, president of the University of California, American Federation of Teachers. He runs the blog Changing Universities. during the interview on Democracynow.org by the host Amy Goodman – Friday, November 20, 2009.

Similarly, Zen Dochterman, UCLA student taking part in the protests made the following plea:

“I’m a student representing no one.

We are under no illusions. The UC Regents will vote the budget cuts and raise student fees. The profoundly undemocratic nature of their decision making process and their indifference to the plight of those who struggle to afford an education or keep their jobs can come as no surprise. We know that the crisis is systematic. It reaches beyond the regents, beyond the criminal budget cuts in Sacramento, beyond the economic crisis, to the very foundations of our society.

But we also know that the enormity of the problem is just as often an excuse for doing nothing. We choose to fight back, to resist where we find ourselves, the place we live and work, our university. We therefore ask that those who share in our struggle lend us not only their sympathy, but their active support.

For those students who work two or three jobs while going to school, to those parents for whom the violation of the UC charter means the prospect of affordable education remains out of reach, to laid-off teachers, lecturers, to students turned away, to workers who have seen the value of their diplomas evaporate in an economy that grows without producing jobs, we say that our struggle is your struggle, that alternative is possible if you have the courage to seize it. We are determined that the struggle should spread. That is the condition in which the realization of our demands becomes possible.”

————————————————————————————————–

True Perspective – By Padmini Arhant

Unarguably, the state of California is in shambles. The dilemma is the structural damage caused by the lack of leadership in Sacramento. In addition, the obstinacy NOT to resolve the burgeoning budget deficit with result-oriented actions is having a pronounced impact on the residents across the spectrum.

On the other hand, the public educational institutions run as a private enterprise entrenched in the philosophy that regards ‘Profit as Prophet’ is widespread in the growing culture based on – “All for me and none for you.”

There is urgency for California and the nation to address the serious educational demands directly linked to the economy and the future. Undergraduate education is the stepping-stone for any individual to survive leave alone attaining a decent life in the competitive global economy.

These students are the immediate valuable resources for the American business and work force in the human capital criteria. It’s a travesty to deny them an affordable education in the dire economy with staggering unemployment widening the gap between the ‘haves’ and the ‘have-nots.’ Obviously, the priority among the head of the institutions is to safeguard their personal interest over that of the nation.

It’s no rocket science to figure out that nations cannot exist or sustain without the prolific academic environment focused on providing least expensive and high quality education for all. Any compromises as noted in the latest event appropriately calls for the removal of the entities responsible for the embarrassing distressful situation brought upon the students and the teaching faculty expected to be learning in the classrooms rather than imploring to the oblivious authorities at the institutions and the state assembly.

Recently, civil disobedience for various legitimate causes mired by unnecessary arrests and extreme use of force undermining democracy. It’s imperative to release the students in custody and instead divert attention on those appointed as the head of the institutions viz. UC President Mark Yudof and the Governor of California along with the legislators for failing to fulfill the constitutional duties towards the citizens of California. Perhaps, it might be worth considering a recall given the deliberate negligence of legislative responsibility.

The students, teaching faculty and the workers should not be subject to monstrosity demonstrated in the worst educational battle. Ironically, the students and teaching faculty as taxpayers are denied fair opportunities in the backdrop of Wall Street bailouts, bureaucracy and sheer incompetence prevalent in Sacramento and the UC system.

Hence, it’s incumbent on the UC regents to repeal the proposal and undemocratic action with respect to student fees, staff layoffs and other activities inevitably hampering the economic recovery.

Congress should approve federal grants and educational stimulus with a stipulation that funds to be explicitly used for better and cost effective academic purpose, and simultaneously restrict educational institutions from squandering the funds in speculative Wall Street investments.

Finally, Students should continue their education and defy the unfair fee imposition by maintaining the peaceful dissent until the issue is resolved in their favor.

Thank you.

Padmini Arhant

Economic Bailouts On An Unprecedented Scale

July 23, 2009

By Padmini Arhant

Presentation of Economic Bailouts on an Unprecedented Scale

From: Stimulus Package Details

Source: http://www.stimuluspackagedetails.com/bailout.html

Mortgage Stimulus Packages

No industry has been helped more by the various economic stimulus packages than the real estate industry.

Add it all up, and $500 billion was committed in 2008 by the Bush Administration, and

The Obama Administration chipped in another $275 billion in early 2009, not to mention the $1 trillion that was designated for buying up toxic assets (which are comprised primarily of sub-prime loans given to suspect borrowers, collateralized by overvalued real estate).

Economic Bailouts On An Unprecedented Scale

Starting in 2008, and extending into 2009, the U.S. Federal Government became involved in a myriad of companies and industries, handing out bailouts at an alarming rate, blurring the lines between capitalism and socialism, free enterprise and government intervention.

Below, in alphabetical order, are the major recipients of economic bailouts.

Automakers

$25 billion in low-interest loans to General Motors, Ford, and Chrysler

$22 billion in low-interest loans to General Motors, Chrysler

$30 billion to help General Motors steer through bankruptcy

Total: $77 billion

AIG – Insurance Company

$60 billion loan – September 2008

$40 billion purchase of preferred shares – September 2008

$25 billion in purchase of toxic assets – October 2008

$25 billion loan (credit limit raised to $85 billion total) – October 2008

$30 billion loan – 2009

Total: 180 billion

Bear Stearns – Investment Bank And Brokerage Firm

$29 billion in guarantees – 2008

Fannie Mae/Freddie Mac – Mortgage Companies

$300 billion – 2008

$200 billion – 2009

Total: $500 billion

G-20 World Leaders Stimulus

$1 Trillion Stimulus Package – G-20 World Leaders Stimulus – April 2009

The leaders of the 20 most powerful countries in the world (representing 85% of global economic production) convened in London and agreed to $1 trillion in economic stimulus funds, as well as tighter global financial regulations.

June 2009 update: According to the Obama Administration, only about 5% of the $787 billion stimulus package passed in February 2009, has been distributed.”

————————————————————————————————–

Bush Stimulus Package

July 23, 2009

By Padmini Arhant

Presentation of Bush Stimulus Package details

From: Stimuls Package details – Thanks

Source: http://www.stimuluspackagedetails.com/bush.html

Bush Stimulus Packages

In 2008, the Bush Administration handed out a slew of economic stimulus packages.

Under President George Bush’s administration, the Federal government gave

$29 billion to bail out Bear Stearns,

$178 billion to American taxpayers in the form of economic stimulus checks,

$300 billion to bail out American homeowners,

$200 billion to bail out Fannie Mae and Freddie Mac,

$150 billion to bailout AIG, and

$700 billion to bail out banks (TARP).

Total Bush Administration Bailout – $1.557 trillion dollars i.e. $1 trillion and $557 billion dollars.

Timelines Of The Bush Economic Stimulus Packages

Following is a timeline of the economic stimulus packages, in chronological order.

March 2008 – $29 Billion Stimulus Package – Wall Street Bailout

The Federal Reserve stepped in to prevent the collapse of Bear Stearns (one of the world’s largest investment banks and brokerage firms) by guaranteeing $29 billion worth of potential losses in its battered portfolio. This provided enough economic stimulus for JP Morgan Chase to take over the beleaguered firm.

May 2008 – $178 Billion Stimulus Package – Average American Bailout

The U.S. Treasury provided an economic stimulus package to American taxpayers in the form of $600 economic stimulus checks for individuals and $1,200 economic stimulus payments for couples.

That cost the government $100 billion, and they threw in another $68 billion in tax breaks for businesses, $8 billion to increase unemployment benefits from 26 weeks to 39 weeks, and a $4 billion economic stimulus package to be doled out to states and local municipalities to buy and rehab foreclosed properties.

July 2008 – $300 Billion Stimulus Package – Homeowners Bailout

The Bush Administration committed $300 billion for 30-year fixed rate mortgages for at-risk borrowers, as well as tax credits for first-time homebuyers, who could be eligible to receive up to a $7,500 tax credit.

September 2008 – $200 Billion Stimulus Package – Fannie Mae and Freddie Mac Bailout

Fannie Mae and Freddie Mac (privately owned mortgage companies that are backed by the federal government) were about to fail, due to declining house prices and rising foreclosures.

The Bush Administration stepped in with a $200 billion economic stimulus package and placed Fannie Mae and Freddie Mac and their $5 trillion in home loans in “temporary conservatorship,” to be supervised by the Federal Housing Finance AgeSeptember 2008 – $50 Billion Stimulus Package To Guarantee Money Market Funds

When the economic crisis reached a crescendo, Americans began to pull their money out of money market funds – historically considered to be the safest investment. To stop the bloodshed, the U.S. Treasury agreed to guarantee up to $50 billion, for up to a year.

September 2008 – $25 Billion Stimulus Package – Automakers Bailout

In an attempt to stave off bankruptcies for the “Big 3 automakers,” the Bush Administration gave General Motors, Ford, and Chrysler $25 billion in low-interest loans.

September – November 2008 – $150 Billion Stimulus Package – AIG Bailout

With the world’s largest insurance company in dire straits and 74 million clients at risk, the American government chipped in and gave AIG (American Insurance Group) $150 billion in a stimulus package that included: loans, purchase of toxic assets, and purchase of preferred shares.

October 2008 – $700 Billion Stimulus Package – Banks Bailout

The Bush Administration, under the umbrella of the U.S. Treasury, committed $700 billion in economic stimulus money under TARP (Troubled Asset Relief Program). By many accounts, if this economic stimulus money hadn’t been injected, credit between banks would have frozen overnight, and not only the American economy, but also the global economy, would have seized up.

———————————————————————————————

Is The Economic Stimulus Package Working?

“Is the economic stimulus package working” seems to be the question on most people’s minds.

But which economic stimulus package are you talking about?

Bear Sterns was taken over by JP Morgan Chase, so maybe that $29 billion economic stimulus plan worked.

We all got our economic stimulus checks in 2008, but we didn’t necessarily put them back into the economy, so that $178 billion might not have been well-spent.

The $300 billion mortgage stimulus, “Hope For Homeowners,” awarded in July 2008 didn’t work very well either, because few people took an interest in the program. While proponents of this particular economic stimulus package estimated that 400,000 homeowners could be helped over a three-year period, in the first month, only 111 had applied.

The $200 billion economic stimulus handout to Fannie Mae and Freddie Mac, the mortgage giants, stabilized them enough to prevent collapse.

The $50 billion economic stimulus to stabilize money market funds might have averted a disaster.

The $150 billion doled out to AIG, the insurance giant, prevented their closure, but must not have completely solved the problem since AIG came back for $30 billion more less than six months later, even as they were awarding $165 million in bonuses to their top executives.

The $25 billion given to the Big 3 automakers, Chrysler, Ford, and GM, allowed them to live to see another day, but they remain on the brink of disaster.

The $700 billion bank bailout, given in extreme haste in October 2008, might have kept the banks functioning, but no one really knows where that money went or what was done with it, so it’s hard to judge whether TARP is working.

$700 Billion Bush Stimulus

The $700 billion Troubled Asset Relief Program, (TARP), given out by the George Bush Administration in October 2008. No one can seem to track down any details on this. The money was given to banks with the goal that they would lend it to people. They didn’t seem to do that, but no accountability was written into the hastily concocted plan, which seems to have been concocted in a matter of days, in a “cocktail napkin” format.

And that was just the economic stimulus packages of 2008.

Bush Stimulus Package

July 23, 2009

By Padmini Arhant

Presentation of Chronological Stimulus Package Details:

From: Stimulus Package Details

Source: http://www.stimuluspackagedetails.com/bush.html – Thanks.

Bush Stimulus Packages

In 2008, the Bush Administration handed out a slew of economic stimulus packages.

Under President George Bush’s administration, the Federal government gave

$29 billion to bail out Bear Stearns,

$178 billion to American taxpayers in the form of economic stimulus checks,

$300 billion to bail out American homeowners,

$200 billion to bail out Fannie Mae and Freddie Mac,

$150 billion to bailout AIG, and

$700 billion to bail out banks (TARP).

Total Bush Administration Bailout – $1.557 trillion dollars i.e. $1 trillion and $557 billion dollars.

Timelines Of The Bush Economic Stimulus Packages

Following is a timeline of the economic stimulus packages, in chronological order.

March 2008 – $29 Billion Stimulus Package – Wall Street Bailout

The Federal Reserve stepped in to prevent the collapse of Bear Stearns (one of the world’s largest investment banks and brokerage firms) by guaranteeing $29 billion worth of potential losses in its battered portfolio. This provided enough economic stimulus for JP Morgan Chase to take over the beleaguered firm.

May 2008 – $178 Billion Stimulus Package – Average American Bailout

The U.S. Treasury provided an economic stimulus package to American taxpayers in the form of $600 economic stimulus checks for individuals and $1,200 economic stimulus payments for couples. That cost the government $100 billion, and they threw in another $68 billion in tax breaks for businesses, $8 billion to increase unemployment benefits from 26 weeks to 39 weeks, and a $4 billion economic stimulus package to be doled out to states and local municipalities to buy and rehab foreclosed properties.

July 2008 – $300 Billion Stimulus Package – Homeowners Bailout

The Bush Administration committed $300 billion for 30-year fixed rate mortgages for at-risk borrowers, as well as tax credits for first-time homebuyers, who could be eligible to receive up to a $7,500 tax credit.

September 2008 – $200 Billion Stimulus Package – Fannie Mae and Freddie Mac Bailout

Fannie Mae and Freddie Mac (privately owned mortgage companies that are backed by the federal government) were about to fail, due to declining house prices and rising foreclosures. The Bush Administration stepped in with a $200 billion economic stimulus package and placed Fannie Mae and Freddie Mac and their $5 trillion in home loans in “temporary conservatorship,” to be supervised by the Federal Housing Finance Agency.

September 2008 – $50 Billion Stimulus Package To Guarantee Money Market Funds

When the economic crisis reached a crescendo, Americans began to pull their money out of money market funds – historically considered to be the safest investment. To stop the bloodshed, the U.S. Treasury agreed to guarantee up to $50 billion, for up to a year.

September 2008 – $25 Billion Stimulus Package – Automakers Bailout

In an attempt to stave off bankruptcies for the “Big 3 automakers,” the Bush Administration gave General Motors, Ford, and Chrysler $25 billion in low-interest loans.

September – November 2008 – $150 Billion Stimulus Package – AIG Bailout

With the world’s largest insurance company in dire straits and 74 million clients at risk, the American government chipped in and gave AIG (American Insurance Group) $150 billion in a stimulus package that included: loans, purchase of toxic assets, and purchase of preferred shares.

October 2008 – $700 Billion Stimulus Package – Banks Bailout

The Bush Administration, under the umbrella of the U.S. Treasury, committed $700 billion in economic stimulus money under TARP (Troubled Asset Relief Program). By many accounts, if this economic stimulus money hadn’t been injected, credit between banks would have frozen overnight, and not only the American economy, but also the global economy, would have seized up.

————————————————————————————————–

Is The Economic Stimulus Package Working?

“Is the economic stimulus package working” seems to be the question on most people’s minds.

But which economic stimulus package are you talking about?

Bear Sterns was taken over by JP Morgan Chase, so maybe that $29 billion economic stimulus plan worked.

We all got our economic stimulus checks in 2008, but we didn’t necessarily put them back into the economy, so that $178 billion might not have been well-spent.

The $300 billion mortgage stimulus, “Hope For Homeowners,” awarded in July 2008 didn’t work very well either, because few people took an interest in the program. While proponents of this particular economic stimulus package estimated that 400,000 homeowners could be helped over a three-year period, in the first month, only 111 had applied.

The $200 billion economic stimulus handout to Fannie Mae and Freddie Mac, the mortgage giants, stabilized them enough to prevent collapse.

The $50 billion economic stimulus to stabilize money market funds might have averted a disaster.

The $150 billion doled out to AIG, the insurance giant, prevented their closure, but must not have completely solved the problem since AIG came back for $30 billion more less than six months later, even as they were awarding $165 million in bonuses to their top executives.

The $25 billion given to the Big 3 automakers, Chrysler, Ford, and GM, allowed them to live to see another day, but they remain on the brink of disaster.

The $700 billion bank bailout, given in extreme haste in October 2008, might have kept the banks functioning, but no one really knows where that money went or what was done with it, so it’s hard to judge whether TARP is working.

And that was just the economic stimulus packages of 2008.

Earmarks, Pork-barrel Spending

March 8, 2009

By Padmini Arhant

The budget vote delayed due to enormous ‘pork’ in the $410 billion spending bill. The defenders of various pork projects may have their own justification.

Nevertheless, Washington must relinquish wasteful spending through several pet projects carried out on behalf of lobbyists by lawmakers concerned about their own job security in the future elections.

As stated earlier in the article “Omnibus Spending” on the website www.padminiarhant.com , the nation is grappling with dire economic situation due to significant job losses and housing crisis at this time and families are desperately seeking relief from both free market system and the government.

Unfortunately, the free market system dependent on taxpayers’ bailout is barely capable of remaining solvent despite unprecedented capital infusion in modern financial history. The root cause of all these problems attributed to lack of ethics, accountability, transparency and importantly executive management failure.

The critics of taxpayers’ bailout argue in favor of non-interference in the market economy on the assumption the system would correct itself in due course. They fail to recognize the fact that the economic meltdown commenced in the early 2000, though the impact was not acknowledged up until late 2007.

During that limited or non-regulatory period, the capitalist system had ample opportunities to review and reassess their performance and prepare them for the worst scenario.

However, it did not happen, even though Wall Street witnessed and experienced the collapse of Enron, WorldCom, Tyco, Global Crossing all in the year 2002 resulting from failed Corporate management, unethical accounting practices and blatant greed.

Somehow, the free market advocates seem to have forgotten these events because of their inability then to envision the domino effect on the entire economy in the immediate future. Another reason for the denial of economic crisis previously was the skyrocketing of the technology stocks combined with oil and defense stocks at the phenomenal cost of American taxpayers’ dollars and human lives in Iraq war.

The financial sector created its own superficial boom during that time with the concoction of subprime mortgages and diverse toxic assets bundled together and sold by the hedge fund managers in the overseas markets. This entire taking place while the past administration was preoccupied in the implementation of unjust Iraq war.

It is unequivocally a miserable failure on the part of the predecessors in Federal Reserve, Treasury department as well as the Securities Commission primarily responsible for monitoring and evaluating the daily market events and executing necessary precautionary measures to prevent the economy from overheating.

Surprisingly, with the history of ‘Great Depression’, Oil crisis, economic recessions, one would assume that the authorities would remain alert and watch over the economy with prudent advice against extravagant spending in unnecessary wars or at least demanded the administration engaging in wasteful spending provide legitimate cost and benefit investment analysis.

The gridlock in Washington or State legislature is contributed by political ideologies resisting flexibility to resolve any crisis. The fiscal conservatives steadfast against tax increases, the predominant revenue source for any government, consistently target essential programs designed to promote consumer spending vital for economic recovery.

Similarly, the spendthrift legislators on both aisles with a penchant for pet projects or pork spending refuse to yield to frugality and prioritize their commitments to lobbyists and local governments assuring their re-election over national interest.

The electorate voted for Change in 2008 and change has hope only with representatives in Congress and Senate quitting habits that create rather than solving crisis.

It is evident that the $410 billion spending bill is injected with significant pork projects and it would be appropriate for the sponsors to present cost / benefit ratio in monetary terms to justify inclusion in the bill.

Again, these projects must be evaluated to benefit the taxpayers and the nation as a whole rather than the individuals regardless of them being legislators or the lobbyists.

The lawmakers have lately advised ordinary citizens to downsize their lifestyle according to their means, the same should apply to them as any sermons, preaching, and advice is meaningful when individuals demonstrate through action.

After all, shouldn’t one practice what they preach others?

No matter how one circumvents the legitimacy of earmarks particularly at these tough economic times, it is inappropriate now and in the future to squander taxpayers’ dollars for far-fetched projects with beneficiaries being the authorizing entity and/or special interests rather than the entire nation.

Please refer to the following articles from other sources for data confirmation on earmarks / pork barrel spending.

Thank you.

Padmini Arhant

——————————————————————————————————————-

Senate Republicans force delay on budget vote:

GOP Members want to offer Amendments on $410 billion plan criticized for Pork – By Andrew Taylor,

Associated Press – Thank you.

Washington – Senate Republicans, demanding the right to try to change a huge spending bill, forced Democrats on Thursday night to put off a final vote on the measure until next week.

The surprise development will force Congress to pass a stopgap-funding bill to avoid a partial shutdown of the government.

Republicans have blasted the $410 billion measure as too costly. But the reason for GOP unity in advance of a key procedural vote was that Democrats had not allowed them enough opportunities to offer amendments.

Majority Leader Harry Reid, D-Nev., canceled the vote, saying he was one vote short of the 60 needed to close debate and free the bill for President Barack Obama’s signature.

The 1,132-page spending bill is stuffed with pet projects sought by lawmakers in both parties.

Democrats and their allies control 58 seats, though at least a handful of Democrats oppose the measure over its cost or changes in U.S. policy toward Cuba. That meant Democrats needed five or six Republican votes to advance the bill.

None of the GOP’s amendments is expected to pass, but votes on perhaps a dozen are now slated for Monday night, Reid said.

The huge, 1-132-page spending bill awards big increases to domestic programs and is stuffed with pet projects sought by lawmakers in both parties. The measure has an extraordinary reach, wrapping together nine spending bills to fund the annual operating budgets of every Cabinet department except for Defense, Homeland Security and Veterans Affairs.

Once considered a relatively bipartisan measure, the measure has come under attack from Republicans – and a handful of Democrats – who say it is bloated and filled with wasteful, pork-barrel projects.

The measure was written mostly over the course of last year, before projected deficits quadrupled and Obama’s economic recovery bill left many of the same spending accounts swimming in cash.

To the embarrassment of Obama – who promised during last year’s campaign to force Congress to curb its pork-barrel ways – the bill contains 7,991 pet projects totaling $5.5 billion, according to calculations by the GOP staff of the House Appropriations Committee.

Sen. John McCain, R-Ariz., Obama’s opponent in last fall’s presidential campaign, called the measure “a swollen, wasteful, egregious example of out-of-control spending.”

The earmarks run the gamut. There’s $190,000 for the Buffalo Bill Historical Center in Cody, Wyo., $238,000 to fund a deep-sea voyaging program for native Hawaiian youth, agricultural research projects, and grants to local police departments, among many others.”

—————————————————————————————————

Further Excerpt of the article –

Sen. John McCain blasts $237,500 for Japantown museum – By Frank Davies, Mercury News Washington Bureau – Thank you.

Reps, Zoe Lofgren, D-San Jose, and Mike Honda, D-Campbell, secured that money to help the museum.

Honda, who is Japanese American, – “Jap. Museum boost tourism (thus jobs) in SJ Japantown, last of 3 authentic US Japantowns, Zoe & I proudly supported its funding.”

—————————————————————————————————-

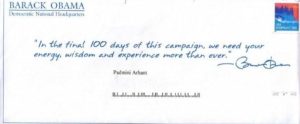

We need to fix our economy

January 30, 2009

President Obama and his administration are trying to address this serious economic crisis at home.

It takes the entire nation to get involved in the rescue operation.

Let us come together and do everything possible to revive the economy.

Please standby for some important guidelines and suggestions for economic recovery on www.padminiarhant.com.

Also, focus on resolving California’s budget crisis will be presented on the website shortly.

Meanwhile, please follow through the request from President Obama’s administration to create awareness and collective effort required to survive the crisis.

Thank you.

Padmini Arhant

———————————————————————————–

Last year, America lost 2.6 million jobs. This week, some of our biggest companies announced plans to cut tens of thousands more.

The economic crisis is deepening, but President Obama and members of Congress have proposed a recovery plan that will put more than 3 million Americans back to work.

You can learn more about how the plan will help your community by organizing an Economic Recovery House Meeting.

Join thousands of people across the country who are coming together to watch a special video about the recovery plan. Invite your friends and neighbors to watch the video with you and have a conversation about your community’s economic situation.

The economic crisis can seem overwhelming and complex, but you can help the people you know connect the recovery plan to their lives and learn more about why it’s so important.

Sign up to host an Economic Recovery House Meeting the weekend of Friday, February 6th.

The President’s plan passed the House of Representatives on Wednesday. But if it’s going to move forward, we need to avoid the usual partisan games.

That’s why supporters are opening their homes to talk with neighbors and friends about how the plan will work — and what it means for their community.

The video will outline the basics of the plan and how it will impact working families. It will also include answers to questions from folks across the country. Invite your friends and family to watch the video, discuss the plan, and help build support for it.

Don’t worry if you’ve never hosted a house meeting before — we’ll make sure you have everything you need to make it a success.

Take the first step right now by signing up to host an Economic Recovery House Meeting:

http://my.barackobama.com/recoveryhost

Time and again, you’ve demonstrated your commitment to change. Now you can help America move in an important new direction.

Please forward this email to your friends and family, and encourage them to get involved as well.

Thank you for your hard work,

Mitch

Mitch Stewart

Director

Organizing for America

Foreclosures

October 7, 2008

The stock market performance particularly on October 6 and 7, 2008 is a strong indication of the lack of effective measures to address the problems that triggered the financial crisis and subsequently the economic meltdown. The tumbling of the stocks due to aggressive selling day after day is from panic and deep concern among investors across the globe.

The “Treasury” has secured the financial package for the “rescue” plan as an instant relief to the current crisis. However, in preparation to relieve the financial institutions from “bad debts” and “toxic assets”, it has failed to look beyond the “Corporate” horizon. The immediate priority is to lift the nation from the burgeoning “housing market” crisis i.e. “foreclosures” and provide relief to the “homeowners”.

The Congress must act now on bipartisan basis to implement “Moratorium” on the “foreclosures”, and vigorously re-enact the “Bankruptcy provision” to relieve homeowners across the nation. It should not be at the discretion of the financial institutions that are primarily responsible for the mortgage crisis to resolve on their own terms and conditions. As stated earlier, the “foreclosures” are the result of the multi-tiered structures in the financial and real estate industry engaging in unethical practices and reckless conduct with no oversight.

If the “rescue” package does not involve the solutions to the problems of the current economic and stock market turbulence, the entire effort by the Congress is futile. Therefore, it is necessary for government intervention to relieve all homeowners dealing with “foreclosures” and delinquency on their mortgage payments due to the sudden increase in interest rates initially offered as “teaser” rates on the subprime mortgage loans.

The urgent and direct focus on the “housing market” is the only prudent economic strategy available to revive the “housing sector”, one of the structural foundations of the economy. The consistent decline of “home values” is a major factor for the “economic stress” with a ripple effect on the entire financial and commercial sectors.

The “housing” and “energy” industry are fundamental components of the economic infrastructure. Hence, the rescue plan must address the “cause” of the current financial crisis i.e. the “foreclosures” besides facilitating financial liquidity in the commercial sector to stimulate economic growth and development. In terms of the economic stimulus package under consideration, the “energy” subsidies would highly benefit the economy and ease the burden on the “main street” anticipating high “energy” costs in winter.

The impending purchase of the mortgage-backed securities under the “rescue” plan must follow the guidelines to benefit the investor i.e. the taxpayers in both the short and long run. It is important to address effectively any concern by experts such as “The HOPE for Homeowners Act needs to pay less than 36.5 % of the face value of the subprime mortgage backed securities. If more is paid the government loses money in the long run and owners of the securities profit now” and any loopholes that might hamper the deal in the investor i.e. taxpayer’s favor must be eliminated as a safety measure.

The consensus on the legislation of the bill “HOPE” for The Homeowners Act, 2008 is promising and expected to provide relief to an estimated 400,000 families. It is important to follow through the process and ensure transformation of “HOPE” into reality for “homeowners” severely hit in the “housing” market crisis due to massive “foreclosures”.

“Congress” and the financial institutions could reverse the current stock market decline through diligence and prudent economic strategy combined with robust fiscal policy and financial measures to boost investor confidence. Meanwhile, domestic and foreign investors must restrain short selling in the wake of current crisis that is contributing to the pandemonium in the stock market.

The stock market turmoil will cease upon following all of the above measures with no further procrastination to protect the interests of all i.e. the “main street”, the “wall street” and the global market.

Thank you.

Padmini Arhant

PadminiArhant.com

PadminiArhant.com