India – Economic Crisis And Jammu Kashmir Ground Reality

August 10, 2019

India – Economic Crisis

And

Jammu Kashmir Ground Reality

Padmini Arhant

The videos from third party alternative news outlets discuss and disclose India’s state of affairs on economy and Jammu Kashmir citizens anguish over inability to reach family and avail essential services in the aftermath of government’s overt authority.

Source – Newsclick – Thank you.

India’s economic crisis is hardly a matter of concern for those in government involved in exacerbating problems like Trifurcation of Jammu Kashmir & Ladakh with centralization of power assuming overwhelming jurisdiction.

Why do governments evade economy?

Whenever the government has no real effective solutions or robust economic policy to deal with soaring unemployment, slowing business and economic sector on the whole, inflation, credit crunch, agrarian distress, industrial slump in consumer and capital goods, real estate downturns, stock market and currency value decline among myriad economic woes, the government strategy is to distract suffering population attention to anything political, social or religious event rather than economy.

India’s incumbent government headed by Prime Minister Narendra Modi and Home Minister Amit Shah are leading the nation towards point of no return with dismal economic conditions taking toll on ordinary lives and businesses nationwide.

On Jammu Kashmir – Why Kashmiris now declared Indian citizens continue to remain in lock down denying them communication access via telephone, internet and local media?

What is the government agenda behind massive troop deployment in the valley having been downgraded from statehood to union territory under Prime Minister Narendra Modi and Amit Shah direct control?

Why are the political leaders and prominent party members with whom PM Narendra Modi government forged alliance until recently in Jammu Kashmir held in detention?

What exactly is the government plan considering naturalized Kashmiris as Indian subjects following recent abrogation of Article 370 and 35A are experiencing Modi Shah wrath of human rights violations barely known to the rest of the nation or the world for that matter due to communication black out since the rapid abolition of statehood?

How democratic is it for government to deny own citizens in Jammu Kashmir – the inalienable rights to contact family, relatives and members of community within and outside the territory in indefinite curfew?

When is RSS run BJP government and political class going to abrogate and eliminate archaic abhorrent caste system in India while denouncing Triple Talaq (Divorce) and gender discrimination alienating females in property inheritance deceptively cited as Article 370 component as antiquated practice?

No government is above law and no heads of the state have the authority to impose violent restrictions depriving people normal existence.

Any government engaged in such activities could not be democratic exposing the true characteristics of unconstitutional authoritarian governance that sooner than later meet undesirable conclusion.

Unfortunately, Jammu Kashmir citizens are victims of Modi Shah government malfeasance that is being allowed with political opposition complicity and others choosing to remain silent spectators in society barring few exceptions voicing their opinions and objection to the ongoing unruly unconventional politics in the name of ending status quo only prolonged to a greater devious political goals to benefit self and vested interests.

Jammu Kashmir citizens deserve fair treatment and importantly normal environment that are prohibited under government order that are in serious violation of citizens civil, democratic and constitutional rights.

Prime Minister Narendra Modi’s latest address to the nation on Jammu Kashmir and Ladakh trifurcation is least convincing at best given ground reality in the valley and Kashmiris dire straits and alarming at worst reflecting PM Narendra Modi and Home Minister Amit Shah’s absolute disregard for basic human rights extending their political legacy from Gujarat tenure endangering democracy.

India cannot afford a government exceeding limits in every respect from misrepresentation, misinformation to miscalculation of political, economic and social outcome as a result of egregious recalcitrant approach ignoring common plight.

India rising to the occasion and urging Modi Shah government to respect life and human rights in Jammu Kashmir along with directing focus on the ailing economy is the need of the hour.

Thank you.

Padmini Arhant

Author & Presenter PadminiArhant.com

Prakrithi.PadminiArhant.com

United States – Jobs, Economy and Deficit Reduction

September 18, 2011

By Padmini Arhant

United States unemployment at 9.2% and disproportionately higher among African Americans about 16.2% is national concern deserving attention from lawmakers, corporate America and institutions in the advisory role on job creation.

Economic stimulus through banking industry and automobile sector bailouts including various tax credits to middle class as well as tax breaks to companies,

Not barring Bush tax cuts extension to the wealthiest in the growth revival expectation is yet to produce anticipated jobs across the nation.

Beginning with credit crunch affecting small business and medium enterprise along with housing market decline despite historic lower interest rate,

In addition to stagnant job market restrains consumer spending relevant to energize industrial output.

Incentivizing small and medium entrepreneurships with required capital via business loans at special rates for established business and those struggling to retain or hire workers,

While minimizing health care costs and tax burden might provide relief to small businesses in turn easing the unemployment situation.

Corporations holding cash reserves could boost consumer confidence through jobs with domestic investments in manufacturing and service industry besides promoting research and development.

Tax breaks to corporations when utilized in job retention would promote economy and revenue prospects to address deficit reduction.

Simultaneously tracking tax evasions by corporations and wealthiest in the society could potentially deduce contributors to existing economic woes and growing national debt.

Regulations in the legislated financial reform is redundant with the lack of initiative and political will to appoint dedicated consumer advocate including crucial checks and balances on Wall Street irregularities having become standard business practice in the era of hedge fund type mismanagement.

Housing market is still under enormous pressure due to inadequate programs to help homeowners salvage foreclosures and short sales – promoting unscrupulous methods among trade representatives and lenders focused on immediate gains precipitating decline in home value.

As a result home investments is less attractive driving long term investors away from real estate to other investment opportunity with precious metals and commodities comparatively yielding better returns even against the increasingly volatile bond securities.

Stabilizing housing market with pervasive assistance largely from financial institutions having benefitted in the taxpayer bailouts could now reciprocate by offering relevant discounts or considerations to all i.e. first time buyers and significant population facing hardships to keep their homes in the deepening recession.

Such comprehensive measures would then generate rebound in home prices and construction industry not excluding occupations associated with commercial and residential real estate resetting employment for labor segment.

The current threshold in home rescue plan viz. ‘Make Home Affordable’ (MHA) is restrictive barely accommodating the needs of vast majority entirely at lenders’ mercy and discretion in interest rates modification or present market value adjustment for viable affordability given the available parameters favor lenders more than borrowers in the prevalent economy.

Monopoly in the national or global market share redefines capitalism endangering consumer rights and market economy dynamics.

J P Morgan Chase heading a group of five banks in control of 95% world derivatives market could inevitably threaten competition with corporate policies overriding consumer protective regulations and other necessary market interventions.

Similarly in the telecommunication sector – AT&T recent acquisitions are T-Mobile, Verizon, Cingular, Xanboo…are just a few with more on the horizon.

Nations confronted with rising debt and austerity to survive credit rating and budget crisis pose lingering uncertainty in the global financial market and general economy.

The constant speculation on possible default foment trepidation in the otherwise willful overseas economic partners investment proposals to alleviate challenges in the higher debt economies struggling between rigorous spending cuts and political opposition to tax hikes against wealthiest reaping benefits at the poor and middle income groups cost.

Tax code reform and streamlining tax structure closing loopholes is centralized discussion missing in action.

Another vital revenue source is holding domestic black money hoarders in foreign bank accounts especially Swiss bank deposits and several tax havens under disguised operations accountable with no bars in the application of law against culprits.

National bankruptcy is attributed to erroneous economic policies and indefinite military engagements offshore,

Notwithstanding unlawful activities in tax avoidance striking the hard working demography – the lower and middle class burdened with bulk tax payments as active consumers and taxpayers without substantial privileges unlike the wealthiest corporations and individuals deriving maximum income on minimum tax liability.

The pending job legislation seeking $447 billion stimulus from the Super Committee $1.5 trillion savings with compromises on social security and Medicare is contentious for it would directly impact the core consumer percentage forced to withdraw or constrain retail expenditure on common household goods and services for expensive private health care within limited disposable income.

The ramifications would be severe on retail and small businesses in the slowing consumerism with main street struggling to make ends meets in the dire economy.

With respect to infrastructure jobs in the package – the stimulus bill $787 billion passed in February 2009 consisted allocation for infrastructure repair and restoration.

Perhaps review in this context would shed light on productivity and precise job delivery in the past two years from this particular source prompting access to any residual funds for remaining job oriented national projects.

Funds interjection into the economy requires monitoring and periodic evaluation to determine performance followed by remedial course n the absence of desirable outcome.

If the bill comprises new techniques different from the earlier stimulants with guaranteed job surge, it might be worth pursuing the targeted goals.

However, reallocating nearly one half trillion funds calls for due diligence forsaking repeat experiments and,

Instead shifting resource deployment across the economic spectrum facilitating progress in farming, manufacturing, small business and medium enterprise, education, preserving essential services and programs via technology based outlets but cutting back on excess administration and bureaucracy in public and private sectors,

Green energy & technology supply without government sponsorships from the executive or legislative branch to safeguard taxpayers dollars.

In terms of corporate role with surplus cash in improving job conditions,

The reservations appear to emanate from looming deficit and Washington handling of the economy contrary to political perception premised on additional tax bonuses to entice corporate America on the 98% population backs enduring economic pain.

Free market economy is endowed with financial and human capital. The player in the wide-open competitive field wasting time and resources on underlying risks is unfortunate –

The myopic view failing to recognize macroeconomic benefits tied to job investments.

In a nutshell, corporations having been responsible for economic meltdown in the heavily deregulated environment with no transparency to deter reckless activities involving public funds and holdings arguably bear prime responsibility in the status quo reversal.

Again, the political leaderships’ complacency and complicity exacerbated downslide with widespread implications on jobs, housing market, skyrocketing deficit, currency disputes, trade imbalances – revealed in Q2 US GDP 2011 at 1.3%, credit downgrading and overall grim economic report.

US Small Business Optimism index falls to 13 month low.

US August import prices excluding Fuel rise 5.3% from last year.

US Census: Median Household income in 2010 fell 2.3% to $49,445.

US Census: US Poverty rate rose to 15.1% from 2009 – the highest now since 1983.

US Posts $134.2 billion budget deficit for August 2011.

US YTD (Year-To-Date) budget gap compares with $1.26T in 2010.

United States is not deficient in ideas, innovation and ingenuity.

The diverse skills in the American work force combined with exemplary business acumen and corporate successes are testimonies to U.S. economy being instrumental in the global economic feat.

United States economic stability and sustenance is paramount for worldwide development.

U.S. currency as international monetary unit in conjunction with developed and developing economies dependability on U.S imports reinforces United States position – the global Super turbocharger.

Corporate and political leaderships in the respective domain pledging commitment to economy and the country could expedite economic recovery uplifting citizens’ living standards with secure jobs, affordable housing and health care, Green energy and last but not the least –

Safe and clean habitat – the legacy for future generation.

United States has triumphed the trials and tribulations throughout history and unified efforts around this time is pertinent to resolve daunting issues on the economic, political, social and environmental fronts.

Peace to all!

Thank you.

Padmini Arhant

http://youtu.be/PDyhq00nvcY http://youtu.be/oHDiUvWh_JY

Presidential Q&A Session

September 10, 2010

By Padmini Arhant

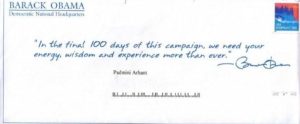

President Barack Obama this morning addressed the press corps on a variety of issues ranging from the economy to international affairs.

The President elaborated on the Congressional Democrats and the White House achievements thus far.

President Obama also laid out the economic progressive tax structure with permanent tax cuts for the middle class and those earning up to $250,000 income.

On the previous administration’s tax cuts expiration for the top 2% wealthy individuals earning above $250,000 – the economic strategy would benefit the higher income groups and not hurt them as claimed by the critics.

As the President explained – the first $250,000 earnings would qualify for the permanent tax cuts and only the remaining income would be subject to the applicable tax. Essentially 98% taxpayers might qualify for the permanent tax cut creating a vast middle income that would expedite economic recovery.

In terms of various appointments being stalled pending Senate confirmation – the President’s frustration was justified. Among them the Consumer Protection Agency Director position that needs to be filled in the immediate future requires bipartisan support in the Senate.

The consumer related problems on credit cards, mortgages and other financial commitments could be addressed effectively through the agency specializing in these issues.

The President also emphasized on the urgency to pass the bill facilitating small business loans through community banks for economic revival. The bipartisanship on this legislation is crucial for it would clarify the opposition minority stance in assisting the small business community worst hit in the economic recession.

In fact, the President urged on the bill to be approved upon the Senate resuming session in the coming weeks.

On the infrastructure plan – the President’s second stimulus $50 billion was raised at the news conference. Considering the proposal is self-funded by closing tax loopholes, any blockade would be political rather than economic.

Further, the $787 billion stimulus had funds allocated for this purpose and the combined investments would be a job booster upon $50 billion bill overcoming the Senate hurdle.

The economic plan is sound and guaranteed to generate jobs provided the Senators across the aisle extend their bipartisan cooperation to help the President and the Congress members jumpstart the economy to improve American lives.

Other matter at the session will be discussed individually.

Overall the President’s message on the economy and Israeli-Palestinian peace talks were very hopeful and optimistic.

Thank you.

Padmini Arhant

Federal Republic of Germany – Bundestag Election

September 28, 2009

By Padmini Arhant

Congratulations! to the Chancellor of Germany Angela Merkel and the FDP leader Guido Westerwelle on the re-election of CDU-CSU (Christian Democratic Union and Christian Social Union) in grand coalition with the Free Democratic Party in the 17th German Federal election on September 27, 2009.

As a major economic power and the largest exporter as well as the second largest importer of goods, Germany is significant to the global economy and the international progress. The export-oriented nation has been drastically affected from the global economic crisis. It experiences the common woes like the financial market failure leading to the government bailouts; massive job loss in the manufacturing sector especially the automobiles and heavy industrial equipments…having a ripple effect on other sectors in the economy.

However, Germany has contained the crisis from further deterioration due to the various government run programs viz.

The comprehensive system of social security, universal health care established in 1883 – now comprising 77% government funded and 23% privately funded health care system, public or affordable housing in suburban settings providing decent dwelling for the lower income originally created in the early twentieth century by the Social Democrats to curtail visible poverty.

The recent victory by the conservative coalition attributed to the poor voter turnout with the sizable electorate not having confidence in the major or minor political parties, although the ‘Green’ party focused on vigorous environmental policies gained impressive margin against others.

It would be interesting to monitor the measures adopted by the winning coalition in the economic recovery, given the FDP’s economic policy subscribed to the government involvement ‘as extensive as necessary’ and ‘as limited as possible.’ Otherwise, the party embraces the free market structure with privatizations, deregulations, restraining public subsidies – the predominant source of the present global economic meltdown, while maintaining the strong unionized work force and the vast government social infrastructure. Perhaps, the platform contributed to the surprise emergence of the once minority party successfully eliminating the Socialist Democrats that took a severe blow in the latest election.

With the rising unemployment causing much frustration among the population, the coalition has a tough balancing act to leverage the situation in the four-year term offered by the German electorate as a second chance to transform the campaign promise into a reality.

Regarding other issues of national concern, the electorate appears to be less enthusiastic in their country’s involvement as a NATO member in the eight-year old Afghanistan war. This is despite the relatively minimal troops’ presence in the region proving the unpopularity of the Afghanistan war.

Germany like the rest of the world is confronted with the economic, social and environmental issues and the industrialized nation’s rapid revival is crucial for the global economy as a member of OECD, G8 that is appropriately the present G20, besides being the biggest development aid in the world.

I take the opportunity to wish the leaderships and the people of Germany lasting peace and prosperity to share with the rest of the humanity.

Thank you.

Padmini Arhant

Pulse of the Economy

June 11, 2009

By Padmini Arhant

With a finger on the pulse of the economy, the recent reports on employment, housing, financial and stock market post stimulus funding worth $787 billion approved by Congress in February 2009, has drawn both praise and criticism from different quarters. The praise is always welcome and encouraging for any administration and the Obama administration is no exception to the rule, particularly when they are relentlessly engaged in stabilizing the economy as the top priority.

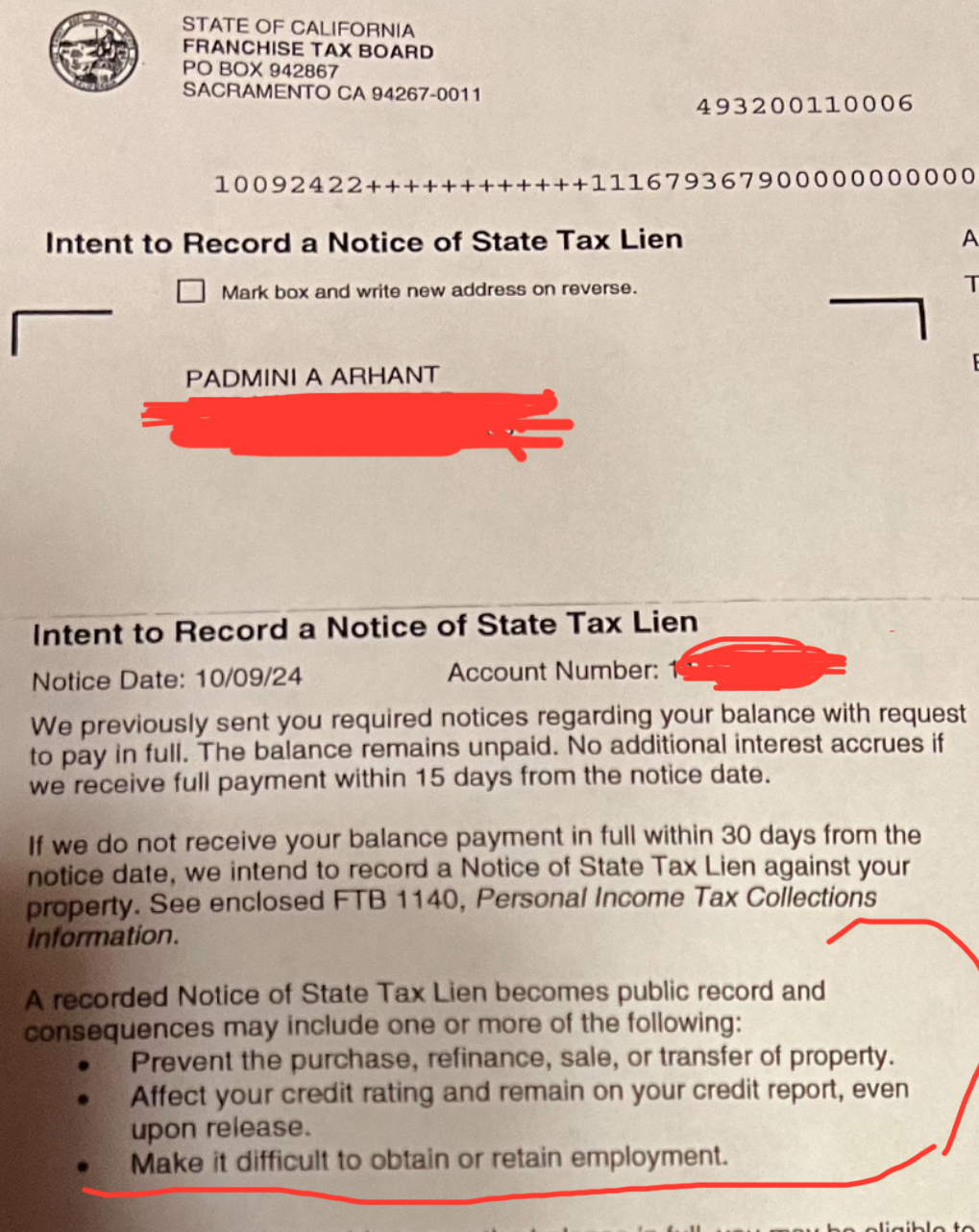

Whereas, the criticism aimed at the President is no revelation considering the partisan Washington atmosphere. The results thus far, indicate the current national unemployment rate at 9.2% against 8% in the pre-approval stimulus package forecast. Further, the reports reveal the economy shed 1.6 million jobs with the White House claiming 150,000 jobs saved since the passing of the stimulus measure. Obviously, it’s a contentious issue for all Americans receiving pink slips for paychecks and IOU’s in the state of California respectively.

The main criticism being the Obama administration’s optimistic approach in selling the stimulus plan not correlating with the job market results, a fair analysis is due to clarify doubts and speculations on the stimulus plan prospects and its effect on the economy.

According to the White House and other reports, only $44 billion i.e. 5.6% spent from the $787 billion stimulus funds with an accelerated investment committed this summer. In light of the above scenario, the 150,000 jobs rescued towards 5.6% funding is a confirmation of President Obama’s cautious and calculated expectation from the economy.

Even at the present conservative trend, the job market results for the remaining 94.4% of the stimulus fund upon targeted investment should adequately restore the employment rate from the growing underemployment and unemployment status with a combined saved and created job ratio yielding approximately 2,528,571jobs in a similar environment.

It is not uncommon for the critics and analysts to focus on the dismal job market figures affected since the onset of the economic recession in December 2007. The skeptics’ myopic view neglecting economic progress in other areas is attention worthy. Various reliable sources confirmed the financial sector strengthening with the bailout funds interjection in an effort to amortize the toxic assets from the sub-prime mortgage debacle. The leading financial institutions such as Bank of America, J P Morgan and Chase and other banks in the top ten range enabled capital management viability proven in the balance sheets.

The rapid foreclosures primarily responsible for the declining housing prices nationwide conversely contributing to the median home prices plateau with the 47 percent foreclosed homes resold in the entire Bay Area in April 2009 compared to 52 percent in February 2009 – indicating the desirous regress in foreclosures and signs of early recovery in the housing market.

The reports also confirm the home sales and value up for month and down for the year attributing to the Obama administration’s strategy of “the combination of lower prices, average mortgage rates of 5 percent or less for smaller loans, and a new $8,000 federal tax credit for first-time buyers” in the anemic housing market.

When the foreclosures pervasively diminished or extinguished nationwide with the stimulus programs, the housing market rebound will be visible motivating the lenders to participate in the melting liquidity market. However, caution required with the rising bond market’s pressure on interest rates imperative in alleviating the housing market crisis.

In the stock market – the significant gains by the commodity market and technology sector reflected in the recent rally is invigorating. Other industries lagging behind in performance likely to benefit from the steadily easing financial market credit crunch, promoting private sector investments directly related to boosting the job market, housing market and consumer spending essential for speedy economic recovery.

As for the quasi investment deals in the GM takeover causing pandemonium among the well-wishers across the aisle, the taxpayers’ financial commitment to rescue jobs slighted for political bickering. The ‘bankruptcy’ triggered cynicism about the government imprudence in investment goals with taxpayer dollars, while conveniently ignoring the fact that the auto industry problem originated during the former administration’s era and their $17 billion initial investment in the corporation set for failure.

Ironically, the temporary and modest government intervention in the free market characterized as ‘nationalization’ of industries necessitating required action from colossal mismanagement.

Meanwhile, the Obama administration’s objective in the GM deal to avert the deepening crisis in the frail industry challenged by the competitive global market is a thoughtful approach. Now with taxpayers as the majority shareholder in the once iconic corporation the management goals anticipated to synchronize with the twenty first century demands ensuring excellence in purpose, productivity and profitability.

Moving on to the other pertinent and popular health care issue debated and discussed to reject rather than embrace the premise of the President Obama’s health care plan – choice, affordability and quality, the perfect remedy to relieve the economy from the health care burden costing the nation in trillions while leaving the uninsured in millions.

Despite the innuendoes and insinuations about the mounting debt, the investments miscategorized as ‘squandering’ in the national economy ranging from health care, education, energy, environment, housing to financial sector and other industries is a pledge towards substantial economic security for the present and future generation.

The controversy surrounding the diverse investments costs applied to two particular sources viz. borrowing from China and tax hikes on the corporations and wealthy groups. Contrarily, the tax breaks to the top ten percent in the highest income bracket and corporations evading tax through tax havens with limited free market regulation or deregulation in the past eight years aside from being counterproductive resulted in approximately $9.5trillion dollars national debt with a cumulative effect on the status quo of the economy.

There was no clamor over the increasing liabilities on the baby boomers and the younger generation in the extravagant spending on illegal wars with a guarantee to fund itself from oil revenues in Iraq…an unequivocal myth until date.

Then the financial sector bailout with respect to AIG and oligarchs to a tune of $700 billion and more in 2008 with no accountability or transparency exacerbated the liquidity crisis against the intended proposal. Interestingly, the past events currently dismissed as irrelevant claiming that Obama administration disavow the incidents pertaining to the prior administration yet owe an explanation for the phenomenal deficit, the previous administration’s legacy to its successor.

Only if the opposition’s present vigilance on fiscal responsibility existed from 2000-2008, perhaps the People’s Republic of China and The Kingdom of Saudi Arabia would be vigorous competitors to the world financier ‘The United States.’

The demands from the conservative right exceedingly high launched with rhetorical comments and negative attacks such as “false Prophet’s failed Presidency.”

In the absence of any ideas and solutions to the burgeoning crises created by the previous administration’s historical blunders serving testimony to the beacon of incompetence and failures in Presidential history, the political posturing is paradoxical.

With respect to the economy in the ‘Golden State of California’, the clock is ticking for the state and the local government authorities to resolve the budget crisis and close the $24 billion deficit in the state budget and $73 million in the San Jose City budget.

Even though the strategy in both situations is scrambling to wipe the deficit by any means with mostly eliminating the vital services and benefits to the weak, the poor and the vulnerable, the repercussions of draconian cuts with no tax increases will far outweigh the immediate illusory results not barring the political risks in the 2010 gubernatorial elections.

Following the special election results on May 19, 2009, it’s incumbent on the state legislature to adopt several guidelines and viable options provided by concerned citizens through many sources in resolving the fiscal crisis. There is no patent right on the thoughts in the matter affecting the entire state and the community at large. It is a patriotic and civic duty of every citizen volunteering suggestions to deal with the stalemate confronting the California state legislature.

Governor Arnold Schwarzenegger’s recent comments on undocumented workers and their plight aptly placed the sensitive immigration issue in perspective. It’s time for the Governor to translate into action by issuing drivers license to the undocumented workers in the State of California that would not only aid the budget but also enhance the opportunity as the preliminary step towards legalization of the Californian residents.

More often, the leadership is subject to test the will, wisdom and courage against the odds exclusively the unpopular decision eventually ending in greater good for all.

I wish Governor Arnold Schwarzenegger and Mayor Chuck Reed of San Jose ‘Good Luck’ in their decisions appropriate to defend many but might offend few in the process.

Thank you.

Padmini Arhant

Bailout Débācle

March 22, 2009

By Padmini Arhant

The past two weeks dominated with AIG and oligarchs debating over the controversial $165 million and now increased to $218 million bonuses to executives instrumental in driving the insurance giant to the brink of collapse along with the financial markets of the world.

As usual, Washington vs. Wall Street dispute contributed to media frenzy and aptly reflected in the roller coaster performance of the stock market. The interesting factor in the blame game is those pointing fingers at others fail to acknowledge that remaining fingers are pointing towards them as they are equal partners in this charade.

By now, well-educated American taxpayers upon the quest to secure their future convinced that both Wall Street and Washington have serious credibility issues in wealth management and nation governance.

The back and forth allegations in the political crossfire reveals the true sense of Washington politics and Wall Street free market systemic corporate management failure. Again, the beneficiaries in this deal are the legislators responsible for the bailout approval and the corporations rewarded with taxpayer’s funds for unprecedented incompetence in modern economic times.

They are the beneficiaries because the legislators secured their emoluments by rushing the operating budget $410 billion omnibus bill ladened with pork projects to the tune of $8 billion to curb ‘government shut down’ rather than passing the required operating budget and isolating the earmarks spending for individual scrutiny through separate legislation.

The Corporate executives in due diligence spared no opportunities to collect remuneration, bonuses retrospectively and in the foreseeable future to maintain their status among the top 10% wealthiest hierarchy.

Let’s not forget in the Darwinian "Survival of the fittest contest" the weak, fragile and frail average taxpayer doesn’t stand a chance against the ferocious Corporate executives (compared to sharks) and Capitol Hill crusaders.

Events unfolding in the entire scenario deserves attention from every citizen involuntarily pledged to carry the burden of national debt currently projected at $9.3 trillion i.e. $1 trillion budget deficits every year for a decade, 2010-2019.

It is worth examining the role of legislators, corporations and lobbyists in securing taxpayer bailouts more prevalent in the past year 2008 and continuation of it in 2009. Prior to the diagnostic procedure, it is essential to shed light on the alliances forged by the key cabinet members and Wall Street merchants.

According to http://www.wsws.org/articles/2008/sep2008/paul-s23.shtml – Thank you.

Published by the International Committee of the Fourth International (ICFI)

Who is Henry Paulson?

By Tom Eley, 23 September 2008

Henry Paulson rose through the ranks of Goldman Sachs, becoming a partner in 1982, co-head of investment banking in 1990, chief operating officer in 1994. In 1998, he forced out his co-chairman Jon Corzine “in what amounted to a coup,” according to New York Times economics correspondent Floyd Norris, and took over the post of CEO.

Goldman Sachs is perhaps the single best-connected Wall Street firm. Its executives routinely go in and out of top government posts. Corzine went on to become US senator from New Jersey and is now the state’s governor. Corzine’s predecessor, Stephen Friedman, served in the Bush administration as assistant to the president for economic policy and as chairman of the National Economic Council (NEC). Friedman’s predecessor as Goldman Sachs CEO, Robert Rubin, served as chairman of the NEC and later treasury secretary under Bill Clinton.

Agence France Press, in a 2006 article on Paulson’s appointment, “Has Goldman Sachs Taken Over the Bush Administration?” noted that, in addition to Paulson, “[t]he president’s chief of staff, Josh Bolten, and the chairman of the Commodity Futures Trading Commission, Jeffery Reuben, are Goldman alumni.”

Prior to being selected as treasury secretary, Paulson was a major individual campaign contributor to Republican candidates, giving over $336,000 of his own money between 1998 and 2006.

Since taking office, Paulson has overseen the destruction of three of Goldman Sachs’ rivals. In March,

Paulson helped arrange the fire sale of Bear Stearns to JPMorgan Chase. Then, a little more than a week ago, he allowed Lehman Brothers to collapse, while simultaneously organizing the absorption of Merrill Lynch by Bank of America. This left only Goldman Sachs and Morgan Stanley as major investment banks, both of which were converted on Sunday into bank holding companies, a move that effectively ended the existence of the investment bank as a distinct economic form.

In the months leading up to his proposed $700 billion bailout of the financial industry, Paulson had already used his office to dole out hundreds of billions of dollars. After his July 2008 proposal for $70 billion to resolve the insolvency of Fannie Mae and Freddie Mac failed, Paulson organized the government takeover of the two mortgage-lending giants for an immediate $200 billion price tag, while making the government potentially liable for hundreds of billions more in bad debt. He then organized a federal purchase of an 80 percent stake in the giant insurer American International Group (AIG) at a cost of $85 billion.

These bailouts have been designed to prevent a chain reaction collapse of the world economy, but more importantly, they aimed to insulate and even reward the wealthy shareholders, like Paulson, primarily responsible for the financial collapse.

Paulson bears a considerable amount of personal responsibility for the crisis.

Paulson, according to a celebratory 2006 Business Week article entitled “Mr. Risk Goes to Washington,” was “one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in their pursuit of profits.” Under Paulson’s watch, that meant “taking on more debt: $100 billion in long-term debt in 2005, compared with about $20 billion in 1999. It means placing big bets on all sorts of exotic derivatives and other securities.”

According to the International Herald Tribune, Paulson “was one of the first Wall Street leaders to recognize how drastically investment banks could enhance their profitability by betting with their own capital instead of acting as mere intermediaries.” Paulson “stubbornly assert[ed] Goldman’s right to invest in, advise on and finance deals, regardless of potential conflicts.”

Paulson then handsomely benefited from the speculative boom. This wealth was based on financial manipulation and did nothing to create real value in the economy. On the contrary, the extraordinary enrichment of individuals like Paulson was the corollary to the dismantling of the real economy, the bankrupting of the government, and the impoverishment of masses the world over.

Paulson was compensated to the tune of $30 million in 2004 and took home $37 million in 2005. In his career at Goldman Sachs he built up a personal net worth of over $700 million, according to estimates.

—————————————————————————————————————–

Washington and Wall Street Analysis:

By Padmini Arhant

The beginning of the chain link usually found on the campaign trail, when corporations fund election campaigns through donation loopholes despite contribution limits by electoral commission and reign in on the successful candidate for the entire term.

After all, in the contemporary world focused on “What’s in it for me” deals, there is no free lunch with the exception of debt-consumed public yearning for believable change and better future offer available resources in terms of time, energy and money during the electoral process and beyond.

Who gets preference by the elected officials in the so-called democracy?

Indeed the Corporations due to the inter-dependency of sweetheart deals and brokering that take place throughout the election campaign. The deafening noise in the Capitol Hill about identifying the guilty party and pursuing disastrous course of action such as 90% tax on AIG bonuses after having approved without any stipulations predictably backfired at the victims none other than the average American taxpayers, presumably the majority shareholder at 80% of the multinational conglomerate.

In a bizarre development, more appropriately deterioration of the bailout fiasco, the headlines, news across the nation reverberate…

—————————————————————————————————–

AIG sues its biggest shareholder – us

By David S. Hilzenrath, Washington Post – March 21, 2009. Thank you.

As AIG takes billions of dollars from the federal government to stay afloat, it is suing the government for millions more.

The big insurer is trying to recover $306.1 million of taxes, interest and penalties from the Internal Revenue Service. Among other things, AIG is contesting an IRS determination last year that the company improperly claimed $61.9 million of tax credits associated with complex international transactions.

AIG has also asked a court to make the government reimburse it for money spent suing the government.

Given that the government owns 79.9 percent of AIG and has been using taxpayer money to fill a seemingly bottomless hole at the company, the lawsuit might seem like a case of biting the hand that feeds it. But an

AIG spokesman said the company has an obligation to press its case.

AIG believes it overpaid the IRS, and it “has a duty to its shareholders, including the government and other shareholders, to insure that it pays the proper amount of taxes,” spokesman Mark Herr said by e-mail.

Washington tax lawyer Martin Lobel agreed with that assessment.

‘If in fact they honestly believe that they’re entitled to a refund of those taxes, it would be a breach of their fiduciary duty not to” sue, Lobel said.

“On the other hand, the sense of entitlement from AIG is awesome,” Lobel said.

Because the dispute pits the government against a company that has essentially become a ward of the government, the only clear winners are likely to be lawyers, legal experts said. The legal expenses could consume millions of dollars, they said.

Lawyers at the firm Sutherland Asbill & Brenan, which is representing AIG, did not respond to an interview request.

For partners of similar stature to those representing AIG, fees can run $700 to $900 an hour, said Dan Binstock, managing director of BCG Attorney Search, a legal recruiter.

AIG’s dispute with the IRS focuses on taxes for 1997 and dates at least as far back as March 2008.”

———————————————————————————————————————

L.A. congresswoman defends actions

Husband Linked to Bank that got AID

By Richard Simon – Los Angeles Times – March 14, 2009 – Thank you.

Excerpts from the article:

Rep. Maxine Waters, D-Los Angeles, on Friday defended her efforts to help minority-owned banks – including one with ties to her husband – scoffing at the notion that she, a liberal Democrat, could influence George W. Bush’s presidential administration in deciding what financial institutions would receive bailout funds.

Waters, a senior member of the congressional committee that, oversees banking, has come under scrutiny because OneUnited Bank, on which her husband Sidney Williams had been a board member and stockholder, received $12 million in bailout funds. The money was provided in December, three months after Waters helped arrange a meeting between officials from the bank and other minority-owned institutions and Treasury representatives.

“I followed up on the association’s request by asking Treasury Secretary (Henry) Paulson to schedule such a meeting, as did other members of Congress,” she said.

She said she did not attend the meeting. She released letters by the National Bankers Association requesting the meeting and following up on it – signed by the group’s incoming Chairman Robert Patrick Cooper an officer with OneUnited.

Waters said the decision to provide bailout funds to OneUnited was “based on the merits of the bank’s request, not based on anything said at the September meeting and not based on political influence.”

She said that she has fully disclosed her husband’s ties to the bank. Williams served on the bank board until early last year and held at least $500,000 in investments in the bank in 2007, the most recent year for which public financial disclosure statements are available.

Waters could not be reached for an interview Friday. OneUnited Chief Executive Kevin Cohee said Friday he didn’t have time to speak with a reporter.

Melanie Sloan, executive director of the watchdog group Citizens for Responsibility and Ethics in Washington, said she found Waters’ behavior “inappropriate and certainly has the appearance of impropriety, even if it doesn’t rise to the level of an actual conflict-of-interest under House rules.”

Sloan said Waters’ comments that the meeting focused on the general problems of minority-owned banks “don’t seem credible” in light of statements from Treasury officials that the session became a discussion of one bank’s troubles. “At a minimum, Treasury officials should have been apprised of her interest in the bank before the meeting took place.”

Waters’ efforts, she said, raise a question: “How many members of Congress are having meetings with the Treasury Department pleading for funds for certain banks?”

“Treasury has said they’re going to list the lobbying contacts,” Sloan said.”

———————————————————————————————————————

Voice of the Electorate:

San Jose Mercury News – Readers’ Letters – March 18, 2009

Obama’s earmarks stance disappoints

I am disappointed that President Barack Obama backed off his campaign pledge to eliminate earmarks. The process subverts democratic government by avoiding votes on specific issues. It encourages our representatives to compete to spend more—if they fail to “bring home the bacon,” they may be seen as ineffective and not be re-elected. The further we move from specific votes for specific programs, the less inclined people are to support the government and the more inclined to resist taxes.

We must promote responsible stewardship. While many of the projects are meritorious, that hardly means they should be funded. Tax dollars are a scarce resource and every expenditure should be carefully scrutinized. Obama was right on this issue during the campaign; he is sliding off track now.

Christopher K. Payne

Stanford

———————————————————————————————————————

Ethical Lapse

By Padmini Arhant

The sparring political factions, the far left and the far right along with the centrists is in a strange dilemma today as they witness their reflection in the image of the accused parties in the most expensive soap opera entertainment.

As more Washington and Wall Street scandals are exposed, the more disingenuous the legislators appear to be in their pledge to turn the nation around.

An average citizen struggling to make ends meet asked the following questions –

“Why should I vote for anyone in the next election when I see politics as usual prevailing over the promised inevitable change?

Can the elected officials with public housing, guaranteed regular and several other sources of income, supreme health care, and free transportation relate to the suffering population dealing with job loss, foreclosure and other miseries?”

Unfortunately, the Washington atmosphere is secluded as elitist not making connection with the plight of the populist. The deepening of the recession combined with the multi-trillion dollar national debt forecast is a matter of great concern for the vast majority of population in precarious economic conditions due to job insecurity and declining prospects all around.

The American electorate enthusiastically elected the new administration with the hope to experience the “change” they deserve and the recent events are adversarial to the optimism built during the campaign.

Campaign promises involved Accountability, Transparency and changing Washington by eliminating corruption, cronyism and conventionalism. The passing of the $787 billion stimulus bill and subsequently the $410 billion omnibus spending bill loaded with earmarks confirms the status quo in Washington.

The pet projects, however meritorious they might be, cannot be more important than supplementing K-12 educational funding by retaining qualified teaching professionals and providing after school sports activities for students from lower income families and scores of other important social services for the constituents in California and other states.

It is obvious throughout the legislative process from the authorization of illegal invasion of Iraq war to Wall Street bailouts that lawmakers as representatives of the electorate in a democracy no longer consider it important to peruse the budget and other legislative bills because of the voluminous content. Hence, hastily resort to wasteful spending at taxpayers’ expense.

With the national debt projection in multi-trillion dollars, the wasteful spending in billions doesn’t seem to matter to the sponsors of the pet projects. Apparently, $8 billion added to the national debt for projects experimenting swine odor, road to nowhere, monuments ‘supposedly creating jobs’ when the industries are crumbling apart clearly signifies misplaced priorities by the legislators expected to be in touch with reality of their respective constituency.

The people are hurting and their mere existence is challenged by the hour while Washington and Wall Street continue to engage the nation in burgeoning financial crisis through legal and constitutional confrontations of the bailout débācle.

Perhaps it is time for the victims and the lame duck, the average taxpayers to rise to the occasion and execute power in the mid-term election to restore democratic values, ethical and moral standards desperately lacking in the corporate and political system.

It is best to eradicate the narcissistic culture that permeates the surroundings like weeds destroying the grassland and fertile grounds.

Evidently change is necessary and necessity is the mother of invention.

Thank you.

Padmini Arhant

Balancing California Budget

February 12, 2009

The golden state is in deep economic crisis, sharing the status quo of the nation.

As per Wikipedia.org – California would have the 7th highest GDP in the world if thought of as a country (not including the US as a whole, if so, it would be 8th).

A great state like California being the epicenter for – besides earthquakes,

Technology

Biotech and stem cell research

Entertainment symbolized by Hollywood

Diverse talent and skill pool making outstanding contributions in various fields.

Yet, the fundamental responsibility of the state government to balance the budget postponed indefinitely due to partisan politics with Republican minority misusing the two-third majority approval against the incumbent Democrats in the legislature.

As a result, the taxpayers of the economy are abandoned and the entire population is at the mercy of the minority rule upholding the conventional ideology against contemporary wisdom.

It is Déjà Vu for those following the federal government struggle to get the economic stimulus bill approved by both Houses of Congress.

The dilemma of balancing the budget with the political parties’ resistance to compromise is a daunting task for any administration. It is beyond comprehension that failed policies and inconvenient principles continue to dominate the center stage at both state and federal level in legislative matters.

California budget deficit currently at $42 billion with unemployment skyrocketing to 9.3% and expected to worsen by the year-end;

Clearly, the economic recession is widespread and taken severe toll on the present and future taxpayers of the economy.

———————————————————————————————————————

Challenges:

How does the state reduce the budget deficit of $42 billion?

Generally, the options would be exploring ways to generate revenues and cutting costs proven liabilities with no income or other benefits to the taxpayers of the economy.

Revenues:

How does the state generate revenues?

Usually, the government revenue sources are taxes paid by individuals and Corporations.

They are in the form of income tax, estate tax, corporate tax, payroll tax, sales tax, customs and excise duty on export and import items as well as fees and charges for any government provided services. If the state has other assets in the form of government bonds and treasury bills, they comprise negotiable instruments to borrow money.

In addition, the government could potentially expect income from investments in industries via quasi contracts, state run institutions, sale and/or leasing of government land to private sectors and trade goods and services with neighboring states or foreign governments. Some states find ways and means to share natural resources with their neighbors within and outside the nation for income.

Then, a federal aid to boost social services, health and educational programs is other channel for financial assistance.

Obviously tax increases is the common strategy for meeting budget shortfall. If income and aid are available from stated sources, then funding expenses is affordable.

——————————————————————————————————————-

Spending or Costs Elimination:

In this category, the lawmakers vehemently opposed to tax increases propose massive cutbacks and reduction in spending by a sweeping shutdown of essential services and programs with dire consequences in the long term.

Ironically, investment in education, health, housing, energy and environment are easy targets as “wasteful spending” for legislators in opposition to tax hikes during budget crisis. Those policy makers fail to understand the importance of protecting and nurturing the beneficiaries of these programs as they contribute to the economy today and tomorrow as taxpayers.

Lately, legislators have taken a swipe at education or investment in public school systems at both state and federal levels. It is tragic that such measures are even contemplated leave alone legislated in the industrialized and advanced nation that should be leading the world in K-12 educational program.

The public school system in the State of California and across the nation is in shambles. The infrastructure and the general classroom environment are in desperate need of face-lift to improve academic performance by students of all socio economic backgrounds.

Every dollar spent in a child is an investment in future.

Complete overhauling is required in areas like classroom size, materials including new Textbooks, enriched curriculum with emphasis in Math and Science, Music and Arts, Sports facilities, recruitment of qualified teaching staff, Teachers’ salary, training and professional development, new energy efficient buildings regardless of districts and zones in every state.

Undoubtedly, education must be a priority with K-12 system being the foundation for young minds entering the academic world. The reason United States is lagging behind in international standards is due to neglect of our school system particularly the early learning stage (K-12) when the opportunity to help every student thrive is available to educators.

Therefore, the state and the federal government are obligated to enhance achievements in educational programs through investments in the state-of-the-art educational system.

Similarly, health, housing, energy and environment are equally important as the taxpayers benefit from adequate health care, proper housing, affordable energy, clean and safe environment.

——————————————————————————————————————

Pragmatic Solutions:

The best option to reconcile California budget is to consider both tax increases and costs reduction as suggested by many analysts and experts on this issue.

According to the analysis by San Jose Mercury News, February 8, 2009

Budget spending outpaced inflation and state’s growth.

Interestingly, the social services and K-12 education received proportionately less funding as compared to the extra spending identified in Criminal Justice, health care and filling the gap for the reduced vehicle license fee in the analysis of actual spending in 2007-2008.

First, action is required to identify the revenue sources via tax increases.

1. Marginal increase in Sales Tax of goods and services including the sales on the cyberspace would provide an even tax distribution for the society.

2. Increasing Vehicle License fee for all is necessary to address the massive deficit. In this context, it is important to raise another explosive issue of undocumented workers in California without drivers’ license or vehicle registrations.

Issuing drivers license and allowing all undocumented workers to register their vehicles would not only generate income for the state, it would also strengthen state and national security with the documentation of all residents in the state.

Subsequently, acquiring vehicle insurance by the undocumented workers would minimize the burden on registered owners in addition to stimulating the economy through insurance industry.

At present any vehicle registration or insurance by undocumented workers carried out in a back alley manner depriving the state due proceeds.

3. Target items for tax increase to reduce health care costs such as tobacco, hard liquor products and items subject to possible health abuse.

4. In the establishment of social standards, tax increases on winnings through gambling and advertisement sales of pornography (assumed to be a multibillion dollar industry) is justified to make way for important social services and programs.

5. Review and revise taxation policy for California Corporations hoarding income in tax havens along with their offshore subsidiaries.

6. Airport tax, Port fees, dutiable goods, customs and excise duty are other sources of revenue.

7. Increase tax on entertainment industry to pay for education, kids welfare, community hospitals, colleges and institutions.

8. Specific environmental protection act by levying heavy penalties on environmental pollution (air, land and sea) through negligence such as oil spilling, carbon emissions and violation of aviation standards.

9. Marginal increase in gasoline tax would enable energy efficient programs such as solar, wind and hydro thermal power.

10. Last but not the least, leasing government land to corporations and scientific institutions, university laboratories or airline industry with enforcement of strict environmental regulations, not excluding sale of government assets no longer useful in the short or long run.

——————————————————————————————————————————————-

Costs Reduction:

Criminal Justice System:

A thorough examination of the Criminal Justice system is necessary from the analysis and news reports.

The State must devise a mechanism to reduce prison population through major social reforms at all levels beginning with the juvenile detention center.

Further, the parole system, three strikes law and other misdemeanor charges reassessed and offenders deployed in monitored community services rather than crowding prisons is the ideal strategy to cutback spending.

Health Care:

Healthy Approach to reducing health care costs –

Medicaid for senior citizens and economically disadvantaged population.

Promoting preventive care with immunizations.

Early diagnosis of diseases through annual or bi-annual medical checkups and

Subsidized prescription drugs through tax incentives to pharmaceutical and bio-tech industry are few possibilities to deal with health care crisis.

Counseling services and Therapy for psychological and other mental health problems as a preliminary screening process to ease the substantial costs in this regard.

General well being encouraged through active life combined with healthy diet in schools and other areas of the community.

Vehicle License Fee backfill – To be reinstated as outlined above.

General Government – Electronic record keeping and updating technology would considerably improve efficiency and prohibit excessive spending in administrative services.

Higher Education – Engagement in community development activities in return for student loans is a progressive cost recovery scheme.

Transportation – Cost savings methods and effective transportation means aimed at conservation of time and energy recommended for this expense.

Resources and environment – Best to follow guidelines suggested above for environment.

All other costs and spending not discussed or highlighted must be carefully reviewed and those proven redundant with no benefit to taxpayers or the State eliminated to reconcile the budget.

———————————————————————————————————————

Time for Action by California Legislators

Investment in better education and all of the essential services means building future with healthy, responsible and productive citizens as opposed to increasing prison population demanding major diversion of funding to criminal justice system.

There is an urgency to underscore the fact that not all taxpayers necessarily benefit and appreciate the frugal tax savings by preventing tax increases because such action favors the wealthy minority while leaving the majority marginalized in a society.

If the legislators really care for their constituents and the state/nation they pledge to serve, they need to pause and reflect on the realities of depriving majority of the population to decent lifestyle and economic prosperity, the predominant cause of the current sluggish consumer spending.

Often, provision of unemployment and social security benefits, Medicaid, health insurance, food stamps…dismissed as socialized enigma in a Capitalist economy. Unfortunately, a reminder is required that subscribers of these benefits and services ultimately contribute to the success of the capitalist system as consumers of various products and services.

As stated earlier in the blogpost titled Redistribution of Wealth, Oct 31, 2008, www.padminiarhant.com

Promoting economic status as highlighted above…

Eventually, create a fair system of sharing the economic burden by all rather than only by the affluent ones.

Such farsighted and permanent solutions are in direct contradiction to the myth and misnomer of the doctrine against short term tax increases essential to combat severe economic recession.

Socialism, Marxism may well be the nemesis to Capitalism,

Capitalism cannot thrive without consumerism – – That is the fact

California budget crisis must be resolved with no further delay.

It is time for legislators to set the priorities right to fit in with the new millennium goals.

Thank you.

Padmini Arhant

Stock Market Crisis

October 10, 2008

Courtesy: http://www.godlikeproductions.com – Thank you.

Whats Driving the Stock Market Chaos??

Denninger Speaks… – Thank you.

Quote

What The Media *Didn’t* Cover

So yesterday the “news” was all about the long end of the Treasury curve rocketing higher (yield), which many people believe is about “risk acceptance” and The Fed (along with other central banks) cutting rates by 50 basis points.

Uh huh.

Let’s talk about what’s really going on.

First, our rates. The EFF (Effective Fed Funds) rate has been trading at 1.5% now for a couple of weeks. Two percent schmoo percent; a target rate only in name is no target at all. In reality the 50 bips cut, even though it resulted in an instantaneous 40 handle rocket shot in the /ES futures Wednesday morning, was entirely a CONfidence game (with the emphasis on “Con”!)

The RTS (Russian Market) is down 87% YTD, and is closed until further notice. The Nikkei is trading below the DOW – that’s not good. Indonesia’s stock market was shuttered Wednesday and remains closed after tripping “lock limits” within 90 minutes of the opening bell. As of Thursday morning the RTS was closed again after Putin allegedly strong-armed a whole bunch of Russian wealthy to “stick it in” (to the stock market); this sort of v-fib in a market does horrifyingly bad things to ordinary investors who find themselves out just before the market rockets higher without underlying economic cause.

Iceland has essentially melted down. Their currency went straight into the toilet and two of the three largest banks were nationalized – all in the space of 24 hours. The culprit? Bad loans. Where have we seen this movie before?

Mexico’s peso has fallen some 40% in days against the dollar. Great if you’re traveling there as an American. Sucks severely if you’re a Mexican. That alleged fence on our southern border is going to need reinforcements.

Wednesday morning Britain and the EU zone all announced major bank rescue operations. Same deal – “throw money at it, paper it over.”

Nowhere a mention of forcing balance sheet transparency and truth.

Except in one place – here in the US! Plans to standardize CDS contracts and force them onto an exchange are actually under way. This is a major positive move and fulfills one of the three prongs of my view of how to solve this problem, once implemented. We’ll see how much pushback we get, and whether OTC derivatives are actually banned (as they should be), or whether the big trading houses and banks insist on being able to play “pick pocket” along side the “regulated” world.

The NY Fed announced plans to extend a further $39.6 billion credit line to AIG. The tab is now almost $120 billion dollars. Where did the other $80 billion go? Has it been vaporized trying to raise capital to pay down CDS contracts that have gone the wrong way on them?

Speaking of which, Thursday is D-Day – D standing for either “derivative” or, if things go sideways on people, “detonation.”

See, this is the day that Lehman’s CDS contracts are supposed to be resolved. Since Lehman’s bonds are trading at ~20-30% recovery (horrible, on balance) the writers may have to fork up 60 to 70 cents on the dollar.

The $64,000 question is how many of those contracts net out. The real liability is what’s left once everything is “balanced” (a long and short held by the same guy net to zero, assuming that both contracts are “money good”, leaving the holder with no liability – and no asset)

This has the potential to be a big “nothingburger”, a minor tremor, or a 250′ high tsunami that washes over Lower Manhattan (and the City) tomorrow. There’s no good way to know in advance which outcome will manifest, since nobody (at present) knows what the true netted-out open interest is. This is one of the problems with not having a public exchange; lack of knowledge.

The bright light of reality will shine tomorrow……

The architects of this, by the way, are the folks who took the cuffs off the banks, going back to the Gramm-Leach-Bailey law and the repeal, piece-by-piece prior but finished by GLBA, of Glass-Steagall. GLBA, by the way, was passed in 1999 – just as the Internet bubble was in full force. Coincidence? No. The root cause of this mess? Right there. Thank Congress, and make sure you include those members who have been around for the entire thing, including John McCain.

On the equity market side shorting is once again available, the order having expired. The lack of shorts was a definite factor in the stiff selloff that we’ve seen, and Chris Cox owes investors in America an apology – on the air. This was an objectively stupid decision, as shorts provide necessary liquidity during serious downturns. Without them you get “no bid” circumstances, and they sporadically appeared during the last few days in financials, which certainly exacerbated the selloff.

In the bond markets Treasury refunded some “off the run” bonds and got an ugly surprise – the market didn’t want them. They had to pay a 40 bips “tail” to get them to go, which may be the start of a really troublesome trend. See, Treasury is now throwing over $100 billion a week into the market, and this only works on days when the market is crashing. THEN you can get people to suck up all you puke out, but the rest of the time you’re going to have to pay up, and Treasury has had to do so – dearly.

This may be the start of the “bond market dislocation” that I have long feared. I hope and pray not, but if this trend continues Treasury is going to find that it cannot sell its debt into the market without slamming rates higher, especially on the long end of the curve, which means an instantaneous implosion of what’s left in the housing market.

The ugly is that 3-month LIBOR widened today, as did the TED Spread. Both should have come in. They did not. LIBOR is essentially unsecured lending and the bad news is that a lot of corporate (and some personal) borrowing is indexed off it. If you are, you’re screwed.

Why has LIBOR refused to come in despite these “coordinated” effort? Its simple: the underlying trust issue has not been addressed, and nobody is seriously proposing to do so.

Paulson and Bernanke now are truly caught in the box, as I have been talking about for more than a year. As they introduce and fund these silly programs like the “TARP” each new program produces more foreclosures by depressing home values and thus tightens the spiral.

See, as long rates go up house prices go down, since the value of a home for most people is Dependant on what they can finance, and that is directly related to interest rates. Get out your HP12C and run the principal value change for a fixed payment if interest rates change from 6% to 8% or 10% – that’s the impact on the value of your house from these changes that are occurring in the Treasury marketplace.

This outcome is what I warned of in “Our Mortgage Mess” back in April of this year; a potential ramping of borrowing costs for government debt, which will not only make sustaining government spending (and perhaps government operation) impossible, but in addition destroy private credit by driving costs in the private sector skyward as well.

Simply put, the “TARP” or “EESA” must be repealed here and now.

It is unacceptable to risk Treasury Funding destruction in order to bail out some bankers. And make no mistake – there is and will be no benefit to taxpayers.

We are also now entering into earnings season, and Alcoa was a warning blast. They missed badly. That won’t be the last.

This is the “value trap” problem that many investors fall into. You see the market down 30% and think its a great buying opportunity.

It is a great buying opportunity only if earnings going forward can be sustained. But in this case, they cannot. It is flatly impossible; with Treasury borrowing money like a madman, tacking on more than 20% to the national debt in the space of months, carrying costs will inevitably rise as will taxes. Both of these have a multiplier effect (in the wrong direction) on corporate profits, and in addition the “faux profits” from financial engineering have all disappeared at the same time.

The S&P 500’s profit, in terms of gross dollars, are almost certainly going to come in by 50% from the highs, and that assumes we get a garden-variety recession and not something worse. This of course puts “Fair Value” on the SPX down around 750, or another 25% down from here.

The ugly stick potential is what I discussed yesterday, and that risk is very real. Treasury borrowing cost ramps can produce a 1930s-style dislocation in credit, and if it happens then you will see mass bankruptcies not only in corporate America but among individuals as well as borrowing costs ramp to the point of shutting down the marketplace for credit.

Treasury and Bernanke claimed that “credit markets seized”; this is only half-true. Credit markets always close to those who are lying, because there is no reason to loan someone money if you’re not reasonably sure you will get paid back.

But there is a second form of seizure and this is the frying pan into which we’ve now jumped – that is a credit market that prices beyond what the market can bear at its imputed rate of return. In that market credit is available but it does not matter, as you can’t make enough profit to generate a positive carry on the borrowed money, and consumers in that environment fall into a vortex of interest payments that spiral faster than they can borrow to stay ahead of them.

That rabbit hole is how we got the 1930s, and it is the danger we now face. Congress was in fact conned by Treasury, George W. Bush and the banking industry (including Ben Bernanke), who instead of forcing the malefactors into the open and exposing those who were bankrupt (or just plain corrupt – notice the common stem on both words?) threw them a line – unfortunately, the line is cleated to the entire economy of the United States, and they have enough negative buoyancy to drag us all under the waves.

——————————————————

Analysis: This is one of many opinions floating around all over the cyberspace regarding the latest downward spiral in the stock market. The consensus is clear; a few operatives with a major stake in the gamut of the financial world are driving the mania for their profiteering with utter disregard for the rest of the population around the world.

It is time for the people of the United States and around the world to rise to the occasion and intervene as the snowballing of losses in market shares is not a natural event. Clearly, this kind of manufactured, well-orchestrated and premeditated mechanism is the result of greed, corruption and cronyism that is rampant and has now come to surface.

Not surprisingly, there is no investigation or reports by the media as the Corporations, the de facto beneficiaries own them. The world must awaken now and deal with the reality to bring all of these entities to justice. It is time to make every one of them accountable for their actions and inaction as well as make them absorb all of the losses generated by their devious “modus operandi”.

The current situation is not an isolated occurrence. The cause and effect factor is evident in the existing stock market turmoil. As suggested earlier, the unethical practices resulting from the lack of accountability and oversight is contributing to the pandemonium in the market worldwide with the infusion of the “survival of the fittest” theory.

The world is shocked and in despair, seeing no end to the plundering of wealth that rightfully belongs to the righteous and not the self-righteous. However, it is presumptuous of those involved in this mass abduction of world treasury that they will not be exposed and brought to spotlight.

Perhaps, Armageddon is the only alternative now to restore morality and world order. The degradation of principles, ethics and democratic values by the ruling power will not escape the judicial verdict.

Therefore, it is in the best interest of all those involved in the conspiracy to come forward and demonstrate figment of integrity by stabilizing the stock market decline or be prepared to deal with the wrath of natural phenomenon.

Further, to those entities responsible for the current economic disaster, “the end justifies the means”.

Any attempt to ignore the warning will be an invitation to their peril.

If the authorities in power fail to exercise diligence, proper management, and immediate interventional policies to stabilize the market, they will share similar destiny as the recently convicted O.J. Simpson.

The judicial mantle seized by the power is in denial and defiance of the existence of force that will deliver justice.

The mortals brought nothing upon their birth hence; take nothing upon death.

Thank you.

Padmini Arhant

PadminiArhant.com

PadminiArhant.com