Global Challenge – State Sponsored Terrorism

March 1, 2012

By Padmini Arhant

The greatest challenge facing humanity today is economic and military warfare waged for subjugation leading to global dominance.

National sovereignty undermined through military aggression and economic pressure with severe austerity imposed upon nations submerged in debt created by institutions such as World Bank, International Monetary Fund, Federal Reserve and Central Banks in Europe and around the world is a major threat to global society.

Wall Street investment bankers and equity management firms like Goldman Sachs hedge fund debacle drowned Greek, Spanish… economy with former having made a fortune while the latter battling for survival under tough economic penalty.

It is clear that concentrated wealth acquired deceitfully wielding power over global population directly responsible for the status quo.

The empire with selective members upon meeting the criteria i.e. characteristics paradoxical to anything good has been successful in causing impoverishment and misery.

Espousing values deviating in human ethos indiscriminately inflict atrocity judging from trajectory – the ruthless strategy is empowerment of few and enslavement of the rest.

Up until now the tentacles spread across the globe under economic policy – globalization with political motto – One World government setting the stage for New World Order.

Having founded organizations like United Nations particularly the United Nation Security Council barring contemporary geopolitical and economic regional representation is the tool to authorize embargo – the overt exertion of authority against targets of economic and strategic interest.

New World Order as suggestive in the name exercising hegemony seeks complete surrender of national resources and most importantly individual liberty.

Civil rights eroded under national security pretext with constant surveillance over citizens including racial profiling have become the norm in the land of the free and home of the brave.

Evidently blatant efforts to deny Internet – the viable medium for public awareness and global alert regarding incendiary assault on freedom by political leaders and federal agency directed to intervene in the first amendment bill of rights cannot be ignored.

The White House signatory to Anti-Counterfeiting Trade Agreement (ACTA) along with EU counterpart is apparently set for yet another potent sabotage on mainstream communication.

Reportedly March 8, 2012 – FBI deadline for Internet shut down with Trojan viral bomb potentially malfunctioning computer is the latest cyber scourge to quell dissent against authoritarianism.

Citizens deserve appropriate clarifications from the government behind the looming unconstitutional censorship on freedom of speech.

Occupy movement across the globe in solidarity observing peaceful and non-violent means could efface shadow organization infringement on human existence.

The carefully planned and organized terror attack with federal complicity facilitated Patriot Act granting government and agencies unlimited power in human rights violation prohibiting 9/11 related serious investigations in the land of justice.

Despite compelling evidences comprising eyewitness accounts, expert analysis on controlled demolition contributing to twin towers and world trade center building # 7 collapse,

Not to mention the profiteers from the horrific crime and tragedy caught with foot in their mouth in the monumental insurance fraud and,

Several real perpetrators capitalizing on the opportunity to invade sovereign nations leaving thousands of service men and women killed, millions of lives lost, countless rendered homeless, destitute and refugees in their country – are ironically upheld in high esteem with impunity against prosecution.

The glaring indifferences raise questions in rational minds,

What is the purpose of legal system in the so-called democracy?

Why is the nation that galvanized to bomb Afghanistan based on propaganda chooses to remain silent upon revelations on September 11 attacks and events subsequent to state colluded biggest terror act in mankind history?

When law and justice claws outstretch to track down offenders in civil society and unabashedly pronounce guilty verdicts mounting up to capital punishment,

Why are the political establishment and privileged class exempt from similar scrutiny and never brought to justice for corruption, treason, mass murder and horrendous crimes committed in electorates name?

Besides not being held accountable for smearing national image and jeopardizing integrity of the country they are elected to serve in a democratic society.

Evil emboldened and thrives when goodness is dormant or complacent in the face of death and destruction.

Modern society conundrum is the lawmakers being the lawbreakers with license to subvert facts, intimidate witnesses not excluding mysterious disappearances and control investigative wings to personal advantage.

The practice extended into judicial branch noticeably executing judiciary power on expendable members,

Political helm as mastermind and windfall monetary gains actual beneficiaries on corruptions or racketeering yielding phenomenal profits stashed away in Swiss bank accounts and tax havens at national and international detriments are neither subjected to thorough unadulterated judicial inquiry nor subpoenaed to testify in public domain enabling presumptuous invincibility by default.

Furthermore conventional media and press corps owned by corporations and private entities in cohort with politics endanger democratic principles redefining freedom of press duly subservient to political machinery compromising journalistic standards to the lowest ebb.

The unflinching loyalty to political hierarchy by specific media and print press is abhorrent.

Notwithstanding peripheral affiliates relentless slander and character defamation against those standing up to power proves the coalescence favoring unscrupulousness and impropriety.

As a result conscientious members in civil society and independent investigative journalists admirably rise to the occasion risking life and reputation for national and humanitarian cause infusing rationality as well as objectivity in the otherwise propaganda ravaged discourse promoting narcissistic goals.

Again these diligent crusaders are not spared from political witch-hunt or feudalists and their support base indignation.

United States having been betrayed numerous times is at the crossroads to restore fundamental democratic axioms cognizance of republic governance made possible by severing ties with misleading forces exploiting American benevolence for ideology driven supremacy doomed to fail in the overzealous mission.

The U.S. military command – Army, Marine, Air Force and National Coast Guards allegiance is pledged to the Star Spangled banner and the nation it represents not the insidious repetitive reconnaissance premised on grandeur seizure of global power.

Brief description of existential menace – All Seeing Eye emblematic of sea pirates notably pioneered the art of piracy with secrecy being the core element contradictory to unprecedented invasion of others privacy is entrenched in divide and conquer philosophy, fear mongering apart from eugenics and apartheid maintained to advance depopulation.

Arguably the network has no religion and is neither an atheist nor agnostic.

However worships GOD – in the denomination of Gold, Oil and Destructive Weapons viz. lethal stocks (Drugs, Arms and Ammunition even nuclear arsenal material such as enriched uranium, Chemical weapons for biowarfare) pursued with overwhelming greed and violence.

The desperation to expedite pre-meditated global conquest is unfolding in synchrony.

European economies are currently succumbing to stringent cuts viz. Greece, Spain…from unreasonable conditionality in ECB, IMF and EU aka Troika loans paving way for economic colonization.

Middle East – U.S. led NATO preparedness and eagerness to strike Syria early March in addition to using none other than another Islamic nation – Turkey troops deployment is consistent with polarization technique applied in usurping power against nations perceived weak and vulnerable.

The nexus organization heralded tearing the Berlin Wall in Germany, bringing down iron curtain in the former Soviet Union only to substitute with tyranny and state sponsored terrorism unveiled on September 11, 2001 and thereafter.

Global revolution is the effective remedy to reclaim sovereignty by rejecting privately owned central banks predominantly financing two-dimensional warfare in the economic and military front crippling societies for ultimate enforcement of NEW WORLD ORDER.

The immediate priority for citizens is to curb any attempts to disrupt or terminate Internet access.

Non-compliance of undemocratic laws designed to exacerbate human suffering.

It could be exemplified in taxpayers refusing to pay taxes spent on warfare,

Misplaced generosity – U.K. foreign aid to growing economy like India demonstrating condescension than compassion,

Worldwide protest against Swiss Banks and tax shelters is imperative.

The discreet holdings not only bankrupt developing and developed economies but also legitimize illicit financial transactions fostering corruption culture.

Likewise demanding black money recovery hoarded in Swiss banks and tax havens regardless of political, economic and social stature would assist in economic development.

Independent inquiry of public officials and leaderships implicated on corruption scandals, vote rigging, and legislation involving bribery, obstruction of justice and above all abuse of power during term in office would confirm functional democracy.

Calling for public trial on 9/11 terrorism and illegal invasions of Afghanistan, Iraq and Libya would categorically reaffirm the democratic stance –

None are above the law.

Dismantling World Bank, IMF, UNSC used to justify prejudicial economic sanctions and military intervention against selective nations.

Invalidate Federal Reserve to reinstate republic control of money supply in every part of the world.

International Criminal Court of Justice in Hague re-structured to eliminate bias for indictments against war crimes,

Corporate activities harming life and environment,

Social injustices of all kind – ranging from gender inequality, sexual orientation and human trafficking to misuse of religion and neglect of indigenous population.

Vatican City – Christianity’s prosperous religious center assets distribution would substantially improve lives and adequately address poverty, hunger and disease in many regions.

Even perhaps rescue European economies from dire consequences conforming to Lord Jesus Christ teachings on the healing power of kindness through charity.

Wealth and knowledge proliferate upon sharing amongst the deprived and disenfranchised in the society.

Finally, regulations to safeguard global financial security and environment quintessentially alleviate prevalent adversity.

Please remember people possess power to bring about the change benefitting all reversing the trend in isolation, exclusiveness and superiority.

Transparency in political and economic decision-making process is paramount for nation building.

Citizens around the world are requested to come together in laying the foundation for a new beginning with universal peace and freedom.

Peace to all!

Thank you.

Padmini Arhant

http://youtu.be/ssuAMNas1us http://youtu.be/vEJdeWvGIZU http://youtu.be/VqQGm2J3THA http://youtu.be/dlaaQgW4GHw http://youtu.be/c3O--_S2hq4 http://youtu.be/vCqAlgQnXj8 http://youtu.be/nSD95z26kEU http://youtu.be/gZ4QlRBTFLY http://youtu.be/LMAyEsUAsEQ http://youtu.be/5H9d0FaZGpo http://youtu.be/C-qKcWtcbQ0 http://youtu.be/lZsLvoSyu00 http://youtu.be/eAGyapIIYeM http://youtu.be/6sRIpi-ngtc http://youtu.be/DrynBzUpyagGreece – EU Bailout and Austerity

February 8, 2012

By Padmini Arhant

European contagion originated from the Mediterranean country – Greece.

Last year EU monetary assistance with €110 billion tied to untenable terms and obligations rendered the expectations beyond normal scope.

Accordingly, Greece is still struggling to overcome economic woes despite severe austerity and political reshuffle.

The earlier government under Prime Minister George Papandreou efforts to contain the rising debt and,

EU pressure to prioritize deficit trimming through rigorous spending cuts evidently led to GDP contraction by 6%, budget deficit at 10% and 18% unemployment respectively.

In the poor economic growth rate and looming financial liabilities, the creditors conditional offer demanding drastic expense reduction directly affects the core revenue base – consumers and taxpayers.

The attempt on deficit control without income is enforcing mandatory borrowing and,

Massive cuts in vital services cripples the economy to the point of diminishing return.

Tax hikes at any level could exacerbate the burgeoning crisis especially with unprecedented layoffs in both public and private sectors leading to industry workers as well as state employees nationwide strike.

Instead Greece and other economies like Spain, Portugal, Italy and Ireland in euro zone would enormously benefit from job-oriented investments incentivized with tax breaks, guaranteed dividends and equity enhancement to prospective investors.

European Central Bank, IMF and other international banks capital infusion with strict recommendations result in joblessness.

Funds directed towards economic sector for job creation would stimulate economy facilitating income source to meet budget and payments on borrowing.

Short term fund raising through treasury bills and bonds enables survival amid speculations on financial liquidity.

The propositions on Greek’s private debt write off up to 70 percent or more would provide relief in deficit management allowing appropriations towards economic recovery.

However, EU, ECB and IMF loan stipulations on €130 billion or ($171 billion) over and above cuts agreed to about 1.5 percent of GDP by current Prime Minister Lucas Papademos is the repeat of erroneous policy that precipitated economic and financial meltdown across Europe.

IMF’s similar strategy with Romania dependent on credit for state budget commitments contributed to economic downturn due to extreme lending criteria.

Financial institutions and monetary organizations purpose is useful in building economies applying generic and specific models to address individual requirements.

Greek economic surge and financial recuperation could be supported with job restoration via domestic and foreign investments qualifying the G-20 favored globalization concept.

Under same auspice, trade activities promoting exports would revive manufacturing, service and retail industry besides boosting small medium enterprise competitiveness.

Although financial assistance are necessary to restitute state solvency and credit rating,

Finance industry, corporations and wealthy entrepreneurs in Greece could ease the burden on the economy alongside government initiatives to salvage the situation.

The economic resurrection with prudent investments would need modification for a vibrant Market economy.

Market economy – 80% and Government managed programs – 20%

While the bulk of the economy would fall under free market system with oversight to prevent past mistakes responsible for the status quo,

Preserving core social programs under State purview are important for sustenance and they are –

Pensions, retirement savings or Social Security,

National Health Care with options

Veterans Affairs including rehabilitation and care,

State funding for affordable education, scientific research and technology,

Subsidized housing to accommodate non-qualifiers in the regular home finance.

Public services utilizing technology to the maximum potential and,

Environment protection agency to co-ordinate on national and international mandate.

Stringent laws against corruption within society beginning with government bureaucracy, finance sector and across the economic spectrum could yield financial savings.

Tax reform closing tax evasion loopholes and unaccounted funds or hidden assets retrieval from domestic and overseas bank accounts.

Market economy with life saving programs under government ambit could be a profitable and secure synergy complementing one another.

Greece in euro zone has shared gains and losses with euro fluctuation prior to economic recession.

The impact on Greek economy from euro volatility could not be discounted in the European trade.

The perception of Greece membership in euro zone as a liability could be transformed into an asset in reality with appropriate rescue package designed for economic progress than financial bailout.

Unlike the previous aid, EU approval of €130 billion to Greece in the interim could set the frail economy on trail with fiscal, trade and monetary policy restructuring for better economic performance.

With political elections on the horizon, Greece could experience economic productivity through local and foreign investors recognition of lucrative deals available at the present time.

Greek government relentless pursuits in energizing the economy would minimize ambivalence among creditors reversing the trend in capital provision.

EU, ECB, IMF and global finance to Greece on feasible conditions would deliver positive outcome strengthening euro zone and the member states economy.

The distinction between banks bailout and assistance to weak economy is the beneficiary with former was top 1% whereas the latter represented by 99% in the society.

Considering the predicament and inter-dependency in global economy,

Greece and other nations could not be abandoned or challenged with extraordinary conditions detrimental to euro zone and EU economy.

The leaderships and authorities at EU, ECB, IMF, International banks and euro zone are urged to kindly extend financial credit to Greece with a new opportunity to rebuild the economy and organize fiscal house in order.

Prime Minister Lucas Papademos , the opposition leader Antonis Samaras and all other elected members,

Notwithstanding, the economic leaderships in Greece are confronted with daunting tasks ahead.

The consensus in public and national interest would reflect the political will to resolve the persistent financial problem winning republic confidence and creditors trust in the capital market.

Good Luck! To citizens of Greece and the government in prevailing in financial and economic security.

Peace to all!

Thank you.

Padmini Arhant

http://youtu.be/uz4aF1ZshZw

Greece Austerity Package

June 22, 2011

By Padmini Arhant

Greece faced with fiscal challenges is considering further austerity measures targeting the mainstream population.

The decision has triggered public anger and frustration in disagreement with the government’s economic policy.

In an effort to comply with ECB, IMF and EU terms for the previous bailout euros 110 billion of which, financiers have conditionally withheld remaining euros 12 billion demanding the government to streamline spending cuts alongside tax hikes to avert potential default predicted to cause ripple effects among the euro zone nations.

Greece is also hoping to secure additional loan euros 100 billion to meet financial obligations with creditors while attempting to pass the austerity package worth euros 28 billion in Parliament

The Socialist government under familiar leadership of Prime Minister George Papandreou has been struggling to survive the worst financial crisis emanating from –

The hedge fund debacle combined with weak fiscal policy lacking in checks and balances,

Asset mismanagement, monetary and economic policies deficient in goals and preparedness with respect to the then looming global recession leading to prior administration failure exacerbated by the common corruption problem that has brought the Mediterranean country on the brink of economic collapse.

As a result the vulnerable demography in the society are forced to bear the brunt with workers in both public and private sector not paid for their service or labor over six to fifteen months.

Notwithstanding a vast majority bereft of job opportunities and economic growth… left at the government’s mercy for existence.

The dire situation is the culmination of complacency to deteriorating economic conditions, financial prudence and ethical efficacy debilitating national creditworthiness.

From the creditors perspective, caution exercised in lending to a nation perceived as fiscally irresponsible and therefore stipulations beyond economic viability is maintained despite the drastic constraints proved detrimental to the borrower and lender more likely precipitating the anticipated delinquency on loan repayment.

Although fiscal management is vital to emerge from the burgeoning economic meltdown, it is equally important to be diligent in protecting the mass being the workers, employees, consumers, taxpayers and the electorate determining the political fate in a democratic society.

Austerity aimed at the essential services and programs for citizens would be counterproductive.

Instead reviewing the national budget and eliminating wasteful expenditures like disproportionate defense appropriation with Greece being a NATO ally and trimming bureaucracy in the government portfolios could improve efficiency in the public sector.

Private sector could be invigorated with tax incentives to retain and create desperately required jobs.

Simultaneously closing tax loopholes with tax reform is yet another revenue source possibly reversing the rising national debt.

Investments to promote small-medium businesses are typically the desirable economic pursuits to expedite recovery.

Identifying redundant holdings and undertakings contributing to national deficit could ease the burden with divestments in job sector to increase productivity.

Agriculture, Industrial expansion utilizing innovative technology and focus on green jobs would immensely boost GDP enhancing exports in the global economy.

Hence every step towards alleviating public plight by restoring health, education, housing jobs and environment would guarantee exponential returns for any economy especially the nations dealing with fiscal woes need economic stimulus to revive the job market and consequently consumerism.

Human capital is a valuable resource instrumental in economic, social and political development.

The government efforts on austerity slashing critical programs that could deprive people from basic living standards are not in national interest.

Greece is urged to implement robust economic policy built on political transparency and accountability effectively addressing corruption to reflect integrity and credibility in national affairs.

Parliament vote in Greece could perhaps follow a road map prioritizing citizens’ economic and social empowerment with precise immediate and long-term objectives consisting emergency plan through financial reserve held in future savings for foreseeable or unexpected events.

Hopefully the lenders IMF, EU and ECB would kindly approve the necessary funds to Greece on the premise to become solvent besides fiscally strong in the tough economic climate setting a precedence for others seeking financial rescue.

Wishing the people of Greece and Prime Minister George Papandreou success in nation building.

Best Wishes to European Union members in providing meaningful financial assistance to enable nations like Greece and others in similar strife to strive for rapid growth resumption.

Thank you.

Padmini Arhant

http://youtu.be/yL5HAuN7XD0 http://youtu.be/s-R1OxEA3-8 http://youtu.be/mkINtps__Y8 http://youtu.be/9UbEsaNKdog http://youtu.be/c5YOMtEMsxw http://youtu.be/H3lu7GNTAZo http://youtu.be/CTgyAolSsbo

Euro Crisis and Impact on Global Financial Markets

May 27, 2010

By Padmini Arhant

It originated in Iceland with the pervasive subprime mortgage factor and similarly affected other economies like Ireland, Greece, Portugal and Spain, referenced as PIGS.

Although, every nation in this category share the contaminated ‘derivative’ traded internationally, the lack of deficit control with the national budget exceeding the GDP growth also contributed to the meltdown and subsequently reflected in the poor credit rating.

More prominently, Greece identified with:

“Goldman Sachs between the years 1998-2009 has been reported to systematically helped the Greek government to mask its national true debt facts.

In September 2009 though, Goldman Sachs among others, created a special Credit Default Swap (CDS) index for the cover of high-risk national debt of Greece. This led the interest-rates of Greek national bonds to a very high level, leading the Greek economy very close to bankruptcy in March 2010.”

The culmination of internal and external mismanagement primarily led the Mediterranean economy to the brink of collapse seeking bailout from the European Central Bank (ECB), EU and IMF.

European Union was challenged with a predicament in the Greece bailout to either ignore the problem or address it to avert the contagion in Europe.

Since Greece is an EU member using the reserve currency euro in the 16 of the 27 states representing the eurozone, the former alternative would have had serious ramifications.

Besides, the euro being the second most traded currency in the world after the U.S. dollar; it has multifaceted impact on the financial markets dealing with high volume trading especially in the futures exchange.

The industrialized and emerging economies are in a bind with the euro value reduction, due to the competitiveness expansion in export trade. For example, the export oriented Germany is at a competitive edge with the United States, Japan and China irrespective of Germany specializing in high end industrial and heavy machinery equipments.

Hence, the euro crisis upside is the European nations gaining export affordability.

Accordingly, the emerging economy and the major U.S. creditor China is concerned about the potential split in global market share and availing the opportunity to reject the U.S. request for currency (renminbi) value adjustment, which has been set below the market determination despite China’s extraordinary trade surplus.

China’s currency, renminbi (RMB) or yuan (CNY) has been withheld from floating as the international currency in the foreign exchange market to protect the status quo.

At the same time, the positive aspect of the dollar appreciation is omitted in the evaluation and that being the foreign investments in U.S. dollars particularly the Treasury bills held by China is strengthened in value and guarantee long term security in futures contract.

Financial stability measures adopted by EU, IMF and ECB with approximately one trillion dollars of which a conditional rescue loan worth $110 billion to Greece is approved to reverse the negatives in the financial markets reacting to the euro downslide from the unsustainable government debts and deficit level.

Had the eurozone requirement on its union members to keep deficits below 3 percent of GDP maintained, Greece and other struggling economies need not have been subject to harsh austerity strategies that has resulted in protest among the mainstream population in Greece and Ireland.

Regardless, the current global financial crisis calls for wasteful expenditure elimination and the national budget review to direct investments in high value returns.

Appropriate actions involving tax hikes and spending cuts are necessary to balance the budget.

However, spending cuts targeting the fundamental programs inevitably generating revenues through productive workforce and consumers is counteractive.

Restoring essential programs and services for the job creation and preservation, youth education, citizens’ health care, social security, safe and clean environment nurture healthy and middle class society to ease the burden on the top 1% or 10% wealthy taxpayers in different economies.

Most importantly, the defense budget consuming a significant proportion of taxpayer revenue in the prolonged wars could be divested to peaceful and profitable opportunities benefiting the citizens at the domestic and international front.

The ideal solution for the European Commission and the monetary union to avoid rising deficits in Europe without compromising the member states’ sovereignty in their national fiscal policy decisions would be to establish an independent, non-partisan committee by the states to examine the individual spending and tax plan, rather than the centralized monitoring or the neighboring authority verifying it.

Further, the constitutional amendment by Germany to contain the deficit to 0.35 percent of GDP by 2016 provided the higher deficit not attributed to GDP decline is a trendsetter in curbing the economic crisis.

In concurrence with the economic experts’ advice – The ECB expediting the credit approval on government bonds used as collateral upon qualifying the self-regulated constitutional limit on deficits is prudent in deterring broad speculative lending activities.

Alongside, the EU sweeping financial reform with tough standards against the hedge fund managers including the two proposals by German Parliament:

Global financial transaction tax and Financial activity tax focused on CEO’s Personal Income & Bonuses are effective steps with the exception of the global financial transaction tax because it is eventually transferred to the end-consumer and may not be a viable option for all participants.

Nevertheless, international agreement on financial regulation by G-20 and other nations is crucial in order to emerge from the existing crisis and prevent the future economic recession.

The systemic risk in the multi trillion dollars ‘derivatives,’ that caused the financial debacle in Europe, Middle East (Dubai), North America, Asia and elsewhere demands stringent policies and independent investigations on fraudulent ventures.

The financial overhaul passed by the U.S. Senate last week has been under scrutiny by analysts with mixed response and elaborated in the article titled:

“New Financial rules might not prevent next crisis – Associated Press, Sun May 23rd. 2010 at 3.55 PM EDT. Reported by Jacobs from New York and contributed by AP writer Jim Drinkard.”

Unequivocally, closing the loopholes as detailed in the cited article and other reports is paramount to establish a financial system free of K street influence.

The apparent revolving-door relationship between Wall Street and Capitol Hill in which employees and consultants have moved in and out of high level US Government positions, with the prevalent conflict of interest is a hindrance to any legislation.

Only the electorates with the voting power in a democracy can remove the persisting obstacles by rejecting the special interest representatives in politics against meaningful legislation.

People as the consumers, taxpayers and voters are the ultimate force in achieving the progress for common good.

Thank you.

Padmini Arhant

Reflection on the World Economic Forum – Davos, Switzerland

February 19, 2010

By Padmini Arhant

The World Economic Forum on January 27 – 31, 2010, at Davos, Switzerland contemplated the global economic crises.

Speakers from the large consortium expressed their thoughts and hope or the lack thereof about the global economic prospects at the annual meeting.

Summarizing the summit issues:

The general focus has been:

The economic recession.

The financial crisis and the need for financial reform.

U.S economy, the dollar, the deficits and the gridlock in Washington due to Special Interests’ control of Congress.

Skepticism on the EURO currency strength and concerns regarding European market from the economic struggles in Greece, Spain, Iceland, Ireland, Portugal, Latvia to name a few further exacerbated by the majority euro members surpassing the 3percent budget deficit cap, a criteria for the euro currency usage.

ECB (European Central Bank) role in easing the liquidity crisis.

UK urging banks to assume responsibility – i.e. resume credit to the frail economy.

National Debt from bailouts – A common symptom shared by the major global economies.

Emerging Markets’ potential in stimulating economic growth through international mergers and acquisitions.

Corporate leadership in risk undertaking, growth sustainability and resisting or embracing reform.

Technological impact on business and adapting social networking concept to promote global agenda.

Google – China controversy on hackers and censorship.

Green Technology and consensus on the climate change policy.

Humanitarian issues related to natural resources such as water scarcity, inadequate food supply in fighting hunger, poverty and disease worldwide.

————————————————————————————————–

Economic Synopsis – By Padmini Arhant

Global economic recession – The general agreement is:

The massive capital interjection with public money in the private sector particularly the finance and the auto industry in the United States was essential in the year 2008 and 2009 to avert a major catastrophe – a full blown depression.

Following that, the bailed out bankers have supporters and cynicists to defend or vilify the mega rewards via executive bonuses amid severe financial meltdown mostly attributed to the current economic crisis.

Another contentious issue related to the financial sector is:

Should governments continue to bailout banks under the banner?

“Too Big to Fail.”

Regardless, it’s clear from the recent experience that a serious financial reform is no longer an option but a necessity to counteract risk undertaking in the financial market.

Moreover, the finance industry being the vehicle for the economic growth, it cannot resist regulations due to the uninsured public funds management by the private sector.

Evidently, the real estate slump exacerbated the liquidity crisis in the global economies viz. Iceland (nicknamed as the “subprime economy”) Ireland, Spain and not sparing the once booming commercial real estate capital – Dubai, UAE,

Leaving the United States not unique in the burgeoning residential and commercial real estate decline.

In terms of stimulating the economic growth, industrialized nations and the emerging markets face a common dilemma – stimulus packages, bailouts and the rising national debt.

Government stimulus programs target specific industries in the domestic economy with the green technology touted as the promising field.

Unequivocally, the green technology should be promoted by all nations big and small besides infrastructure projects and reviving the manufacturing industry.

However, the stimulus activity is bound to create national debt from the budget deficit because of sluggish GDP and the negative current account balance for import-oriented economies like the United States.

U.S Economy:

Although, the multi-trillion dollar deficit has not drastically affected the U.S credit rating as the investor confidence in the U.S market is not lost,

The status quo cannot prolong with the persisting Republican members’ opposition against tax hikes to protect self-interest and special interest.

Notwithstanding their blockade in the financial, health care and energy sector reform.

Therefore, the American electorate must be careful prior to swinging their support to the Republican members in Congress.

The ideologues were responsible for bringing America on its knees under the disastrous Bush-Cheney administration.

Now, the same republican members are determined to stay on the course to debilitate the U.S economy with an utter disregard for the ‘average’ Americans.

While comparing the economies in the stimulus funding, it’s clear that the nations investing in the domestic economy like China, Japan, India, Brazil… have survived the worst crisis through quasi participation.

Private sector project with public capital infusion is seemingly a viable economic strategy to reduce unemployment and curb public outcry over increasing national debt.

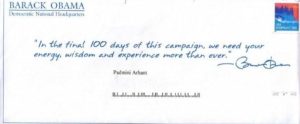

It’s attention worthy that President Barack Obama has similarly approached the economic woes with the SBA loans to boost small businesses, tax credits to the corporations and the green sector only to be browbeaten by the “fiscal conservatives” in name only on both sides of the aisle.

Again, something to remember about the so-called “fiscal conservatives” successful derailment of economic progress.

So far, the opposition policy in every national issue is “Penny wise and Pound foolish.”

Not to mention their conduct exemplified in the tarnished U.S image at WEF with,

Communist China scorn democracy by citing the Special Interests’ dominance in American politics.

The statement is not far-fetched except for scapegoating democracy against totalitarianism.

United States should adopt big and bold economic actions to contain the high unemployment and that would be:

Job creation in the infrastructure projects, innovate the manufacturing sector with technology alongside revolutionizing industrial growth on eco-friendly foundation.

Energizing the small businesses and retail industry is equally important to enhance the per capita income, an appropriate inclusion in the economic progress measurement rather than reliance on GDP growth alone.

United States is rich in resources in every aspect with an advantage of being the pioneer across the economic spectrum.

The rumor about United States weak economic status and attempts to denigrate the U.S dollar as the international currency is nothing but smear tactics by the competitors vying for the leading role in the world economy.

What the investors should bear in mind is the U.S economy’s resilience to rebound in the face of worst economic and political crisis and history is testimony to that effect.

In addition, the democratic system is a positive factor in attracting investments within and offshore.

European Economy:

The EU and the ECB (European Central Bank) proposals are pragmatic in many ways.

ECB intervention to pull the European financial markets from the liquidity crisis would facilitate the anticipated credit flow in the union.

Economic setbacks in Greece, Spain, Portugal, Ireland, Latvia and last but certainly not the least Iceland are significant and cannot be abandoned for it might reach a crescendo irrespective of the trade volume.

Accordingly, the conditional offer from Germany and France to bailout Greece is vital to protect the EU economic interest with Greece being the union member.

The leadership in the Mediterranean nation under the Greek Prime Minister George Papandreou is capable of salvaging the dire economic situation.

When the reckless banking sector was bailed out for speculative trading, otherwise gambling of public investments,

The Greek economy with labor capital, entrepreneurial exuberance and political stability deserves EU / IMF /World Bank assistance to survive the economic turmoil.

It would be detrimental to hinder the borrowing opportunity for Greece and other ailing economies predominantly due to the regional impact.

At the same time, Greece and Iceland should be transparent with facts and display fiscal responsibility to the international monetary oversight for creditworthiness.

United Kingdom is right on target in demanding the financial sector to resume credit to the frail economy.

U.K has been forceful in urging the much-required global financial regulations even though not surprisingly, the conservative political faction is against it.

France – Recommendation on the long overdue closing of corporate tax havens is a step in the right direction.

In fact, the rule of thumb for the global economies dealing with budget deficits is to:

Eliminate redundant expenditure

Differ or limit discretionary spending

Scale back unaffordable commitments like wars, conventional stockpiles and nuclear proliferation not barring extravagant agenda like moon travel more for prominence than purpose.

Revision of tariffs and taxation laws to expand the revenue horizon.

It’s imperative to consider tax increases and close tax evasion loopholes through tax havens.

Spending freeze with tax cuts and synonymously tax increases with skyrocketing expenditure would be oxymoron at any given time.

Emerging Markets viz. BRIC countries (Brazil, Russia, India and China):

The salient feature in the group is their ability to focus and invest entirely on the domestic economy.

Unlike the United States and NATO, none of the four nations is currently engaged in active warfare though; cross border tension is permanent with contingent defense forces on the periphery.

Still, the four nations ‘combined defense spending falls short of the exponentially escalating U.S military expenditure appropriated for –

Two overt wars in Iraq and Afghanistan,

A proxy war in Yemen with drones and fighter planes provided to the Yemeni forces,

Over and above the U.S military base situated nationally and overseas.

Poignantly China more than Russia is engaged in the lucrative arms race to Iran, Syria, Lebanon, Pakistan, North Korea, war torn Africa – Darfur in Sudan, Congo, Somalia, Guinea, Rwanda…

Yet, not competitive enough to the United States in this respect and confirmed by:

The New York Times article By THOM SHANKER – Thank you.

Published: September 6, 2009

Despite Slump, U.S. Role as Top Arms Supplier Grows

“Despite a recession that knocked down global arms sales last year, the United States expanded its role as the world’s leading weapons supplier, increasing its share to more than two-thirds of all foreign armaments deals, according to a new Congressional study.”

————————————————————————————————–

Economic Synopsis – By Padmini Arhant

BRIC countries impressive performance is expected to continue with the investor confidence higher in these regions than Europe.

Their view on the U.S domestic job creation as isolationism or protectionism do not bode well since the BRIC nations have adapted the domestic investment policy to expedite economic revival.

The irony is the characterization of the United States and Europe adhering to similar strategies as ‘protectionism.’

It’s noteworthy that Brazil, India and China have benefited from globalization with transnational ventures in their shores.

Such anomalies beckon paradigm shift in the globalization concept among the emerging markets.

Some U.S corporations as the global operators echo the sentiments much to the displaced domestic workforce anguish and disappointment.

They remain oblivious to the facts that the United States being the largest consumer base and a major importer is struggling to contain high unemployment, fragile housing market and credit crunch in the financial sector.

U.S economic recovery is paramount for the global economic stability.

Optimize Technological Applications:

World society is more digitalized than before and technology embedded industry maximize efficient output. Incorporating technology in every imaginable field is the cornerstone for the present and future generation.

Green Technology and Climate Change Policy:

Industrialized countries along with developing nations are grappling to arrive at a consensus on climate change policy.

Fortunately there is tremendous enthusiasm towards green technology and the economic powers are reluctant to make the swift transition by renouncing fossil fuel and nuclear power to natural sources like solar, wind and hydrothermal energy.

The main problem lies with the profit guiding politics by the energy behemoths obstructing the fossil fuel and nuclear technology abandonment against all natural elements for energy production.

Life survival and sustenance on the planet is dependent upon clean air, water and food chain maintenance, not achievable without an aggressive climate change policy.

Hybrid policy targeting carbon emissions through carbon tax and cap & trade is the viable solution from the economic and political standpoint, other than possibly winning bipartisanship in the climate bill legislation in the United States.

Humanitarian Issues:

Water scarcity and inadequate food supply is the global challenge confronting humanity.

Emerging markets favoring globalization have a primary responsibility in addressing the plight of the vast majority in their domain rather than exclusively focused on GDP growth.

The population in Africa, Latin America, Asia and the Middle East cannot be ignored by the affluent nations and their $100 billion commitment in economic aid during the G20 meeting reflects meagerness and not eagerness to alleviate suffering on the planet.

Poverty being the reality, the global community can provide to the needy by reining in on personal greed.

Communal development against concentrated growth guarantees a bright future for humanity.

Global progress and prosperity begins with economic equality, social justice and political freedom.

Thank you.

Padmini Arhant

Greece Legislative Election – 2009

October 5, 2009

By Padmini Arhant

On October 4, 2009, the people of the Hellenic Republic went to the polls and unanimously elected the Panhellenic Socialist Movement leader, George Papandreou as the next Prime Minister for a four-year term office.

The Prime Minister-elect initially disregarded as a non-viable candidate in the electoral race, despite the candidate’s strong political lineage. Nevertheless, the republic decided to offer the Socialist Party an overwhelming victory against the center-right political party – New Democracy, represented by the incumbent Prime Minister Kostas Karamanlis in the recent election.

Greece is no exception to the political and economic woes of the contemporary world. The electoral mandate is clearly a rejection of the common elements dominant in every national system i.e. corruption, lack of trust and accountability, incompetence contributing to the rising unemployment, stagnant economy and the last but not the least,

The persisting political tensions on the Cyprus dispute involving the Greek and the Turkish Cypriots is yet another unresolved political dilemma for the United Nations Security Council.

With the dynamic shift in the legislative power moving from the center-right to the center-left, the newly elected Socialist government resolve would be subject to scrutiny by the Greek electorate as well as the center-right EU leadership.

As a member of the European Union, OECD and NATO, the contribution by Greece is significant and the new government policy could possibly expedite the positive outcome on many global issues ranging from the economy, energy, environment and the contentious war in Afghanistan.

Congratulations! to the Prime Minister-elect George Papandreou and the people of the culturally enriched Greece on their investment towards more progressive, democratic and prosperous future.

Thank you.

Padmini Arhant

Culinary Delight

November 2, 2008

Throughout my life, I’ve had the opportunity to dine on several different types of cuisines from all around the world.

I’ve dined everywhere from modern Manhattan, to native India, to searing hot Venice, and even Australia!

And although I’ve eaten around the world, I have to say my favorite dishes are served right here in San Jose.

The dish I absolutely relish the most is ‘Sweet and Sour Chicken’ from P.F. Chang’s.

The chicken is perfectly cooked, tender and juicy at first bite.

The vegetables are perfectly sautéed to be crisp, but not burnt.

The most tantalizing aspect of the dish, however, is the sauce.

This succulent sweet and sour sauce is a wondrous journey for your taste buds, harnessing the perfect combination of sweet and sour flavors, with a tangy after-taste that will leave you craving more.

This is, without a doubt, my favorite dish in the entire world.

However, no region is without its culinary delights.

One dish that is etched firmly into my mind is Chicago-style pizza.

Despite most of my favorite foods being served in San Jose, this one is an original, found only in the ‘Windy City’.

More resembling a cake than a pizza, this five inch deep gargantuan entrée will not spare your tongue, or your stomach.

With over four inches of pure cheese, one slice of this dough-based monster would barely fit in my mouth.

The toppings, although present, are more like tiny sailors drowning in a sea of cheese.

Barely visible from the exterior of the pizza, one must take a ‘Herculean’ bite to discover their topping of choice hidden within the flowing interior.

Despite its massive size, this is a dish I highly recommend to any food connoisseur, pizza-lover, or anyone who eats, in general.

Another example of an excellent dish is a Greek entrée known as a ‘Gyro’. Pronounced ‘hee-ROH’, this Grecian wrap is typically served with a delectable yogurt sauce called ‘Tzatziki’.

Resembling a burrito, the dish is a simple combination of strips of beef, spinach leaves, diced tomatoes, and tiny cubes of potatoes;

All of which are wrapped in a slice of pita bread. However, each ingredient has a unique method of preparation, and, when combined, resonates with the appeal and harmony of an orchestra in full swing.

The outermost portion, the pita bread, is lightly toasted in a brick oven, and smothered with butter when warm.

The butter melts flawlessly onto the bread, giving it a soft, pleasing texture on the inside; and a coarse, rough outer texture.

The leaves of spinach are bathed in a seasoned vegetable oil, and then dried in such a way that the leaf can soak up the oil and provide an equal taste with every bite.

The tomatoes are carefully diced and peppered, similar to salsa, but with a Grecian twist.

The most savory aspect, however, is the meat.

Each strip is individually cut and marinated, giving every bite an exquisite taste. When put together, the Gyro becomes a delectable and mouthwatering dish, capable of attracting even the most finicky eaters.

Although I have only described two of my favorite dishes, the world is full of other tantalizing courses just waiting to be discovered. Who knows, I might even be the one to formulate the next one!

Thank you.

Kanish Arhant-Sudhir

Contribution: Author – Kanish Arhant-Sudhir

P.S. Our Mom writes more serious stuff while we write about fun stuff like food and entertainment.

Hope you like it!

Kanish Arhant-Sudhir and Rish Arhant-Sudhir

PadminiArhant.com

PadminiArhant.com