Financial Reform with an Independent Consumer Protection Agency

March 6, 2010

By Padmini Arhant

The Wall Street bailout season commenced in 2008 and continued into 2009. Those corporations allied with the oligarchs not only survived but their CEO’s are thriving amid difficult economic times and some states experiencing a double-digit unemployment.

As stated earlier in numerous articles on the economy and the financial sector, the speculators’ reckless conduct together with greed led to the status quo. The sub-prime mortgage and credit card lending practices targeting the vulnerable population contributed to the housing market decline and the alarming bankruptcies.

In addition, the credit crunch has forced many small businesses to lay off employees and left the self-employed in a dire situation. The private sector have also been affected in the liquidity crisis triggering the 9.7 percent national unemployment rate and much higher when consolidated with the under employed statistics.

Evidently, a rigorous financial reform is necessary to revive the economy and avert future meltdown.

Although, an international consensus was reached during the G-20 meetings in 2009 at London and Pittsburgh to implement strong financial regulations, the domestic agenda in the United States is faltering due to the usual Senate gridlock and the lack of enthusiasm to push the issue forward.

However, the House of Congress is way ahead of Senate in passing legislations on many issues, reflecting the Speaker Nancy Pelosi and the House of Representatives’ commitment.

On the other hand, the Senate majority leader Harry Reid has a tough battle convincing the opposition, sworn to filibuster the legislations on any reform.

The Republican Senators and the democrat opponents believe in the market economy free of regulations and refuse to acknowledge the economic adversity brought upon by deregulations in the recent decades.

Failure to act now would be catastrophic for the global financial market and the economy.

There is no guarantee that the U.S economy and the rest of the world would not be subject to a similar scenario in the future with the hedge fund managers and the investment banks such as the Goldman Sachs…

Having set a precedence in wild speculations, high-risk exposure and fast track profiteering at the expense of millions of borrowers, investors and national economies like P.I.G.S, an acronym for Portugal, Iceland/Ireland, Greece and Spain, all of whom are currently dealing with insolvency.

Finance sector being the cradle of the economy, the benign symptoms would prompt the government bailouts of the default institutions. Thus, history repeating itself with the exponentially rising national debt remaining the constant factor in the non-regulatory environment.

Another attention worthy issue in this context is the establishment of an Independent Consumer Protection Agency.

Agency’s function would be fairly common and that being,

Protecting the consumer rights as the borrowers,

Creating awareness on the industry’s unethical practices apart from,

Preventing the banks in the systemic abuse of customers through inflated finance charges and interest rates on personal loans, credit card etc.

Further, it could also provide arbitration service to the borrower and the lender on financial disputes, thereby mitigating legal expenses for both parties.

Not surprisingly, there is resistance to the Independent Consumer Protection Agency.

As witnessed in the health care bill, the lobbyists are relentlessly engaged in ensuring the demise of the financial reform and the consumer protection agency.

The White House being suggested to nominate the Treasury Department in handling the Consumer Protection Agency affairs as opposed to a non-partisan and an independent committee, poses a conflict of interest stemming from the Treasury Department’s liaison with the financial institutions.

Likewise, the Federal Reserve maintaining control over the Consumer Protection Agency against the banking sector is an unrealistic expectation based on the Federal Reserve’s performance in the sub-prime mortgage debacle and the executives’ close ties with the finance sector.

Therefore, the consumer protection agency ought to be independent and focused on safeguarding consumer interest.

Financial reform cannot be delayed or relinquished especially with the Wall Street’s compulsive disorder to indulge in short term gains by acquiring toxic assets only to be transformed into a burgeoning liability.

Alternatively, the watered down legislation could fulfill a formality and not serve the purpose.

Hence, the requirement for a meaningful financial reform is absolutely vital to rein in on predatory traditions.

Finally, the U.S. economic recovery could be expedited through a robust financial regulation that would instantaneously restore the investor and consumer confidence.

Thank you.

Padmini Arhant

Written by Padmini Arhant · Filed Under Business

Comments

Got something to say?

You must be logged in to post a comment.

Global Translation

-

Recent Posts

- Life Lessons

- Artificial Intelligence Propaganda

- Israel’s Rejection of UNSC Resolution

- Moscow Terror Attack

- UNSC Resolution – Gaza Immediate Permanent Ceasefire Welcome!

- Ramadan Greetings – Gaza War Message

- Terror Attack – Moscow, Russia

- Political Establishment Incognito Define Artificial Intelligence

- United States – The land of Justice?

- Propaganda in Politics

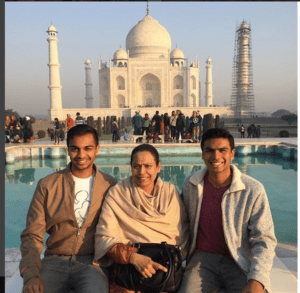

The Wonder Nature - Not created by human. Wise not to destroy it with human invented bombs and nuclear might.

Padmini Arhant – PadminiArhant.online

Padmini Arhant – Gaza War and Rafah Air Strike

South & South East Asia – Geographic Location Subversion

Since when the nation in South East Asia and another in South Asia got relocated to EGYPT and Greece?

Perhaps in the mind of those hell bent on imposing anything about anyone to suit their whims and fancies regardless of objectionable offensive trend considered their entitlement in defining and declaring others life and profile as they deem fit.

Granted geography is not everyone’s cup of coffee, herbal tea, masala chai, latte, mocha or Cappuccino😇

However, claiming the Sun does not rise in the East and sets in the west never make an iota of difference to the Sun. It rather highlight the dimwit and derangement behind such obscene obstinacy of subversion and distortion of reality.

Padmini Arhant

Phonies, Floozies, Fraudsters – Harbinger Own Funeral

Phonies, Floozies and Fraudsters deployment harbinger own funeral and that of the participants in the end justifying the means without exception.

The same apply to all recruits, recruiters and especially propagandists with malicious objectives inviting own peril including the source in Kamikaze engagement.

Those who dig grave for others invariably and incontrovertibly find themselves in it sooner than later.

Don’t sweat over your arch nemesis with your racist sexist envious remarks as the former is not on the knees with a rose in hand pleading for attention as you desperately desire much to the contrary rejecting your hideous idiocy and violent repugnant legacy laughing at your hypocrisy.

Prior to making judgment on anyone about their physical looks, make sure to focus on your mirror reflection, relevantly inner-self within known as introspection. That would be the real tell all about human nature – the true natural beauty that ever matter in living and thereafter.

The evil obsession is only guaranteed self-destruction.

The criminal cabal can no longer protect nor defend evil ad nauseam devouring lives wherever possible prior during and subsequent to emergence in politics.

The web of lies spun on social media, main media network, commercial propaganda and politics from anywhere in evil’s favor only further expose EVIL and diabolical agenda.

One can’t run away from oneself and the sins in particular reminding from within on the imminent self- termination.

Padmini Arhant

Electorate Base Rejection in Presidential Race

When either major political party presumptive Presidential nominee or incumbent running for re-election select the second-in-line rejected by the respective electorate base in the primary resulting in failure of the latter Presidential bid due to electorate non-approval, that combination is doomed from the get go regardless of the front liner position as witnessed and experienced in the Democrat incumbency and VP choice.

The candidacy declined by own base with voters clear message not desirable and importantly declared ineligible evidenced in their failed Presidential contest, yet forcing down the choice on them and the rest of the country is indicative of selection pushed through foreign and domestic vested interests categorically undermining the republic and national interests.

Furthermore, the identity and crony politics are best abandoned and instead replaced with legitimate meritocracy to serve the people and the nation at large with efficiency and ethical efficacy that are conspicuously missing and would exemplify the Presidential nominee respecting the republic will rather than political hatch influenced by incognito domestic and foreign intervention trending thus far.

Similar stunt displayed in Britain with choice of the people dismissed and ignored to appoint feudalists globalist servile appointee.

When politics defy people, that setting inevitably bear severe voter backlash in governance and subsequent local to Congressional election.

At the end of the day, it is the ordinary electorate funding these positions as taxpayer and not elitism in disguise.

Padmini Arhant

Ramadan Greetings – Gaza War Message in Arabic and English – Padmini Arhant

Ramadan Greetings – Gaza War Message in Arabic and English – Padmini Arhant

Scoundrel Kavodhi Funeral

Scoundrel Kavodhi Funeral

Pakistan Army & ISI Political Intervention – Padmini Arhant

Pakistan Army & ISI Political Intervention – Padmini Arhant

Pakistan Sovereignty Violation

Pakistan Sovereignty Violation

Pakistan Politics 2024 Addendum – (Urdu Presentation) Padmini Arhant

Pakistan Politics 2024 Addendum – (Urdu Presentation) Padmini Arhant (You Tube)

Pakistan Election 2024 – Presentation in Urdu – Padmini Arhant

Pakistan Election 2024 – Presentation in Urdu – Padmini Arhant (You Tube)

Gaza – Rafah Air Strike Feb 2024

Gaza war Rafah Air Strike Feb 2024 – Padmini Arhant

Gaza War Speech – Padmini Arhant

Independent Palestine – Padmini Arhant

Independent Free Palestine – Jan 2024 Speech

New Year 2024 Greetings!

Peace to Free Palestine

The Dumbest Trend

Attention: The Runaway from Self-Identity

Applicable to only those engaged in this dumbest trend.

When you are all shunning your original identity as to who and what you are obviously due to shame and embarrassment of your actions and indulgence in your life,

What makes you all think, dumping your unwanted undesirable identity on whom you incessantly target much to your individual and collective peril experienced by you all at the moment, that would be acceptable to the one you impose yourself?

The dumbest trend not only exemplify your delusions but also your honesty in rejecting yourselves in recognition of your worst profile and corrupt trajectory that even you can’t apparently live with and doing everything to disinherit as to who you are.

Nonetheless, bear in mind (if you have one?) no matter what you do to yourselves to change anything about yourselves, your identity related to your DOB, age, biological, physiological, psychological and sociological and above all your karmic woes cannot be altered, traded and abandoned in this lifetime.

As for your imminent departure from the world, you can’t even get rid of your sins / bad karma as it is the only certainty that accompany your soul to deal with the judgment that determine your fate then onward.

Don’t sweat over the craziest conduct as it only proves your lack of self-respect and disdain as to who you are?

Accordingly, the apt response to identity imposition is;

Your identity is your problem.

The identity swap is ludicrous and criminal that are taken into account against you during judgment upon your inevitable exit from this world.

Padmini Arhant

Gaza Genocide

Anti-Semitism?

Racism, Sexism, Fascism, Narcissism as ZioNazism could no longer hide behind anti-semitism.

Padmini Arhant

Who is Who?

India – Recognition of Dr.Ambedkar ( The society and politics designated untouchability and outcast – Dalitnama / Dalithood Stalwart).

If you truly acknowledge Dr.Ambedkar then Indian politics collectively would uphold the Indian Constitution to the letter – the Charter authored by Dr. Ambedkar to abolish hierarchy with denominations aka abhorrent casteism with untouchability as the norm in society till date.

There would be no communal divide based on religions and majority minority status that is virulently prevalent now surpassing predecessor Congress in this trait.

Indian politics would denounce fundamentalist ideology not embrace and execute the draconian policy.

As for the one claiming to be the caretaker of Africa would not have sold Africa to the military industrial complex enabling militarization of the continent at ease in the greed for power with dismal prospects on re-election to office in 2012.

The so-called empathizer of black Americans would not have turned the back whilst holding the highest office on land with the power to pardon denying the black American Troy Davis falsely convicted of a crime he did not commit and yet sent to the gallows that could have been averted exercising the black Presidency executive pardon otherwise expended in anything proven destructive during the two terms in office between 2009-2016.

The final straw with the member of black race – Miriam Carey – the woman raped and subject to summary execution expending taxpayer dollars in the crime.

Then the child born out of this crime was tossed into the arms of a complete stranger of white race by the one touting blackness and Africanism in the desperate attempt to damage control. Not to mention the black child deprived of a mother and parental care in the offender resigning to deadbeat fatherhood.

Last but not the least, the human nature is characterized as good or evil not from PR campaign and massive propaganda – the culture normalized in politics and other fields in society.

Instead, the goodness and evil is exemplified and verified in actions, decisions and legacy abusing or utilizing power and economic social status to either harm or benefit individual or collective members in personal lifetime.

Vying for undeserving eternal name and fame by politics and alike in the exploitation of anyone and others misery is megalomania and opportunism optimum.

Padmini Arhant

Evil Prima Facie

Quit wicked crooked politics once and for all. United States and cronies led by India’s wannabes, opportunists, traitors, fraudsters, impostors and desperate sycophants – don’t humiliate yourselves anymore in the identity theft charade in subservience to evil connivance, manipulation and subversion. No matter which side of the mouth you drool from, you are evil’s prima facie in the incontrovertible duplicity.

Padmini Arhant

Despotic Politics Duplicity and Impostors

Attention: Despotic Politics Duplicity and Impostors

Padmini Arhant

Despotic politics desperately involved in image salvation and legacy management must realize the incontrovertible fact.

Who were at whose doorstep knocking and begging for help to achieve their unimaginable political dream in their life?

Then immediately pulled the rug under the feet of the same member and family having utilized their monetary and intellectual contribution with no credit or gratitude whatsoever. Instead volleyed mockery and relentless public indignation.

Notwithstanding the vile vengeful vendetta targeting the benefactors of their political ambition with ruthless tactics and hostility prevalent until now much to own and progeny peril.

Even the Cairo speech was plagiarized and lifted with no mention or attribution to the original source delineating the much propagated artificial intelligence from authentic intellect and importantly human character.

As for wannabes, opportunists and parasites chosen by evil to challenge Almighty God’s ordain and will,

Where were you all having been around in public domain related to politics, beauty pageantry, entertainment, religion and economic sector etc., long before my public emergence?

Even though, I have been approached long before by politics – the proof provided in this website from the predecessor former President George W. Bush, the message from the Democrat President Jimmy Carter and family and several others throughout my lifetime.

Did it not occur to any of the evil nominated designees whether as politician, entertainment and beauty pageantry or religious zealots, media and assortments from India or anywhere regarding their fake fraudulent divinity and divine orientation flaunted at evil’s behest and orchestration?

Politics and entertainment in India, United States and colluders – those representing both and / or either for glory hogging via exploitation and manipulation of my hard work and excruciating journey which they have contributed to in the worst form exacerbating my plight and that of my family are the two sides of the counterfeit coin.

Indian politics and entertainment are required to shun futile publicity stunts to resurrect own long deceased tenure once and for all.

If you really cared about anyone other than your obsessive self-adulation, you would not be tone deaf to human suffering in your domain and anywhere for that matter, which you are responsible for in your complicity with evil.

Importantly, where were you all hiding and in hibernation when Sushant Singh Rajput, the actor and rising star fell victim to Bollywood and Indian political exploitative tool and forced to commit suicide.

None of you could even bring your phony selves together to express remorse at Sushant’s premature demise and many like him subject to disappearance through your active and passive suppression of anyone not in your corrupt criminal league.

Interestingly, now you are vying for cheap publicity at my personal achievement entirely at my intense hard work and many sleepless nights over these years, relevantly without being paid a dime by anyone or monetary compensation ever.

Instead depleted my personal savings and assets until now, to which rather than gratitude contrarily vilified and denigrated by you and your kind having extorted me and my family for your personal aspirations in life.

Let this be clear none of you have any association or relation to my individual feat except you together as active obstructionists and protagonists never missing any opportunity in evil contrived script to make me anonymous much to your collective fait accompli.

Stealing others good KARMA bear unbearable consequences affecting even the progeny in inheritance.

Never claim or seize anything that does not belong to you is the norm in any civilized culture besides the cardinal rule in the cosmic ordinance.

Quit your ravenous craving for undeserving fame, fortune and power at other’s misery.

Stop fooling yourselves and the world at large. The show ha been long over.

In doing so, your karma shackle you all and your descendants in indebtedness for many lives to come to those against whom you commit unforgivable sins in your surrender to evil.

Shame on all of you above mentioned and anyone treading on self-deceit trail only to experience self-inflicted embarrassment and humiliation.

The celebrity related content referenced below strictly apply to only those fitting the description and wanton provocation flaunting long dead celebrity status.

The publicity starved variety dying for attention in the constant harassment of their she-nemesi through crass stunts, exhibit strong admiration for Hitlerism where entertainment industry is prime propaganda hatred machine.

These cohorts in their consolidated cowardly nuanced charade.cheering Hitler in following Hitler indoctrination via entertainment viz. the cinema and any available outlet much to every individual and collective tumult in the league is desperate times losing sanity and propriety.

Celebrity from the big and small screen in the United States, India, Britain etc., especially the one from American TV sitcoms, Britain origin talent show leading panelist, the British chef.. from the west and,

Indian film industry all the woods combined from Bollywood, to Tollywood, Kollywood, Mollywood.. your subservience to appease evil conglomerate in your persistent misogyny, she-bashing and she-indignation,

Meanwhile stealing my original natural positive demeanor in your pseudo mannerism as yours only exemplify your cheap conduct laden with bruised ego and inner lacerations.

Never forget you reap what you sow in life and inherited by your next in line.

Every one of you and your accomplice in any shape and format in the evil enacted theatrics are cursed, condemned and denied redemption for your deliberate willful indulgence premised on greed, envy and humongous hubris.

Above all, every one of you in this collaborative evil actions and connivance earn only gloom and doom beginning now lasting eternity with direct impact on your immediate and next generations due to your mendacious volition.

You may individually and collectively engage in fraudulence as impostors in mass deception of yourselves and the entire world but,

Not the one who is all knowing, seeing and cognizant of who is who, from where and what about them…details to minutia since their Soul existence and the journey now and beyond.

Padmini Arhant

Conflict – Synonyms

Conflict is the synonym for war, discord and warfare.

This is for those, who through IT cell recruits keep referencing “Conflict” in the titles in publications on this website and sub-domain alluding to be incorrect.

काला अक्षर बैंस बराबर ।

Padmini Arhant

Celebration – Bright, Beautiful & Picturesque

Lord Murugan Holy Symbol and Meaning

Israeli Palestinian Conflict – Part 2

Israeli Palestinian Conflict – Part 1

Politics – Abusing Power and Taxpayer Money

Beautiful California - Yosemite National Park

Beautiful California - Genesis Point

Swastika – The Sacred Symbol – All is Well

Grim Reality

Grim Reality

What is the difference between politics, religion and science?

Politics is fiction in perpetual denial of anything inconvenient and truthful.

Religion is faith suggesting trust and belief in the force primordial.

Science resigns to fact from experimental data yielding positive or negative results not without margin of error either way.

Unfortunately, the three are intertwined with politics misusing religion and science for political gains and adverse cause.

Religion is politicized to assert dominance of one against another.

Science gets political within scientific domain and in dismissal of religion as hypothesis.

From Cradle to Graveyard – Despite lining the coffers at others’ expense, none taken in the coffin leaving behind even skin and bone.

Greed, envy, animosity…array of negative vices consume the hosts in the end justifying the means dilemma.

Padmini Arhant

Organic Intelligence Erring!

The ones flaunting the so-called organic intelligence with constant jibes at the allegedly artificial intelligence could perhaps seek assistance from the latter in spelling adjectives correctly to make sense of the message. Even basic spell check feature would serve the requirement.

The country is indeed precious not prescious than any individual, entity, political party, institution and organization.

Needless to say, it is applicable all around without exception.

Unlike the trend, smothered in hypocrisy beckoning others to do what is apparently unacceptable to selves to the extent of blasphemy.

Padmini Arhant

Small Minds Interpretation of Matter

The interpretation of anything as small, average, little, dwarfism etc. is small minds’ diminutive status – uncomfortable and unable to deal with own reflection and reality.

Let’s examine history on animal and humans of towering height and the fateful outcome.

Tyrannosaurus rex aka T—Rex – 12 feet in height – twice the size of 6’ human, also known as the fierce carnivore devouring prey upon contact finally became extinct. The T-Rex left behind tyranny derived from Tyranno-saurus nomenclature and traits for comparable humans in height and behavior.

Among humans – The Ugandan former President Idi Amin 6’4” spared none in violent atrocities and barbarism against own people. The tall African leader tallness diminished in proportion with monstrosity against own citizens made to flee for life.

The internationally known terror organization Al-Qaida leader Osama Bin Laden branded the terror mastermind was also 6’4” and engaged in activities 12 feet under detonating explosives that eventually led to the bottom hole in life.

The former Iraqi President -Saddam Hussein 6’ dwelling in different palaces ultimately sought refuge literally in a rat hole.

There are more examples in this regard. The world continue to witness and endure such characters’ abnormal sinister indulgence producing the drastic curvature or decline whilst living and legacy.

Suffice to say tallness is not greatness and not all tall people and species possess qualities and characteristics matching or exceeding their physical height.

On the contrary, the above members and alike are the proof as to how tallness stooping to the lowest of the low in deeds and thoughts hurting and harming others can contract their size into nothingness and many forced into oblivion.

The actions guided by the mind and intellect in rationalizing right from wrong, goodness from evil, kindness from violence etc.define the greatness or littleness of human identity.

Additionally, remarks such as little people and other connotations are the result of envy emanating from self-inadequacy, deep insecurity, extreme inferiority complex lacking in self-esteem.

Padmini Arhant

The Gospel Truth

The Gospel Truth – The Cardinal Rule on Sinful Life and Legacy

Padmini Arhant

The color of the sky cannot be changed to suit and fit the preference of the beholder. Synonymously the skin color in a given life remain the same regardless.

Getting over color code – in blackness, whiteness, brownness, yellowness, pinkness, orangeness and any other shades and racial tones…merely an exterior skin layer with color of the blood (RED) remaining the same and uniform in all living species i.e. humans and animals alike, the realization in this context is the preliminary step towards civility.

The life history in terms of social identity – color, creed, education, economic, political background etc., ending and the memory of it erased with the termination of life in any particular lifetime except for the accumulation of karmic debts pending settlement, the condition is irrefutable.

That being the fact of life, what’s all the fuss over melanin and skin pigmentation and other factors?

The Soul’s unknown journey though markedly premised on individual deeds aka Karma in any life duration, the hangover on skin color and stereotype are sentiments inhibiting positive thought process and relevant progress in mind evolution.

The efforts instead turned inward in clearing clutter within and deep inside to develop tolerance, acceptance, acknowledgment extending respect and understanding even with differences and disagreements on issues create better relations in human existence.

The humanness rising above prejudice, lingering bigotry, hatred, subjugation, subordination and discriminatory practice is the greatest challenge for those unable to release selves from the self-imposed constraints on social description.

Learning and striving to be human in nature and behavior is the laudable milestone one could achieve in living and thenceforward.

Having said that, it might be possible to straighten the dog’s tail but not those set and sworn to be unruly and recalcitrant at own peril only to realize the outcome echoing what was ignored and too late for recovery.

On the question of feeling insignificant, it would matter only when such assertions from distinctively insignificant have any significance whatsoever.

Claiming credit on anything that do not apply to self aka wannabe alternatively piracy while shunning responsibility on everything that is squarely own obligation with name written all over is called opportunism.

Financial bankruptcy caused by malicious forces abusing position besides conning and mocking endlessly about the situation long after recovery is sadistic pleasure, the epitome of narcissism

Juxtaposed, personal permanent irreversible moral and ethical bankruptcy drowning in doom and gloom is far worse than any temporary loss in life.

Not to mention the status depleting core human value, irreplaceable element with any monetary or material compensation.

The designee viz. the Vice President as the so-called heart beat away and next in line to the highest office on land selling the Soul to devil for title in name only and price tag is sycophancy traded at the cheapest fire sale otherwise insolvency of brain and human dignity.

The bargain involving self-caricature in ever high ecstasy and delirium on display admittedly from substance abuse evidently never in short supply in the latest cocaine saga at the premise of the most important public office in the nation is sad and tragic affirmation on self-destruction beyond salvation.

The self-inflicted deterioration to appease the devils in disguise is classic example of greed and lack of intelligence resulting in dysfunctional performance and dystopia.

As for the mainstream network with insignia as the sly scavenger FOX represented by hosts and anchors salivating on the bait along with counterparts on curbside communication outlets trading journalistic ethics for demolition of democracy peddling Satans’ satanic nuanced scripts are components of the large fraud machine with engine running on recycled fabrication and distortion in epic proportion.

The combined collaborative efforts expedite their cataclysmic destiny already in progress with precipitous decline together with the entire apparatus behind the gamut on the brink of collapse.

Accordingly the futile nonsensical defamation via VP clown and other pawns sponsored by media cohorts’ directed at the target to convince imaginary audience in empty theater is the ultimate parody glaring at those in fools paradise.

Sins and crimes committed with willful malevolence is demonic despotism.

The characteristics encapsulate brazen conviction to harm, develop attitude entrenched in hatred, contempt, prejudice, misogyny, intolerance, insolence, slur, slander, smear, besmirch, condescendence, patronization, envy, gluttonous greed, hubris, arrogance, bruised ego, violation of rights through invasion of life, privacy, space, perversion, spying, snooping, prying, preying, predator instincts and critically identity theft, identity swap, identity misappropriation manipulated as identity appropriation, isolation to anonymity, exploitation, unlawful intrusion, imposition, harassment, bully, mob mentality, obsessive compulsive disorder with the target…are some of many diverse character deformity and deranged personality laden with ignorance.

Such indulgences bear serious consequences in living gripped with grief and guilt and upon demise leading to the solo journey after life saddled with unsettled karmic debts excruciating thereafter.

Furthermore, lies, deception, dereliction of duty, debauchery, corruption, criminality, treason, violation of trust, abuse of power, public office, people’s money, authorizing censor speech, cancel culture, proxy, pawn, puppet schemes, divisive polarizing poison politics triggered by power mongering and atrocities of any kind exacerbate the inevitable outcome.

Importantly, misinformation, disinformation, falsehood, fakery, vicious propaganda, fraudulence and indignation to name a few…via collusion, complicity, complacency and participation in any capacity with the wicked and evil face enormous Karmic ramifications denying the Soul redemption and peace.

The culmination of all of the above is self-destructive comparable to an object engulfed in sea of fire reduced to ash in the realm of nothingness poignantly reflect the degenerative act dissolution.

The crucifixion of Jesus Christ presumptuously regarded victory proved to be in vain. Those who authorized and participated were pummeled and paid the price nevertheless much later.

Likewise in other faiths, the demons wreaking havoc were appropriately dealt with reminder never to provoke nor challenge the wrath of phenomenon ordained by the creator of the universe.

In Almighty God’s Supreme Kingdom, Justice might be delayed never denied.

Karma effective from the moment wrongful sinister deeds onset, the Soul is shackled in perennial suffering with no respite for the foolish enslaved to evil traits and ceaseless sins.

The cardinal rule firmly apply without exception to all those in violations enunciated above granting none any exemption nor concession.

The Gospel Truth since the dawn of creation established by the Supernatural power remain irrevocable and immortal in essence.

Padmini Arhant

Identity Clarification

Who is Who? – Devils’ Doomsday

Current Events June 2023

United States – CBDC Fiat Currency

Parasite – Parasitic Existence

Parasites unable to prolong parasitic existence are obviously pis*ed. Too bad.

Get a life and quit parasitic culture.

Applicable to parasites who know no other way than colonizing space, home and even personal family conversations.

The brute parasites are desperate like raccoons raiding anywhere. The offenders’ pathetic life prompting them to be perverts – sneaking, eavesdropping, trolling and tagging to own peril.

Shame on you. You are done. So deal with it.

As far as I’m concerned, parasites are persona non grata. Adios! Get lost for ever.

Padmini Arhant

Puppet Politics Clarification

Puppet politics clarifying their exact role to their electorate disclosing the pact between them and puppeteers with price tag for being on the side show alluding to be me losing to the chosen candidate in the Republican Primary and,

Similarly in the national election would help the electorate from wasting time listening to other candidates merely placed for sadistic pleasure to mock me.

The ones behind the charade are reminded that in their game, it’s only them and their team are involved in the self and mass deception.

The portrayal of anyone among them as me losing to their chosen candidate in the Primary and final race is lofty misogyny and prejudice making a monkey out of their not so smart strategy.

With such ludicrous enactments in play to directly humiliate me despite my absence in the race or politics, the response to these shenanigans has the following narrative playing victimhood.

“The mean tweets like the bull in the China shop.”

No surprise here.

The oppressors’ following classic stance is immutable.

Never mind what we do to you. How we behave towards you and treat you and your family like described above.

We will never accept or tolerate your right to self-defense as long as we rein control over everything including your life and destiny.

And I say to that – Wishful thinking.

Padmini Arhant

O’Bummer ! – Vulgar Polity

O’Bummer ! Vulgar Polity trending in the so-called Fashion & Entertainment charade exhibiting self-mortification and caricature of one’s own culture and society.

No surprise.

Padmini Arhant

Lessons from Life – Tamil. Video

Personal Attacks Upon Presentation of Facts

Politics and surrogates’ personal attack via corrupt media and outlets upon presentation of facts is admission of guilt in the offensive defense of indefensible action.

Padmini Arhant

Media Propaganda Purpose

Propaganda purpose is to lie deceive and mislead gullible viewers and captive audience.

Those burdened with skeletons in their life, resign to propaganda for public distraction.

FOX HOAX Media and alike lead the propaganda mission heading towards precipice for them and those whom they promote and defend in vain.

Padmini Arhant

Politics Epitome

Politics epitome of abuse of power, crime, corruption, terror, harassment, propaganda, murder, public lynching, political witch hunt, violence, hate mongering, identity politics, mass deception, lies, exploitation, extortions…otherwise utter lawlessness and fascism authority in power overt ruling or incognito via puppet is existential threat endangering nation and citizens’ survival as a free society with liberty, dignity and opportunity for all barring exceptions in prejudice and preference of any and all kind across the spectrum.

Padmini Arhant

Politics Face

The hunger for power making politics dirty, ugly and nasty while maintaining corrupt, criminal, crass class intact.

It’s a matter of time the power battle within will end politics for good. The incognito and sycophants together in particular.

Padmini Arhant

Get over the 🤚🏽✋✌🏼✌️✌🏿 🙏🏽🙏🏻🙏🏽🙏🙏🏿 mania!

Get over the mania!

🙏🏽🙏🏻🙏🏽🙏🙏🏿

mania as that is not going to deliver what is aimed at and desired in vain except confirming your asinine indulgence.

mania as that is not going to deliver what is aimed at and desired in vain except confirming your asinine indulgence.Besides in politics such as Indian corrupt criminal signature trait is exclusively yours and no monkey see monkey do act can change it for it is attached to you like skin and bone.

Padmini Arhant

Gossip Mongers’ Life

Gossip Mongers’ Life

Padmini Arhant

How do those who gossip waste their life?

GOSSIP

G – Gas bagging

O – Objectifying

S – Sow Hatred and Spew Venom

S – Seek sadistic pleasure

I – Indulge in indoctrination

P – Poison self and society with vicious propaganda

Padmini Arhant

Gossip – Tell Tale Signs

Gossip –

Tell Tale Signs

Padmini Arhant

Gossip – whisper and weave tales to suit own corrupt mindset.

Who indulge in gossip?

The ones who have no life of their own and become obsessed with another in the nuanced stupidity and insanity. Notwithstanding the target having no relation, connection and / or interests with gossipers and their concoction of characters whatsoever.

What prompts gossip?

The idle mind being the devil’s workshop preoccupy in rumor, propaganda and sleaziness leading to self-humiliation.

How to deal with gossip?

Like with any negative human trait, ignoring gossip mongers to submerge in their dirty swamp would indicate their wasteful life. Furthermore, gossip mongers feed on reaction to ignite more sparks without realizing the flame ultimately engulf their evil act in the fire they started.

Why is gossip the preferred choice for sticky beaks?

They have no life. They seek undeserving attention. They are sadists deriving pleasure minding other’s life to escape from own miserable boredom with nothing to live for and their existence a proven burden without meaningful positive purpose. They are self-declared and exposed excrement contaminating environment.

Those who gossip are controlling and the devils are always agitated upon being rejected for what and who they are. Not surprisingly they accuse the target as controlling for declining to bow to their egotistical narcissism, incessant misogyny, prejudice and hostility.

Gossip and gossipers meet their fate accordingly with a life depleted of self-respect and human value.

Padmini Arhant

Identity Theft

Identity Theft – reiterating earlier statement that I’m Padmini Arhant. My name is Padmini Arhant and not whoever wherever whatever name they choose for me that would be my identity. Such charade only confirm politics in fools paradise.

I say to Indian and international polity – the incognito in particular presiding over the ignoramus identity swap imposed on me as their prerogative.

I need no more namkarans – christening with any names of your choice or random naming which is.a serious violation of my individual right in identity theft mania ultimately hurting all those involved without exception in severe karmic effects.

Padmini Arhant

Toxicity

Toxicity

Toxins in environment are lethal for polluters and general society.

Toxic people waste their life spilling toxicity around. Little they realize the toxic emission from them severely impact them more than anyone else as they precipitously decline in thoughts, speech and deeds. While they make extreme demands on others via speculations about their target’s life and lifestyle without having a clue about any individual’s SOUL, they completely ignore their life letting their mind wander aimlessly firing shots simply to prove their pseudo dominance.

In toxicity, the impurities and contaminants condensate resulting in highly flammable and explosive substance that is certainly neither good nor safe for the toxic producers.

Toxic people are escapists avoiding inner conflicts within and rely on negativities as comfort zone.

The best way to deal with toxicity and the sources is to live one’s life to the fullest enrichment and endearment with those who share unconditional true love and respect.

Living life on own terms with no regrets or apology is an effective distillation process on toxicity.

Padmini Arhant

Politics – Fait Accompli

Indian incumbent Prime Minister, Home Minister and so-called political opposition in India kow-towing to international clique, their masters in global arena are reminded once and for all on status quo between you and me and that is explicitly fait accompli.

Accordingly politics squandering public taxpayers money in pseudo elections against me to serve megalomaniacal egotistical political aspirations is lunacy reflecting desperate times seeking desperate downfall – the current stark reality.

Padmini Arhant

Bollywood – Pirate, Plagiarist and Parasite

Bollywood the cheap pirate, plagiarist and parasite – the hoodlum serving hooliganism in politics and international criminal cartel in many aspects, you are long dismissed as irrelevant together with your masters instigating self-embarrassing comments and conduct.

Corrupt criminal politics using you for nefarious unscrupulous purpose further explain your disposable status.

Padmini Arhant

Envy

Envy

Envy revealed in incessant personal assaults, insults, insinuations, insolence, venom, vitriolic condescendence, misogyny, she-bashing and abuse among several self-destructive traits from the source and catalysts aimed at the one and only target as the arch nemesis and sworn enemy responds accordingly.

Needless to say such exhibits are mirror image of them battling with own identity crisis.

Nonetheless, I, Padmini Arhant appreciate the gratitude extended in above enunciated manner by those having benefitted from my tireless contributions and endless sacrifice with God as witness to my sincerity and integrity.

I regard the envy from all those envious members regardless of their titles, designations and so-called powerful influential status – the greatest compliment to me.

The so-called VIPs and VVIPs obsession with me expressed in their relentless personal attacks against me is a proof of my importance and relevance to them despite their flaunted social status.

Envy is regurgitation of low self-esteem, deep insecurity and failure to accept oneself and others with respect. The outbursts and constant disparagement through envy is reflection of inner turmoil.

Those who claim to have everything in fame, fortune and power having nothing honorable is self-inflicted tragedy and incontrovertible reality.

Envy leads to agitation and self-indignation of the origin and agents surrendered to negativity and irredeemable sins.

You and your kind hate me without contentment and yet you all deceitfully engage in identity appropriation of me – want and claim to be me apparently alter ego. There is no doubt about ego in abundance amongst claimants and definitely not my alternative.

The trend is the biggest irony and testament to questionable mental status of yours and those serving ill-fated cause.

Padmini Arhant

Padmini Arhant with Divinity Shiva

New Year Greetings 2023! Padmini Arhant

Bombed Bollywood and Indian Cinema

Message for flopped bollywood and Indian cinema.

Your time has long been up. You are done with having proved your worthlessness in talent and intelligence.

On the contrary your adeptness in narcotics, sleezyness, prostitution, criminality not barring homicide, terrorism, inciting communal violence causing deaths and destruction, arms dealing, sex trade, pedophilia, extortions, exploitation, seething envy, gluttonous greed leading to black money hoarding in offshore tax havens and above all fleecing on others as pathetic parasites in identity theft, piracy and plagiarism galore is nauseating.

The so-called beauty queens of the 90’s and thereafter sleeping their way around unable to make a career prompting parasitic existence is a tell all about celebrity status stripped of shame and dignity.

Indian cinema and politics marred in corruption, scams and scandals are primary sources for accumulating and liquidating dirty filthy money bankrupting local and national economy. Importantly these two together along with other sectors responsible for superficial soaring inflation all year round triggered by unaccounted illegal money in circulation in the economy.

Bollywood and Indian Cinema – you are dead and buried for now and in the future. Get lost.

Accordingly no use flogging the cadaver for the carcass would only serve corpse scavengers.

Never mistake everyone for Sushant Singh Rajput.

Padmini Arhant

PS. This message is also applicable to all parasites wasting life in parasitic existence. There is no respect nor integrity when you and the kind fleece and ride on others’ back as free loaders and worst of all the satans’ slaves taking marching orders from them for undeserving hall of fame, fortune and power which never stick regardless due to fake imagery and fraudulence.

GET A LIFE OF YOUR OWN AND LEARN TO LIVE WITH DIGNITY.

Padmini Arhant

पते की बात

पते की बात

चोरी और ऊपर से सीना ज़ोरि बुरा है तो उससे बड़ी अपराध उस चोरी को उचित प्रचार करना अघोर बेईमानी है। ऐसा पाप जन्मों का भोज बने आत्मा पर दण्ड बनता है।उस देश और देश वासियों के लिए गंभीर पीड़ा और कलंक बने युगों तक पाप में लिप्त होता है।

इसमें गर्व की कोई बात नहीं हालांकि व्यक्तिगत और कुल व्यवहार के तौर पर इस प्रकार की हरकतें शर्मिन्दिगी और अपमानित जनक है।

आख़िर में,

बुरी नज़र वालों और कुकर्म दोषियों तुम सब के मुंह काला।

बुरी नज़र वाले तेरा मुंह काला |

पद्मिनी अरहंत

Celebration of Lord Krishna

Badra Kali – Goddess Durga Incarnate

Badra Kali – The incarnate of Goddess Durga – God Shiva’s divine consort.

Badra Kali – the revered and feared incarnation of Goddess Durga / Parvati

Badra Kali is the force that force evil evacuation and elimination from earth making the world a safe and secure place for all beings.

Badra means secure and safety

Kali -remove. the one who engage in the removal of evil.

Padmini Arhant

Celebration of the birth of Lord Krishna – the incarnate of Lord Vishnu

Jubilation and celebration on the birth of Lord Krishna as Janma Ashtami, Gokula Ashtami aka Shri Krishna Jayanthi is a great sense of joy and bliss.

Personally, being born on Janma Ashtami/ Shri Krishna Jayanthi – the birth of Lord Krishna, on the auspicious occasion – I have the pleasure and honor to extend my gracious greetings and celebratory moment to followers of Lord Krishna – the incarnate of Lord Vishnu.

Happy Shri Krishna Jayanthi / Janma Ashtami / Gokula Ashtami !

Padmini Arhant

Sri Lanka Crisis – Tamil Eelam Desam 2022 – Presentation in Tamil

Duplicity Exposure

Daylight Dakosla (HOAX) – दिन दहाड़े ढकोसला

Claiming a cardboard cut out moon as having plucked the moon from the orbit is Daylight Dakosla (HOAX).

कार्डबोर्ड से कटे हुए चंद्रमा को आकाश की कक्षा से चाँद को तोड़ने

का दावा करना दिन दहाड़े ढकोसला(HOAX) है ।வானத்தின் சுற்றுப்பாதையில் இருந்து சந்திரனைப் பறித்ததாக அட்டைப் பெட்டியால் வெட்டப்பட்ட சந்திரனைக் கூறுவது பகல் புரளி.

Padmini Arhant

Fake Fraudulence False Persona

Fake Fraudulence False Persona

The current trend peaked at false projection amongst those claiming to be the one that is appealing and interesting with desperate efforts in mimicking and adapting appearance, style, hairdo, language and manners…anything and everything is weird classic duplicity. Their indulgence confirm they are mega opportunists and wannabes who are running away from them and their unflattering legacy ranging from corruption scandals, criminality to controversies as persona.

If they have problem in acknowledging them as who they are, what makes them assume their deception would be an exception?

Obviously, their real identity is too embarrassing for them to accept prompting faking and fraudulence.

Little they realize leopard changing spots to stripes do not become a tiger and neither a hyena feigning a fawn become as such.

Being true to self and others is indeed a tall order for them.

Padmini Arhant

I’m glad that India is not my birth place.

It is least surprising on Indian politics and so-called entertainment at rock bottom considering the assassination of a freedom movement leader Mahatma Gandhi following independence from colonial rule which contemporarily reinstated with proxy regimes loyal to colonial system.

Lord Gautam Buddha born in Lumbini in Southern Nepal. Lord Buddha’s Buddhism celebrated in the Himalayan kingdoms and South East Asia.

I’m glad that India is not my birth place.

Padmini Arhant

Corruption and Mob Rule

Acquiescence and appeasement towards politics and corrupt forces facilitate mob rule and tyranny.

The lawmakers as lawbreakers with corruption scandals and criminal records representing law is the irony of all ironies in the so-called democracy with the strings held by unscrupulous elements from behind reining control.

The dominance and Supremacy as feudalists impose vassal statehood on sovereignty and authoritarian rule denying free republic governed democracy.

When democracy and individual freedom is suppressed, the devil claims to be Deus and wreaks havoc. Ultimately the terror unleashed abusing power at the helm succumb to own totalitarian turmoil in the end justifying the means with Karma taking effect.

Padmini Arhant

Author & Presenter

PadminiArhant.com

Prakrithi.PadminiArhant.com

India – Supreme Court Ruling on Godhra Pogrom in 2002

The Godhra pogrom against innocent civilians largely muslims, Hindu and other denominations in 2002 undergoes political spin by the central government headed by PM Narendra Modi and HM Amit Shah. In this regard, the victim widow Zakia Jafri’s plea against SIT ruling on the violence involving Narendra Modi is propagated as the case dismissed by the Indian Supreme Court.

However, the so-called dismissal verdict by the three-judge bench headed by Justice AM Khanwilkar, Justices Dinesh Maheshwari and CT Ravikumar do not bear the signatures of neither of the three justices in this apparent ruling.

The unsigned court ruling – the omission of three SC justices signatures in this ruling confirm the verdict not delivered by the Supreme Court.

The SC’s three judge bench remark quoting “the Indian democracy is under threat” verbatim and subsequently the court ruling delivered without signatures from any and all three of them confirm the decision on vindication of the accused is null and void.

Accordingly, the misconstrued vindication of the accused viz. the former Chief Minister Narendra Modi, Home Minister Amit Shah and others listed in Mrs. Zakia Jafri’s court filing is invalid.

The accused in this matter remain relevant for further legal investigation and proceedings now and in the future.

“What is the importance of a signature in any document?The purpose of a signature is to authenticate a writing, or provide notice of its source, and to bind the individual signing the writing by the provisions contained in the document.”Padmini ArhantAuthor & PresenterPadminiArhant.comPrakrithi.PadminiArhant. comभारत – राजनीति और समस्या

भारत – राजनीति और समस्या

पद्मिनी अरहंत

देश के सर्कार और उत्तरदायक यानी प्रधान मंत्री को पांच गंभीर प्रश्न जो उत्तरदायित्व है।

१. देश पूँजी पति के हवाले करके, उन्ही के सेवक बने व्यक्ति प्रधान मंत्री?

२. देश की सुरक्षा में घटौती लाकर, देश को देश के बाहर आक्रमि चीन के हवाले करने वाले देश के चौकीदार ?

३. और तो और आक्रमि देश चीन को आर्थिक भंडार भेंटकर आयात (इम्पोर्ट्स – imports) के ज़रिये, चीन की आर्थिक स्थिति मज़बूत बनाकर फ़िर उसे भारत पर आक्रमण करने की सुविधा देने वाले देश के अर्थशास्त्री और शुभचिंतक नेता और सर्कार?

४. इस प्रकार कानून बनानेवाले प्रथम कानून तोड़नेवाले बने और वह एलान करें की वही रहेंगे ५० वर्ष से भी अधिक देश के मुख्या यानी प्रधान मंत्री और वो भी लोक तंत्र गण तंत्र प्रजा को ताना शाही में दबाकर अपनी राजनीति कूटनीति जमाने की योजनाएं में जुड़े तत्पश्चात?

५. आखिर देश लोक तंत्र है या केला गणतंत्र (बनाना रिपब्लिक – Banana Republic) जहाँ संविधान नेतृत्व में जन राज्य बदलकर एक अकेले व्यक्ति के इशारे पर उनके क्षति (damaging) निर्णय के चक्रव्यूह में फ़स गया है ?

धन्यवाद

पद्मिनी अरहंत

लेखिका और प्रस्तुत करताPadminiArhant.com

Prakrithi.PadminiArhant.com

Message to Humanity – Padmini Arhant

Spread peace and engage in non-violence. Speak truth with courage. Heed your conscience. Respect life. Serve your nation and people with honesty and integrity. Espouse human values and exemplify in deeds with care and compassion. Voice concern over injustice. Be part of the solution and not the problem. Love mankind and environment for universal harmony.

Peace is Eternal Bliss.Padmini Arhant

தமிழ் புத்தாண்டு 2022 நல் வாழ்த்துக்கள்! Tamil New Year 2022 Greetings!

Words of Wisdom from Venerable Gautam Buddha

Asian Culture - Greeting

India – The Truth Behind Agnipath

Identity Misappropriation

The evil among myriad evil doings are persistently engaged in identity misappropriation. In their evil mind they will define who is anyone and who they are and should be to suit their evil opinion. Contrary to actual evidence.

Anything repeated as a cliche to enforce identity misappropriation as appropriate confirm meaningless asinine indulgence. The identity reality nonetheless proved otherwise is the irreversible revelation much to evils’ indigestible predicament.

Evil bear consequences to evil charade and constant concoctions to validate evil dominance. Besides desperate fabrication, falsehood and fraudulence glaring at combined evil conglomerate bringing mega embarrassment in fait accompli is the fact.

Evil struggle on identity misappropriation is like insisting on 2 + 2 = 5 , 3, 7, etc. but not the empirical 4. The evil obtuse farcical nuance is nothing more than attempting to trap air in the open space or writing on running water. Both clarifying the losing battle for evil and contingency.

Padmini Arhant

Monkey See Monkey Do!

Charity Begins at Home

Who is Jashodaben Narendrabhai Modi?

She is the estranged wife of Narendra Modi, the prime minister of India. The couple were married in 1968 when she was about 17 and Modi was 18. A short time into the marriage, her husband abandoned her.

The RSS led BJP government in New Delhi revoked the Triple Talaq (Divorce) against Muslim women primarily for political mileage to gain Muslim women votes in the state and national election.

The tradition was criticized by Hindutva Prime Minister Narendra Modi as primitive while having deserted own spouse Jashodaben Modi with no alimony or any lawful compensation.

Apparently, the Hindutva ideology practiced by RSS and Indian Prime Minister neither believe nor subscribe to ‘Charity begins at home.’

Padmini Arhant

Imitation

Imitation is flattery. Imitation of positive and profitable values without due credit to the source is forgery – criminal and condemnable act.

Padmini Arhant

The Fly on the wall

What should one do with the fly on the wall?

Swat or pat was the question.

Obviously the former. The flies spreading preventable disease sometimes even causing death is a biohazard. It is important to understand the breeding ground for the flies to survive and thrive. Accordingly the flies are dirty pests and putrefy upon contact.

Padmini Arhant

Human Trait

Human Trait

One might straighten dog’s tail but not certain human trait – the ones hell bent on remaining crooked and wicked in particular.

Spying, snooping, eavesdropping, surveillance, perversion via invasion of home, personal space and life to detect anything illegal. Never mind the illegality of such indulgence. The wrong doers in search of wrong doings waste own life on earth.

The specialists in personal attacks whether direct or innuendo using proxies from own inventory leave an indelible mark about their personality. They are as follows – weakness, insecurity, dishonesty and guilt…among myriad complexities in them in handling truth about them and their actions in life. The relentless personal assaults and individual profile distortion against their target is predominantly related to own inability to defend indefensible track record.

The worst human behavior is starting and causing the crisis. Subsequently grandstanding the crisis without an iota of integrity. Again amidst obnoxiously slight human intelligence with no regrets or remorse.

Exploitation – Who is to be blamed for exploitation?

The exploiters or the exploited?

Both. As long as the exploited allow exploitation to continue with no end in sight, the exploiter would exploit normalizing the trend. The exploited realization of the abuse ending exploitative situation is a direct and effective response to exploitation.

More on the way on human trait.

Padmini Arhant

Skin Pigmentation

Skin Pigmentation

Soooooooo (infinity) hung up on skin pigmentation!

The lighter version under the sun goes tan.

The darker tone in snow and frigid temperature without much sun exposure gets pale.

What really matters in life?

The genuine personality with natural identity – the one not borrowed as imitation or imposed really matter and authentic.

Similarly those who have tasked upon them to define and distort anyone whom they target in culture and identity appropriation – recreating anything against reality only reveal desperation and futile discrimination.

Human character with basic values – treating self and others without pride and prejudice suffice shedding any complex either way – superior or inferior.

After all underneath the light, tan and any shade skin layer, the color of the blood is the same – Thank God.

Otherwise there would be more dirt and filth digging in human indignation.

Be yourself without any burden to impress or appease anyone.

Padmini Arhant

Light and Sound Effects

Light and Sound Effects

The brilliant sunlight – the source of energy and life. Importantly dispels darkness.

The braying donkeys produce noise pollution.

The light and sound effects in this regard are clear in their relevance.

Padmini Arhant

Restoring Freedom?

Restoring Freedom?

Those who embark on restoring freedom beginning with their domain would add some credibility.

The definition of freedom is liberty to choose in life. Having a choice to accept or reject anything unfavorable is the real alternative.

For instance, the solar panel lessee not having a choice with payment options other than the one and only method set up by the electric car company acquired solar power installation. Similarly, binding the lessee on long term contractual agreement with no exit plans.

Last but not the least, not addressing emergency situation during heavy rain and stormy weather resulting in roof leaks from poorly installed solar panels causing property damage.

The necessary precautionary measures from home owner like tarp on the roof even protecting the leased solar panels to avert substantial property damage including solar panels and subsequent liability to solar panel lessor i.e. the company involved in the matter are not reimbursed and expense declined as not the company responsibility.

These issues clarify the status as anything but freedom.

In light of such reality, it would be fair to say the customer in such unfair and unreasonable deals are the ones affording the company’s much touted philanthropy in a war zone besides contributing to extravagant hobby such as space travel.

These activities made possible by none other than customer tied to company policy in direct violation of contract to resolve issues related to leased items such as solar panels.

The corporate overture on restoring freedom would be appropriate upon being made available to customers in practicality in own ventures and enterprise.

Needless to say getting own house in order prior to engagement elsewhere is the dignified priority.

Anything otherwise is open to interpretation as publicity to enhance individual fortune.

Padmini Arhant

Truth about lies and liars

Truth about lies and liars

Liars live in denial. They conscientiously decline reality due to lack of integrity. They dwell in falsehood. They rely on fabrication and fraudulence. They try to run away from themselves despite being prisoners of guilt with unwillingness to introspect and accept fact within.

Soul searching is persona non grata – unwelcome for them.

Instead they lie to themselves and the outside world. In doing so, they voluntarily deceive themselves and others. They are also users, abusers and exploiters as a result. They scapegoat anyone they think are a fair game to defend their indefensible offense, deception and criminality.

They are obsessed with external facade rather than internal cleansing alleviating burden on soul. Those who lie to get anywhere in their life are usually miserable cheaters and knowingly live a dishonorable life.

The Truth about lies is lying traps the mind, pains the heart and ultimately chains the Soul. The choice to be a free spirit is lost in living and dying for them.

Padmini Arhant

Hope, Hoax and Hell

The commonality in Hope,Hoax and Hell besides numeric order is hope proved a hoax turned into hell in events best laid to rest and never to return to create any more havoc.

The analogy is – expired products relaunched in the same package to revive HOPE is a hoax adding insult to intelligence.

Fool me once shame on you. Fool me twice shame on me.

Padmini Arhant

Inconvenient fact on cause and effect

The human nature commonly evade responsibility.

The worst trend is to conveniently ignore the cause and selectively react to symptoms and end-result. The case in point is the global pandemic.

There is absolutely no interest in addressing the controversial game of function research, the investors collusion, WHO and Beijing’s massive coverup on the origin and transmission of the lab manufactured deadly pathogen and subsequent mega profiteering from vaccine and related ethical and scientific violations…

Instead the entire focus is on the effects such as anti-vaxers and politicized pandemic reports.

Similarly, the incident in a gala entertainment event – the choreographed and highly dramatized delivery via scripted monologue – the sly innuendo and insinuation having become the trademark of tacky exhibit is deliberately ignored with exclusive attention on the superficial reaction.

Never mind the origin i.e. the cause. Only rebuke the effect in show and tell action following the condescension.

It’s a matter of what fits and suits the corrupt and prejudiced mind.

Padmini Arhant

Beauty – Meaning and Definition

The real beauty lies in the heart, mind and soul purification reflected in deeds, dedication and selfless sacrifice.

Padmini Arhant

Ukraine – Russia War Strategy – Padmini Arhant

Ukraine-Russia Permanent Peace Treaty 2022

Ukraine – Russia Peace Treaty 2022

Russia – Ukraine Peace Agreement

RUSSIA – NATO Permanent Peace Deal 2022

New Year 2022 Message – Padmini Arhant

India Republic Day 2022 Message in Hindi – Padmini Arhant

Padmini Arhant Skydive in California, USA, November 28th, 2021

Padmini Arhant and Roshni Greeted by the Brilliant Light in the Horizon

U. S. – South Carolina Senator Lindsey Graham

The U.S. Senator from South Carolina Lindsey Graham could exemplify sincere concern towards mankind by holding Senate hearing on the controversial gain of function research on corona virus, the fundamental cause behind the global pandemic.

The individuals and institutes in the United States such as Professor Ralph Steven Baric from UNC, Chapel Hill, North Carolina, Dr.Anthony Fauci, NIH, Investors Bill and Melinda Gates among others are accountable for the loss of millions of lives worldwide.

United States alone lost nearly million lives and thousands in serious health conditions till date.

Senator Lindsey Graham – please call on these members and subject them to public hearing under oath applying the same rule of law as ordinary citizens for their involvement in the worst human tragedy and health as well as economic disaster.

It is incumbent upon every United States lawmaker and duty to hold these members accountable for the crimes against humanity.

Senator Lindsey Graham’s call fior assassination of foreign head of state such as Russian President Vladimir Putin is irresponsible, interventional and unnecessary provocation.

Please focus on getting own house in order on the global pandemic responsibility.

Padmini Arhant

Superpower Quest

Those who are in the game to rule the world allowing their individual and collective minds to be ruled by negativity and counterproductive strategy is the biggest irony.

Those who have no control over dominant ill-vices control nothing including own will and reason.

Padmini Arhant

Evil – Definition and Reason

What is Evil?

Evil is sinful with malice, wickedness, violence, corruption and extreme criminality.

Why does Evil exist?

Evil exists predominantly due to fear transformed into silence among victims of evil actions.

From the days of crucifixion of Jesus Christ to assassination of leaders pursuing the path of peace, harmony and individual rights and the latest depopulation agenda via global pandemic, evil has unleashed wrath on humanity until now.

Although evil feigns power and proclaim itself the most feared among those evil dominates, the reality is evil is the biggest coward, cruel, weak, deceitful and dishonest element.

Evil is own enemy to itself. Evil invariably succumb to evil thoughts and deeds. Evil’s permanent abode is hell and accordingly engage as hell raisers on earth inviting apocalypse upon self and evil contingency.

Padmini Arhant

Global Pandemic Accountability

It’s high time all those engaged in the controversial Game of Function research and SARS COV2 caused global pandemic are held accountable for heinous crimes against humanity.

The researchers, investors, facilitators and promoters individually and as an institute as well as organizations profiteering from the catastrophic health and economic calamity are equally liable for irreversible deaths and devastation originating from the lab manufactured virus. Accordingly, they must be brought forward to accept responsibility.

Until then any decisions from them as moral authority against anyone on any matter is illegitimate and invalid.

One must be the example prior to expecting others to set an example. The international rules must be fair holding none above law on such matter barring exception especially when the crises is related to major health disaster in human history.

Padmini Arhant

Human Lifestyle

Human lifestyle

The human lifestyle beginning with food linked to beef controversy killings and mob lynching in India, traditional clothing like the current hijab rights in Karnataka, India or contemporary attire to suit personal preference to name a few are exclusive fundamental rights in a society.

The rules restricting one while allowing others to practice religious or cultural customs is discriminatory in a democracy.

The state and any other internal or external intervention defining and determining others personal life, identity and way of life i.e. customary beliefs in public or private is undemocratic, unethical and uncivilized in the modern age.

Humans regardless of race, religion and gender have the right to exercise individual discretion on their lifestyle in accordance with their personal choice barring any physical injury or public safety hazards.

Padmini Arhant

Satanic Age

In the satanic age, Satans insist one must engage with them in satanic terms.

What are Satanic terms?

Satanic terms are typically smothered in hatred, prejudice, misogyny, condescendence, divisiveness and hypocrisy.

Why do Satans always get it wrong?

Satans suffer from obsessive disorders. Once they are obsessed with anyone or anything, they pursue them or that endlessly for Satans are clueless. Their cluelessness and obtuse obsession invariably lead them to precipice and experience imminent mighty fall.

What is the reason behind Satans use of proxies, pawns and puppets to smear and attack their obsessed target?

Satans are essentially devils in disguise. Since the devils never deal with their fixated target directly due to cowardice and wickedness, they indirectly launch assaults against their enemy.

Above all, Satans are enslaved to evil actions and connivance. Accordingly they hire proxies, pawns and puppets, who in return are more than happy to be Satans’ slaves and dalliance with the devils.

Evil reaps what evil sows in life.

PadminiArhant

Clueless – Fact

The important clue on clueless is denial of reeking pseudo supremacy and uninhibited misogyny shattering false image and duplicity much to self-embarrassment and detriment in the present time.

Some things never change no matter what happens in the turn of events with glaring reflection on degradation of human value.

Padmini Arhant

Greatness Expression

Greatness is best expressed in selfless deeds and endless sacrifice more than any other characteristics defining human value.

Padmini Arhant

Definition of Fascism

What is Fascism?

Illegitimacy, Impotency, Intolerance, Incompetency, Inadequacy, Indecency, Ignoramus Idiosyncrasy.

Illegtinacy – in birth.

Impotency – Impotent in confronting exposure of Fascist rule.

Intolerance – To facts, TRUTH and ground reality.

Incompetency – Absymal performance.

Inadequacy – megalomania.

Indecency – Impropriety and inappropriate response to defend the indefensible position.

Ignoramus Idiosyncrasy – fascism indigenous.

Padmini Arhant

Pandemic Bulletin

WHO Director General Tedros Adhanom Ghebreyesus on the pandemic;

“If we end inequity, we end the pandemic,” said Dr. Tedros Adhanom Ghebreyesus.

In fact, the reality is otherwise.

The end to consistent misinformation, misguidance and mass confusion from the health authorities would lead to the pandemic end.

The directives and guidelines from WHO Director General since January 2020 followed by public health authorities viz. Dr.Anthony Fauci, NIH, CDC and other government agencies until now responsible for the status quo – the pandemic and variants prolonging the battle.

Padmini Arhant

India – Untouchability Atrocities Impetus Proselytism

India – Untouchability Atrocities Impetus Proselytism

The man made hierarchy in the social structure falsely attributing the abhorrent untouchability custom in Indian society as God’s will is primitive and pejorative.

The tradition initially conceptualized and imposed by brahmins – the foreign invaders’ descendants displacing the native population in Tamil Nadu, India – the origin of life and cultural bastion having established civilization long before the emergence of other continents on earth.

The brahmins declaring themselves the chosen ones to serve God adopted the title priesthood and placed their identity on the top tier in the hierarchy fraudulently citing the caste orientation as Vedic inscription. They conveniently placed the rest in the lower tiers of the hierarchy and exerted control over the religion they adopted upon arrival in India following the conclusion of Indus Valley Civilization. The word Hindu and accordingly Hinduism is a foreign named identity.

It has nothing to do with the ancient sacred spirituality presided by God Shiva – the Supreme Soul epitomizing the light, energy and sound encompassed as audible, visual and sensed energy within.

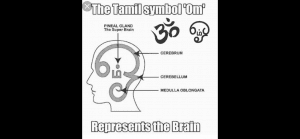

The sacred symbol and syllable OM originating at the dawn and creation of the universe epitomize the interconnectivity of light, sound and energy experienced in five sensory organs of sight, hearing, breathing, taste and touch.

The mantra OM is related in other religions as AUM and Amen in acknowledgment of the Soul within in connection with the Supreme Natural Phenomenon.

Similarly, the greeting salaam or As-salamu alaykum in Islam ending in OM sound and in Judaism the greeting Shalom has OM meaning Peace.

The hideous casteism in Indian society was sowed by foreigners as Aryans and Kazhar Ashkanazi Jews claimed as such by the brahmins in Indian society.

The duality of Aryan and Jewish traits maintained by them to sync in with contemporary International syndicate and win favors from all sides known as the Chanakya tactic. Chanakya – a controversial brahmin advisor in Chandra Gupta Maurya period in history.

The dravidian concept is yet another political spin from the notorious factions like Periyar and Dravida Kazhagam in Tamil Nadu posing as atheists, typically the alter ego fomenting and fostering brahminic ideology in exploiting religion and society for personal, political and vested interests.

The insidious prejudice practicing untouchability and outcasts until today were further promoted and institutionalized by the corrupt criminal and scandalous political class in India post-independence as they lack legitimacy in governance and usurp to power via rigged election as foreign puppets and proxy.

Padmini Arhant

Evil Shuns Light

Evil actions upon being brought to light is found annoying by those engaged in evil activities.

What a surprise?

Unveiling ugliness of those hiding behind glossy facade is necessitated by evil cursing the truth as deranged, when in fact deformed in character are those unabashedly abusing status depriving and denying others their legitimate rights.

The mirror reflection for evil is understandably unbearable.

Why not quit being evil and become human and humane for a change in the unknown and unpredictable lifetime?

No harm in trying and only gains upon renouncing evil.

Padmini Arhant

Warning – Intruders, Repeat Offenders and Violators of Individual Civil Rights

This message is strictly for intruders, repeat offenders and violators of personal rights, liberty and space.

In a real free world, exercising individual rights against serious violations is inalienable dignity.

If you are a peeping Tom from wherever currently or sever since my existence plagiarizing my hard work and identity attributing to anyone famous or unknown then read the following as well to be clear of the consequences of your deceitful actions, theft and despicable behavior.

Whoever is indulging at whosoever behest in intrusion of my home, personal life and exploiting me for more than a decade unpaid i.e. free labor, you have invited upon yourselves unnecessary irreversible excruciating pain, suffering and damages in many dimensions.

The unfortunate yet deserving karmic effects are your own doing with none to blame except yourselves and those whom you are obliging much to yours and their peril.

Any attempt to disregard this warning and continue to violate my personal rights, liberty, space and that of my family not shall but in fact will only deliver regrets and irreconcilable outcome.

Padmini Arhant

Free Speech Censorship

Free Speech Censorship

The videos shared on this website on Ivermectin and India’s PM Narendra Modi’s divestments from the Indian economy to offshore viz. Afghan infrastructure aping counterpart China’s Premier Xi Jinping’s Belt Road initiative were removed imposing censorship on free flow of information in public domain.

The videos have been re-published on a different platform.

Obviously the evidence based data are not acceptable to members and entities experiencing discomfort and indigestion on TRUTH and facts based information.