United States – July 4th Celebration

July 3, 2017

By Padmini Arhant

United States celebrating independence anniversary on July 4th would be meaningful upon liberty and justice experienced by all transcending race, religion, economic and ethnic background.

Unfortunately, the social racial divide and economic disparity deprives many citizens from claiming equal rights witnessed in judicial outcome and deteriorating living standards among Native Americans, African Americans, Latinos, and immigrant population.

The increasing wealth and monopoly on fame, fortune and power characterized as elitism subjugate the rest with little or no concern for actions and decisions affecting majority. The apathy qualifying as narcissism is not a healthy trend given reliability on the less fortunate to work in harsh conditions making survival a challenge.

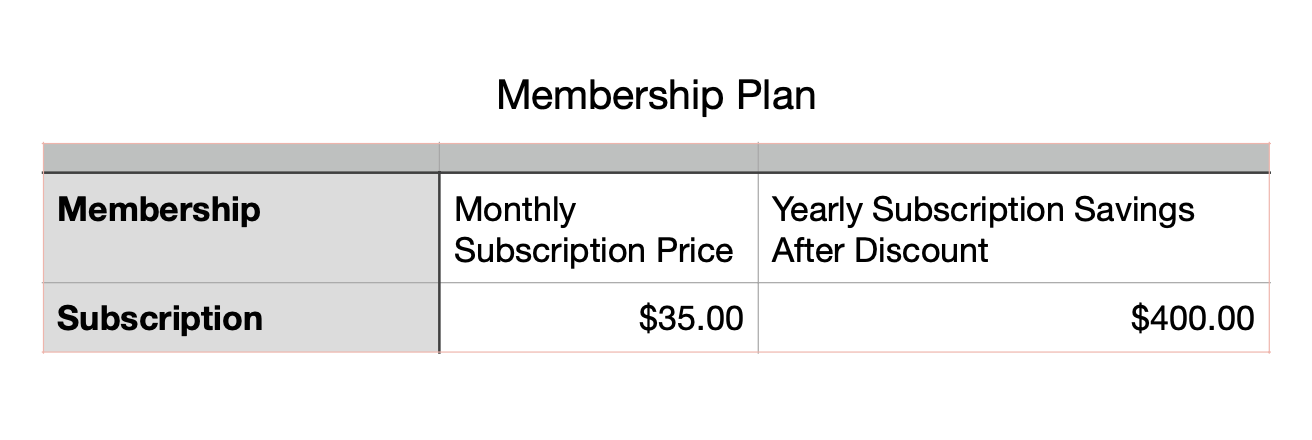

A free nation would not impose existing mandatory laws such as health insurance subscription with penalty upon failure to do so favoring profit centric health insurance industry without similar provisions tied to penalty on insurance industry regularly not meeting their end of the bargain.

In a real democracy, there would be no tolerance to private entities and foreign members like European Royals secret meeting behind closed doors barring public and citizens represented press from gaining information on policies regarding global matter and more than seven billion inhabitants fate. The reference is to Bilderberg conclave held annually with attendees sworn to secrecy in heavily guarded location.

The free country would not selectively profile law abiding citizens under the guise of national security while granting immunity to members in the position of authority on treason, corruption and criminal dealings based on fraternity and mutual advantage.

Then there is misrepresentation and false propaganda misusing communication resources to mislead the nation and world at large to maintain status quo.

United States could lead in many frontiers provided the nation is liberated from illegitimate incognito forces functioning by proxy to promote self and vested interests exerting supremacy and dominance proved counterproductive thus far.

United States efficiency and energy is a consolidation of efforts and contributions from people of diverse orientation working towards common goal to improve lives for self and others in different domains.

Accordingly, collective rather than exclusive progress in society would define fair income distribution alleviating burden on lower and middle- income class and socially disadvantaged segments bearing imbalance in the economy.

United States strategies in domestic and foreign affairs are premised on benefits to political class their campaign financiers, special interests and influential entities ignoring ramifications at national and international level.

The private ownership of federal reserve in control of monetary policy and money circulation further undermines United States independent status. With legislations directed to profit campaign donors from economic sector and those near and far, the electorate expectations are barely met disappointing voters in the otherwise opaque unaccountable and devious system.

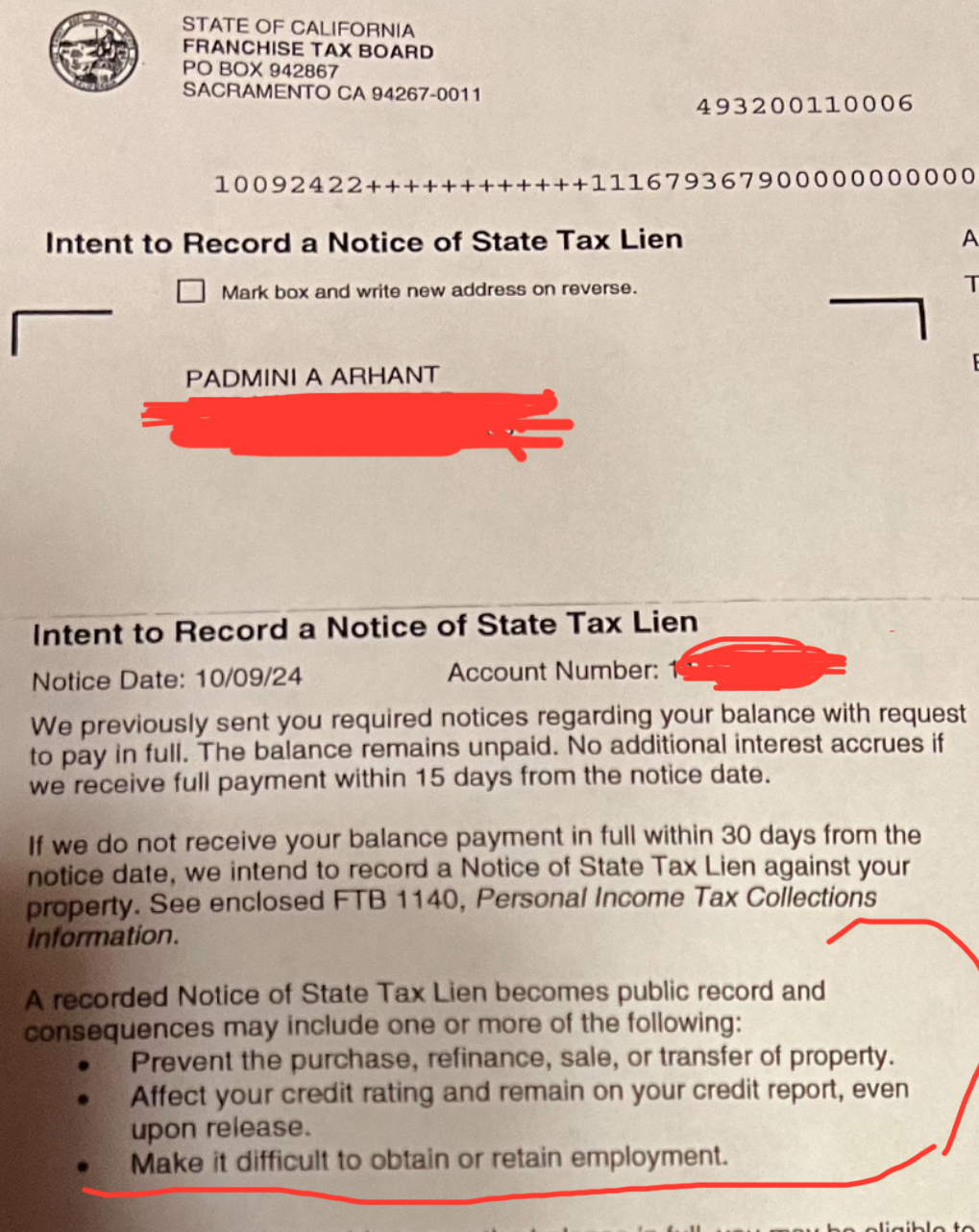

National and state operation is outsourced to private management like the credit bureaus run by three specific private companies with no oversight apply arbitrary rules leaving the victims of home mortgage fraud and credit card exorbitant interest hikes by banks at their mercy.

As long as government remains a mechanism for private organizations, political factions and those forging close relations with insiders to promote agenda threatening unity, peace and economic development,

Freedom for all is a mere dream and available at a dear price.

July 4th arrives and remembered with joy every year. The day equal opportunity and greater accessibility for optimistic future to citizens across the spectrum is no longer a struggle, the celebration would be worthwhile.

Hope for a better tomorrow beginning at present sets the path to reach milestone.

Happy July 4th !

Peace to all!

Thank you.

Padmini Arhant

Author & Presenter PadminiArhant.com

Spouse in Divine Mission

Federal Program Evaluation on Mortgage Refinance and Foreclosures

April 1, 2010

By Padmini Arhant

Please refer to the details laid out in the preceding articles from other news organizations published on this website under the title ‘Mortgage Refinance and Foreclosures.’

Information is also available in the article, @www.mercurynews.com

“By Sue McAllister – San Jose Mercury News, Saturday, March 27, 2010 – Thank you.

“Titled – Debt Relief – Mortgage program: Who will benefit?

Answers to how the federal plan will work and whom it will help”

———————————————————————————–

Program Evaluation – By Padmini Arhant

Making Home Affordable program targets the vulnerable homeowners on the verge of losing their homes.

Mortgagees who are unemployed, underwater and delinquent in their payments could seek assistance upon they meet the criteria.

Aligning mortgage debt with the asset value in order to help people retain ownership is a prudent measure to stabilize the struggling housing market.

It’s evident from these news reports that the program is well intended but the burden rests on the taxpayers through,

Federal Housing Administration insured loans absorbing the entire risk on potential loan default,

And,

Incentives to lenders to reduce principal value for the underwater and unemployed customers provided from the TARP funds…

The finance sector responsible for the subprime mortgage crisis is exempt from any liability.

On the contrary, they are being coerced with the federal funding that appears to be inadequate to rescue the vast majority from foreclosures and loan qualifications.

Federal programs or reform requires oversight to ensure the rules adherence by the industry.

Again, an independent / non-profit consumer rights agency is appropriate to avoid the conflict of interest.

As stated by the consumer advocates, the bankruptcy procedure for loan modifications is more reliable than the service offered by the federal partnership with lenders.

When a particular method is not yielding the desirable results, it is best to choose the option with a positive outcome.

Since the rules are ignored by the industry, setting consequences for non-compliance is an effective approach to limit the program failure.

If the borrowers are subject to terms and conditions then it should be applicable to the lenders as well.

Finally, the program would be beneficial with the banks accepting a fair share of monetary obligations in the principal reduction and the refinancing structure, having been the beneficiary of taxpayer bailout.

Thank you.

Padmini Arhant

Mortgage Refinance and Foreclosures

March 31, 2010

By Padmini Arhant

In the current economy, two major issues deserve urgent attention.

They are – unemployment and home ownership.

This topic will focus on the homeowners and the federal program under consideration to address the foreclosures arising from high mortgages.

Meanwhile, the following news report and editorial from other news organizations are presented for reference.

According to the –

1. New York Times report By David Streitfeld – Friday, March 26, 2010 – Thank you.

New help for homeowners – Revising Loan Modification

The Obama administration will announce today a broad new initiative to help troubled homeowners, potentially refinancing several million of them into fresh government-backed mortgages with lower payments.

The escalation in aid comes as the administration is under rising pressure from Congress to resolve the foreclosure crisis, which has put millions of Americans at risk of losing their homes.

A major element of the new program, according to several sources who spoke on the condition of anonymity, will be to encourage lenders to write down the value of loans for borrowers in modification programs. Until now, modification programs have focused on lowering interest rates.

Another major element will involve the government, through the Federal Housing Administration, refinancing loans from borrowers whose home value has sunk below what they owe on it.

More than 11 million homeowners are in this position, known as being underwater.

That aspect of the plan would apply even to borrowers who have not fallen behind in their mortgage payments.

Investors who own the loans would have to swallow losses but would probably be assured of getting more in the long run than if the borrowers went into foreclosure.

The FHA would insure the new loans against the risk of default.

Many details of the administration’s plan remained unclear Thursday night, including the precise scope of the new programs and the number of homeowners likely to qualify.

This much was clear, however:

The plan could put taxpayers at increased risk.

If many additional borrowers move into FHA loans, a new downturn in the housing market could send that government agency into the red.

The FHA has already expanded its mortgage-guarantee program substantially in the last three years as the housing crisis deepened, insuring more than 6 million borrowers.

Sources said the agency would receive $14 billion in funds from the Troubled Asset Relief Program, cash it could dangle in front of financial institutions as incentives to participate in the new program.

A third element of the White House’s housing program will require lenders to offer unemployed borrowers a reduction in their payments for a minimum of three months.

An administration official declined to speak on the record about the new programs but said they would “better assist responsible homeowners who have been affected by the economic crisis through no fault of their own.”

The plan would essentially supplant the government’s earlier mortgage modification plan, announced a year ago with great fanfare.

It has resulted in fewer than 200,000 people getting permanent new loans.

As many as 7 million borrowers are seriously delinquent on their loans and at risk of foreclosure.

The news was greeted with cautious enthusiasm by groups that have tracked the foreclosure crisis and tried to assist communities and underwater homebuyers.

“It sounds really good, and I’m not used to saying that,” said Kevin Stein of the California Reinvestment Coalition in San Francisco.

He said “the two main weaknesses” of the existing federal Home Affordable Modification Program were that,

It didn’t reduce the mortgages of underwater homeowners,

And, didn’t help borrowers who were underemployed or unemployed and would have difficulty qualifying for a loan modification.

“It seems they have taken these issues to heart,” Stein said.

“It’s unclear how many people will qualify – that’s the one hesitation. We’re not sure how broadly these initiatives will reach.”

Martin Eichner, with Project Sentinel in Sunnyvale, said the proposals sound good but he would like to see the details.

“It has to help significant numbers of people and there has to be enforcement,” Eichner said.

“These plans always look great in the first news release, but we’ve often been disappointed in the performance. To the extent that lenders write down principal balances, that would be a significant improvement,” he said.

Eichner said the home affordable effort also needs an enforcement mechanism.

“Without any real consequences, day to day we see lenders ignoring what we think are pretty clear rules under the current making home affordable program,”

While the number of foreclosure-related filings is beginning to flatten or decline, the number of borrowers who are seriously distressed is rising.

In the fourth quarter, the number of households at least 90 days past due on their mortgages swelled by 270,000, according to a report issued Thursday by the Office of the Comptroller of the Currency.

“The government is seeking to persuade people to stay in their homes by aligning the mortgage debt with the asset value, which is the only viable path to real housing stability,” said one person who was briefed on the government’s plans.

Several people who described the plans would speak only on condition of anonymity, since they had not been authorized to disclose details ahead of a White House briefing scheduled for this morning.”

————————————————————————————————–

2. Editorial in the Bay Area News Group – March 29, 2010 – Thank you.

www.mercurynews.com/opinion:

Titled – Foreclosure plan has carrots but needs sticks –

“Eight million households are behind in their payments or in foreclosure. But the Making Home Affordable programs has modified just 200,000 loans.

Forgive us for not jumping up and down with delight over the Obama administration’s latest plan, announced Friday, to help stem the tide of foreclosures.

The changes will help those who are unemployed, underwater or both.

But they have come so late that it’s difficult to muster much enthusiasm.

Banks participation in solving this problem has been optional for too long.

The government must require those who caused this debacle to do more to end it.

Since the foreclosure crisis began three years ago, 6.6 million families have lost their homes, according to the Center for Responsible Lending.

The problem is not getting better.

Eight million households are behind in their payments or foreclosure, and

One in five are underwater – they owe more on their mortgages than their homes are worth.

The administration’s primary tool against foreclosures, the year-old Making Home Affordable partnership with lenders, has so far modified the terms of just 200,000 loans. It is not up to this enormous task.

But the changes announced Friday have the potential to improve that record.

The program will now be open to the unemployed, who previously couldn’t qualify but are a primary victim of foreclosures.

They’ll be eligible to get up to six months’ forbearance and to have their payments lowered to reflect their reduced income, at least for a short time.

Those who owe more than their homes are worth – in California, that’s more than a third of borrowers – may finally be able to get their loan principals reduced.

This much-needed shift in approach addresses another key driver of foreclosure.

Lenders will get incentives to reduce the amount owed.

Borrowers who are current on their payments but underwater – prime candidates to walk away from their mortgages and further weaken the housing market – could refinance into a cheaper government loan.

All of this will help. But the main problem with the government effort remains:

It’s all carrots, no sticks.

Consumer advocates have been pushing Congress for years to allow bankruptcy judges to modify loan terms for primary residences, which could reduce foreclosures up to 20 percent.

The financial industry’s army of lobbyists has managed to beat back that idea, known as “cramdown,” saying it can deal with the problem on its own and through Making Home Affordable.

That’s clearly not the case, because of malice or incompetence.

It would be wonderful if politicians gave the same consideration to desperate homeowners that they do to banks.

Most everyone facing foreclosure nowadays did nothing wrong – they’re simply caught in the cascading wave that began with the subprime mortgage crisis.

The same can’t be said of the banks that got us into this mess and then took billions of taxpayer bailouts.

Allowing judges to modify loans in bankruptcy would add structure to an overwhelmed system.

Reasonable compromises worked out in court would set precedents for lenders to follow.

If they didn’t, they could be forced to by a judge.

Judges have this power for second homes.

There’s no good reason they shouldn’t have it for every home.”

————————————————————————————————–

Comment – Review and Analysis is in progress and will be presented shortly.

Thank you for your patience.

Padmini Arhant

Congressional Conservatives’ Legislation Blockade

February 10, 2010

By Padmini Arhant

In the preceding article “Progressive Policy for National Progress and Prosperity,” I emphasized on the need to intercept the Congress gridlock by electing the ‘Progressives,’ in the Democratic Party.

Following news articles reaffirm such recommendation.

——————————————————————————————–

1. Congress trying to have it both ways on spending

Lawmakers lament rising deficits but fight for pet projects

By Carl Hulse – New York Times – February 7, 2010 – Thank you.

Washington – While Sen. Saxby Chambliss, R-Ga., said he was all for slowing federal spending , he has no appetite for the substantial cuts in farm programs proposed in President Barack Obama’s new budget.

Rep. Todd Akin, R-Mo, issued a news release simultaneously lamenting the deficit spending outlined in the new budget and protesting cuts in Pentagon projects important to his state.

And Sen. Jeff Sessions, R- Ala., a fiscal conservative and a senior Republican on the Budget Committee, vowed to resist reductions in space program spending that would flow back home.

The positions of these Republicans – and similar stances by dozens of other lawmakers of both parties – are a telling illustration of why it is so hard to control federal spending.

Every federal program has a constituency, and even lawmakers who profess to be alarmed by rising deficits will go to the mat to preserve money that provides jobs and benefits to their constituents.

“I am not a hypocrite,” Sessions said in reconciling his fiscally conservative credentials with his outrage over the administration’s proposal to essentially end the human space flight program and allow private enterprise to take on some of the load – an approach that Republicans typically favor.

Sessions said money taken from NASA would not be saved but would instead be directed to other Obama administration priorities that he did not support.

Others said that the annual tableau in which members of Congress criticize the spread of red ink even as they reassure voters back home of protection for popular subsidies and Pentagon projects exposed the high degree of cynicism and lack of conviction that colors the fight over congressional spending.

“It shows that in Washington, you can be firm on your opinions; it is your principles you can be flexible on,” said Rahm Emanuel, the White House chief of staff.

The Republican juggling act on spending comes after a legislative proposal for an independent commission to study ways to cut the deficit stalled in the Senate, partly because some Republicans who had originally backed the idea balked.

“There are not enough statesmen who will stand up and say, “Cut it even when it is in my district,” said Rep. Jeff Flake, R-Ariz., who has crusaded against spending by both parties on pet projects known as earmarks.

It is not only Republicans who are trying to have it both ways.

Conservative and moderate Democrats who have pushed against deficit spending also quickly protested the cuts in NASA, military and farm spending.

————————————————————————————————–

2. GOP hammers Obama over jobs

Republicans oppose giving leftover bailout money to small banks

By Phillip Elliott – Associated Press, February 7, 2010 – Thank you.

Republicans sparred with President Barack Obama in their Saturday media addresses over proposals to create jobs, further evidence of the difficulty of bipartisan solutions to the nation’s pressing problems.

Obama pushed Congress to use $30 billion that had been set aside to bail out Wall Street to start a new program that provides loans to small businesses, which the White House calls the engine for job growth.

Republicans, meanwhile, taunted Obama with a familiar refrain:

Where are the jobs the president promised in exchange for the billions of dollars already spent?

The barb came a day after the government reported an unexpected decline in the unemployment rate, from 10 percent to 9.7 percent.

It was the first drop in seven months but offered little consolation for the 8.4 million jobs that have vanished since the recessions began.

“Even though our economy is growing again, these are still tough times for America,” Obama said.

“Too many businesses are still shuttered. Too many families can’t make ends meet.

And while yesterday, we learned that the unemployment rate has dropped below 10 percent for the first time since summer, it is still unacceptably high – and too many Americans still can’t find work.”

To help the recovery, Obama asked Congress to use leftover money from the Troubled Asset Relief Program, or TARP, to provide to small banks so they can make more loans to small businesses.

Republicans have criticized the move, arguing any money left over from the bailout should be used to reduce the budget deficit.

In the weekly GOP address, Rep. Jeb Hensarling of Texas chided Obama for proposing a 2011 budget last week that would increase spending, taxes and the national debt.

“Americans are still asking, ‘Where are the jobs?’ but all they are getting from Washington is more spending, more taxes, more debt and more bailouts,” Hensarling said.

The Republicans attack came even as key Democrats and Republicans in the Senate are working on a bipartisan jobs bill.

The senators hope to unveil legislation as early as Monday.”

————————————————————————————————–

3. Obama seeks boost in business lending

Proposals draw fire from Democratic leader in House

By Christine Simmons and Marcy Gordon – Associated Press – February 6, 2010

Seeking to create more jobs, President Barack Obama on Friday asked Congress to temporarily expand two lending programs for the owners of small businesses.

But a Democratic House leader slammed the president’s proposals, saying they’re the wrong approach to creating jobs.

Obama said Friday he wants to bolster the impact of the businesses that are the chief creators of new jobs in a struggling economy.

Just hours before he spoke, the nation’s jobless rate finally dipped below 10 percent – to a stubborn high 9.7 percent – in the latest government figures.

The president said he wants businesses to be able to refinance their commercial real estate loans under the Small Business Administration and he wants that government agency to increase loans used for lines of credit and capital.

The truth is, the economy can be growing like gangbusters for years on end and it’s still not easy to run a small business,” Obama said as he visited a heating and air conditioning company in a Maryland suburb of the capital.

The White House said Obama’s plan would temporarily raise the cap on Small Business Administration Express loans from the current maximum of $350,000 to $1 million.

Obama’s plan would also expand the SBA’s program to support refinancing for owner-occupied commercial real-estate loans.

But even the Democratic head of a House committee wasn’t pleased about the plan to expand SBA lending.

Rep. Nydia M. Velazquez, D-N.Y., chair of the House Small Business Committee, said the SBA Express program has been criticized for underwriting loans that banks would have made without government backing and for carrying the highest default rate of any SBA program.

“With loan defaults on the rise, we should not base our strategy on increasing the size of the least stable SBA lending program,” Velazquez said.

The initiative to refinance commercial real estate debt may dilute it and draw away too many resources, she said.

————————————————————————————————–

Food for Thought – By Padmini Arhant Feburary 10, 2010

It’s clear from the listed articles that, the priorities for the congressional conservatives’ on both sides are not the people i.e. the working class, the middle class and the small businesses.

If they were, they would not try to have it both ways as suggested in the article.

Evidently, the national interest is not the primary concern for the Congressional conservatives and moderates in both parties.

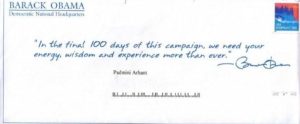

They are preoccupied in their faultfinding against President Barack Obama, instead of cooperating with the rest of the Congress in passing legislations especially,

The health care and health insurance reform where a staggering 46 million Americans are reportedly dying due to these lawmakers’ unwillingness to pass the much-required legislations to heal every American.

Notwithstanding, the credit crunch experienced by the small businesses from the ‘bailed out’ banks’ reluctance to facilitate lending.

Again the finance sector’s default in containing the worsening real estate crisis in both residential and commercial markets calls for immediate action through finance reform – conveniently rejected by the conservatives’ and moderates on both sides.

These legislators positioning them to be ‘fiscal conservatives’ and rebuking President Obama on the rising national debt that, they are contributing with their ambitious pet projects over the ‘average’ American plight, speaks volume on their lack of commitment to the people electing them to the office.

With respect to President Obama’s strategy on SBA lending to the small businesses, the Democrat House Committee response is irrational and confirms the legislator’s ‘out-of-touch’ with reality.

The President’s justification on this issue is right on target.

Since the bailed out finance sector is back in the game with “business as usual,” motto and focused on self-promotion with multi-million dollar bonuses culminated by their Washington representatives’ successful blocking of the finance reform,

The President’s proposal is the only viable option to stimulate the job growth in the most desperate segment of the economy – the small business.

Besides, in the absence of the banking industry long overdue lending activity, the investment risks in the small business is blown out of proportion compared to the risk exposure in the multi-trillion dollar bailouts to the banks still withholding credit to their creditors-cum-taxpayers and consequently restraining the economic recovery.

Time is running out for the conservatives on both sides in correlation with patience among the suffering millions in the economy.

If the Republican members are counting on their rebellious attitude towards the democrat President and the Congress to win elections in November 2010,

They are in for a serious disappointment for the American electorate would not reward the party with a victory in the face of their deteriorating economic conditions resulting from the Republican members’ blockade.

Somehow, if this were to happen, then it would be at the democracy’s peril.

Perhaps, it’s something, the American electorate ought to think about because they are responsible for the stalemate in Washington.

Having elected the ideological representatives for whom the people seem irrelevant – transparent in their obstinacy on legislative matter, the people are the ones who can undo the wrongdoing by voting the redundant representations out of power this November or even sooner.

Democracy is held hostage by the recalcitrant congress members defying the constitutional responsibility to serve the people and the nation as an elected official.

Washington hue shines through in these issues.

How can any President possibly achieve anything in such a hostile environment?

You decide.

Thank you.

Padmini Arhant

Housing Market Recovery by decelerating Foreclosures

January 18, 2010

By Padmini Arhant

As stated earlier, the key to the economic recovery is to revive the job market, the housing market and passing the health care legislation. Both job and housing market is entirely dependent upon the consolidated commitments from the public and the private sector.

The public sector represented by the government has the right agenda with the President’s proposal to levy tax on the financial institutions responsible for the financial crisis. However, the collected tax and fees from the finance industry is rumored to be accumulated in the stimulus pool against the Republican supporters’ demand that the proceeds be applied to the national deficit reduction.

Another contentious issue is the industry retaliation to the tax levy trickling down to the end consumer. It’s reported earlier that the industry has vowed to pass on the charges to the customer with an alternative threat to move jobs overseas.

Banking sector’s response of this nature is not unusual and prompts a swift termination of such protocol through regulations blocking the antagonistic traditions that brought the economy on the brink of collapse. Otherwise, taxes and fees should be imposed on the bonuses and stock options claimed by the executives and the senior management.

It’s important to enlighten those individuals fixated on reducing the national deficit when the economy is struggling to emerge from the deep recession. Further, the national deficit is a matter of great concern regardless of political allegiance as the debt mitigation burden is on the immediate and the future generation.

Minimizing deficit by merely returning the revenues and sources of income while, ignoring the cited economic woes is analogous to an attempt to contain the flood with an imaginary barrier.

Expansion in economic growth would directly contribute to the deficit contraction and there is an urgency to divert attention towards the two components i.e. the job and the housing market.

An element of truth noted in the funds being allocated to the potential banks’ bailout per disclosure by the current Treasury Secretary Timothy Geithner on the $75 billion housing market stimulus package.

The frustration in this respect is mutual and shared between the Tea Party movement and the Progressives in a bizarre convergence. It’s indeed a relief to view the polarized factions possessing some commonality, proving that a consensus can be arrived on national issues.

Taxpayers can no longer afford to bailout industries who betray them upon being bailed out and fail to fulfill their end of the bargain, i.e. to create and protect jobs that would lead to the economic revival.

Reverting to the tasks ahead for the public and the private sector, the effective strategies are:

Congress should reinstate the repealed Glass Steagall Act that prohibits the finance industry from indulging in speculative trading and instead focus on equity building, deposit security and bar insurance undertakings with high-risk collaterals.

The stand-alone Consumer Financial Protection agency as part of the rigorous financial regulation is a requirement to address the waywardly conduct demonstrated by the financial sector.

President Obama’s proposal in the creation of an agency to safeguard the consumer interests against abuses in mortgages, credit cards and other form of lending is precisely the remedy for the ethically deteriorating banking sector.

Abandoning the measure is a green signal for the repeat episode. Any legislators opposing the proposal are clearly against their constituents and the national interest.

In another related issue, stripping the Federal Reserve of all regulatory responsibilities is based on the dismal performance by the Federal Reserve authorities in the past two decades predominantly due to excessive power entrusted to the single most Federal institution.

On the contrary, the Administration’s position to expand the Fed’s role is a move in the reverse direction considering the status quo.

A noteworthy factor in the legislative affairs is, whenever a suggestion or a legislative proposal is made to reform any industry from the democratic side, the Republican representatives in the House and the Senate have unanimously rejected with a rare exception of one or two daring members casting their vote by bowing to the conscientious call of duty.

The partisanship and double standards was prevalent during the Clinton Presidency but even conspicuous throughout the Obama presidency.

The point in reference is available in the recent Financial Reform bill favoring the stand-alone consumer financial protection agency introduced by the Democratic Senator Chris Dodd and initiated by President Obama.

In contrast, the legislation with a similar agenda from the Republican aisle is overwhelmingly approved not only by the Republican minority but also with the cooperation from the democratic side.

A classic example being the year-end legislative amendment to the financial reform bill put forth by the Republican House of Representative Ron Paul –

The House Financial Services Committee approved Rep. Ron Paul’s measure by 43-26, calling for drastic expansion of the government’s power to audit the Federal Reserve.

The irony being, the ideological opposition consistently against the democrats sponsored government action characterized as ‘take over’ in any legislation is somehow complacent to the vast government intervention in this particular case.

Nevertheless, the amendment is a positive step in the financial regulation aimed at achieving transparency and accountability from the Federal Reserve, the long desired goals in the political and economic sphere.

With populace demand, the gridlock in Washington could be prevented by identifying the legislators contesting the party and not the issue. Likewise, those lawmakers obstructing their constituents opportunities for self-benefit through filibuster and unfair deal negotiations in the Senate vote, ought to explain the reason behind violating the constitutional oath.

Proceeding towards the core economic issue, the housing market decline has unequivocally contributed to the liquidity freeze and paralyzed the residential and the commercial real estate trajectory across the nation.

The housing market synopsis from the news report is depressing and conclusively the forecast is dire unless multiple course of action from the combined forces of the finance industry, the Treasury and the Congress is taken to resurrect the dying sector.

Source: Associated Press, January 16, 2010

Mortgage modifications fall well short of U.S. goal

Housing market may face another difficult year, economist says

By Alan Zibel

“Almost a year later, it appears about 750,000 homeowners – a fraction of the 3 million to 4 million originally projected – might complete the application process, predicts Mark Zandi, chief economist at Moody’s Economy.com.

A record 2.8 million households were threatened with foreclosure last year, up more than 20 percent from a year earlier, RealtyTrac reported this week.

The foreclosure listing firm expects another record this year.

Home prices, meanwhile, are down 30 percent nationally from the peak in mid-2006.

“It’s a very serious threat to the housing market, and still one of the most significant risks to the broader recovery,” Zandi said.

The Obama plan aims to help borrowers in financial trouble by making homeowners’ payments more affordable.

But just 66,500 borrowers, or 7 percent of those who signed up, have completed the program as of December, the Treasury Department said Friday.

Another 49,000, or more than 5 percent, have dropped out of the program entirely – either because they missed payments or were found to be ineligible.

Thousands more remain in limbo awaiting an answer.

There’s blame on both sides:

Mortgage companies say they have struggled to get back the necessary paperwork, while homeowners and housing counselors say navigating the bureaucratic maze often seems impossible.”

————————————————————————————————–

Resolving the Solvable: By Padmini Arhant

Since the government is the largest employer during the economic recession, it’s reasonable to expect the agencies involved in the housing program to function efficiently. In addition, maximum utilization of technology should enable user-friendly application format.

As for the homeowners and the counselors faltering on the paperwork submission despite simplifying the process presumably with a deadline, serving a written notice with a foreclosure warning should yield the necessary response or action from them.

On the paperwork completion, it’s entirely up to the homeowners to salvage their homes from being foreclosed. There are non-profit workshops and agencies working in many counties apart from the internet sources to assist homeowners with the documentation.

Eligibility is the bone of contention in most national issues from housing to health care.

Perhaps, the program needs a thorough review and necessary threshold adjustments to accommodate the volume that would eventually relieve the homeowners, the mortgage companies and the banks from the debt confinement.

It appears that the stringent rules often cause more harm than good in resolving crisis of great magnitude confronting the nation at the present time.

Given the gloomy economic environment, sometimes leniency or relaxing the rules on an individual basis would help the situation with the homeowners retaining possession of their homes.

Foreclosure is an epidemic and drastically affects everyone involved beginning with the mortgagee, the lender, the county, the city and the nation at large, not to mention the crime emanating as a result of the unfortunate event.

Improvement in home values made possible through customized lending as opposed to generic programs is crucial in dealing with the escalating foreclosures, thereby significantly easing the economic recession.

Thank you.

Padmini Arhant

Radio Show Schedule

January 22, 2009

I will be doing a live radio show for 120 minutes from 2.00P.M to 4.00P.M. (PST) on the following days:

January 23, 2009 Friday from 2.00 – 4.00 P.M (PST) to accommodate listeners from all time zones.

Category: Current Events

Topic: Corporate Bailout

Discussion:

What should financial institutions do with the taxpayers’ bailout?

Why have they not utilized those funds to stimulate economy?

What is public demand from them and the legislators?

———————————————————————

January 30, 2009, 120 minutes 2.00P.M – 4.00P.M

Category: Current Events

Topic: Economy and Health Care

What should the new administration do for you and the economy?

How do we fix the Health Care system?

———————————————————————————-

Podcast live : http://www.blogtalkradio.com/Padmini-A

Guest Call-in-number: (646) 727 -3778

I invite you all to participate in the public forum and share your concerns, ideas and knowledge.

Your comments and thoughts are welcome in the political discourse.

Let us keep democracy alive and help our new President Barack Obama and Vice President Joe Biden in rebuilding our nation.

Look forward to the session.

Thank you.

Padmini Arhant

P.S. My apologies for not being able to schedule a convenient time on January 21, 2009. I am aiming to provide as much time as possible through whatever avenues available in getting us back on our feet.

Your participation is a huge encouragement and always appreciated – Thank you again.

PadminiArhant.com

PadminiArhant.com