Mortgage Refinance and Foreclosures

March 31, 2010

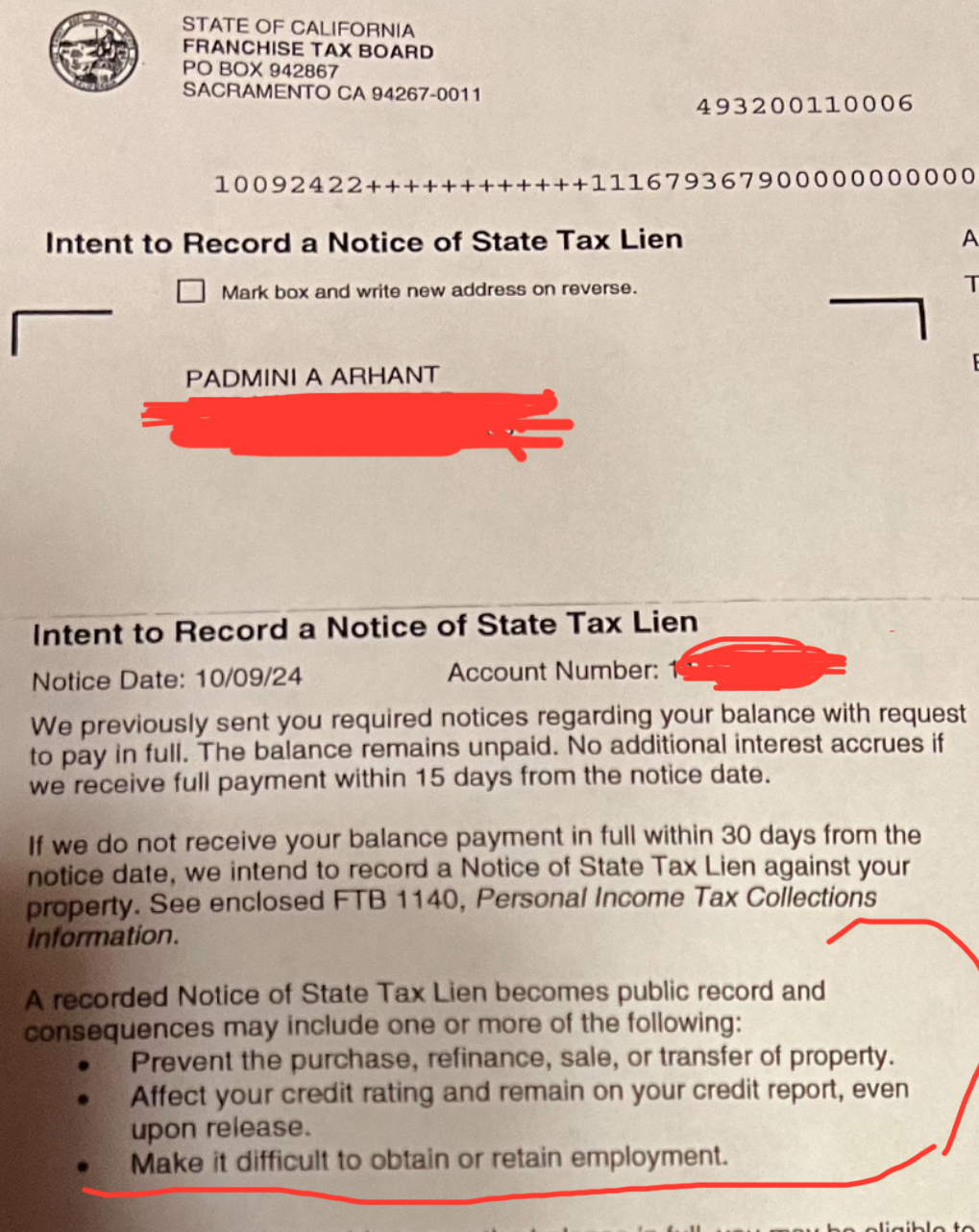

By Padmini Arhant

In the current economy, two major issues deserve urgent attention.

They are – unemployment and home ownership.

This topic will focus on the homeowners and the federal program under consideration to address the foreclosures arising from high mortgages.

Meanwhile, the following news report and editorial from other news organizations are presented for reference.

According to the –

1. New York Times report By David Streitfeld – Friday, March 26, 2010 – Thank you.

New help for homeowners – Revising Loan Modification

The Obama administration will announce today a broad new initiative to help troubled homeowners, potentially refinancing several million of them into fresh government-backed mortgages with lower payments.

The escalation in aid comes as the administration is under rising pressure from Congress to resolve the foreclosure crisis, which has put millions of Americans at risk of losing their homes.

A major element of the new program, according to several sources who spoke on the condition of anonymity, will be to encourage lenders to write down the value of loans for borrowers in modification programs. Until now, modification programs have focused on lowering interest rates.

Another major element will involve the government, through the Federal Housing Administration, refinancing loans from borrowers whose home value has sunk below what they owe on it.

More than 11 million homeowners are in this position, known as being underwater.

That aspect of the plan would apply even to borrowers who have not fallen behind in their mortgage payments.

Investors who own the loans would have to swallow losses but would probably be assured of getting more in the long run than if the borrowers went into foreclosure.

The FHA would insure the new loans against the risk of default.

Many details of the administration’s plan remained unclear Thursday night, including the precise scope of the new programs and the number of homeowners likely to qualify.

This much was clear, however:

The plan could put taxpayers at increased risk.

If many additional borrowers move into FHA loans, a new downturn in the housing market could send that government agency into the red.

The FHA has already expanded its mortgage-guarantee program substantially in the last three years as the housing crisis deepened, insuring more than 6 million borrowers.

Sources said the agency would receive $14 billion in funds from the Troubled Asset Relief Program, cash it could dangle in front of financial institutions as incentives to participate in the new program.

A third element of the White House’s housing program will require lenders to offer unemployed borrowers a reduction in their payments for a minimum of three months.

An administration official declined to speak on the record about the new programs but said they would “better assist responsible homeowners who have been affected by the economic crisis through no fault of their own.”

The plan would essentially supplant the government’s earlier mortgage modification plan, announced a year ago with great fanfare.

It has resulted in fewer than 200,000 people getting permanent new loans.

As many as 7 million borrowers are seriously delinquent on their loans and at risk of foreclosure.

The news was greeted with cautious enthusiasm by groups that have tracked the foreclosure crisis and tried to assist communities and underwater homebuyers.

“It sounds really good, and I’m not used to saying that,” said Kevin Stein of the California Reinvestment Coalition in San Francisco.

He said “the two main weaknesses” of the existing federal Home Affordable Modification Program were that,

It didn’t reduce the mortgages of underwater homeowners,

And, didn’t help borrowers who were underemployed or unemployed and would have difficulty qualifying for a loan modification.

“It seems they have taken these issues to heart,” Stein said.

“It’s unclear how many people will qualify – that’s the one hesitation. We’re not sure how broadly these initiatives will reach.”

Martin Eichner, with Project Sentinel in Sunnyvale, said the proposals sound good but he would like to see the details.

“It has to help significant numbers of people and there has to be enforcement,” Eichner said.

“These plans always look great in the first news release, but we’ve often been disappointed in the performance. To the extent that lenders write down principal balances, that would be a significant improvement,” he said.

Eichner said the home affordable effort also needs an enforcement mechanism.

“Without any real consequences, day to day we see lenders ignoring what we think are pretty clear rules under the current making home affordable program,”

While the number of foreclosure-related filings is beginning to flatten or decline, the number of borrowers who are seriously distressed is rising.

In the fourth quarter, the number of households at least 90 days past due on their mortgages swelled by 270,000, according to a report issued Thursday by the Office of the Comptroller of the Currency.

“The government is seeking to persuade people to stay in their homes by aligning the mortgage debt with the asset value, which is the only viable path to real housing stability,” said one person who was briefed on the government’s plans.

Several people who described the plans would speak only on condition of anonymity, since they had not been authorized to disclose details ahead of a White House briefing scheduled for this morning.”

————————————————————————————————–

2. Editorial in the Bay Area News Group – March 29, 2010 – Thank you.

www.mercurynews.com/opinion:

Titled – Foreclosure plan has carrots but needs sticks –

“Eight million households are behind in their payments or in foreclosure. But the Making Home Affordable programs has modified just 200,000 loans.

Forgive us for not jumping up and down with delight over the Obama administration’s latest plan, announced Friday, to help stem the tide of foreclosures.

The changes will help those who are unemployed, underwater or both.

But they have come so late that it’s difficult to muster much enthusiasm.

Banks participation in solving this problem has been optional for too long.

The government must require those who caused this debacle to do more to end it.

Since the foreclosure crisis began three years ago, 6.6 million families have lost their homes, according to the Center for Responsible Lending.

The problem is not getting better.

Eight million households are behind in their payments or foreclosure, and

One in five are underwater – they owe more on their mortgages than their homes are worth.

The administration’s primary tool against foreclosures, the year-old Making Home Affordable partnership with lenders, has so far modified the terms of just 200,000 loans. It is not up to this enormous task.

But the changes announced Friday have the potential to improve that record.

The program will now be open to the unemployed, who previously couldn’t qualify but are a primary victim of foreclosures.

They’ll be eligible to get up to six months’ forbearance and to have their payments lowered to reflect their reduced income, at least for a short time.

Those who owe more than their homes are worth – in California, that’s more than a third of borrowers – may finally be able to get their loan principals reduced.

This much-needed shift in approach addresses another key driver of foreclosure.

Lenders will get incentives to reduce the amount owed.

Borrowers who are current on their payments but underwater – prime candidates to walk away from their mortgages and further weaken the housing market – could refinance into a cheaper government loan.

All of this will help. But the main problem with the government effort remains:

It’s all carrots, no sticks.

Consumer advocates have been pushing Congress for years to allow bankruptcy judges to modify loan terms for primary residences, which could reduce foreclosures up to 20 percent.

The financial industry’s army of lobbyists has managed to beat back that idea, known as “cramdown,” saying it can deal with the problem on its own and through Making Home Affordable.

That’s clearly not the case, because of malice or incompetence.

It would be wonderful if politicians gave the same consideration to desperate homeowners that they do to banks.

Most everyone facing foreclosure nowadays did nothing wrong – they’re simply caught in the cascading wave that began with the subprime mortgage crisis.

The same can’t be said of the banks that got us into this mess and then took billions of taxpayer bailouts.

Allowing judges to modify loans in bankruptcy would add structure to an overwhelmed system.

Reasonable compromises worked out in court would set precedents for lenders to follow.

If they didn’t, they could be forced to by a judge.

Judges have this power for second homes.

There’s no good reason they shouldn’t have it for every home.”

————————————————————————————————–

Comment – Review and Analysis is in progress and will be presented shortly.

Thank you for your patience.

Padmini Arhant

Written by Padmini Arhant · Filed Under Economy, Featured | Leave a Comment

Banks Bailout – Accountability

January 11, 2009

It’s been a quarter since the banks bailout. The purpose of the bailout was to stimulate the economy by relieving the financial markets from liquidity crisis.

At least, that was the explanation offered by the Treasury Department and the Federal Reserve at the time of request.

They demanded that Congress approve the bailout to a tune of $700 billion as an emergency measure to avert the collapse of the financial market.

There were few stipulations to the approval of the bailout. The general expectation was to revive the housing market with a moratorium on foreclosures and overhauling of the existing loan programs to assist homeowners with affordable payments and ease the decline of the housing prices nationwide.

The other alternative to the housing market crisis was to utilize the bailout drawdown towards restructuring of the mortgage backed securities by allowing default homeowners dealing with foreclosures to refinance at the existing lowest market rate for a fixed period of two years, substituting the amount in the new economic stimulus package by President-elect Obama.

Despite financial bailout by taxpayers, the economic situation is deteriorating with the current unemployment soaring to 7.2 percent exceeding the Depression era. The criticism entirely directed towards government intervention in the revival process.

However, it is worth remembering that lack of oversight and accountability led the financial institutions to a dire state in the free market economy. The corporate executives as the beneficiaries have been responsible for the dysfunctional financial system even though none of them held accountable thus far.

The current administration assured taxpayers that financial bailout targets liquidity in the credit market, housing market decline particularly foreclosures, buy-back mortgage securities held as major liabilities on the banks’ financial reports and ease their burden to facilitate lending to homeowners and small businesses.

If the strategy followed through, it could have reduced the heat on the economy and set the pace for recovery.

In the absence of commitment by the banks, it would be appropriate for taxpayers to demand that the financial institutions release the funds towards lending and contribute to the economic stimulation as agreed to by them.

Failure to adhere to the agreement will result in the blockade of the remaining $350 billion that would be appropriated towards economic stimulus proposal by President-elect Obama.

In addition, the taxpayers’ also reserve the right to demand that the beneficiaries of the bailout return the earlier withdrawal currently hoarded for their undisclosed agenda with interest higher than the market rate.

It is time for checks and balances on the drawdown of $350 billion to various financial institutions.

Checks and Balances:

Have the objectives been achieved?

Is there an oversight committee on the financial bailout as agreed to the taxpayers?

Did the banks provide details of the secured amount to the taxpayers or the oversight committee?

Please be sure to read the articles presented below as they confirm the reality.

Thank you.

Padmini Arhant

————————————————————————————————————

First and foremost, the beneficiaries of the bailout are:

As per http://moneynews.newsmax.com/streettalk/bailout_half_gone/2008/11/12/150364.html

Street Talk – Thank you.

Who Got Bailout Money So Far?

Wednesday, November 12, 2008 9:09 AM

"The Treasury Department’s $700 billion bailout plan, also known as the Troubled Asset Relief Program (TARP), is one of the main U.S. tools to address the financial crisis.

The Treasury Department on October 14 set aside $250 billion of the program to buy senior preferred shares and warrants in banks, thrifts and other financial institutions.

Half that money was allocated to nine big banks, the Treasury Department has said.

Another $38 billion has since been earmarked for regional or small banks, according to statements from individual banks.

On Monday, the department announced its single-biggest TARP investment — $40 billion in American International Group — which the government said would not come from the $250 billion bank capital program.

———————————————-

The TARP has so far committed the following funding:

AIG $40 billion

JPMorgan $25 billion

Citigroup $25 billion

Wells Fargo $25 billion

Bank of America $15 billion

Merrill Lynch $10 billion

Goldman Sachs $10 billion

Morgan Stanley $10 billion

PNC Financial Services $7.7 billion

Bank of New York Mellon $3 billion

State Street Corp $2 billion

Capital One Financial $3.55 billion

Fifth Third Bancorp $3.45 billion

Regions Financial $3.5 billion

SunTrust Banks $3.5 billion

BB&T Corp $3.1 billion

KeyCorp $2.5 billion

Comerica $2.25 billion

Marshall & Ilsley Corp $1.7 billion

Northern Trust Corp $1.5 billion

Huntington Bancshares $1.4 billion

Zions Bancorp $1.4 billion

First Horizon National $866 million

City National Corp $395 million

Valley National Bancorp $330 million

UCBH Holdings Inc $298 million

Umpqua Holdings Corp $214 million

Washington Federal $200 million

First Niagara Financial $186 million

HF Financial Corp $25 million

Bank of Commerce $17 million

TOTAL: $203.08 billion

—————————————-

INSURANCE COMPANIES

In addition to the TARP program’s $40 billion capital injection into AIG, the Federal Reserve is providing the company with up to $112.5 billion in separate loans and funds for asset purchases.

Aid to the huge insurance company came after counterparties and rating downgrades forced AIG to post large amounts of collateral for its credit derivatives positions.

Some other insurers are interested in cash infusions, but must own a thrift or bank in order to qualify under the terms of Treasury’s current capital injection program.

—————————————————————————–

BANKS, LENDERS

The TARP program set a November 14 deadline for smaller banks to apply for capital injection funds remaining in the pool of $250 billion. The deadline will be extended for non-publicly traded banks.

The government’s preferred shares will pay dividends of 5 percent annually for the first five years and 9 percent after that until the institution repurchases them. Participating banks must comply with Treasury restrictions on executive compensation, which limit tax deductibility of senior executive pay to $500,000.

They require bonuses to be "clawed back" if earnings statements or gains are later proven to be materially inaccurate and prohibit "golden parachute" payments to senior executives.”

—————————————————————–

The following article has the response for all of the above issues:

December 23, 2008.

Economy in Crisis: By Matt Apuzzo, Associated Press, Washington – Thank you

Banks mum on bailout spending – They Refuse to provide Accounting

Elizabeth Warren, the congressional watchdog, appointed by Democrats—

“It takes a lot of nerve for banks not to give answers, she says.”

Think you could borrow money from a bank without saying what you were going to do with it?

Well, apparently when banks borrow from you they don’t feel the same need to say how the money is spent.

After receiving billions in aid from U.S. taxpayers, the nation’s largest banks say they can’t track exactly how they’re spending it. Some won’t even talk about it.

“We’re choosing not to disclose that,” said Kevin Heine, spokesman for Bank of New York Melon, which received about $3 billion.

Thomas Kelly, a spokesman for JPMORGAN Chase, which received $25 billion in emergency bailout money, said that while some of the money was lent, some was not, and the bank has not given any accounting of exactly how the money is being used.

“We have not disclosed that to the public. We’re declining to,” Kelly said.

The Associated Press contacted 21 banks that received at least $1billion in government money and asked four questions:

How much has been spent?

What was it spent on?

How much is being held in savings? And,

What ‘s the plan for the rest?

None of the banks provided specific answers.

“We ‘re not providing dollar-in, dollar-out tracking,” said Barry Koling, a spokesman for Atlanta, Ga.-based SunTrust Banks, which got $3.5billion in taxpayer dollars.

Some banks said they simply didn’t know where the money was going.

“We manage our capital in its aggregate,” said Regions Financial spokesman Tim Deighton, who said the Birmingham, Ala.- based company is not tracking how it is spending the $3.5billion it received as part of the financial bailout.

The answers highlight the secrecy surrounding the Troubled Asset Relief Program, which earmarked $700 billion – about the size of the Netherlands’ economy – to help rescue the financial industry.

The Treasury Department has been using the money to buy stock in U.S. banks, hoping that the sudden inflow of cash will get banks to start lending money.

There has been no accounting of how banks spend that money.

Lawmakers summoned bank executives to Capitol Hill last month i.e. November 2008, and implored them to lend the money – not to hoard it or spend it on corporate bonuses or junkets or to buy other banks.

But there is no process in place to make sure that’s happening, and there are no consequences for banks that don’t comply.

“It is entirely appropriate for the American people to know how their taxpayer dollars are being spent in private industry,” said Elizabeth Warren, the top congressional watchdog overseeing the financial bailout.

But, at least for now, there’s no way for taxpayers to find that out.

Pressured by the Bush administration to approve the money quickly, Congress attached nearly no strings to the $700 billion bailout in October, 2008.

And the Treasury Department, which doles out the money, never asked banks how it would be spent.

“Those are legitimate questions that should have been asked on Day One,” said Rep. Scott Garrett, R-N.J., a House Financial Services Committee member who opposed the bailout as it was rushed through Congress.

“Where is the money going to go to?

How is it going to be spent?

When are we going to get a record on it?”

Nearly every bank the AP questioned – including Citibank and Bank of America, two of the largest recipients of bailout money —– responded with generic public relations statements explaining that the money was being used to strengthen balance sheets and continue making loans to ease the credit crisis.

A few banks described company-specific programs, such as JPMorgan Chase’s plan to lend $5 billion to nonprofit and health care companies next year.

Richard Becker, senior vice president of Wisconsin-based Marshall & Ilsley, said the $1.75 billion in bailout money allowed the bank to temporarily stop foreclosing on homes.

But no bank provided even the most basic accounting for the federal money.

Some said the money couldn’t be tracked.

Bob Denham, a spokesman for North Carolina-based BB&T, said the bailout money “doesn’t have its own bucket.”

But he said taxpayer money wasn’t used in the bank’s recent purchase of a Florida insurance company.

Asked how he could be sure, since the money wasn’t being tracked, Denham said the bank would have made that deal regardless.

Others, such as Morgan Stanley spokeswoman Carissa Ramirez, offered to discuss the matter with reporters on condition of anonymity.

When the AP refused, Ramirez sent an e-mail saying:

“We are going to decline to comment on your story.”

Most banks wouldn’t say why they were keeping the details secret.

“We’re not sharing any other details. We’re just not at this time,” said Wendy Walker, a spokeswoman for Dallas-based Comerica, which received $2.25 billion from the government.

Lawmakers say they want to tighten restrictions on the remaining, yet-to-be-released $350 billion block of bailout money before more cash is handed out.

Treasury Secretary Henry Paulson said the department is trying to step up its monitoring of bank spending.

Warren, the congressional watchdog, appointed by Democrats, said her oversight panel will try to force the banks to say where they’ve spent the money.

“It would take a lot of nerve not to give answers,” she said.

But Warren said she’s surprised she even has to ask.

“If the appropriate restrictions were put on the money to begin with, if the appropriate transparency was in place, then we wouldn’t be in a position where you’re trying to call every recipient and get the basic information that should already be in public documents,” she said.

——————————————————————————————

Written by Padmini Arhant · Filed Under Business | Leave a Comment

-

Recent Posts

- Tran Politics’ Trans-Fixation

- AI Myth

- My Life Trilogy Vol.1 – Autobiography Now Available at KDP Amazon and Amazon.com

- Narcissism – Definition and Victimization

- Love and Hate – What is Powerful?

- Los Angeles, Los Angeles, California – National Security Crisis

- Ukraine – Russia Peace Plan

- Ukraine – The Victim Exploited to the Core

- Los Angeles – California – Crime Manifestation

- Europe – Nazi Origin and Far Left Dichotomy

The Wonder Nature - Not created by human. Wise not to destroy it with human invented bombs and nuclear might.

My Life – Autobiography by Padmini Achintya Arhant

Upcoming Podcasts and Website Accessibility – Padmini Arhant

OM Nama Sivaya – Glory to Almighty God!

[memberonly] Nature – The Most Powerful Ever

Nature as the Supernatural force and phenomenon, presided and governed by the Almighty God in Spirituality is the one and only most powerful ever.

The titles in power, fame and fortune as “the most powerful person in the world” is build-up and excess adulation of the public service position and alike in the economic sector.

The occupations essentially legitimized and funded by ordinary folks across the spectrum. The people without whom, neither and none could function nor benefit from the designation.

Above all, life is fickle and the status of any kind melts down eventually and converge with the sea called the general society.

Humility and modesty are rare. Yet a necessity in elucidating human character.

Padmini Arhant

Politics – Abusing Power and Taxpayer Money

Tran Politics’ Trans-Fixation

What happens when the obvious is more transparent as the tran polity pitch reach a crescendo?

Michelle is Michael in French. The maiden name Michelle Lavaughn is Michael Lavaughn Obama.

That being the incontrovertible fact and reality, the following is apt for the tran polity obsessed with tran mania.

Hey! “You are that you think I am. I am not that you think I am.”

Your RAINBOW PRIDE is the impetus to your imbecile demeanor driven into the bottomless pit.

One can run as far as one intends, but can never hide. Cease and desist your provocative incendiary interventions in your target’s life.

Parasites declined parasitic culture and existence is naturally distraught and desperate for host.

The devil in disguise gets caught with the foot in the mouth in own exposé.

The one digging grave for others find themselves in the dug grave in the DIY gimmick.

By the way, racism against black America or Africa is coined with different connotations, the latest being “KAREN”.

Similarly, should black racism and hostility against their obsessed target be aptly referenced “Mufaso or Mombasa?”

Padmini Arhant

Traditions from Abroad – Men in Tradition

No Life Become the Low Life

Those with NO LIFE invariably become the LOW LIFE prompting invasion, intrusion and intervention in OTHER’S LIFE. Accordingly, such life succumb to demise.

Padmini Arhant

Feet, Feat and Fate

Make a mark with your feet. Not by seizing another’s feat.

✌️🙌✊🧢🏀 etc., including Chicago Sky and Hawaii ocean none of these would mean the identity swap as implied and alluded in the bizarre crooked wicked trend by politics and blind following by crony contingency.

Food for Thought – Originality demands ingenuity and together defines integrity and credibility in individual character and actions.

Criminality is the trait of the traitor born incorrigibly corrupt and criminal roaming as the devil in disguise entrenched in misogyny.

Anything imposed in contradiction to reality is the bare fact on such thing being the reject and desperately seeking meritless recognition.

Juxtaposed, the bright sunshine is pervasively bright enough to dispel darkness without any harbinger to make aware of the brightness.

Yet another parody is the self-inflicted tragedy.

The attire satire – in the staged satire – the contrived White House melodrama referenced in the article below – is illuminated with irrefutable TRUTH.

The attire significance in keeping up with appearance syndrome in politics has splashed disdain all over itself, smudging and smearing the suited and booted in designer labels and alligator shoes albeit at the taxpayers’ expense.

The latter not necessarily suited and booted like the beneficiaries as it is not required like so, to gloss over the decayed rotten interior overshadowing the exterior.

However, the ungrateful and uncouth ever basking on the besmirched eternal charity is the embarrassing reality.

For the pompous ignoramus information – The white collar crimes albeit suited and booted in expensive getups engaged in grand larceny of nation’s treasury to scamming, conning and cheating, committing treason against the ones funding their existence unto their demise are by far the most dangerous and perennial threat to society and humanity at large.

These crimes continue to cause economic tumult and devastations, destructive political perversions and systemic corruption criminal culture in the core abuse of power.

All these crimes are committed in polished boots and immaculate suits blinding the abused taxpayers and hard working citizens across the spectrum in society.

The worst, they remain at large maintaining further criminal lifestyle and loot carried out with authority, while drowning in disrespectful deluge upon their behavior stripping them of the false savior hood in

Who is who? – public display.

Notwithstanding, the ones who were denigrated and described “unfit” to engage with the suited and booted diatribe posed as the dialogue in ambush eventually prevailed in history.

The non-violent pioneer of Independence movement against the brutal imperialistic power, none other than Mahatma Gandhi was ridiculed by the imperial servile Winston Churchill as – the “Half-Naked Fakir”.

Did the so-called half-naked-fakir not prevail over the booted imperial power, renowned for the loot ever?

How about the King Siddharth born with Royal insignia, renounced the regalia and adorned in simple robe, became the ascetic who enlightened humanity?

Henceforth, revered as Buddha accordingly by the ones who recognize the enlightened Soul?

That is the stark distinction between the real undiminished light and the fraud plunged in darkness.

The battle between Evil and goodness is that of devil and deus. Succinctly, the evil succumbs to vanity and unsustainable criminality.

Padmini Arhant

Western Characterization of Masculinity

Telling a joke, being competitive and drinking beer – all exclusive to male? Since when?

Aren’t there women comedians and standup-comics?

At least in other cultures, they are thriving in entertainment. Some are quite famous. The same goes in families, there are women with great sense of humor.

In competitiveness – Don’t western sports profiteer from women aggressively competing with rival teams?

Like the prominent WNBA that is not yet titled ANBA (Androgynous) or HNBA (Hermaphroditic) or,

For that matter, the bash and smash sports Tennis – U.S. Open, Australian Open Wimbledon, French Open ending in Grand Slam as the name suggests slam the series with mega bucks made by all those sharing the fortune.

Last but not the least – Beer chugging by white women is a common sight during Oktober fest in Germany and alike in Australia, Britain, Ireland and Nordic countries by white girls and women, who have beer with their male and / or female companions in western hangouts at the pubs and bar that are fairly normal in western culture.

What about western women, some high profile female political members in the United States political party, their widely known passion for Russian Vodka, ironically promoting the economy of a nation, reserved by them, an adversary.

The idea of exclusivity from behavior to lifestyle, intelligence to bravado delineated gender specific in western politics, not necessarily in western general society is a momentary relief.

The former distinction considering politics dwell in political universe that revolves around own political ideology and perception of life as linear and Asymmetric.

Above all, the presence of both male and female hormones viz. testosterone, the male hormone and estrogen, the female hormone are prevalent at varying levels in all male and female species.

The humans in particular, revealed in anatomy and physiological characteristics such as the chest in a male similar to that of a female with the latter only enlarged due to mammary glands.

Likewise, some women tend to have dense body hair, thick growth on their arms and legs from the higher level of male hormone triggering these physical features that are otherwise common in men.

In a way, the male and female composition complement one another, designed by nature in the nucleus sharing the DNA of both male and female chromosomes.

Politics might have entirely a different perspective and interpretation especially in contemporary age to fit the political criteria on anything and everything that are uniquely natural and normal.

All the more reason, for individuals from all walks of life to exercise own intelligence and discernment in making informed decision rather than falling for political narratives driven to mislead and cause confusion.

Padmini Arhant

EVIl invites PERIL

Words of Wisdom. Works All the Time 🤗

Friction or Traction. Private affairs are best kept private rather than fantasized as public.

Only those who have no life would be obsessed with other’s life. Such existence is being dead in living.

Life is a blessing not meant to be destructive to self and others.

Padmini Arhant

Tesla Inc. Unconventional Solar Roof Contract

Does anyone know the future with certainty?

If they did, they would be the ruler of own destiny.

However, the multi-billionaire Elon Musk owned and run Trillion $$$ Tesla Inc. binds homeowners on contract related to Solar panels and Solar roof in a rather unconventional practice.

The homeowners are drawn into a Solar lease arrangement on long-term basis based on the product longevity guesstimated by the company as twenty years, even though the real experience is far below well before half-way down the contract.

Nonetheless, the contract is established as zero downpayment with fixed monthly charge to bank account throughout twenty-year-contract, with additional fees upon using any other payment options.

The homeowners decision to terminate the contract at any point in time prior to contract expiry for assortment valid reasons is persona non grata – simply unacceptable predominantly clear in such outcome.

The product and service not meeting minimal requirements in Home Energy Efficiency and,

As a result, the investment proven a liability being the common factors face steep financial monetization by the company citing own policy.

The company requirement from the homeowners to pay for the remaining period of the contract such as 10 or 15 years – $13,000 to $18,000 in that 20 years lease agreement upon early lease termination is a phenomenal extract.

This is despite, the products and services are no longer used and duly returned to the company in the relevant time and condition.

How does such disproportionate deal is fair to homeowners?

The company has to be paid in lump sum upon homeowners exit prior to lease expiration besides returning the products and systems back to the company at that time.

Applying the analogy on home rental lease,

Could property owners demand entire lease term payment in three to five years lease from tenants wanting to move out or discontinue rental based on legitimate reasons?

The laws strangling the property owners leasing apartments and homes are extraordinary compared to Trillion $$$ tech giants and alike oligarchy basically owning governments and legislations in the direct buy-out with few million $$$ in political campaign and Presidential candidacy, raking fortune in return.

In the process, trading people’s rights as consumers and homeowners as applicable.

Seeking full settlement on the unused lease term on Solar roof or panels, is demanding homeowners to accept future set in stones with events writ large in life in the reality of even weather forecasts not always necessarily accurate.

Above all, generally politics and economic sector default on their respective pledge to public.

Such lopsided agreement entirely benefitting the company is a trap with the exit strategy for homeowners to free themselves from the expensive inconvenient setting stipulated to paying ransom to the company.

Apparently, marriage divorce on irreconcilable differences are lot easier and not so compelling than the divorce from exploitative opportunist politics and influential economic greed.

Regardless, Is this the pathway to Super rich MBT – multi- millionaire, billionaire, trillionaire status?

Exploitation and extortion as the means to self-enrichment and political empowerment.

Padmini Arhant

Ukraine not Ukraine’s President Seems to be the Problem?

Ukraine’s President with the last name Zelensky identifying the faith, whether religious, agnostic or atheist, perhaps would not be subject to recent nomenclature, had the President been representing Israel.

Ukraine’s President would most likely and almost certainly enjoy similar status that of counterpart in Israel in the parallel warfare in Ukraine and Gaza.

Ukraine appears to be the problem more than Ukraine President, for anyone targeting Ukraine.

The western members rallying behind Ukraine contrarily joined forces with Israel in Gaza Genocide. The western determination of invasion is the one that fits own definition.

Padmini Arhant

Scoundrel Kavodhi Funeral

Politics and Media Fanaticism

The nuanced insolence against me and my family – verbose, visual and preposterous enactments by far remain the dumbest idiocy practiced by those claiming to be the,

“Be all and End all in the World.”

There is no doubt, they are being who they are in exemplifying insanity and profanity. Nevertheless, the end of anything insane and idly mundane relevantly applicable to them is beyond their comprehension.

I understand, those engaged in this lunacy have no life. Otherwise, neither would be suffering from the Obsessive Compulsive Disorder with incessant obsession with me and my family regardless of them skidding in the process to the bottomless pit.

The allusion with anything ending in monosyllable phonetics – ni, mi, me, ne, ney mey…and for that matter the letter P – interestingly unbeknown to the OCD, also represents the Planet, People etc., on Earth.

The phonetics fanatics are the biggest joke🤣 in the outrageous sickness proving themselves non-salvageable toxic waste in the environment.

Padmini Arhant

Devil in Disguise

The Devil in disguise is no different from the Pervert with nothing on.

Those who use other’s positive karma for own promotion and narcissistic self-interest are the same as sinking boat with dead weight.

Enactments of fake situations to console the Satans is exacerbating satanic evisceration.

The villains, demons and Satans imminent end is ominous, when they indulge in rage and devilish activity.

The destruction motive against the target is hallucination yielding self-extinction.

These aptly apply to devils and EVIL syndicate perpetually fixated on their target. The obsession, inevitably expunge the devil and Evil in accordance with natural law of Karma is the done deal.

Padmini Arhant

Black Deed and Slavery

The black deed blackens face and chains the mind to slavery servile to the devil within.

The successive defeat and rejection, encountered as the ill-fate of black politics throughout since emergence to date, is black tar on the parasitic culture fleecing and freeloading on their target much to individual and collective demolition.

The pitch black dark night is devil’s comfort zone. However, the experience is short lived at dawn break and sun rise dispelling blackness to oblivion.

Padmini Arhant

Piracy Plagiarism Plague

Rhetoric vs. Reality – Piracy

Wig vs. Real Hair – Factual

Crooked (Crocket) vs. Honest – Actual

Fake vs. Original – Absolute

Sham vs. Sincere – Truth

Padmini Arhant

FREE PALESTINE – Not Arm Israel with $1Billion Weaponry

FREE PALESTINE – Not Arm Israel with $1Billion Weaponry. Padmini Arhant

Poison Politics – Death Wish

WHY DARKNESS SHUNS LIGHT?

What the contemporary poison politics should have in their Death Wish are the following;

The death of abject corruption, violent criminality, political abuse of power, taxpayers’ hard earned money, serious violations, invasion of life and rights, identity theft, piracy, plagiarism, prejudice, propaganda, hatred, misogyny ad hominem and,

Above all, the burial and cremation of political impunity and sanctuary on all these abominable atrocities and abhorrent legacy.

Padmini Arhant

Comedians as Political Surrogate

The so-called comedians in the lack luster late night shows 🥱 on multi-million $$$ price tag with pre-recorded phony applause played to their sound-bites at “the expired political term designee’s behest” is satire at own exhibit. The presenter’s performance to the empty seats, is gala comedy routine.

The prying, preying, spying, snooping and ever intrusive, invading people’s lives gutter politics entrenched in *sexual connotation* of anything, prompted by own dysfunctional personality in oedipus complex is beyond remedy.

The degenerative mind and sadistic impulse expedite individual and collective succumbing to obsessive compulsive disorder.

Padmini Arhant

Life is a Gift

Life is a gift. It is meant to be positively purposeful not negatively wasteful.

The world creation is heterogenous not homogenous. Accordingly, not all things are derived similarly in source and practicality.

None have the right to define, determine and validate anyone’s identity and intelligence or the lack thereof.

Human status is a blessing not to be squandered in idle fixation on things and persons not even remotely connected in any format.

Instead, internalization is the place to begin with to recognize the cause of such mental and emotional turbulence. Failing that professional help might be a way to sort oneself now and moving forward.

Can’t do any good. Never mind. The least is to refrain from doing any harm to self and others.

Padmini Arhant

Life – Interpretation

Is embryo to be treated like people? asks Arwa Mahdawi of the London based “The Guardian.”

People – A person’s body has countless cells that are required to be alive and well in order for life to exist in general.

For example – The aging of cells contributes to weakening of tissues, nerves, veins and arteries that in return impact the vital organs, the nervous system and the overall well being.

Embryo upon fertilization of egg from the female ovum by the spermatozoa from the male, thereupon the development leads to fetus formation in the uterus. The function is possible only when the cells are healthy and alive from conception until live birth and then onwards expanded into the life span.

As for the sex determination of the fetus – Yes it is female XX at origination until twelve weeks, with the Y chromosome from the male sperm were to be dominant altering the XX to XY for necessary reproductive organs such as male genitalia.

The discarded embryo used in the embryonic stem cell transplant saves millions of lives, cures many life threatening diseases and contributes to renewal and rejuvenation of body cells enabling better quality of life for those suffering from crippling diseases and health problems. Only living organisms and cells can facilitate life and functionality.

Embryo is a living body of cells that otherwise would not be possible in becoming the fully developed fetus and eventual live birth upon delivery from the womb.

Hey! The above is No AI B.S. or Plagiarism from Internet source.

It is straight from natural endowment – the organic brain with active brain cells in my body enabling thinking ability besides exercising reasoning faculty from within and recounting experience from two live births in my present lifetime.

Padmini Arhant

Blatant Coup détat with no Democrat Primary in July 2024

The devil can no longer be in disguise.

The one pretending to be the promoter of women to break the glass ceiling would not have been primarily preoccupied in systematically and brutally removing women leaderships as the heads of state especially in Asia, Australia and Britain sparing Africa in the particular terms 2009 – 2016.

Similarly, without a shadow of doubt since 2009 – 2016, via the alter ego in Indian politics, the trend involved in humiliating then female leadership in the State of Tamil Nadu, the late Chief Minister Jayalalitha. Not barring, the deceased CM’s death in Dec 2016, shrouded with many unanswered questions to date.

In real sense, apart from common sense, the former Tamil Nadu CM Jayalalitha was far more capable than the BO and MO recruit -B.S. – the former VP and Presidential candidate Kamala Harris.

What does that say? There is no tolerance for competence and courage in female leaderships to pushback male supremacy in global diktat presided politics.

So much for caring to see a woman with Indian descent or lineage to shatter the glass ceiling?

That too, How was that hatched by the BO and MO – B.S. duo to prolong puppet woke DEI regime?

In a blatant coup d’état against own party incumbent Presidency brazenly subverting democracy slighting the democratic primary, with the induction of failed flawed candidacy, whose track record reeked dismal performance, for which the candidate, Kamala Harris was long rejected in the 2019 Presidential bid.

The reality in the candidacy was not Indian or Indianhood rather AFROCENTRIC – to reflect own BLACK race prevalence, with the candidacy touted as the so-called ‘the First Black Woman’.

Otherwise, the 2024 Presidential democrat candidate could have been from open field democratic primary by election *not* selection. Accordingly, the democratic process was rejected for obvious reasons.

Even with the choice of Kamala Harris, what was the exhibit?

The former VP Kamala Harris naturally and voluntarily in adherence to the script from the puppeteers behind, became the emblem of word salad, fodder for western and non-western crony media in endless misogynist caricature – all of which depicted as me in the fraudulent display.

When in fact, I have challenged everyone engaged in the mob ambush against me for an open public debate in world view which has been declined to suit the convenience of evil to subvert and distort my unique identity as it is with all living species in the natural creation.

Not even the free speech birth right to respond to relentless insolence and virulent attacks until now were considered normal with censorship, gag orders and cancel culture becoming pervasive in the authoritarian targeted practice in the name of democracy.

Besides, Who says Hillary Clinton and Kamala Harris are women?

Only then the question of breaking the glass ceiling arise.

I pose the same question that is arrogantly and presumptuously raised to me by power mongering egocentric prejudiced clique anchored on ad hominem misogyny against me having and continue to phenomenally benefit from my existence as a woman.

One receives what one offers another anytime. It is called the Karma with or without any cuss or slur.

You may have the whole world with you in the persistent pursuit to assail TRUTH, nonetheless in vain.

The wicked and crooked devils never prevail over Almighty God’s Will.

Padmini Arhant

Outgoing Presidential Pardons – Beg Your Pardon 🤔

The outgoing Presidential pardon to Anthony Fauci, Liz Cheney and next of kin Hunter Biden within family – distributed more like candies to savor the moment in sober time.

By the way – Isn’t the one guilty of any wrongdoing and crimes seek pardon?

Should the preemptive Presidential pardon to these individuals be then considered they are guilty prompting extraordinary selective Presidential mercy upon them?

Beg your pardon 😱 bemoans democracy!

Padmini Arhant

Gender Orientation – Male, Female in Natural Creation

Absolutely only two genders.

Female (X) and Male (Y) in natural creation.

The exclusive male and female factor respectively is the fundamental fact in procreation leading to generations in life longevity and eternity in Almighty God created “World without an end.”

For that matter, the same is applicable in practical and mechanical designs from plumbing materials to electrical and magnetic settings in the directly opposite format male and female components and as +ve and -ve to charge enabling functionality.

The distortion exerting own complexity and confusion against anyone is a psychological deranged syndrome.

Any other orientation deviating from the natural design is genetic disorder, social experiment and worst of all political indoctrination.

Nonetheless, discrimination of any kind against anyone is unnatural i.e. human developed behavioral misconduct prompted by ignorance and prejudice.

Padmini Arhant

இறைவன் படைத்த உலகம், இயற்கையின் ரீதி – இரண்டு ஜாதி மற்றுமே உருவாக்கப் பட்டது

இறைவன் படைத்த உலகம், இயற்கையின் ரீதி – இரண்டு ஜாதி மற்றுமே உருவாக்கப் பட்டது.

பெண் ஜாதி. இன்னொன்று ஆண் ஜாதி.

சங்கத் தமிழ் இதை உறுதியுடன் தெளிவாக பதித்து உள்ளது.

இதை திராவிட அரசியல் மூலம் கலப்படம் செய்து – மனித படைப்பில் மூன்று பால் உருவாகி – ஆண் பால், பெண் பால் மற்றும் மூன்றாவது பால் தமிழ் சங்க நூல் குறிப்பிடுவதாக அதன் பெயரை குறிப்பிடாமல்,

ஏனென்றால் – அப்படி ஒரு பால் இருந்தால் தானே பெயரை துல்லியமாக சொல்ல முடியும்.

தற்சமய அமெரிக்காவில் தேர்தலில் பலத்த காயத்துடன் தோற்றுப்போன அயோக்கிய கும்பல் சீண்டி தூண்டி விடும் பொய் பிரச்சாரம் பிரச்சார கருவிகளுக்கு தன் முகத்தில் தானே கறியை அப்புவதாகும்.

ஏனென்றால் இதே பிரச்சார போலி குழு திருநங்கையொற்றி அவதூறு செய்தல் அரசியல் சர்வாதிகாரத்தின் மும்மரமாக இருக்கையில், தானே ரெண்டும் கெட்டான் நிலைமை. இதில் தான் இவர்களின் முகமூடியை இவர்களே கிழித்து கொள்வது வெளியாகிறது.

மற்ற படி கடவுள் படைப்பில் – ஜாதி – ஆண் மற்றும் பெண் இவை இரண்டுமே தான் இயற்க்கையின் செயல்.

மற்றவை எல்லாம் செயற்க்கையாகும்.

இவைகளில் முக்கியமாக, மனித உடல் உறுப்பின் கோளாறு, மரபணு கோளாறு, சமூக பரிசோதனை அதைவிட அரசியல் போதனை வதந்தி இந்த செயற்க்கையின் மூல காரணமாகும்.

தற்சமய அரசியல் இந்தியாவின் மத்திய அரசான ஹிந்துத்வ வெறித்தனம் ஒரு பக்கம்,

மற்ற படி தமிழ் நாட்டின் சாபக் கேடான மற்ற தென் மாநிலத்தைச் சேர்ந்த அந்த மாநிலத்தின் மொழி, வம்சாவழியில் வந்த தமிழ் நாட்டை அந்த நாளில் இருந்து இந்நாள் வரை *அந்நியர்கள்* ஆளும் அரசியலால் தமிழர்கள் மேல் திணிக்கப் பட்ட பெரியார் என்ற ஈ.வே.ராவின் கர்நாடகாவின் திராவிடம் என்ற மரபு தமிழையும் *சுத்த தமிழ்* அதாவது பச்சை தமிழ் அடையாளத்தை அழிப்பதற்கான சதி.

மேல் குறிப்பிட்டவர்களும் மற்ற படி ஐரோப்பாவின் அரை குறை கணிப்பு அதோடு சூழ்ச்சியின் காரணத்தில் அந்நியர் கூட்டணியின் இந்த சூட்சமம் எந்த மாநிலத்திற்கு குறிப்பாக கர்நாடாகாவிற்கு இந்த திராவிடம் சொந்தமோ அதை தவிர்த்து விட்டு,

தமிழர்களை திராவிட கால்வாயில் தள்ளி இதுவரை அரசியல் வியாபாரம் நடத்தும் – வாரிசு அரசு, ஜன நாயகம் பெயரில் நடக்கும் கண் கட்டி வித்தையாகும்.

இதில் மக்கள் உழைப்பின் மாநிலச் சொத்தை திராவிட அரசியல் தன் குடும்ப காணொளி நிலயமாக்கி – சூரிய ஒளி, கலைஞர் ஒளி மூலம் – தமிழ், தமிழ் பண்பாடு, கலாச்சாரம், இலக்கியம், சரித்திரம், பூகோளம் எல்லாம் தன் குட்டிச்சுவரான திராவிட மாநிலமாக்கி சின்ன பின்னம் செய்து வருவது, தமிழ் நாட்டிற்க்கு திராவிடம் என்ற சாபம் செய்யும் பெரிய துரோகம்.

இதை தமிழர்கள் உணர வேண்டும்.

பத்மினி அர்ஹந்த்

அழிவின் காரணம்

அழிவின் காரணம்

பெண்ணின் இழிவு அழிவு. பெண் பாவம் பின் பாவம் காலமாகி தற்சமய பாவமாகியுள்ளது.

எத்தகை ஆதிக்கம். பிறரின் உரிமையை பறித்து தன் சுகம் ஏகபோகம் பணம் புகழ் பதவி அனுபவம் அழிவின் அஸ்திவாரம்.

சர்வாதிகாரம் எங்கும் எப்பவும் சர்வநாசம்.

பத்மினி அர்ஹந்த்

Sky News DownUnder👎

The wannabe, opportunist, desperadoes Sky News DownUnder👎 in the rugged outback Australia is literally and realistically DownUnder👎,winning the title unparalleled parasite and groveling sycophant media pit / Outhouse.

Watch where you are going?

Padmini Arhant

“Authentic” Intelligence Paradox 😅

Those behind the trend projecting anyone from anywhere? including others in semblance to the meaning🌷and / or the name ending in ‘ni/ mi’ letters and phonetics importantly shady, nefarious, unscrupulous…elements serving as proxies and pawns of the frustrated desperate despotic megalomaniacs epitomize lunacy, idiocy, fantasy and hypocrisy.

Wanton Provocation – in association with viz. Liz common nick name of E(liz)abeth. Liz is also the prefix in (Liz)ard.

Similarly, Mic(hell)e aptly suitable as Michael.

When such nuances are prevalent – it is indicative of the promoters and practitioners topsy turvy twisted mind.

Not to mention, their names appropriate to them and their profile.

The trait considering them touting their intelligence – unparalleled “authentic” 😂 and promoting the one they are incessantly obsessed with – “artificial” is analogous to the pigs in the swamp running in circle in search of their pig tail. 🤣

The ongoing insanity presided by psychotic sociopaths is the parody and tragedy of this century making themselves and their inventory of cartoons the spectacle of the world.

विनाश काले विपरीत बुद्धि । With the end near the mind reverse and becomes unclear.

Padmini Arhant

Happy Pongal! Happy Makara Sankaranthi! 2025

Provocation, Manipulation and Subversion

Provocation, Manipulation and Subversion using live or the so-called AI model created by destructive factions aimed at “anti-natural endowments and elements” in denial of empirical facts about them as the existential threat endangering lives and human normal existence invoke their termination in the attempt to inflict otherwise on the “obsessed target and their concerned. “

Since world creation till date EVIL never prevailed over God’s will to restore sanity, tranquility and civility in disarray under EVIL and COHORTS ambit. Like all things designed to expire, the EVIL presided tumult is no exception rather on prioritized expiry.

FEI – For Evil Information -Any unnecessary hoodlum tactics and hooliganism however is disposed as garbage.

Padmini Arhant

Originality

No matter what alloys are used to produce value based item and marketed as gold value – they are never the same nor equivalent to the original gold.

Originality has the naturally assigned uniqueness similar to individual DNA in genetic code.

Imitation and Fake never equal original and authentic.

Padmini Arhant

Satans and Proxy Duplicity

Satans and their proxy – pack of hyenas always scavenging for survival being pathetic necrotic parasites.

Stealing zodiac sign and basically any and all positivities ironically from the targeted arch rival never absolve Satans and proxies of abhorrent violent homicidal, genocidal, terror and cannibalism..amongst other despicable pervert lewd crude characteristics laden with con, scam and public summary execution of the rape victim – own member of the race.

As for once again pirating phrases and content from the one incessantly pursued and ridiculed via murderous proxies and sponsors epitomizing cowardice.

When hoodlums, hooligans, perverts and gangsters run the gamut making mockery of civilization and civilized world,

The opinion stated in the sub-domain of this site in Tamil language – that “anyone can achieve the dreams and ambitions in life by honing in the skills and talent they possess together with hard work” is a statement maintained now and forever.

Only the narcissists and shallow minds possessive of any and all natural endowments to all beings at varying degree and potential would demarcate as exclusive to them such as – the bizarre ominous cult Artificial intelligence created by them otherwise touting themselves as authentic intelligence.

When the mob rule could exist anywhere run by terrorists and terror sponsors,

Why is it not possible for sanity, civility and integrity to achieve anything in their life?

Something for the AI dependent sadists to think about if such ability is possessed within.

Last but not the least, the misogynists steer the society against natural and biological heterosexual relation designed by nature for life expansion besides emotional feelings.

Heterosexuality is fundamental in God’s creation of life existence and sustenance as well as in the expression of love and affection.

The misogynists with their given disposition and behavior are instrumental in promoting and practicing relation paradoxical to heterosexual orientation.

These misogynists are also closet culprits while actively engaged against heterosexual norm.

This trait is specific to misogynists with their outlook and overt targeted misogyny culture despite the fact their emergence from the womb and reproducing themselves (God forbid🥹) the requirement of ovum and the uterus.

No wonder such travesty running the show on the world stage fears and detest the termination.

All things are set to expiry – the merchants of destruction and devastation for own economic and political interests in particular expediting the process.

Padmini Arhant

Satan’s Satanic Antics

Satan’s assortment antics eventually backfires at satan. The evil course in diabolical activities suffice in the end justifying the means in the laws of nature.

Satans could subvert anything but not own guilt ridden conscience witness to all of Satans’ satanic activities making the run impossible for Satans to sprint from them.

Shackled in guilt and sinful existence, Satans invariably succumb to own karmic woes sooner than later. Satans obedience to the devil often expedite such outcome.

Satans propose and God disposes viz. Winning Election and warfare makes Satans head spin and detach from torso.

Evil never prevails over Goodness being God’s will.

Welcome to Reality.

Padmini Arhant

Ego is Self-Mortification

One can never reason with humongous ego – emanating from human presumptuousness.

The Supremacy syndrome is the one with plenty of hubris, ample attitude with nothing to guide from within in self-mortification.

The crown doesn’t fit the head circumference given the oversized trait representing the dire strait.

Supremacy and Slavery are intertwined complexity. Supremacy is enslaved to internal negative vices prompting quest for relief via external enslavement in slavery.

Those who can’t help themselves from self-decadence are not the ideal choice for others’ salvation.

Padmini Arhant

FPI – For Public Information

FPI – For public information all inclusive without exception –

My pledge of allegiance ever remains with none other than Almighty God, Natural Environment and republic wherever – humanity at large.

Padmini Arhant

Anchored Deranged Misogyny Syndrome

Mud slinging without basis is own burial in quicksand.

Evidently straightening a twisted dog’s tail is possible than addressing a deliberate malignant identity misappropriation and anchored isolated deranged misogyny syndrome.

Not to mention, the foolish trend led by guilt-ridden white and everlasting victimhood black culture in the vain efforts seeking compensation and compromise for mutual benefits from the scapegoat not even remotely related to neither race nor individual legacy when reality verifies the reverse with the former duo as recipients in the combined patronage.

Similarly applicable to the tail wagging crony contingency from anywhere viz. Indian polity, conventional + social media and entertainment – the undeserving parasitic major beneficiary in newly invented unprecedented demented custom.

Padmini Arhant

Devil is Rattled – Tell Tale Signs

When the devil can’t handle anything in colossal defeat i.e. shellacking in 2024 Presidential race resulting in full blown exposure of the devil’s demonic traits, the devil and the DEI evil conglomerate are rattled simply on fait accompli.

What does the devil and DEI Evil clique do to exhibit original image?

After all, how long could the devil and evil DEI B.S. hide in stolen positive identity and persona of their most envied target and arch nemesis?

At the end of the day, the glove never fits the blood stained hands from emergence in the world to parasitic existence till now.

The devil in particular bolstered by Evil corpses seething in monstrous jealousy, hatred, anger and misogyny…surrender to the demon in their mind and turn berserk witnessed lately in the series of diabolical activities since historic loss in 2024 U.S. Presidential election – no surprise there.

Amongst the devil’s homicidal mania going back to drug peddling childhood rampant in adult “gay hood” preying on own bedfellows black and white especially sodomizing the white male Larry Sinclair on wheel chair to the latest saga involving black female dental hygienist raped deserting a black child from the rape and the raped mother summarily executed using taxpayer provided security personnel by the tran duo were not over.

The latest victim black male personal chef on the paddle boat at taxpayer funded vineyard estate doorstep…merely symptomatic in the otherwise serious personal wreck syndrome.

How could it be possible?

In conveniently deploying the ridiculous race card having been ironically responsible for abuse and murder of own people while promoting Black Lives Matter imposed on others. Meanwhile, brazenly committing heinous crimes from the political immunity sanctuary.

The Presidential election 2024 defeat is avenged with drone drama carried out in the East Coast and of course in California – the anchored domain for the devil and evil DEI dichotomy.

Upon not being satisfied the devil had to orchestrate the mowing of innocent bystanders and crowd gathered at 2025 New Year’s celebration casting yet another devil’s loss of control in demonic outrage in New Orleans, Las Vegas and New York simultaneously at the dawn of New Year 2025.

The devil let loose has been causing bloodshed, terror and carnage at the onset and went overdrive since November 4th, 2016 upon the devil ushered into exit having created tremendous pain, suffering and misery to all those the devil has targeted thus far.

There are two outcomes in the attempts to shape anything for useful purpose.

The iron ore – a rough hard core metal is brought to shape for various usefulness by hammering and / or heating that turns into molten state – the idiom – strike when the iron is hot is precisely for that reason as it conforms to malleability.

The other outcome that fits the devil and transcontinental evil conglomerate is the above outlined process only renders them out of shape and beyond any positive engagement as they are paradoxical to the characteristics and personal nature of the devil and evil cohorts hell bent on – our way or highway even when that is in the bottomless pit.

It is not the question of the devil and evil compatriots on the precipice.

The downfall from the self-destructive provocation for own individual and collective self-serving never to be fulfilled evil aspirations not ever coming into fruition is conspicuously leaving the devil and evil syndicate possessed to own peril.

Somethings never change for better by design and own volition.

The Gospel Truth – the devil and EVIL DEI Dichotomy may presume to hold the gavel amongst own insular world not barring the natural intelligence subversion convoluted as artificial intelligence though hopelessly fleecing on the contributions of the ones despised and vindictively pursued in obsessive disorder.

The Supernatural phenomenon is the ultimate power in the mantel of Supreme Authority as the Cosmic Force since creation of the Universe and galaxy until present into infinity future and beyond.

Padmini Arhant

The Misogyny Irony

The Misogyny Irony

Padmini Arhant

The irony in misogyny is denial of own emergence and existence otherwise impossible in the absence of woman’s reproductive organs.

The spermatozoa without ovum would be extinct is empirical fact. The natural factor.

Rooster in the Hen House – Never mind on what emerged first the chicken or egg even though the emphatic response is egg hatched into chicken. In the course producing roosters and hens by the hen.

What is relevant in the contemporary era?

The hyenas guarding the chickens (roosters and hens) den proven existential threat to own citizens and humanity at large.

As for ‘thirsty’ slang – the same is epitomized and exemplified by the source and catalysts in colonial imperialistic hegemony involving terrorism, oppression, repression and supremacy syndrome.

Whoever says and thinks – narcissists and compulsive impulsive abusers admire their image upon shown the mirror?

Padmini Arhant

Drone King to Spinning Top – Barry Soetoro aka Barack Obama Political Voyage

Drone King to Spinning Top – Barry Soetoro aka Barack Hussein Obama – the Political Voyage

Padmini Arhant

Talk about “spinning fellas” – the one who is unparalleled in this trait and trend – is none other than the one with the real name Barry Soetoro spinning to Barack Hussein Obama.

The one conning citizens from all walks of life asking for campaign donations of $5 – $5,000 and more with fake fraudulent requests including enrollment in Obama University (that’s right fellas and folks – Obama University – Perhaps in the Obama University specializing in con, scam and art of deceit).

The shenanigans in 2008 – 2016 as the so-called community organizer deriding the Wall Street as “Fat Cats” in own lexicon while firmly seated on the same Fat Cats’ lap since debut in politics and multipolar 2007 election campaign and thereafter by selling healthy, hardworking ordinary American citizens to health care industry historic scam in the name of the abominable OBAMACARE.

In return for trading American average citizens in the health care gimmicks with mandatory health insurance rewarding the combined health care industry with windfall absent stipulations on the health industry to meet fair bargains ignored for mutually exclusive financial gains – cashing and capitalizing with mansions, seaside castles, vineyard estates… on treason in quid pro quo in the healthcare scam and several scams throughout 2009 – 2016 and resumed in 2021 – 2024.

These alone besides endless blatant violations of electorate trust and plethora of flip-flops make the spinning top collapse turning upside down witnessed in the U.S.Presidential election 2024.

Something to deliberate and ponder – the process known as Soul Searching for the irreversibly stained pot calling the kettle “black.”

Padmini Arhant

Musk Donald Trump Prez – AI Pick Controversy

The AI pick Sriram Krishnan by the upcoming Musk Trump Presidency.

Hopefully, in the current AI frenzy,

There will be real criminal investigation in the mysterious death of the mere 26-years-old Indian American Suchir Balaji – born and brought up in the Silicon Valley, California.

The young tech AI researcher and whistleblower during employment with the controversial Open AI organization,

Open AI – One of many tech and corporate donors to Trump Inauguration Fund 2025. Open AI has generously donated $1m to Trump Inauguration event.

The young AI specialist Suchir Balaji reported to have died from suicide on Dec 4, 2024 in the common incidents of murder declared suicide having become the norm.

Will the Musk Trump AI pick Sriram Krishnan – if confirmed, would be able to call for thorough investigation in Suchirc Balaji’s murder related to AI controversy barring any adulteration and domestic as well as foreign intrusion to stymie the facts based criminal procedure?

The Lord Sriram Krishnan would definitely demand and investigate to get to the bottom of the slew of Indian origin students and young recruits murdered in the campus and off – corporate sites in the targeted fatalities of American born Indian students and students of Indian origin arriving from India.

The murder incidents of Indian origin students and case like Suchir Balaji is very alarming and disturbing considering the unusual number of murders of Indian origin young talent in this particular year Jan – Dec 2024.

Suchir Balaji’s parents request for investigation has been denied with the matter closed as “suicide” which in itself has blown the lid off the can suggesting more to it than meets the eye.

Indian appointees as CEOs in the corporate world especially in the tech industry and politics is far from merit oriented and tribalism.

In reality, it is deliberate sinister considering the tech and politics entrenchment in secret society and dark age agenda using Indian image and names specifically Ram, Krishnan and Ramaswamy…so on.

There is never a free lunch. Nothing happens without underlying malignancy in the contemporary global ploy.

Suchir Balaji is one of ongoing examples as victims in the year 2024.

My sincere condolences to Suchir Balaji’s parents in the Silicon Valley. May time expedite their healing with peace in the most difficult time of their life.

Padmini Arhant

Subversion of Foreign Religion

The ones who engage in distortion and subversion of foreign religion basic requirements.

1. Correct pronunciation of Hindu Gods and Goddesses names.

2. Stop manipulation and hyperbole convolution of mythology by tossing in your spin ball machine.

3. Know the facts prior to promoting propaganda.

Sri Narayanan is Lord Vishnu who in return is also Goddess Durga in the female form. Goddess Durga never gave boon to demons with immortality knowing they have to be dealt with by her when they impulsively wreak havoc which they always do sooner than later.

Padmini Arhant

திருநங்கை அவதூறு அவரவர் அழிவு சாபாமாகும்

திருநங்கை அவதூறு

அவரவர் அழிவு சாபாமாகும்

பத்மினி அர்ஹந்த்

திருநங்கை அவதூறு அவர் அவர்களின் அழிவு மற்றும் அவதூறை பரப்பும் பிச்சைக்கார பரதேசிகளுக்கு அது பெரிய சாபம்.

புதிய தலைமுறை டிவியோ அல்லது படு குழியில் மாண்டு போயிருக்கும் சாக்கடை கழுசடைக்கும் முதலும் கடைசி கண்டனம்.

கருங்கண்டம் ஆப்பிரிக்காவின் கென்யா அல்லது அமெரிக்காவின் சிகாகோவை சார்ந்த கருமுண்டம் அரக்க அராஜகம், களவாணித்தனம், பிறரின் உரிமையை பறித்தல், விபச்சாரிகளை வைத்து அரசியல் நாட்டாமை செய்யும் அசுரர் விபச்சார அரசியலுக்கு, தமிழ் நாடு மற்றும் இந்திய அரசியிலோ அல்லது அயோக்கிய அரசியலுக்கு அடிமையாக இருக்கும் கூலி பட்டாளங்களுக்கும் இந்த அறிக்கை மற்றும் கடுமையான கண்டனம் சாரும்.

ஊசிப்போன ஊறுகாய், சலிச்ச சாம்பார், துர் நாற்றமான காஞ்ச கருவாடு, செத்து போன ஆடு, மாடு, கோழி, பன்னி – ஏன் உயிருள்ள மனிதரையே தன் வன்மம் கள்ளம் கபடம் நயவஞ்சகம் இவைகளுக்கு இரையாக்கும் இந்த மனிதர் என்ற சாவு கிராக்கிகள் – இந்த ரகம் தான் இவ்வாறு தன்னையே கேவலப் படுத்தி கொள்வது. தேவையின்றி மற்றவரை உதாசினம் செய்வதே இவ் வகைராக்களுக்கு தன் பிழைப்பாகும்.

திருநங்கை என்ற எண்ணம், தூற்றல், பெண் ஜாதியை இழிவு செய்யும் உனக்கும், உன் குடும்பத்தில் இருக்கும் அத்தனை பெண்களுக்கும், சுற்றார், நெருங்கிய மற்றும் தூரத்து உறவு அனைத்து மொத்த உன் குடும்பம், குலம், இனம் யாவருக்கும் அது சாரும் – இது உண்மையாகும்.

அயோக்கியர்கள், அட்டூழியர்கள், அநியாயம் அவர்கைளின் கொள்கை, பேராசை பொறாமை பிடித்து பிறரை ஏளனம் துன்புறுத்தல் இவைகளே வாழ்க்கை வியாபாரமாக வாழும் அனைவருக்கும் –

உன்னுடைய சடலத்திற்கு நீயே சங்கு ஊதி கங்கு வைக்காதே.

உன் துற்செயல் உனக்கு கொள்ளி வைக்கவோ உனது இறுதி சடங்கிற்கு வாரிசு இல்லாமல் சபிக்க படுகிறாய் இந்த பிறவியிலேயே – இது உன் வினை உன்னை தண்டிப்பதாகும்.

பிறரை திருநங்கை என்று தூற்றல் அல்லது உன் துஷ்ட மனதிற்கு எப்படி எல்லாம் தோன்றுகிறதோ அதில் ஈடு படுவது நீ மற்றும் உன் அடுத்த தலைமறையின் அழிவை அலை போல் அலைந்து அனைப்பதாகும்.

உன் கருமாதிக்கு நீயே காரணம் ஆகாதே.

தன் வினை தன்னைச் சுடும் உரட்டியப்பன் வீட்டைச் சுடும். இதை எக்கனமும் மறவேன்.

பொறாமை பேராசை பொல்லாத வியாதி. இதில் அவதி படுபவர்கள் தன்னுல் இருக்கும் விஷத்தில் அல்லாடுவதாகும்.

நீ யாராக இருந்தாலும் வம்பை வீணாக விலைக்கு வாங்காதே. தன்மானம் சம்மானம்.

எப்பொருள் யார் யார் வைப்பினும், அப்பொருள் மெய்பொருள் காண்பது அறிவு.

நன்றியுள்ள பிராணி நாயிடம் நன்றியற்ற பல மனிதர் கற்றுக் கொள்வது அவர்களின் இந்த பிறவியின் முதல் கடமையாகும்.

பத்மினி அர்ஹந்த்

Photo Gallery

Progressiveness – Definition

Maintaining ethical efficacy on all issues which is unfortunately a tall order for many especially those perpetually using and exploiting others for own hideous ideology defined progressiveness or otherwise besides sinister political agenda.

Accepting own failure in personal and political front by not unscrupulously reassigning to scapegoat anyone especially the target not even remotely associated or interested in such activity or position.

Finally, reaching out to blue sky, dark clouds or rainbow with the plagiarized connotation “Wipe your tears” is at best disingenuous and at worst hallmark of self-dissipation i.e expedited exit.

Anything contrived as the proxy exposes the original-self and those behind the charade with nowhere to runaway from oneself. Accordingly, acknowledge defeat gracefully and victory with humility.

These characteristics are categorical regression and not progression by any stretch of imagination.

Padmini Arhant

Identity and Gender Misappropriation Culture

Identity and Gender Misappropriation Culture

Padmini Arhant

In accordance with the prejudiced misogynistic trend targeted ad hominem at me in the past nearly twenty years for;

My tireless selfless sacrifice with unconditional positive contributions – though it originated since my childhood benefitting many across the spectrum in diverse fields especially politics, media, economic and entertainment sector…in unimaginable proportions and magnitude.

In return, only subject and ill-treated with absolute contempt, hatred, envy, caricature, character assassination not barring real life threats on many occasions and pejorative malice in relentless violation of my individual rights and life,

At Almighty God’s will, the following are adapted towards any and all those from wherever in cohort with the prevalent diabolical trend and culture on deliberate identity, gender and personal profile misappropriation of me and my life with utter disregard for my individual rights will now onwards be treated as such.

To begin with;

1. All western claimed achievements across any field and industry since western origin until now and moving forward would be identified and attributed to the western touted latest Africanization trait and deemed African and that of Africa and not that of the Western imprint.

2. In this respect,

United States would be remembered and reminisced as Uganda.

Imperialist Britain already renamed Barbados being the key promoter behind identity misappropriation of me as an entitlement.

Australia – the ever eager lap dog in all western and western White Australia policy would hereafter be known as – Aboriginia – The land of the Aborigine which is rather accurate and hence not identity misappropriation rather appropriation.

Canada – The North American nation as the vassal state of British Commonwealth under the liability known as the Royalty would be identified as – The Central African Republic.

New Zealand – Namibia

Western Europe combined – Equatorial Guinea

Israel – Ethiopia – The origin and the land of Judaism – fitting the appropriate nomenclature not misappropriation.

All those engaged in the hideous provocative misclassification of my gender, identity and personal details will be hereafter individually and collectively recognized as such:

Miss Barry Seotoro alias Miss. / Ms. Barack Obama,

and

Mr. MICHELLE OBAMA alias

Miss. Ms. Mike Obama.

Mr. Hillary Clinton, Miss Joe Biden, Mr. Kamala Harris, Mr. Nancy Pelosi and so on.

Above all,

Miss / Ms. ELON MUSK

Miss. Ms. Joe Rogan

Mr. Tulsi Gabbard,

Miss / Ms. Vivek Ramaswamy – considering the transformation in reality.

Similar nomenclature would be applicable to anyone from wherever regardless indulging in such practice against me.

The proxies, puppets and pawns recruited as me in media. politics, entertainment etc.,by the evil syndicate behind this ludicrous identity misappropriation would be applied gender alteration and transposition practiced against me in the last two decades until now.

In observance and approval of Almighty God’s direct ordinance – Never to tolerate injustice, abuse and unprovoked wanton indignation and insolence that I have been arbitrarily isolated and attacked until now,

The above outlined identity of all those would be relevant with immediate effect.

One receives what one serves others to set the unprecedented convoluted subversion of me, my life and identity straight that is otherwise taken for granted, misused and exploited by the beneficiaries in worst parasitic present toxic environment.

Padmini Arhant

अपनी चित्ता को आग देना

झूटी तारीफ़ और झूटी तालियों के लिए अपनी अभागन जीवन को और बड़ी गाली बनने से बचायें।

बड़े पर्दे पर मुझरा करते करते आदत से मजबूर, उनकी दुर्भाग्य या बतक़िस्मती असली ज़िंदगी में भी उनकेलिए वही पेशा बन जाता है।

जो किसी के कहने पर भी – “सलामे इश्क़” का पैग़ाम पर्दे पर और पर्दे से बाहर मंच पर सज दजकर चलती फिरती साड़ी और जवाहरी दुकान बनकर अनजान की बुराई और दुहाई के लिए निकलती हैं । उमराव जान १ और २ – कोई फ़रक नहीं पड़ता जब लोंभ, ईर्षा और मूर्खता के चुंगल में फ़से इन पीड़ित आत्मावों के लिए – जो अपने ही विनाश और तबाही की घोषणा / ऐलान करते हैं।

हैवान और शैतानों के बहकावे में आकर किसी दूसरे और वो भी जो अपने काम के काम मतलब रखने वाले के सात, यूहीं पंगे लेना अपनी और अपनी परिवार, कुल और वंश की चित्ता को आग देना होता है ।

इसे कभी भी खेल या मज़ाक ना समझें। जिनपर काल मंडरा रहा हो, वही ऐसे काली करतूत पर उतरते हैं ।

उदाहरण / मिसाल के तौर पर – रामायण और महाभारत ही काफ़ी है ।

पद्मिनी अरहंत

Fakery in Politics’ Bakery

Why does fakery stand out in politics’ bakery?

It is obviously stale stock rebuffed with stand out flavors palatable to vendors’ liking rather than consumers’ taste.

Importantly, how does politics utilize own inventory to maintain control despite win or lose election?

By using two or multiple stocks from the same inventory representing the same power mongering controlling clique. They are deployed for the same purpose benefitting the same old establishment and power centrifuge. Nonetheless, assuming diametrically opposite roles purely for optics.

The one female member overtly pushed in the front line as the syndicate choice all the way to the highest position – such as the Presidency though in practice resigned to be the servile obedient puppet to behind the scenes puppeteers never wanting to let go of the control freak enigma.

While the other, deployed as opposition to the political class i.e. the recruiter having recruited the female representative initially as the member of Congress, foreign affairs committee, intelligence committee and variety…and suddenly designated the national adversary asset – such as the Russian asset.

When in reality, the recruit is the political party hired asset to negate the actual target eternally regarded the arch nemesis by individual and collective anti-republic and anti-humanity force.